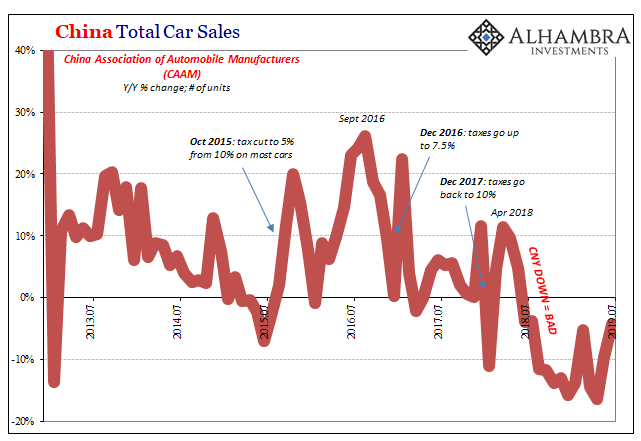

Earlier this year, Chinese authorities reduced the VAT tax the government charges auto manufacturers. Intended to boost consumption, the levy was reduced from 16% to 13% in the hope automakers would pass along the savings to consumers. Many if not most manufacturers did.

The results were immediate, and fleeting. In the month of March 2019, total car sales fell “only” 5.2% after six straight months of double-digit declines. Many were encouraged by the single result. According to the China Association of Automobile Manufacturers (CAAM), sales were even worse in April and May than they had been before March. No lasting effect from the price boost.

The latest figures from CAAM for July have improved but not because China’s auto sector is on the rebound. Total car sales dropped another 4.3% year-over-year, the best result since last August. The reason is simply the base effect – autos are now stacking declines. This is the second straight July with shrinking sales.

With no sign of a turnaround, China’s State Council issued a cryptic statement today suggesting local government authorities currently restricting automobile sales review those policies. It was implied in the release that federal authorities are prodding those local councils to rethink their stance and maybe begin relaxing or removing limitations.

It was, of course, immediately called stimulus in the Western media. That’s almost certainly the intent but that doesn’t necessarily mean it is stimulus.

In fact, nothing seems to be working. One program after another has been undertaken and still the minus signs or record low plus signs keep coming. One Reuters article reporting on the latest official development was particularly flummoxed:

To offset the effects of the U.S. trade war, Chinese policymakers have rolled out various growth measures including reserve requirement ratio cuts, tax cuts and a push for banks to lend to smaller companies.

No wonder there’s so much confusion. The most frustrating part is the rote recitation of orthodox doctrine – the public is only told the problem is China’s trade war with the US and it’s supposedly being handled effectively by doctrinaire stimulus to encourage domestic consumption as its offset.

Yet, time and again we find that it’s precisely domestic Chinese consumption which is the source of weakness. Auto sales are merely the most extreme face of the issue since China’s car manufacturing sector accounts for a huge chunk of overall activity.

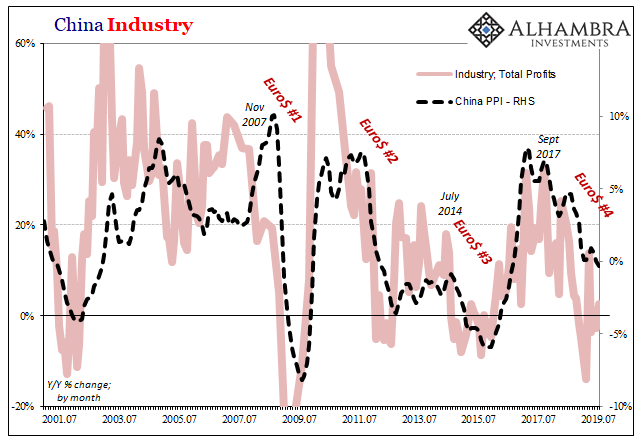

In a separate release today from China’s National Bureau of Statistics, industrial profits swung to the plus side in July – barely. The growth rate was 2.7% following a 2.6% decline in June. Plus or minus, those two numbers indicate basically the same condition. The Chinese economy remains in deep trouble.

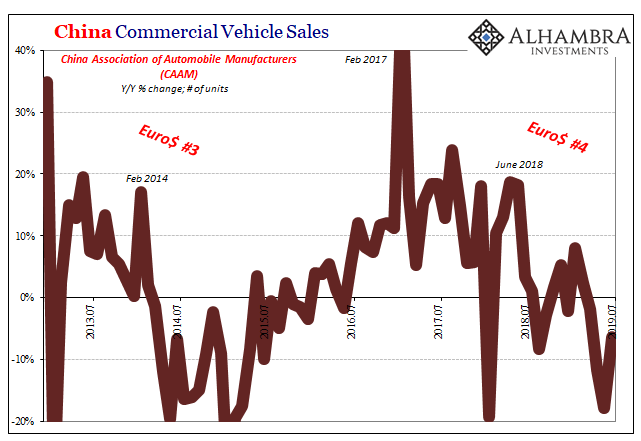

China’s industrial and manufacturing base has been on the downswing since late 2017 and it has reached lows comparable to some of the worst conditions in the country’s modern economic history. This isn’t trade wars (though those restrictions aren’t helping).

Stimulus and trade wars actually trivialize the matter and improperly make it seem like there is space for some kind of determined resolution. It is the Eastern equivalent of “transitory” factors, especially since overlaying all this is a master plan the Communists are supposedly patiently waiting to unveil.

The public just doesn’t get a realistic sense of the risks the whole world is facing right now. At least not before the “public” part of the UST yield curve inverted.

I’m sorry but I just don’t see it. The Chinese to me resemble an increasingly frantic regime pushed around by forces way, way beyond their control. In a vain attempt to placate them, authorities continually appeal to the dangerous and disproven. That doesn’t strike me as patient choice, more like running out of choices.

And like yield curve inversion in the US bond market no one ever sees this other side until it “unexpectedly” pops up seemingly out of the blue. It’s as if these negative pressures just snuck up on everyone. Must be trade wars because what else would it be?

Without any other frame of reference or alternate explanation you can’t see and appreciate what is hiding in plain sight:

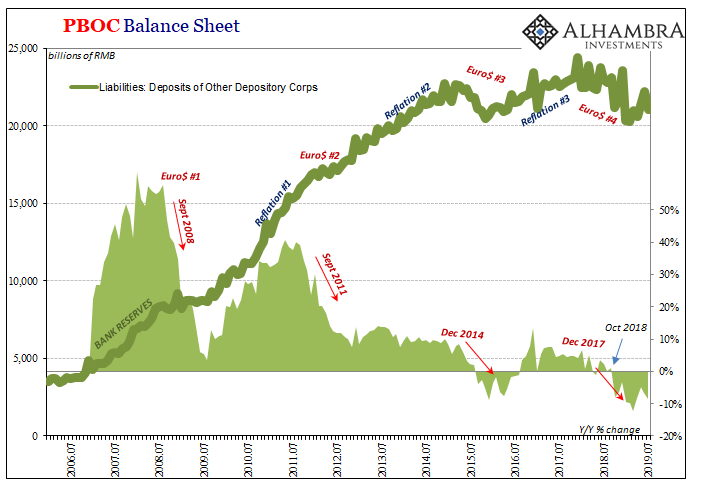

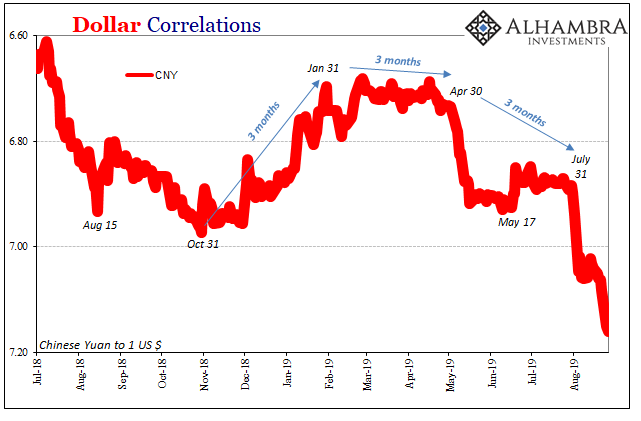

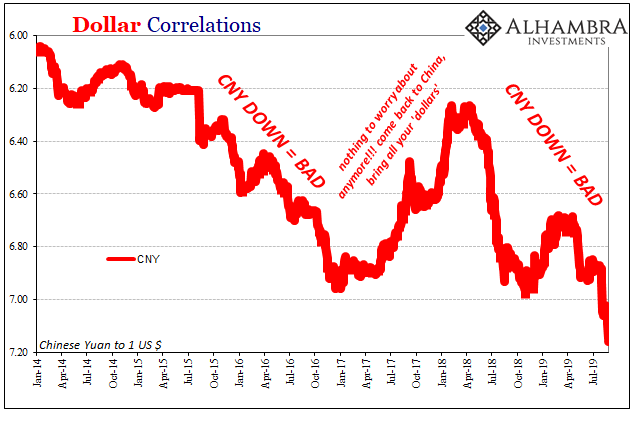

Not only is there now an obvious ticking clock to CNY (which doesn’t make sense to those who argue trade wars and currency devaluation stimulus), its ups and downs over the last half decade match perfectly to China car sales, industrial profits, and the entire domestic economy in between. When the currency rises “stimulus” seems to have worked; when it falls authorities are desperate to roll out one thing after another.

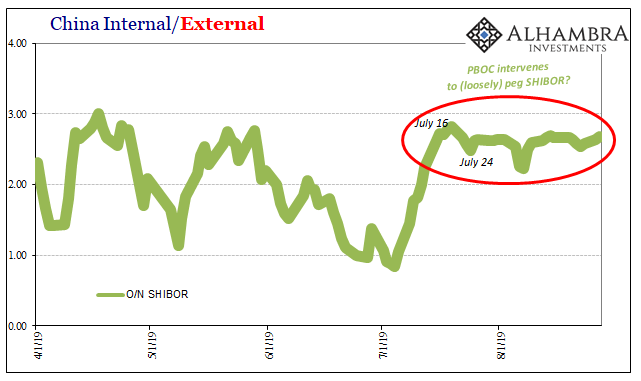

There’s no master plan in China (literally, as it turns out). More importantly, the government is proving how little it can affect economic outcomes. Not only are authorities a passenger when it comes to CNY, they aren’t really faring any better when it comes to RMB:

The Chinese are entirely on the defensive and it wasn’t President Trump who pushed them into becoming entirely reactive.

It’s also easy to take a national viewpoint on China, but we can’t afford to see this as some contest. As I always write, while you can dismiss Argentina for being Argentina it’s harder to paper over serious German struggles. It’s not entirely out of the question, though. But if Germany is joined by Japan and then China, too, and all for reasons that are dollar-based rather than tariffs you really need to appreciate and understand these subtleties that aren’t actually very subtle.

What I said yesterday about Japan goes double for China. You can substitute the latter for the former in the following:

If Japan falls all the way into the eurodollar vortex later in 2019, then that would suggest what we already see in Germany is actually typical for what we might expect for a whole lot more than Germany. The decisive tilt across the global economy is on the downside. Perhaps the most serious downside since 2009.

Right now, all we can do is map out and appreciate the balance of risks – we don’t have a crystal ball from which we can foretell exactly the global future. The longer this goes on, however, the more those risks seem to multiply and deepen.

That’s because, as we see from China’s example, the dollar still rules. And that’s the last misconception, a mistake the President and Jay Powell are also making. It’s not their dollar which is in charge of the global economy. It’s the eurodollar’s world; we are all just trying to live here.

Stay In Touch