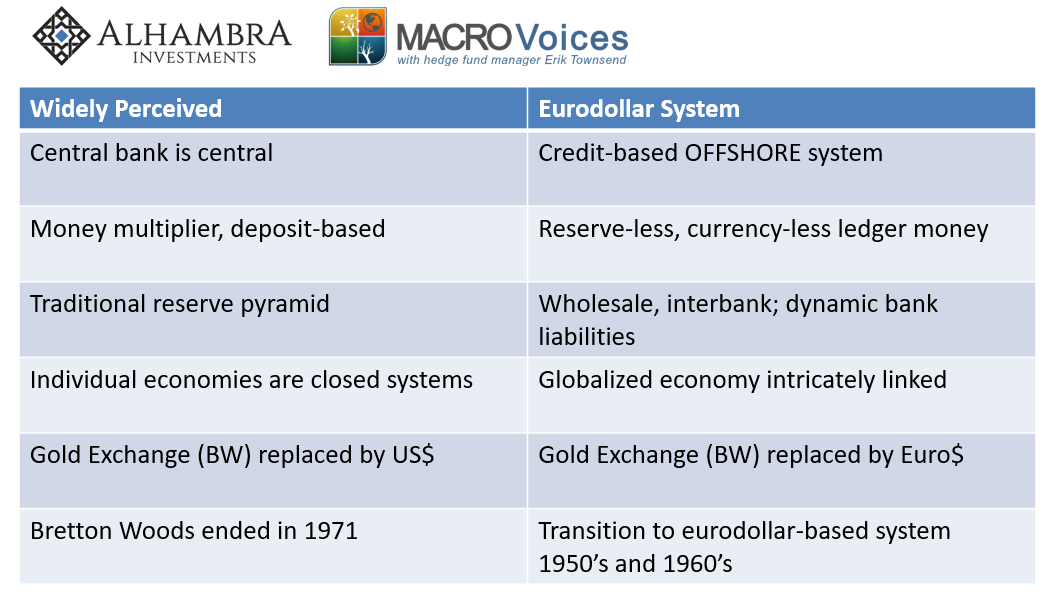

The world has a big dollar problem on its hands. That’s not a statement which will surprise any of you who have been readers here for any length of time. Nor would it amaze you if I also said the world has a massive shadow dollar shortage. The kind of dollars more attuned to bank footnotes than any of the M’s people might still use (even though the Fed abandoned them half a century ago).

It’s been more than a decade since the Global Financial Crisis. Slowly it has begun to dawn on regulators and observers it might not really have been about subprime mortgages after all. The Financial Crisis Inquiry Commission’s final report will forever have mentioned subprime 787 times, but that won’t prevent the world forever from figuring it out.

The GFC was really just a global dollar shortage. A massive and unsparing one, sure, but that is why the hundreds of billions in dollar swaps and TAF auctions populated by American banks with German names.

When the first one was conducted on December 20, 2007, we can now see that the first name on the list is Citigroup. As a courtesy, it seems, the big NYC bank had bid for a minimal $10 million.

The biggest borrowers, though, were other sorts of ostensibly New York banks; firms like, Landesbank Hessen-Thurin, Bayerische Landesbank, Dresdner Bank AG, Deustche Zentra AG, Landesbank Baden Wuerttemb, and WestLB (the LB stands for, as you probably guessed, landesbank). Those six “New York” banks alone accounted for half of the $20 billion allotted. Given the style of these names, you might already be sensing a theme.

Add the $2 billion which went to Dexia and the $1.4 billion handed to BNP Paribas Houston, that’s $14.3 billion out of $20 billion heading to US subsidiaries of overseas institutions in the first major overt liquidity act of the GFC.

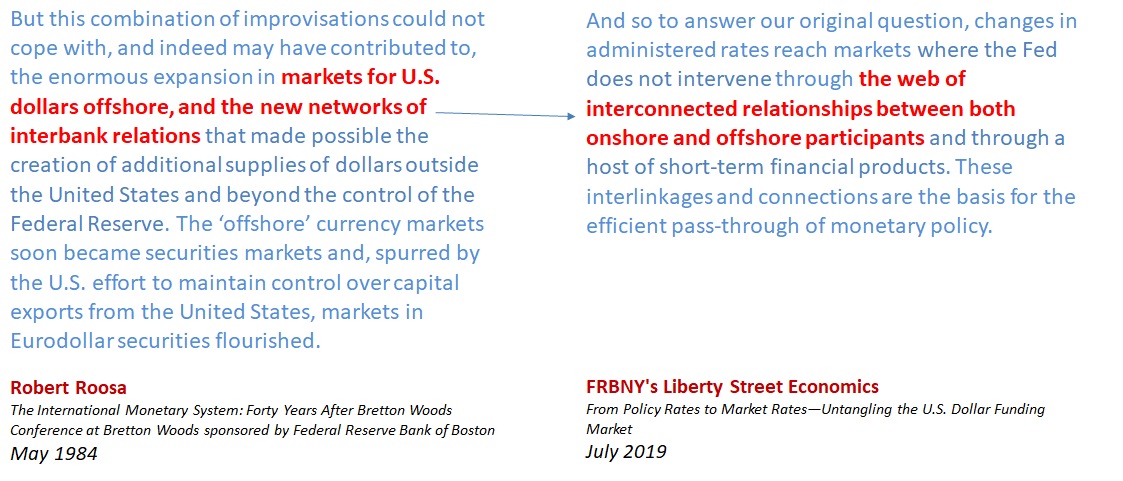

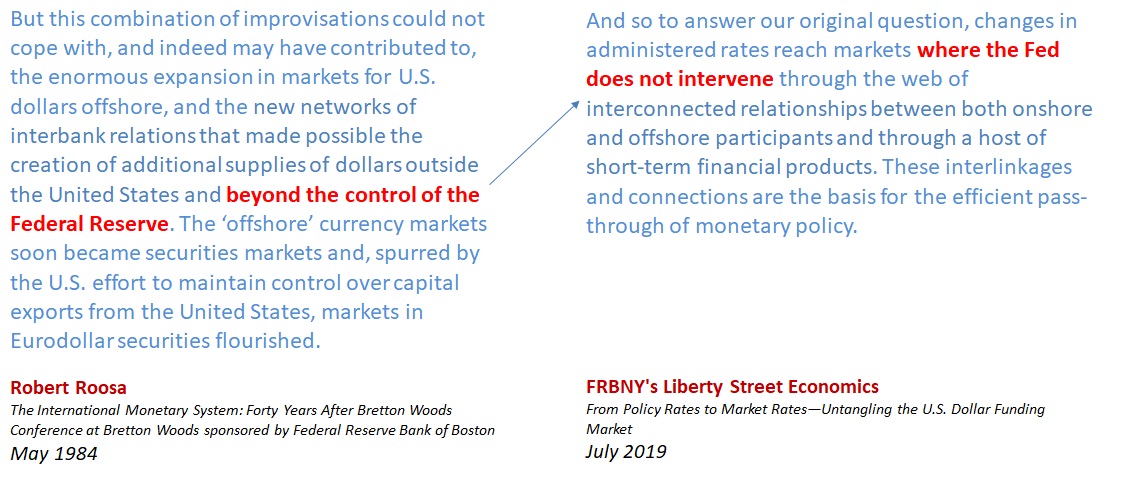

Again, dollar shortage gone global. For the Federal Reserve, its dual mandates end at the US border – therefore, US subs of foreign banks were emergency bidders for liquidity their foreign parents couldn’t obtain from dollar markets outside the United States.

And when that situation arises, as it has four times over the last twelve years, with varying results each time, the dollar’s exchange value tends to go up. Rather than indicate a world going right, King Dollar is really King Kong about to start wrecking things.

Officials have finally come around to understanding the correlation. The dollar goes up and it does not go well. Why the dollar goes up is an entirely different matter.

That divide, however, is slowly, painfully narrowing.

A panel of “currency experts” has now warned the G-20, the Financial Stability Board, and the IMF that the IMF is a dud.

Central banks have lost control of global liquidity. The dollarised international financial system has become treacherously unstable and vulnerable to a sudden reversal in capital flows.

Yet the International Monetary Fund is a diminished force and no longer has the firepower to act as the world’s lender of last resort in an emergency. That is the stark conclusion of a G20 task-force of leading currency experts.

As if anyone needed anything more than Argentina to tell you that. It didn’t stop the IMF’s leader Christine Lagarde from failing upward to now lead Europe’s main central bank. The current state of monetary theory personified.

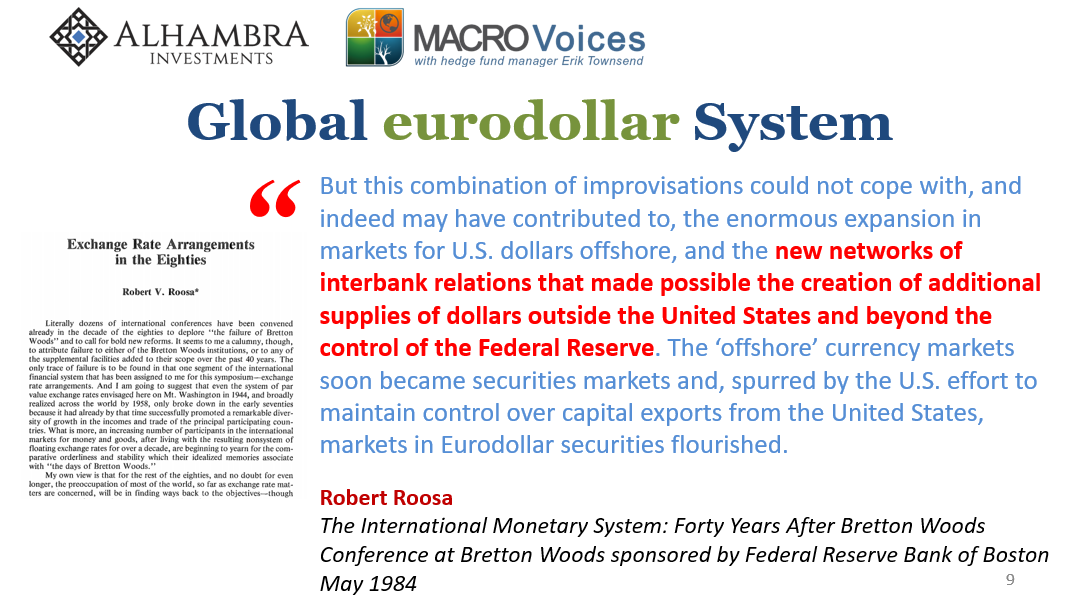

The main fault-line seems to be a, “A surge in offshore dollar lending-increasingly through opaque security markets”, with no central authority standing behind any of it. You don’t say.

But then the “currency experts” blame QE and ZIRP for this situation.

A decade of ultra-low interest rates and quantitative easing has flooded the globe with highly unstable forms of funding denominated in dollars, with no guarantor standing behind them. Glaring currency and maturity mismatches have accumulated.

No, no, no, NOOOOOO. The problem didn’t just become too large for the IMF to handle in recent years, it was always too much for anyone to handle. That’s what the GFC was!

Balance sheet scarcity has pushed the banking system into increasingly creative means in order to be most efficient with what little space they can today afford, and that means more FX to today’s eurodollar compared to yesterday’s. Too much risk, especially liquidity risk, for the too little perceived returns from a global economy that’s not booming and increasingly looks like it never will (three false dawns following a “subprime mortgage crisis” will do that).

This is the world of hidden private reserves I keep telling you about. While authorities diddle around with public reserves, hardly anyone pays much attention to what’s going on where it actually matters.

This private liquidity is highly geared to spasms of risk appetite and over-confidence, and even more geared to panic when trouble starts. It can snap back violently and set off potentially unstoppable chain reactions in a heartbeat. The liquidity is ‘destroyed’ by forced deleveraging. Staircase up, escalator down.

The report doesn’t mention it, but importantly this process of risk-on/risk-off includes collateral availability. A multiplier that expands during “spasms of risk appetite” and then shrinks “when the trouble starts.” How do we classify trouble, though?

Today doesn’t count, they say, since they define the term to mean crash-y kinds of results. A nominal monetary squeeze on the order of several years and no Lehmans doesn’t count for them, even though all the market data says it does for the real economy.

These kinds of baby steps are how you can lose an entire decade, and be one-fifth of the way through another. Specifically with this report, the big drawback is that it is written only to warn about the risks of a possible distant crash – not the very real and ongoing nature of a current squeeze. Official attention is drawn instead toward some theoretical vulnerabilities for a far-off date when another 2008 might be possible.

We don’t need to worry about that scenario, we’ve got a dangerous enough one now already unfolding (for the fourth time).

The Global Financial Crisis was as much a failure of imagination as it had been about repo collateral or (and) the suddenness of balance sheet scarcity. It’s taken this many years for the rising dollar to register its alarm. It’s taken a few more for there to be ongoing work about the “dense matrix of financial claims in dollars” out there in the eurodollar’s domain.

At what point do all these things converge and become a right now issue? Ultimately, that will be the legacy of QE, it’s true purpose. To try to make sure those things never do come together. But like QE’s monetary efficacy, it will ultimately fail here, too. The truth will come out eventually. The only question is how much damage we have to suffer first before enough of them put all these pieces together.

Stay In Touch