The explicit link between QE and the unemployment rate is supposed to be a rough proxy for the domestic economy’s response to repeated monetary prodding. The question is “how rough” a proxy. The official unemployment rate, as noted before, might have served some use prior to the bubble days, but of the economy as it exists in post-2008 there is an obvious disconnect.

Given the unrelenting release of unemployment insurance recipients against a labor force that undercounts marginal workers, the official unemployment statistics certainly fail in their assumed relevance. The other part of that failure lay in the overwrought focus on the bean count, the simple-minded obsession with the numerical tally of “jobs”. In the real world outside of academic and monetary modeling, not all jobs are created (or saved) equal.

The goods economy can fill in these tremendous gaps, serving as a much fuller and broader proxy of every economic aspect we want to evaluate. Stock prices can move to new record highs (on record low volume) but they don’t capture the flow of the economy, particularly in relation to historical precedence.

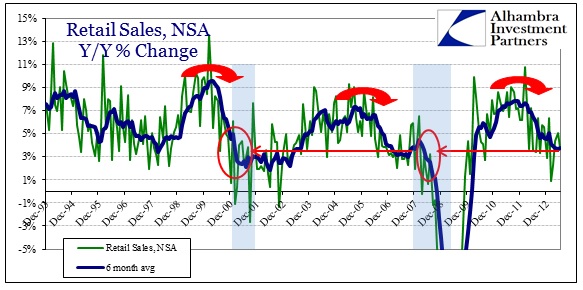

Retail sales provide the closest measure of consumer “health”; and thus as a means of proxy for translating actual income (from whatever source, including some ephemeral “wealth effect”) into economic flow. If the domestic economy is transitioning into growing “traction” (after four years), then it should be readily apparent in spending data. Given the low level of the personal savings rate, there is almost a proportionally direct relationship between household income and spending.

There has been some noted optimism about retail sales in the past few months after a horrendous start to the year. As per usual, economists see month-to-month changes without any context and extrapolate in a straight line to economic robustitude. However, context is king:

The bounce in retail sales has done nothing to break out of the recent trend; with June’s results only confirming the durability of the downswing.

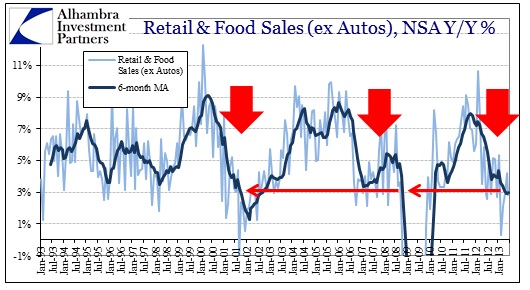

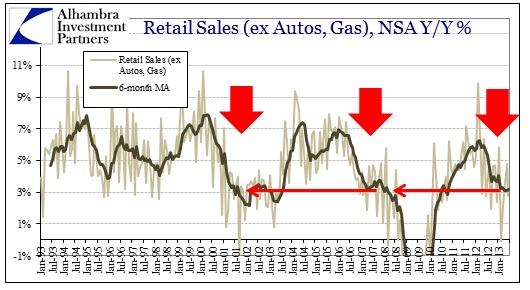

There is also a consistency across sub-segments of the retail sales spectrum that wholly reduces ambiguity. No matter which way you calculate the retail sales proxy, the patterns are fully conforming to an interpretation of the consumer economy at odds with taper-driven optimism and rationalizing:

Given some proper context, it is clear that the retail end of the trade economy is not showing any signs of what might be considered “robust”. In each and every example here, the opposite is clearly the case. The retail economy is at levels typically associated with recession, not a trend that would support claims about the positive efficacy of QE.

If we assume that the trade economy is a more effective proxy for economic affairs, then it is quite at odds with current estimates of employment growth (at least according to the Establishment Survey). That raises two possibilities; either the Household Survey is far more accurate (along with JOLTS) or jobs are a lagging indicator.

While I have certainly argued for the former, there is also good evidence as to the latter, as I will present in Part 2.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch