What is the economy? It seems as if the word has been turned inside out in the modern world. The Greeks who supplied us with its basis simply put together two others of their own; oikos, meaning house, and nemein, meaning manage. Therefore, oikonomia was the management of one’s own household.

Today, “the” economy is far less personal and tangible. To most if not the vast majority, it is an outside view from afar. What’s GDP? How’s the unemployment rate? Someone check the NYSE ticker. These are things which shape a distant view of what must be going on over the horizon. How it is for everyone else out there in the world.

Closer to home, this creates a lot of room for some great distance. Household management is my problems. If there is a very distinct difference in impressions, you can imagine how anyone in that situation might get angry.

If “the” economy is booming, perceived to be, anyway, but “my” economy is not, more times than not I’m going shopping for someone to blame. It’s clearly rigged and unfair, and therefore if it doesn’t change soon maybe we should just tear it all down and start again.

We’ve covered this ground many times before, but it’s interesting (and, frankly, unsettling) now to revisit given where things seem to be heading. Not only are we looking into the abyss of a global downturn in “the” economy, that can only ratchet up the pressure for so very many household economies already on the edge, too.

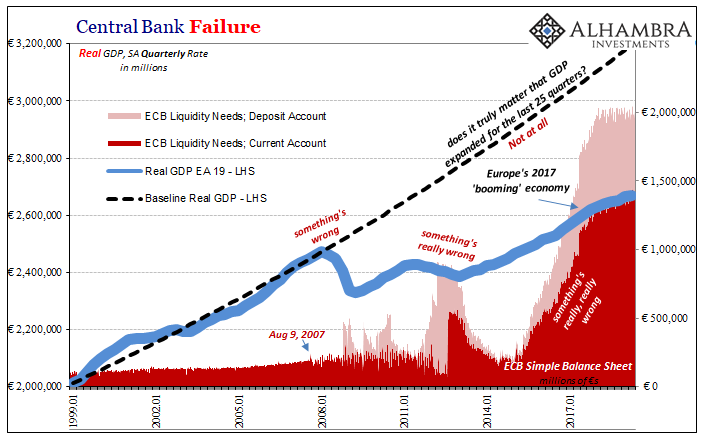

As noted earlier today, and quite often of late, it is Germany which seems to be charting for us what could be our shared global course. “The” German economy whether it was ever booming or not no longer really matters. For a while, Germans agreed that it must have been while in practice they have been acting, at the margins, very differently.

The rise of more extreme political positions is the natural result of what is a product of alienation. That economy and its boom is not my economy, and I can’t help but wonder how it has been stolen from me. There are always, always plenty of politicians who claim to hold the big “answer”; what’s really changed over the past half-decade is how these were never taken so seriously before this economic chasm in tangible experience opened up so wide.

Now with the German economy on the precipice of recession, there’s more than a chance Angela Merkel’s government is finished. By itself, maybe that’s a good thing. What comes rushing in to fill the vacuum, though?

A surge in support for the far-right Alternative for Germany (AfD) party before regional elections next month in two former communist eastern states threatens to wreck Chancellor Angela Merkel’s unwieldy right-left coalition government.

Opinion polls suggest the anti-immigrant AfD could come first in both states in the Sept. 1 elections, in what would be a humiliating outcome for Merkel’s party and the SPD, which have ruled Germany together for 10 of her past 14 years in power. [emphasis added]

Something’s deeply wrong and the ruling establishment can only claim there is nothing wrong. That’s what they’ve been saying since someone thought up the slogan “globally synchronized growth.” It was partly in response to the rise of populism and political alternatives which Euro$ #3 had unleashed in 2016.

To delegitimize any basis for this obvious dissatisfaction, Economists and central bankers (same thing) pointed to the minor upturn in 2017 as proof, indisputable evidence that there were only dangerous undercurrents underpinning the growing political and social backlash. As I wrote practically at the top of Reflation #3:

From a political or “elite” standpoint, this disconnect is somewhat understandable if entirely unsympathetic. It’s not just that Economists claim there is little or nothing wrong with the economy, even those who otherwise relate to the struggle of workers fail to identify and explain the reason for that struggle.

To get closer to the truth, we have to run in a direction that seems entirely backward, or at least wholly inappropriate upon first issue. It is exceedingly difficult to believe in the cause of the problem when that is, among many similar things, Deutsche Bank not making enough money.

That’s just how backwards everything has become, how turned around and disoriented the world. You can’t say “the” economy is not booming because everyone knows that it is. And you also can’t say that banks aren’t making enough money because everyone also knows those greedy bastards are raking it in over things like QE and bailouts. The actual evidence shows neither is true, especially the second one (banks have shrunk), but the issues are so clouded, often upside down, there’s no making heads nor tails from anything.

The whole damn thing is up for grabs as a result. It’s called tail risk. In this case, it’s a tail unlike anything the world has seen in generations.

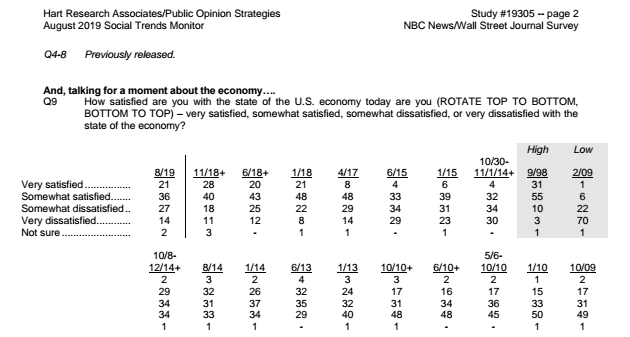

We see this dynamic taking shape all over the world, even here in America where the boom was supposedly boomiest. The updated results from a recent NBC/Wall Street Journal poll show just what I mean. According to their statistics (shown below), the number of Americans satisfied with “the” economy has gone up since the start of 2017 while the proportion very satisfied has gone way up (though it has fallen back since last November’s landmine).

Like consumer confidence indices, it certainly seems to mirror the stock market’s view of things (with a splash of the unemployment rate thrown in).

But if “the” economy is doing so well, why do so many remain just as angry as they were several years ago? The very same poll shows that in August 2019, 70% of respondents say they are angry “because our political system seems to only be working for the insiders with money and power, like those on Wall Street and in Washington, rather than it working to help everyday people get ahead.”

That’s practically the same number as was tabulated in October 2015 (69%). But here’s the kicker. Even after telling researchers how they were satisfied or very satisfied with “the” economy, when it comes to their own view of their own situation it’s a very different story. One that hasn’t really changed much despite record highs in stocks.

Somehow, 56% answered recently how they were still “anxious and uncertain because the economy still feels rocky and unpredictable so you worry about paying your bills, day to day living costs, and whether you can count on your situation being stable.” That compares to 61% who in October 2015 revealed they felt the same way.

“The” economy must be awesome but somehow significantly more than half of Americans don’t see it quite that way for themselves.

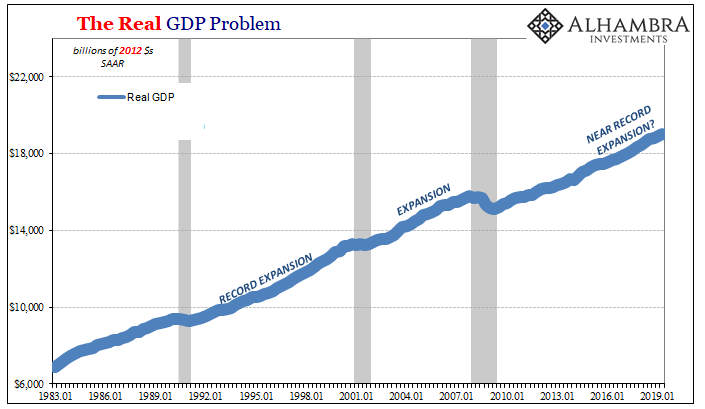

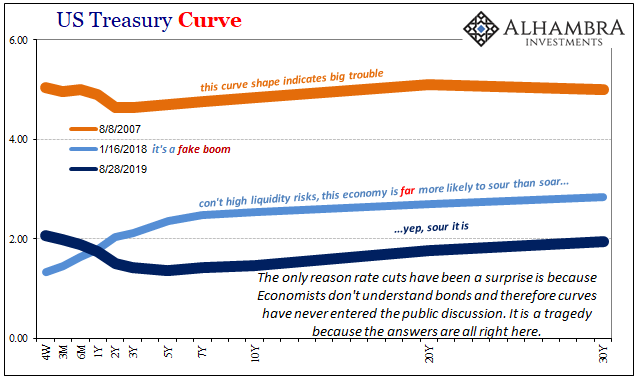

What’s really tragic about all this is that it is really a simple matter of perspective. To the public, “the” economy is this one:

So, they tell pollsters they are satisfied with the blue line, rising share prices, and the constant references to the 50-year low for the unemployment rate. How can anyone not be?

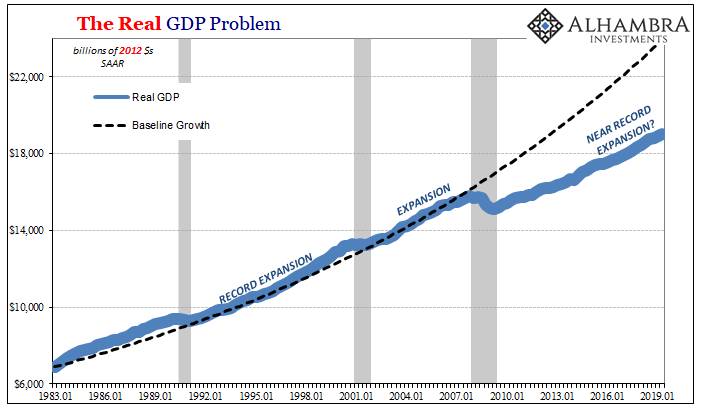

And yet, when they think of their own economy, their household situation, it is perfectly clear that far too many “feel” the real economic situation which is instead this one…

…but can’t explain the disconnect. Nobody even bothers to try any longer.

After having screwed everything up from August 2007 forward and left the world in this precarious state, central bankers have performed one further despicable disservice.

In an effort only to save themselves from accountability, they created a fake boom out of nothing in order to justify the bigger and bigger gap you see immediately above; the same gap into which the world’s public is pouring its collected anger. As I wrote a few months ago:

As such, no Economist nor central banker will draw that [dashed] line. They have every reason to convince you (and themselves) it’s not real. This is one big reason why they hate UST’s and eurodollar futures. These curves remind them that, yes, in fact, the gap is very real and in fact it is all that matters.

It is real and it always was. This gap is the whole global story; nothing else matters. And that was before 2019.

With curves now having gone a whole lot further, you have to wonder what comes next – aside from the perfectly transparent yield curve denial now on display. But for one small but powerful dotted line, the world spirals unproductively in every (wrong) direction.

The Greeks were right. Economy is still about what’s personal.

Stay In Touch