JP Morgan’s CEO Jamie Dimon climbed back up on the bond bear. It was one year ago, May 7, 2018, when he went on BloombergTV and caused a substantial market stir when he said 4%. No one would want to buy UST’s what with inflation raging and the Federal Reserve forced into an overly aggressive stance by virtue of the huge American economic boom, Dimon reasoned. Add the structural “demand” problems on top of that, and it was a recipe for a bond massacre.

Coming from the leader of one of the biggest Wall Street banks, telling the world to prepare for the 10-year UST yields at 4% – just to start – it was a major piece of news. Inflation hysteria personified.

The 10s were at 2.95% last year when Dimon put out his warning. This was several weeks before the events of May 29, a global monetary disruption obviously Mr. Dimon did not anticipate. Yields on the 10s today are 2.45%.

No matter. Appearing again on Bloomberg yesterday, the big bank chief reiterated that interest rates are, in his belief, way too low. His words appeared in the media just as the Treasury announced a very poor 10-year UST auction. For this one auction, Dimon’s warning was, we are told, “validated.”

The bear narrative has (or had) been revived, brushed off and sent running all over the media for one day, especially at Bloomberg:

The U.S. Treasury on Wednesday saw the weakest demand for its benchmark 10-year note in a decade, illustrating the diminishing appetite among some investors to accept current yields…

“Extraordinarily low’’ is how JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon described the current level –- 2.45 percent in London trading Thursday –- in an interview with Bloomberg Television on Wednesday. Large-scale asset purchases by central banks “had to have an effect on the 10-year,’’ he said.

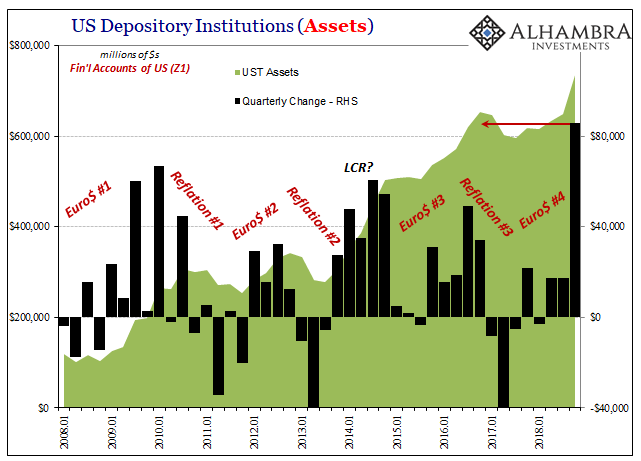

It’s the same question these very confused people keep asking; who is it that keeps buying all these US Treasuries?

Um, JP Morgan.

That very bank filed its first quarter 10-Q with the SEC a week ago. These filings aren’t as detailed as they should be, but there is enough information in them to get a general sense of what’s on their balance sheet asset side. What you find is, surprise, surprise, a whole lot more UST’s and the like.

What’s reported here taken from the 10-Q’s is what the bank says are the total assets being measured at fair value on a recurring basis. That can mean the bank is simply adding assets to this list that were already classified elsewhere on another basis. It’s highly unlikely, however, leaving us to reasonably infer a bunch of buying activity in JPM’s various books.

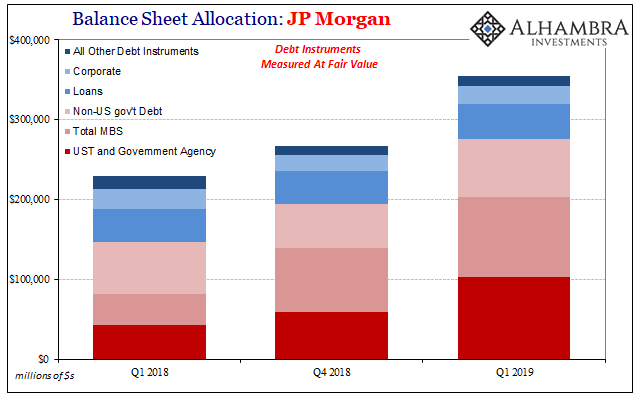

According to the bank’s statements, in Q1 2018, before Dimon’s original 4% alarm, JP Morgan was measuring $42.5 billion in UST’s and Government Agency debt at fair value. By the end of last year, following a whole bunch of chaos and turmoil around the globe, an increasing sense of economic uncertainty if not worse, JP Morgan reported nearly $60 billion in the same assets. An increase of about $17 billion, or nearly 40%.

As of the latest filing for the end of Q1 2019, the bank reported another $43.5 billion of the same debt instruments, primarily UST’s, bringing the total to over $102 billion. That’s up 74% from Q4, and way more than double what was measured at fair value in the same quarter the year before.

The total amount of all debt instruments being valued this way rose in the same period, too, indicating JPM was expanding its footprint in these parts of the credit markets even though its CEO was warning about…credit markets. And as more credit was added, the proportion of UST’s in the overall mix rose substantially.

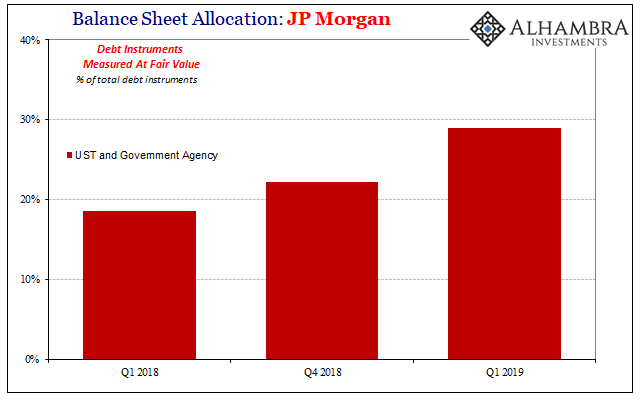

In Q1 2018, 18.5% of all debt instruments being measured at fair value were UST’s and similar agency debt. By Q4, well after Dimon’s warning, 22.2%. As of the latest quarter, 29.0%.

Again, it may be that JPM is doing something else in its statements, reclassifying instruments it has already held elsewhere. I don’t believe that is the case.

Rather, it seems perfectly reasonable given the data the bank publishes for itself as well as what actually happened in the interim to conclude JP Morgan was one of the biggest buyers, and holders, of UST’s and the like over the past year.

If that is the correct interpretation of this one bank’s balance sheet presentation, then it certainly was not alone among its banking peers. While so many bank Economists (and other CEO’s) were out in the public declaring an “end to the 30-year bond bull”, the banks they worked for were so very bullish on bonds in action in opposition to all those mainstream words.

If Jamie Dimon’s own bank is actually doing the opposite of what he says in his public proclamations and contrary warnings, why is he trying so hard to be so out of step so as to end up so firmly on Jay Powell’s side? Instead of constantly and uncritically repeating his Bill Gross impersonations, almost cheering them, perhaps someone in one of these media interviews might ask him that very question.

Stay In Touch