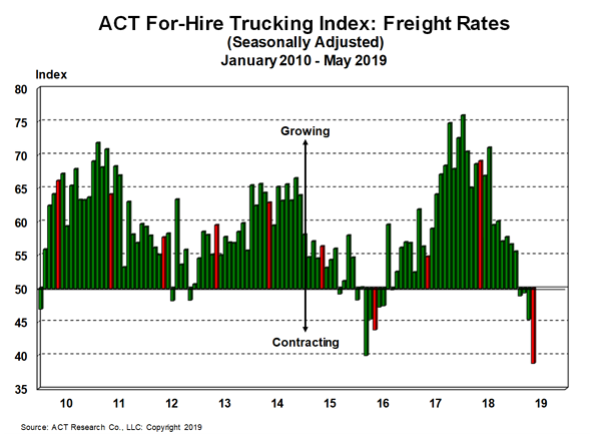

ACT Research, the leading publisher of commercial vehicle industry data in North America, reported last week that freight rates in for-hire trucking had declined in May. It was the fourth month in row when prices had been pressured. More and more, there is a downturn growing in the transportation sector.

Commenting on freight rates, Tim Denoyer, ACT’s VP and Senior Analyst said:

May’s Pricing Index was the fourth consecutive negative, after 30 straight months of expansion. This confirms our expectation that the annual bid season is not going well for truckers…The softness coincides with several other recent freight metrics, with the drop likely due in part to rapid growth of private fleets and the slowdown in the industrial sector of the economy

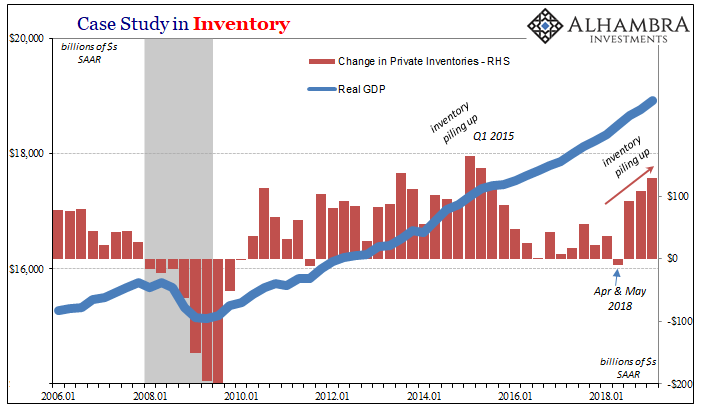

Broad economic weakness can manifest in any number of ways. One is slower and then lower demand to move goods. Even when producers are still making them, if retailers don’t want what’s being produced the inventory will accumulate at various levels of the supply chain and the demand for movement within it sinks.

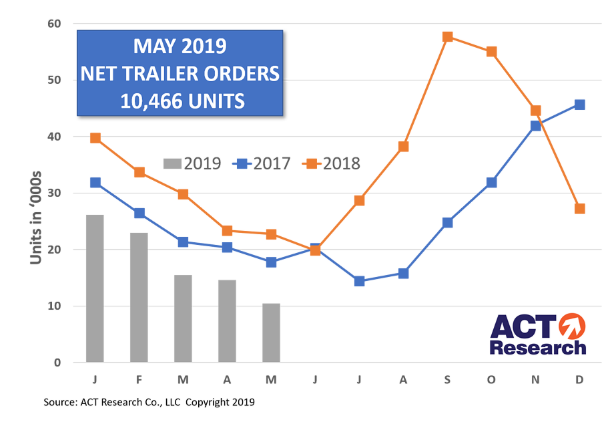

Not only does the rate for trucking decline, it leads to sharply lower demand for trucks themselves. According to a separate report from ACT Research earlier in June, there were 10,800 orders for these kinds of the heaviest commercial vehicles in the month of May 2019. There had been 35,608 ordered in May 2018, a decline of 71% year-over-year.

And it’s not just the one month. Class 8 orders through all five months of 2019 are 64% lower than they were in the same five months of 2018. Given these other results, another ACT VP, Steve Tam, warned:

Clearly, demand is waning. Rates continue to deteriorate. So I think as that story keeps playing out, more and more carriers are becoming cognizant of market conditions, if they are not already getting that message through their firsthand experience.

It is lower level confirmation of the inventory piece of the otherwise happily-accepted Q1 GDP report. The trucking industry is a leading indicator for the goods economy as a manufacturing if not industry-wide (Class 8 includes heavy vehicles for more than just transportion; construction equipment, too) recession.

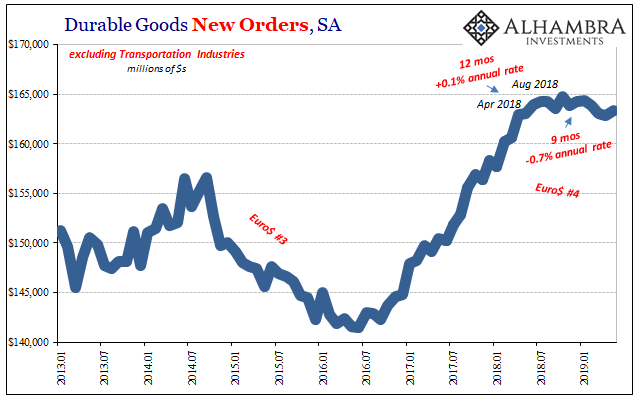

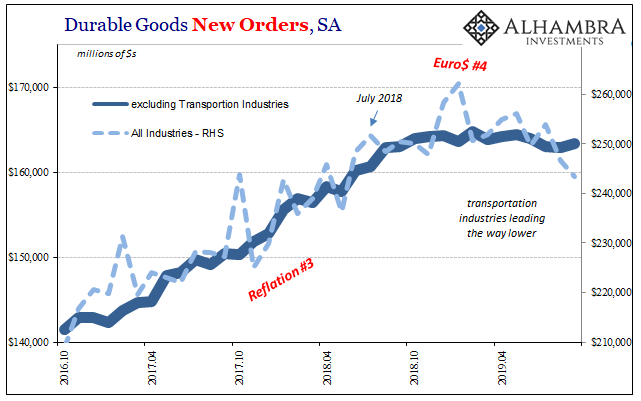

According to the latest data from the Census Bureau, the goods economy may have been in this condition for about a year already. Excluding the transportation sector, orders for new durable goods were slightly less in May 2019 than either last July or August, and about equal to the level of May 2018.

While overall goods orders are down only a little thus far, including the transportation sector they are off more than 7% since last September.

Some of that reflects the struggles at Boeing. Non-defense aircraft orders overall are down, too, as the manufacturer has been hit with a string of questions and problems with its 737MAX airframe. Eight days ago, however, British Airways announced that it had signed a letter of intent to purchase 200 of the 737MAX varieties in the near future.

Obviously, these wouldn’t have been included in the monthly data for May, nor are they likely to show up next month when June’s estimates are released (a letter of intent is not a firm deal, rather the beginning of the negotiation process which will likely involve, in this case, significant haggling over price).

What this could mean is that new non-defense aircraft orders start showing up in durable goods over the summer, leaving the full extent of macro factors to explain the rest of the data however they may turn out.

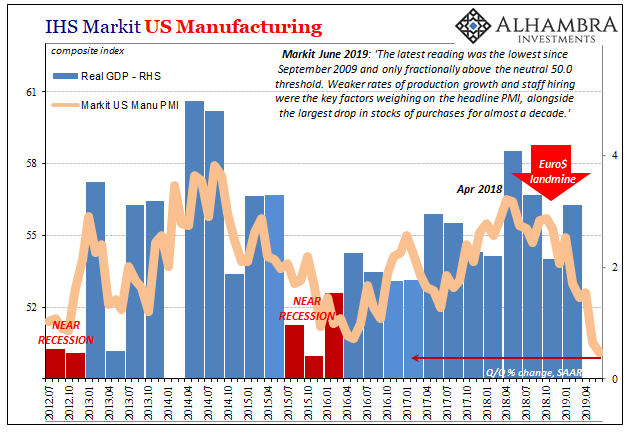

May’s figures place the goods economy in recessionary circumstances, or a predicate condition, but not yet the full-scale drop many associate with a business cycle change.

If we go by PMI data, then it wasn’t until May and really the current month when the more dramatic softening in the manufacturing sector began to show up – at least in the US.

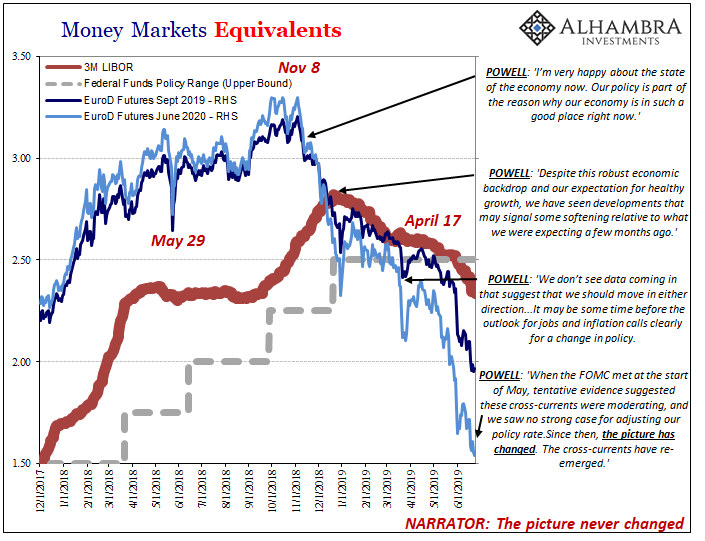

Therefore, any possible Boeing boost is likely to run into these other macro factors in the very near future. Aircraft orders alone won’t be enough for a second half rebound, and if everything else continues the way it is already going, the Federal Reserve won’t be able to hold off on rate cuts until 2020.

In the words of Chairman Powell, these are cross-currents for the economy (really the economic effects of financial and monetary cross-currents) but not yet the full-blown hazardous cross winds. Given what he said yesterday, and the other data leading into durable goods, it might not be very long before they really make their presence here.

Stay In Touch