Former US Senator Augustus Hawkins died in November 2007. It may seem superstitious to superimpose meaning on the timing, but maybe the only way it wouldn’t was if he had passed right on August 9 of that year.

When I think of Humphrey-Hawkins, I don’t think of it at all as the vast majority seems to. I remain struck by what’s missing from it. For most, this seemingly archaic law is nothing more a required bit of theatrics. Twice each year the Chairman of the Federal Reserve is obligated by it to go up to Capitol Hill and report to Congress on the country’s economic situation.

The law doesn’t differentiate, however. In other words, it has nothing to say about whether or not the Federal Reserve Chairman is the right person for the task – whomever that Chairman might be at any given moment. It seemed the correct structure in 1978 when it became law because everything that was wrong with the economy during the seventies was easily laid at the central bank’s door. Why not force him, or her, to answer for it?

Thus, when I conceive of Humphrey Hawkins I consider what isn’t in it any longer. I occasionally give a relatively simple background presentation of eurodollar history as an introduction into the shadows of the modern monetary age. A central piece of it is the Full Employment and Balanced Growth Act of 1978, or what has become known as Humphrey-Hawkins, not really because of the specifics of the bill but because of the general propositions that made it what it was in the increasingly distant past.

As I say:

It was at one time common knowledge that money and economy were inseparable, for how could it be otherwise? In the seventies even the US Congress, let me repeat that, even the United States Congress recognized money and economy as intricately linked… In its original form, though, the law was far more than that. It also required, among other things, the Fed to prepare and maintain monetary targets. Again, even Congress realized the connection between money and economy, or, more appropriately, monetary dysfunction and grave economic dysfunction.

How bad must it have been if as an institution you are outflanked and publicly humiliated by Congress of all things? The last five Federal Reserve Chairs each of them has had no idea how to define money, and the two before them maintained at best a very tenuous grasp. This isn’t some conspiratorial charge, it’s all right there in the public record (Alan Greenspan many times saying so explicitly). Such a divorce came to be believed as regrettable but not dispositive even for operational standards – and then 2008 happened.

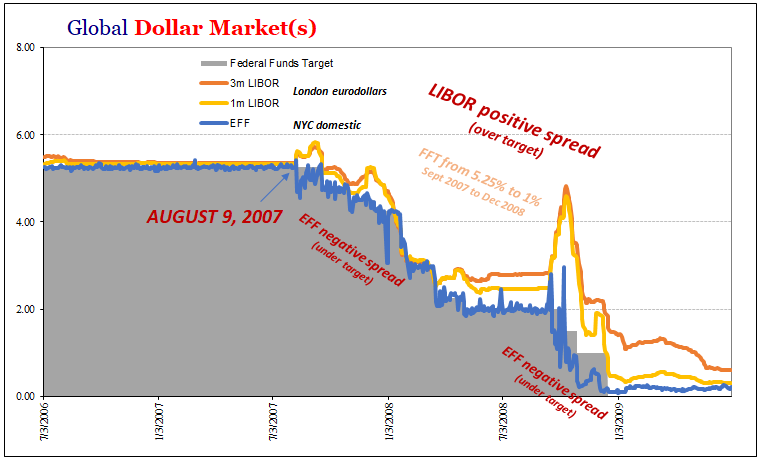

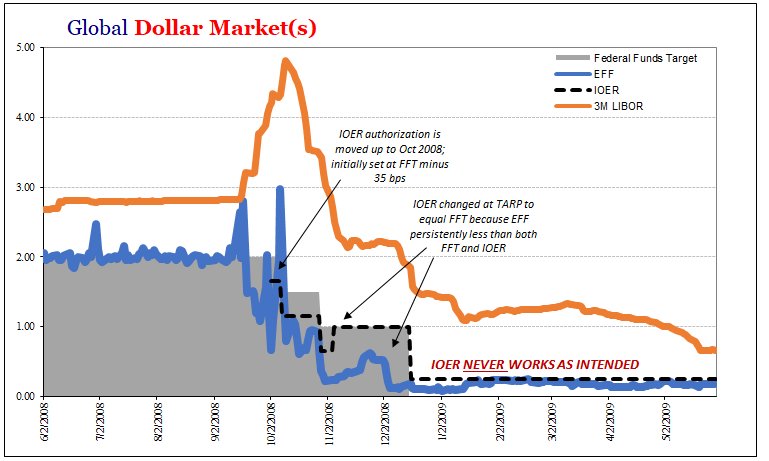

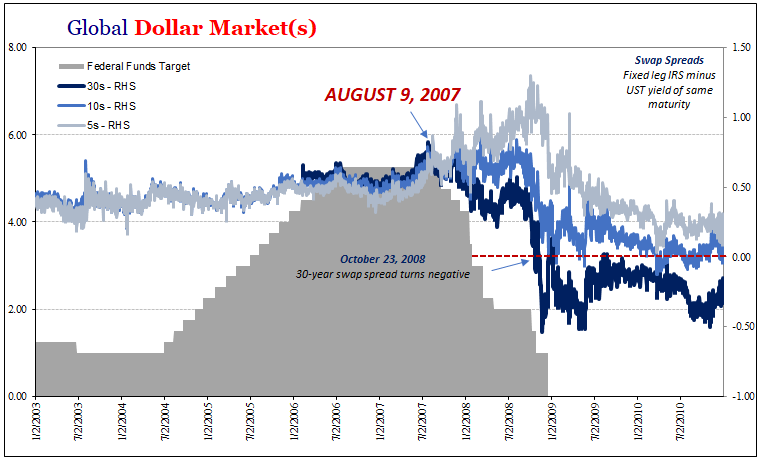

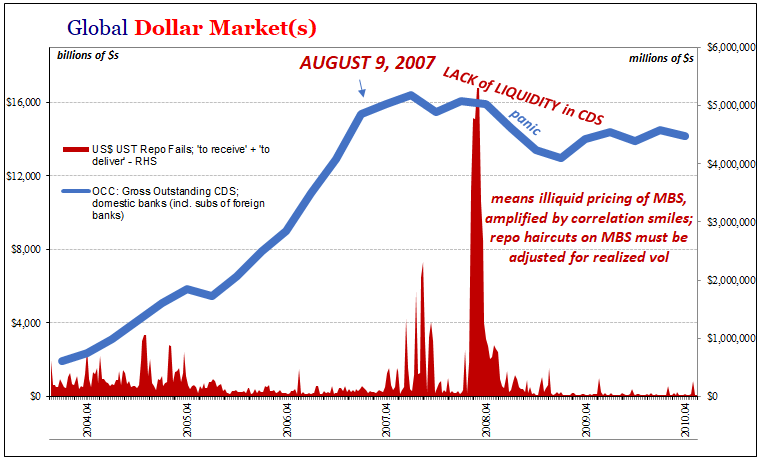

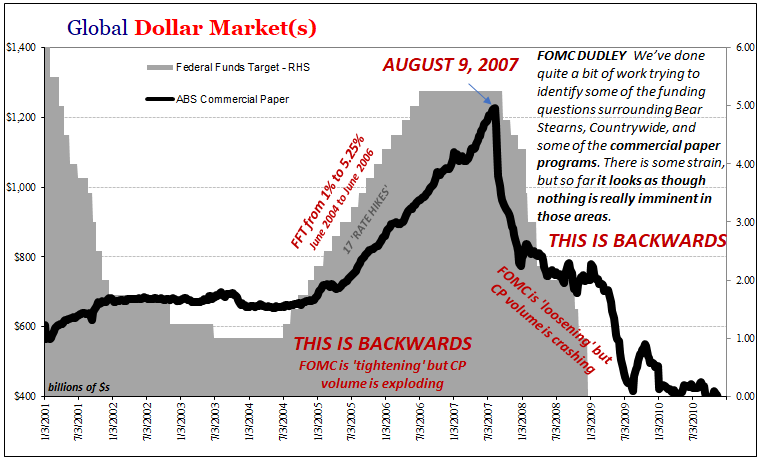

Suddenly, you may have gotten the sense these people didn’t know what they were doing. They had moved the federal funds rate (and only the federal funds rate) around a little at a time and everything seemed perhaps a bit off but largely OK. Then, seemingly out of nowhere, nothing they did worked. The system crashed, and then kept on crashing.

The 2008 panic was really two, maybe even three (the last occurring all in 2009). In between Bear and Lehman, the FOMC minutes would state things like the following (taken from June 2008):

In their discussion of the economic situation and outlook, FOMC participants noted that spending in recent months had evidently been less weak than anticipated, leading participants to revise up their assessment of economic growth in the first half of 2008. Nonetheless, most participants judged that the slightly firmer path of spending did not presage a near-term strengthening of the expansion. Economic activity would probably continue to expand slowly over the next several quarters, restrained by a range of factors, including strains in financial markets and institutions and the resulting tightness of credit conditions; ongoing weakness in the housing sector; and the increases in energy and agricultural commodity prices. [emphasis added]

Only an institution supposedly devoted to monetary stewardship yet so thoroughly divorced from money could ever have made such a statement. Restrained by a range of factors? There was only one thing that mattered in 2008, the very thing the Federal Reserve told everyone it had total control over. And it wasn’t some minor nuisance, either, it was about to wreck everything.

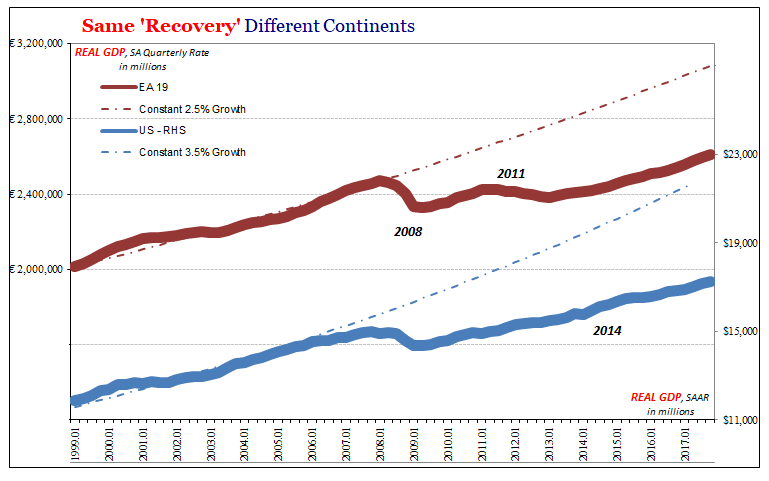

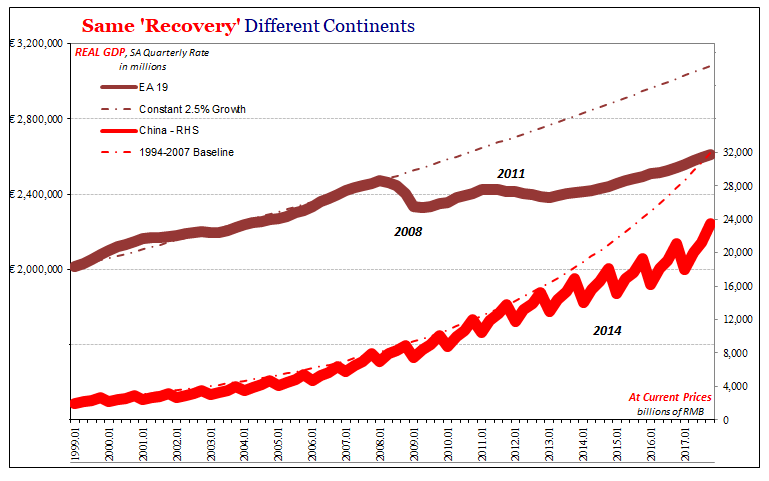

What has changed since? Nothing. Not one thing. As if hellbent on proving just that, they voted for four QE’s (there were four, not three) which removed all doubt. Empirically, it was established the central bank has no control and very little influence over the global monetary system (see: dollar, rising).

The latest FOMC statement for the March 2018 meeting contains within it the same sort of gems as those published before and taken by the mainstream, somehow, completely at face value without any critical questioning whatsoever.

In short-term funding markets, increased issuance of Treasury bills lifted Treasury bill yields above comparable-maturity OIS rates for the first time in almost a decade. The rise in bill yields was a factor that pushed up money market rates and widened the spreads of certificates of deposit and term London interbank offered rates relative to OIS rates.

Here’s the only question that matters: how would they even know what it was? Many people have talked about LIBOR-OIS of late, and most of them (if not all) tend toward the benign like the FOMC. But then none of them can answer for the most basic of monetary questions, starting with where is all this inflation these same people have been predicting for five years?

You don’t “print” trillions of dollars and then undershoot an explicit inflation target year after year after year unless maybe you didn’t actually print anything of use and value. And you only continue to predict this inflationary breakout time and again if you don’t really understand what it was you really did.

Again, how would these people even know?

Humphrey-Hawkins is instructive. The Federal Reserve in particular was viewed at the time of its passage in almost hostile fashion with reason. I wrote a couple of years ago:

This theatrical display of officialdom is but a remnant of much more substantial requirements of decades past. As is typical, historical periods of great upset are where hardened changes and reforms are born. People don’t learn until they are forced to learn; bureaucracies most of all.

The Fed hasn’t really changed, and nobody today is willing to step up and reimpose the same parameters – monetary competence. Where is the next Augustus Hawkins? They can blame bill yields for yet another spread blowout with impunity while somehow avoiding the main element in everything across the last ten years, most especially the still rising economic costs being imposed all over the world.

It’s hard not to look at the charts below and marvel at that June 2008 assessment. Everything actually makes sense by doing nothing more than that.

Stay In Touch