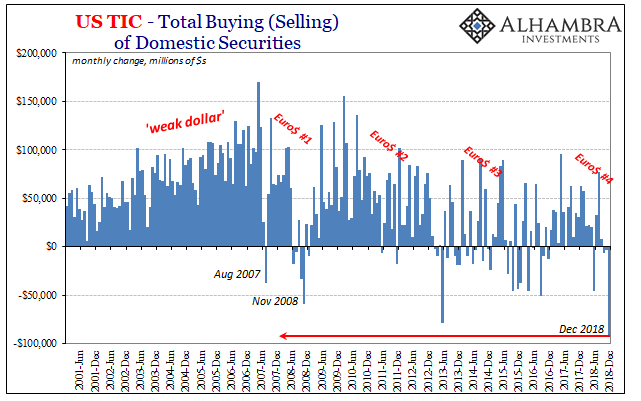

The TIC data for December 2018 starts out well enough, exactly the way it should. The headline says foreigners sold a record amount of US$ assets in that month. Anyone paying attention during it would be the opposite of shocked. Everyone sold anything they could in December. It follows from the idea of dollar shortage.

However, then you start asking who was selling and why. Not only does TIC come up short, it leaves us with more questions than answers.

Let’s start with what we do know. These eurodollar events, up to four now, are almost entirely banking affairs. This is the least surprising aspect once you consider the chief monetary element missing since 2007 has been balance sheet capacity. Bank balance sheet capacity. Not central bank.

The resources the global banking system uses to piece together individual assets, funding them with often esoteric liabilities, and then the even weirder stuff to make them fit constraints (internal as well as regulatory), all of that has been in very short supply the last eleven years. Banks are struggling therefore the central, majority piece of global money does. In a credit-based monetary system, that’s a big deal.

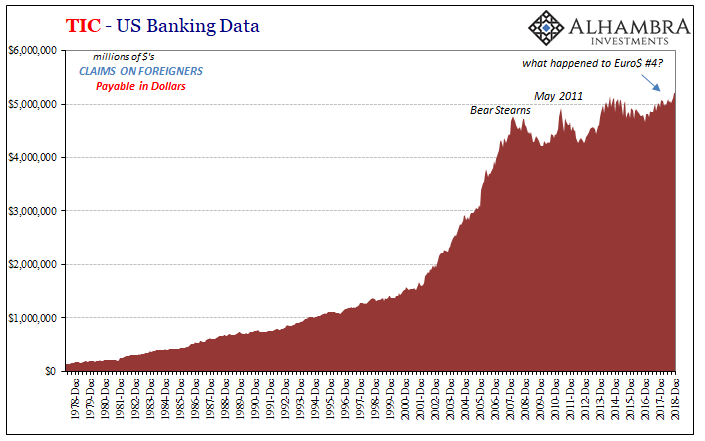

Euro$ #4 shows up right when we would expect – January 2018 coincident to the first series of liquidations. They seem minor in contrast to December’s, but at the time they were shocking in the contrary notion to the inflation hysteria end to the globally synchronized growth narrative. In the buildup to first EM turmoil raging, cross border bank funding was cut back dramatically.

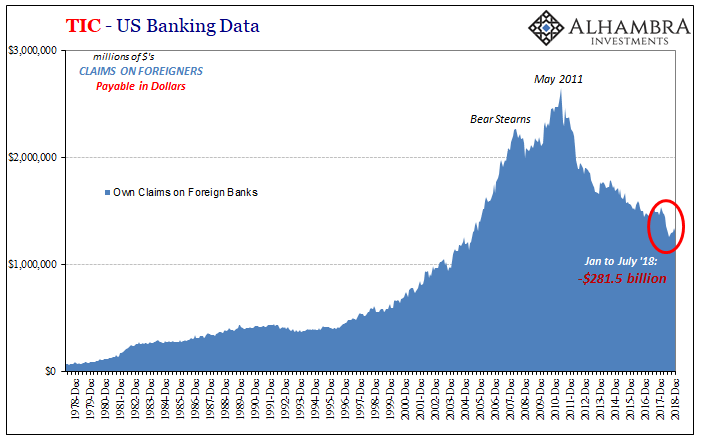

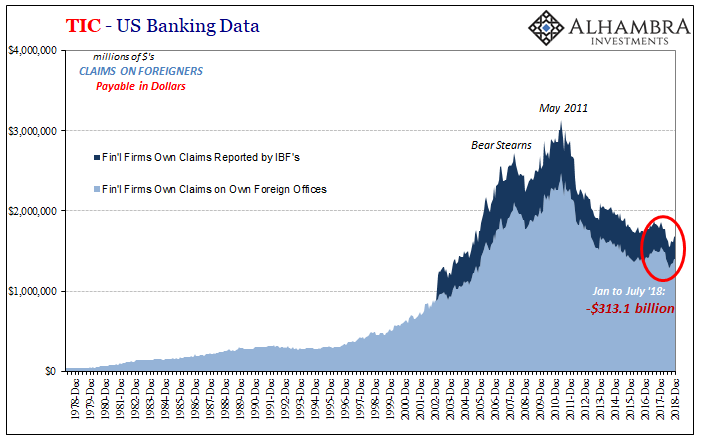

That funding hole hit the same part of the system as what triggered panic in 2008 as well as the mess in 2011 – the heart of the original eurodollar network. Again, individual balance sheet capacity. In the old days of the fifties and sixties, for a variety of reasons banks set up foreign affiliates (including IBF’s) so as to connect their own activities to the burgeoning eurodollar market. This meant a rigorous cross-border trade between a bank and its own foreign subsidiary.

And it was a two-way channel; if there was better opportunity to lend in dollars in London or the Caymans, the foreign sub could undertake the transaction and then borrow the funds from the US parent (or, for foreign banks, their parent might lend dollars in offshore markets by borrowing them from their subsidiaries operating out of NYC). Or vice versa. The vast majority of cross-border bank dollar activity is this back and forth between ostensibly the same financial firm.

What happens when those dollars get offshore is even murkier.

This used to be the backbone governing global money hierarchy. The spread between LIBOR and federal funds, for example, was predictable and predictably small based on arbitrage carried out in just this manner. With fewer dollars going back and forth, it is no wonder money market hierarchy has largely deserted the post-crisis system.

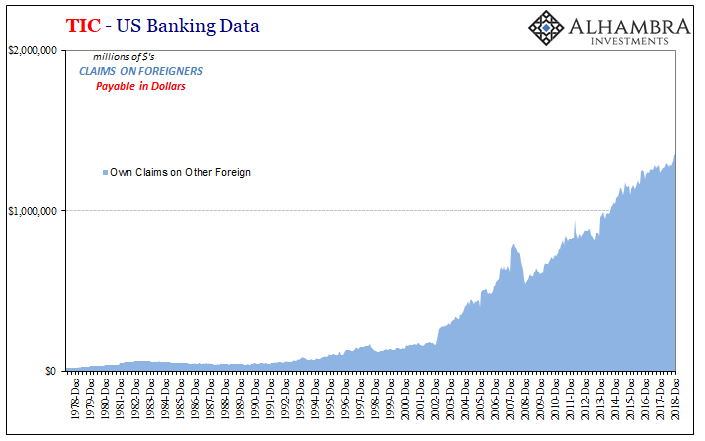

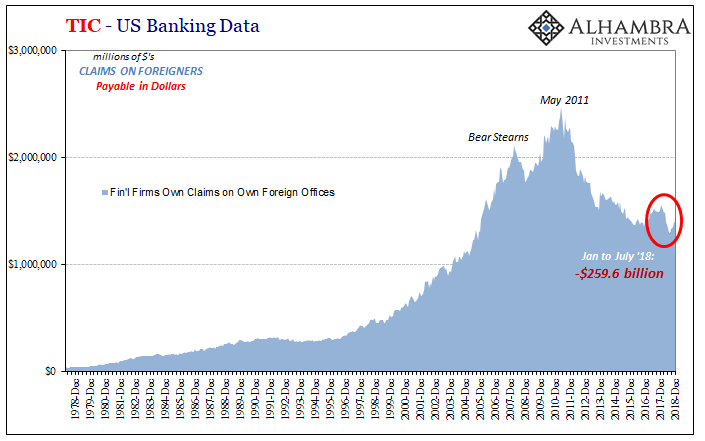

The specific TIC “blue” you see immediately above is US banks lending dollars to their foreign subs (or foreign subs situated in the US lending dollars to their overseas parents). Claims are loans to another entity; assets. These are, to oversimplify, dollars going out into the offshore market.

Between January and July 2018, according to bank call reported compiled under TIC, a quarter trillion of these “dollars going out” just vanished. We can easily infer from there, only starting with Milton Friedman’s eurodollar multiplier, a whole lot of havoc in that offshore space. EM crisis easily explained.

But you’ll notice how since July, this core piece of monetary funding has been on the upswing. In December, the very month in question, another small contribution. In fact, during that extremely crucial October to December window, there was no new trouble indicated here.

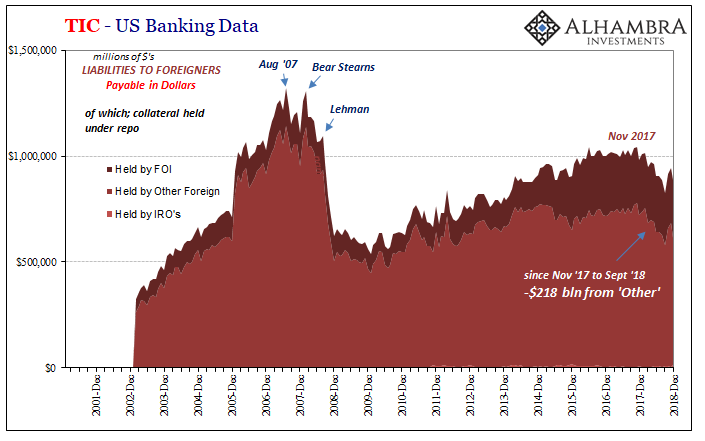

If we flip over to the other side, it’s an even bigger mess. Revisions to, and changes within, the data have completely erased Euro$ #4 from the “red.” Here’s what it looked like several months ago before them:

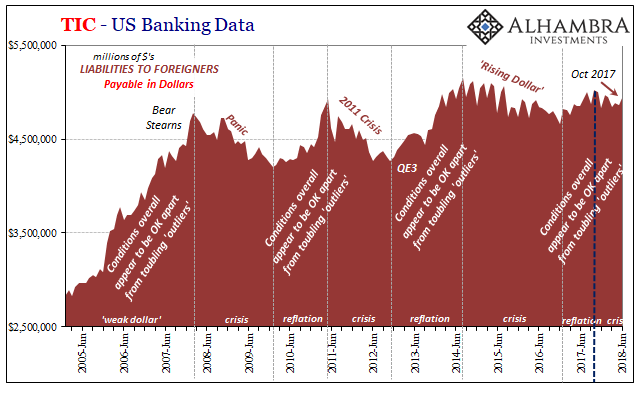

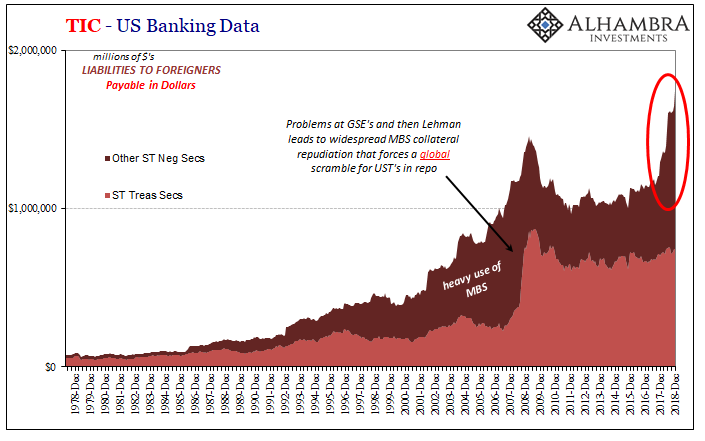

What is most responsible for this revised reversal is the very line we’ve been watching since May 29. Subsequent to what was a major, worldwide collateral disruption the TIC data indicated that “other” financial firms located overseas had somehow, some way supplied “other” financial assets to what sure seemed to have been desperate US entities (at least we know they were banks on the receiving end).

The footnotes for the series suggest these were possibly CLO’s. For what purpose? Can’t say. The amount that just shows up in June was staggering. Sure enough, there was another huge “contribution” in the very same segment during December; +$89.4 billion. I wouldn’t be surprised if it gets revised upward in the coming months.

It seems to be turning effective funding problems, a negative, into a TIC red positive since it is accounted for here as an addition. All we know from these figures is that during and after some of the worst market conditions the past year or so the level of reported cross border positions in something like CLO’s has exploded and continues (at least as far as December) on this way.

This contrasts sharply with other TIC “red” line items such as what is specifically classified as securities involved in cross border repo.

In this section, the big subtraction is what you expect to find after what was observed in the real world. Except, here, too, the last few months of 2018 don’t match. Repo flow was up sharply in October and November, though it did decline substantially in December.

We can speculate wildly about any number of strange possibilities to try and explain this disparity (between repo minus versus CLO positive). I have in my mind EM Eurobonds plus any number of syndicated leveraged loans tied to them and the collateral transformations that have almost certainly been used to fund all the positions. That might account for both.

But even if it does, it still leaves us with our mystery surrounding December 2018. Who? What? Why? We know there was heavy selling and liquidation and we know it hit the offshore arena. Headline TIC shows us exactly that. It doesn’t appear to have originated in the eurodollar bank channel, at least not directly (it could have been reverberations or a hidden and delayed response after collapse in the offshore “multiplier” across different dimensions).

It leaves us, as only a beginning, to suspect the deeper shadows (FX). This is all pretty shadowy to begin with, yet there are other offshore money parts that see even less the light of day. You can take that however you wish, as encouraging or perhaps another warning; we are pretty sure the partially hidden stuff was bad to start 2018 off, and then much less sure it was the more completely hidden stuff which must’ve been even worse to finish the year.

The implication no matter how it might ever shake out, and we just may never know, is that the system is disturbed. This much TIC can confirm, both that something isn’t right as well as how we are still missing some key pieces. It is invaluable data, but it is far from perfect. This is what happens when the Treasury Department only collects the information by accident.

Stay In Touch