Things have changed, obviously. Chairman Powell and the rest of the FOMC, the majority anyway, have come around to rate cuts. Where they were hawkish in December, noncommittal as late as May, they’ve been spooked into them over the last month or so. As it stands, the first one is less than three weeks away.

It’s not so much the lack of inflation any longer. No one should ever forget the 2018 story, the inflation hysteria which raged throughout much of last year and ended in a pile of confused regrets. The unemployment rate told of an economy on the verge of boiling over, beyond overheating in a good way. The Fed had to get ahead of those pressures else a new danger would emerge, more like 1975 than 2015.

But if it was the lack of inflation which first flip flopped the FOMC from hawk to pause, it is the threat of renewed disinflation which is pushing officials from pause to cuts. In the minds of central bankers, they can afford to sit still and let things play out when inflation just doesn’t show up. Sure, they’ll be confused and maybe even regretful, but there’s no rush.

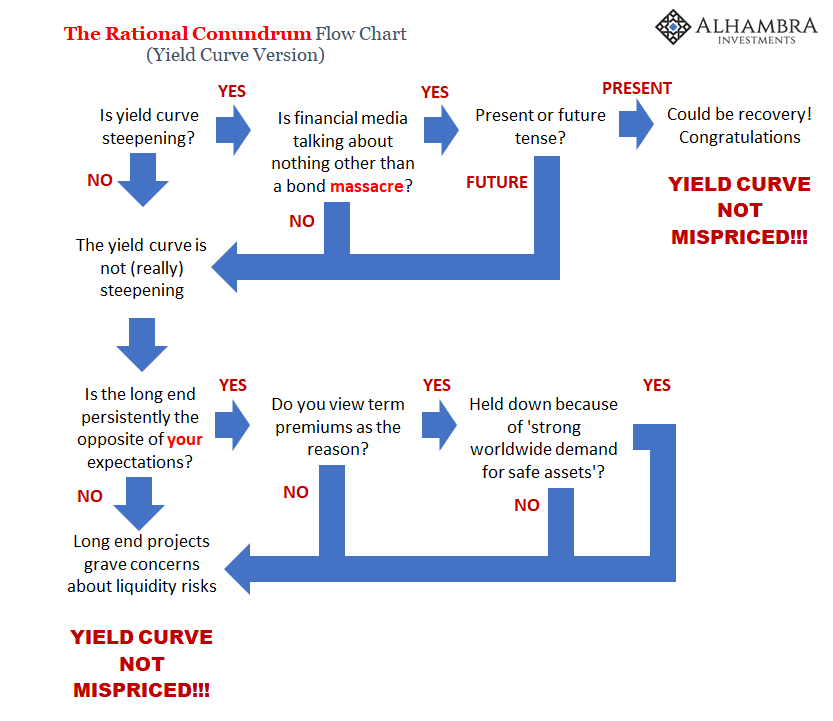

If inflation numbers start to go the other way, though, that’s altogether different. It is the government’s calculations beginning to verify the possibilities contained within the darker parts of the inverted yield curve; the very stuff which last year policymakers implied the bond market was mispricing. Actual and existing downward pressures in the real economy.

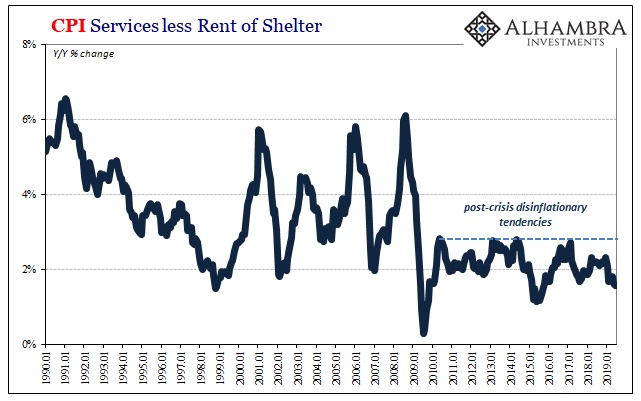

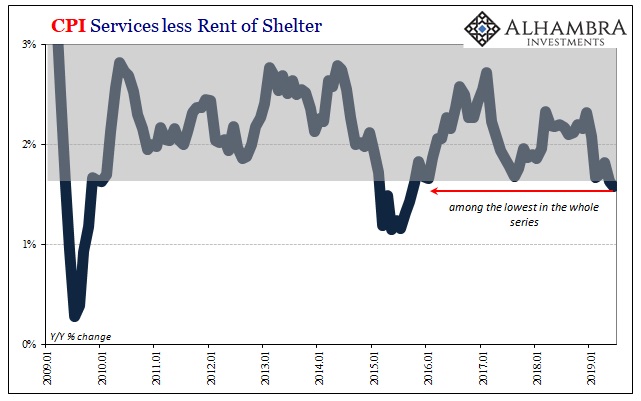

Not only did the so-called core inflation figures fail to ever verify the tight labor market view, in recent months they’ve turned lower. The CPI component for the service sector is a closely-watched and highly scrutinized part of the index. If there was going to be an inflationary breakout due to macro factors in the labor market, here’s where it would show up.

Instead, in recent months (following last year’s landmine), the estimates have turned downward. Beginning in January (the month following the most forceful part of the landmine), this part of the CPI bucket has picked up deceleration in consumer prices more generally. As of the latest figures for June 2019, released today, the rate of change was just 1.58%. It was not only the lowest since September 2015, it is among the lowest in the entire history of the series.

It’s not the only one.

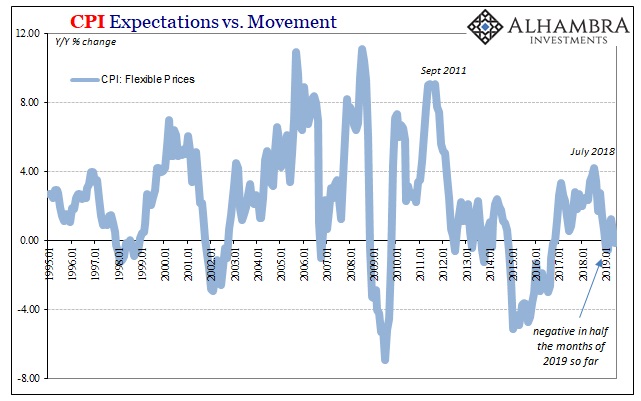

The concept of “flexible” prices doesn’t mean prices like those for oil which can change by a whole lot. Rather, flexible indicates those goods which companies are quick to change prices in response to any number of factors. It is more of a timing issue than magnitude.

Going back to last summer, the flexible prices in the CPI bucket have likewise decelerated. And like Services less Rent, there’s an element of the post-landmine landscape in it. So far of the six months in 2019, including June, half have posted a minus sign for the rate of change.

This doesn’t mean that companies who are prone to change their prices more often are panicking into liquidation-type activities. But it does suggest that there is more uneasiness about the overall direction than otherwise indicated certainly by the unemployment rate. The overall tone has shifted – the wrong way.

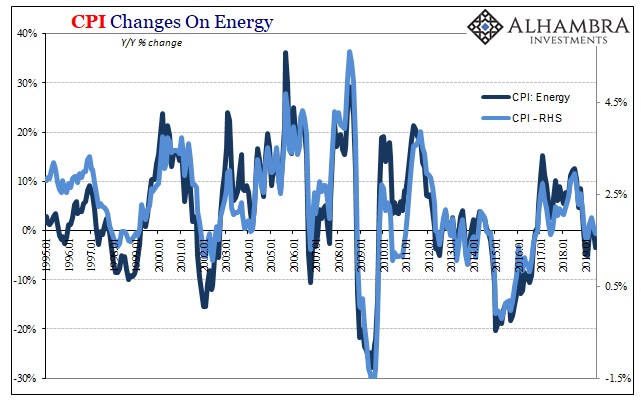

The headline CPI rose just 1.65% last month as energy (primarily oil) and gasoline prices subtracted again. The Fed’s 2% mandate applies to the PCE Deflator, which in terms of the CPI means something like 2.6% to 3%.

Taken altogether and put into Jay Powell’s language, this data begins to paint far more downside than even balanced risks. Add into this mix data from around the rest of the world, “overseas turmoil”, as well as the ridiculous drama in federal funds and other liquidity/funding conditions, that’s your rate cuts starting at the end of this month.

But there’s one more thing FOMC policymakers have to answer for in order to begin them: the unemployment rate. Either it is faulty, or the Phillips Curve must be. In the case of the latter, that doesn’t discount the former, either. Chairman Powell told Congress today (thanks C. Lavers) the Fed may no longer view the Phillips Curve as relevant.

The relationship between the slack in the economy or unemployment and inflation was a strong one 50 years ago … and has gone away.

OK, fine. But that doesn’t get you to a rate cut – it only maybe explains why you needn’t have been hawkish about the LABOR SHORTAGE!!! everyone screamed about in 2018.

There’s still something missing. And it’s the big one:

In additional to that, we are learning that the neutral interest rate is lower than we had thought and … the natural rate of unemployment rate is lower than we thought. So monetary policy hasn’t been as accommodative as we had thought. [emphasis added]

Now we are getting somewhere. In fact, what surely would terrify Powell and the FOMC if they keep following this line of consistent evidence, if monetary policy hasn’t been as accommodative as they’ve bragged, promised, and guaranteed then maybe the economy isn’t nearly in as good a shape as the unemployment rate suggests.

In this case, it’s not that the Phillips Curve might no longer be valid (there’s a real debate as to whether it ever was beyond the narrow scope of AWH Phillips study of UK wage data a long time ago), it is probable even likely the unemployment rate might not be the right measure of economic success. It very well could be faulty, and if it is, combined with disinflation showing up in 2019, rate cuts, rate cuts, rate cuts.

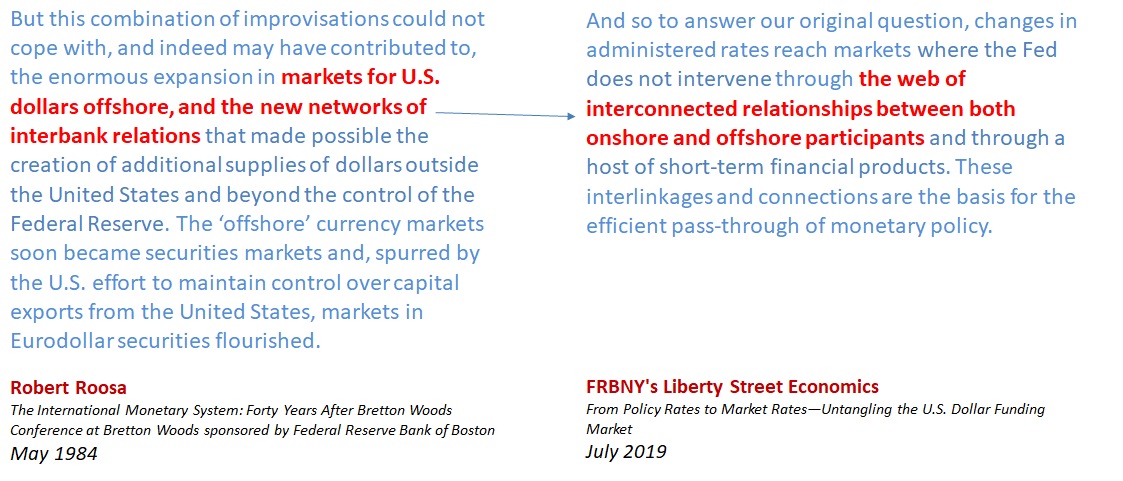

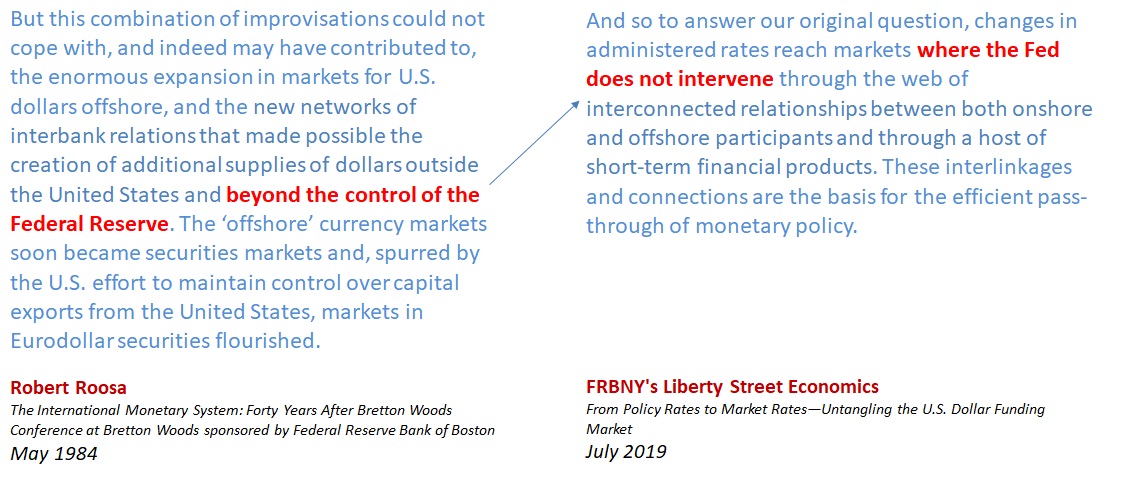

Powell’s admission, however, goes even further – though the FOMC probably isn’t anywhere close to ready to think about the implications yet. It actually goes along with FRBNY’s qualified confession about offshore dollars.

How might monetary policy have been less accommodative than in theory? Economists have centered on R* as an explanation, but even then there’s the ominous fact R* dropped substantially during, and never came back from, 2008. In other words, one way in which monetary policy might be less accommodative is if it isn’t effective in the first place.

And it might not be effective in the first place if, paging Dr. Greenspan, the central bank has no idea what’s really going on in the monetary system. A shadow system in a chronic state of malfunction existing offshore would certainly answer for all these facts.

But that would mean, and have meant for a long, long time, substantial dereliction on the part of central bankers. The public would rightly begin to ask, what have you people been doing all this time? Thus, the constant parade of half-measures and half-explanations, continuous confusion rather than directly face up to where all the evidence is leading.

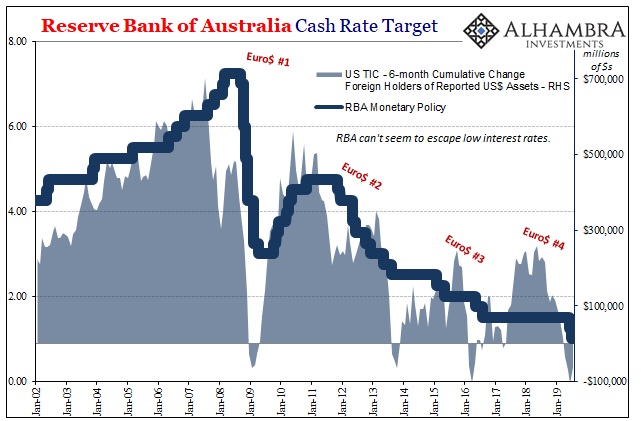

In its own twisted way, the Fed is attempting to come to terms with Euro$ #4 even though Euro$ #4 was for it impossible (something about “transitory” factors). They can observe, and are observing, all the horrifying (given prior expectations for an inflation recovery breakout) data but are still self-blinded from getting all the way there.

As I’ve said all year, the rate cuts will be sooner than you think and they won’t be insurance. They are confirmation that even the central bankers see it, too. They don’t yet know what “it” is, but that doesn’t really matter for Euro$ #4. It’s here. Central bankers around the world can no longer deny.

Stay In Touch