From the growing inconsistencies even in statements about the short run, economists are going to have to be careful lest they conclude monetarism doesn’t work. That is, of course, where most of the rest of the world is headed (and where the “dollar” already resides) but the strains to credulity lately are nails in the coffin. I described the political nature of that outbreak where QE is being practiced in Japan, but there is a similar if less “mature” trend developing of the ECB’s belated activities.

Straight away, there is an contradiction even using “belated” as a QE qualifier for Europe. It may have been of different content, but there isn’t much separating QE in 2015 from the LTRO’s of 2012. The fact that the media describes them as if they were wholly different (or just ignores that they ever took place) as do economists suggests the very difficulties occurring at the moment. When announcing these “non-standard” monetary policy responses, the ECB wrote in its press release:

Overall, it is essential for monetary policy to maintain price stability over the medium term, thereby ensuring a firm anchoring of inflation expectations in the euro area in line with our aim of maintaining inflation rates below, but close to, 2% over the medium term. Such anchoring is a prerequisite for monetary policy to make its contribution towards supporting economic growth and job creation in the euro area.

In its continued efforts to support the liquidity situation of euro area banks, and following the coordinated central bank action on 30 November 2011 to provide liquidity to the global financial system, the Governing Council today also decided to adopt further non-standard measures. These measures should ensure enhanced access of the banking sector to liquidity and facilitate the functioning of the euro area money market.

If not for the date included in the second paragraph above, you might be forgiven for thinking this statement accompanied QE’s announcement in January 2015; instead this same theory was put out as monetary certainty on December 8, 2011. Since that time, inflation has been the opposite of anchored or even responsive no matter what the ECB does or has done. The Wall Street Journal reported last week:

Inflation across the eurozone unexpectedly weakened in August, raising hopes among economists that the European Central Bank will eventually expand its already massive bond-buying program to combat the economic risks associated with too-weak prices.

The annual rate of inflation declined to 0.1% in August from 0.2% July, the European Union’s statistical office said Wednesday. That marks a downward revision to Eurostat’s flash estimate of 0.2% and pushes annual inflation further away from the ECB’s target of just below 2%.

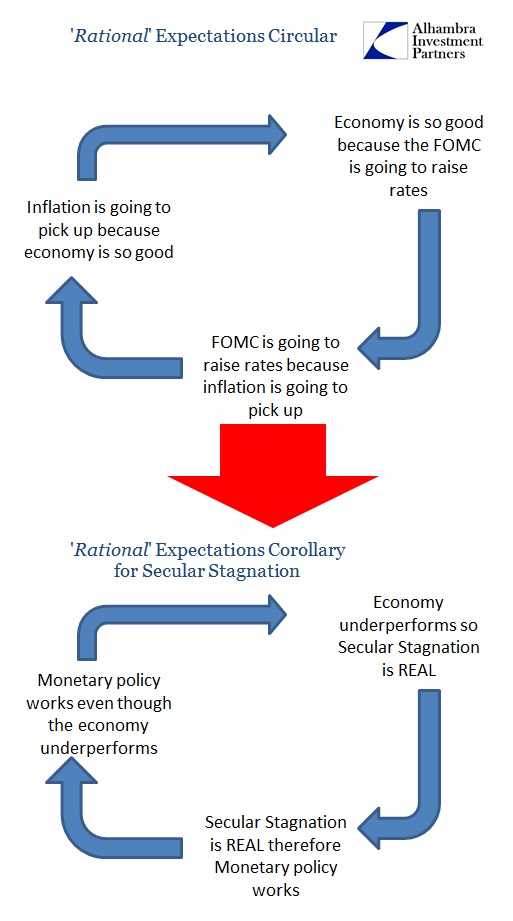

Again, the huge inconsistency between what was supposed to happen and what did; despite “its already massive bond-buying program” that has had no detectible effect we are supposed to believe that more of it will “combat economic risks associated with too-weak prices?” When connecting the “inflation” dots back to the LTRO’s you get the impression that the ECB has no effect on price changes whatsoever, leaving this “stimulus” as pure, unadulterated myth. It only remains described in that fashion because it is described in that fashion – the perfect circularity of monetarism.

As if to emphasize those very inconsistencies, the Wall Street Journal this week essentially repeats last week’s in a different format:

But in many ways, the eurozone is running up against the limitations of what monetary policy can hope to accomplish, economists say.

While the ECB has no mandate to boost employment—unlike the Fed, which can tout real progress on that front—its QE program hasn’t made much of a dent in the eurozone’s jobless rate, which remains in the double digits. Nor has crucial business investment picked up much.

This passage follows an opening that touts QE’s purported successes as being “the value of the euro is down from a year ago and bond yields are low, while bank lending is slowly recovering.” All of those are financial factors that, if you are only slightly awake, don’t seem to have much value for the real economy. In other words, via the most simple logic, QE has devalued the euro and brought bond yields down (bank lending is a canard; the only lending that has increased is financial reshuffling for banks to scalp on QE) but a devalued euro and lower bond yields haven’t “made much of a dent in the eurozone’s jobless rate”, therefore more QE will work?

Extending QE would send a “strong signal” that monetary policy in the eurozone “is going in the opposite direction” than the Fed, said Jonathan Loynes, an economist at Capital Economics. “I would hope that would weaken the euro, and have upward pressure on growth and inflation,” he added.

The weaker euro “hasn’t made much of a dent” upon growth and certainly not “inflation” but an even weaker euro will? The only way any of this can be consistent, logically or otherwise, is if economists claim “magic number” stimulus. Maybe hysteresis has taken over all orthodox effort, but the only argument here is that QE works but we haven’t seen the “correct” threshold for it being able to doing so. This is, as pointed out before, the same argument that Communists continue to make for both Communism and communism, proclaiming that it has never failed because it has never truly been tried.

Communism works because some people say that Communism works; uncomfortable as it should be to monetarists, monetarism works only because some people (the “right” people, all with credentials, no less) say that monetarism works. The inconsistency is jarring at any point, but the condition of 2015 holds the least favor for that absurd proposition. That is why the danger of the “dollar” is acute this year, as the charms of that naked assertion for “stimulus” are being blown away by actual observations that continue to propel nothing but doubt if not further and further outright rejection (if only the faith had rightfully degraded in 2002 rather than 2015).

In the meantime, because they are still “allowed”, central banks will keep groping for that magic quantity while being lost in their distinct lack of self-awareness.

In the US and the “dollar” world, that reality [technocrat failure] has been proven over and over (and over and over) in QE’s just the way in which central bankers talk about it. Their descriptions depend solely upon the tense they use; in the future tense QE “will be” powerful and effective, a quantified and thus technocratic expression of precision and force of singular good and economic righteousness; in the past tense, it “was” short of expectations, as there “were” greater factors to consider including an immense sea of financial noise set against a cacophony “headwinds” purportedly unrelated to monetary factors. When delivering promises, it is unquestionable; when accounting for what was, “it’s not our fault.”

On a different stage there might be some comedy in noticing how QE is written both, simultaneously, as if hasn’t worked but it will work. Unfortunately, monetarism is proving as “transitory” as continued global malaise. If we are going to reside within the absurd, then by dutiful extrapolation the LTRO’s took “inflation” from 3% to 1%; therefore we should expect QE to push “inflation” from 0% to -2%, which will mean ever more of this, described as if it will work by the very allusion it hasn’t:

Stay In Touch