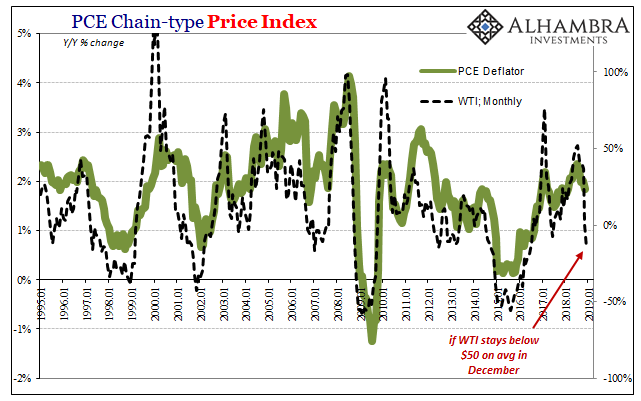

Without crude oil on an upswing, inflation can only be on the downswing. That may seem like a tautology of sorts, but it’s not. In fact, those advocating for the optimistic economic case have been predicting consumer prices being directed by something other than oil. I know it’s a broken record, but here it is again: labor shortage, competition for workers, wages explode, and companies across-the-board raise their prices to offset the increased costs.

The key to that last part, if it was to ever arise, is that companies are able to raise their prices because the economy is actually booming. The theory about wage-driven inflation is really where inflation is confirmation of the economic processes everyone wants to see.

Instead, consumer prices are being set by WTI alone. There is nothing else, more so what is going on in everything else continues to suggest undershoot – no economic strength. Take away the base effect of oil, like during last month, and the PCE Deflator suddenly loses its position near enough to the 2% target.

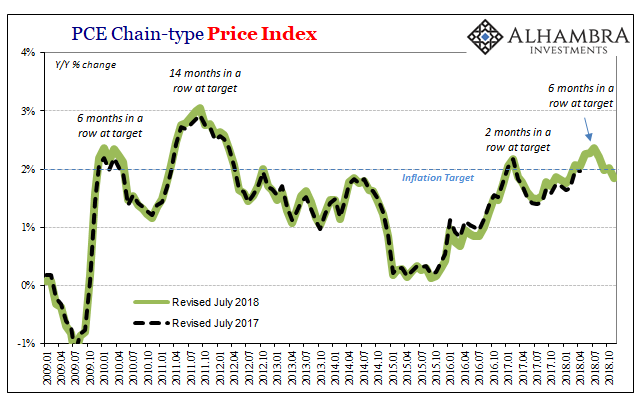

In November 2018, according to estimates released today, the Bureau of Economic Analysis (BEA) says consumer inflation ran at a 1.84% annual rate. It was the lowest since January because WTI was pretty much flat. With the oil crash gaining speed throughout December, Jay Powell is going to need a massive rally into year-end in order for the Fed’s preferred inflation gauge to avoid being pulled further away from its policy mandate.

His entire case derived from the unemployment rate rests upon the PCE Deflator. And while it was above target for six months in a row, and seven out of eight (with a slight upward revision to October), though that was only oil it was enough for the mainstream to suggest there was some inflation consistent with the theory. It at least looked the part.

If the deflator sinks again, as it likely will, the FOMC loses its last piece of sketchy evidence. Markets, obviously, have already given up what little was in policymakers’ favor.

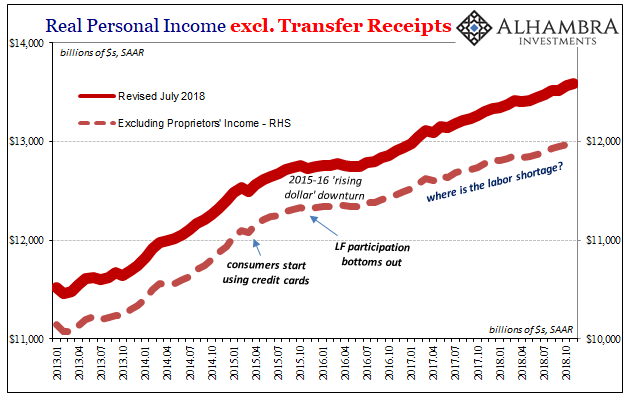

The reason for this is, as always, very simple stuff. The unemployment rate has it all wrong. There is no tight labor market for if there was it would show up not just in consumer price indices. Some could rationalize a lag for the PCE Deflator, that it takes time for these processes to work out, but you don’t even get that far if the rest of the labor market data says there is no shortage, there isn’t even much growth in the economy.

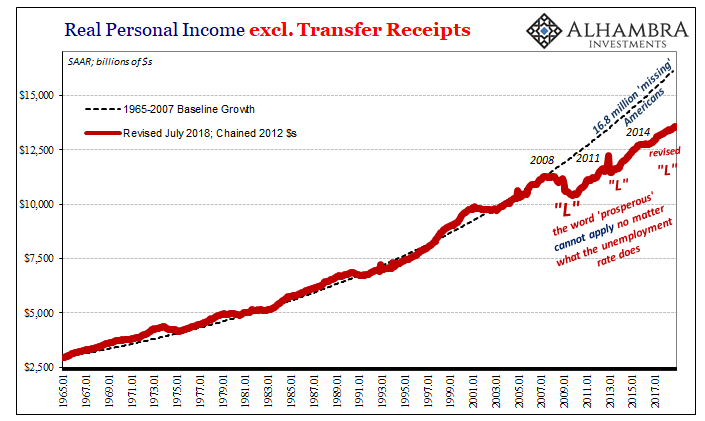

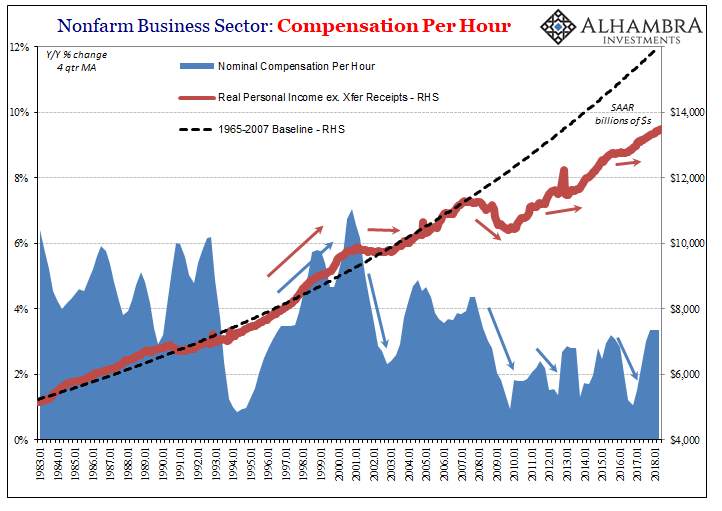

The bigger piece of the PCE data is estimates on Personal Spending and Income. These leave no doubt about what’s actually going on. Incomes remain conspicuously off-track, not only in the sense of the last few years but also overall for what is an established lost decade. You can’t be wrong about employment in these two big picture senses and expect inflation to show up beyond WTI.

That’s just what has happened, as policymakers have attempted to set aside the last ten years as if the economy could do that, focusing on only the last two as if starting from an economic Year Zero in 2017.

This is where the boom just can’t be faked. If companies were seeing one at the same time being forced to compete for scarce workers, it would show up in incomes immediately. This is the only thing, in the end, that really matters. A real boom is one which benefits workers and businesses together.

As noted earlier with the latest corporate profit data, businesses have lost a decade, too, struggling to come back from the last eurodollar downturn – which explains perfectly well why they aren’t paying for more labor no matter how low the unemployment rate goes.

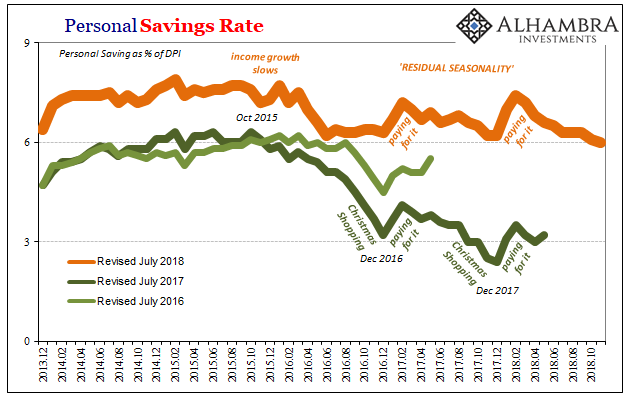

And when they can’t spend on workers, workers have trouble spending on Christmas. The Personal Savings Rate dropped to 6% in November, the lowest level in years as even anemic holiday spending puts a dent in discretionary budgets. Thus, beginning in January it is very likely we will see consumers retrench once the credit card bills show up in their inbox just as they have each year since the labor market slowed down rather than tightened.

This “residual seasonality” isn’t a residual though it is seasonal. It is the same misunderstanding being consistently applied through more and more economic accounts.

The big problem begins with “strong.” Saying the word and writing the economy this way doesn’t actually make it true. What’s weird is why this persists so long as these inconsistencies pile up one after another, month following month, year after year. The gross disinclination to challenge the Fed’s narrative, which is actually very easy, is maybe the real story here.

If the labor market was actually strong and the economy, too, there would be consumer inflation not oil, robust income growth, and the term residual seasonality never would’ve been created as an attempt at further self-delusion. All the data forward and backward is actually very consistent.

Stay In Touch