The US federal government is shut down and certain economic data accounts are being left to go without scheduled updates, things like US trade provided by the Census Bureau. The Bureau of Labor Statistics’ more watched series aren’t among the forgotten, however. The monthly payroll report would be compiled and released even during a nuclear attack. Yes, it really is WWIII but did you see the blowout jobs figures!

I have no doubt that Jay Powell wishes the BLS’ CPI was being treated like Census’ Ex/Im rather than given preference in the same ways as its own employment numbers. We don’t know how much the US imported or exported in November, but we do what the consumer price index did in December. It wasn’t good for him.

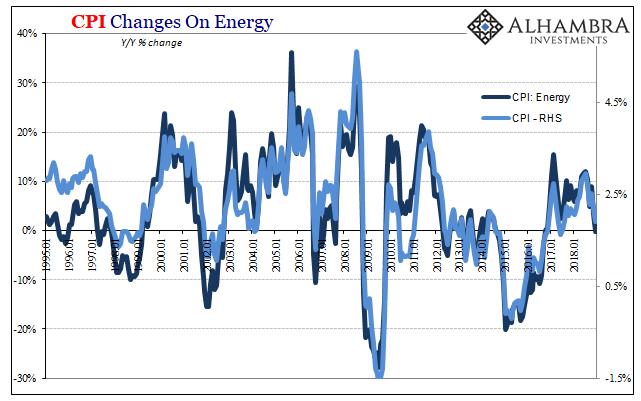

The headline monthly inflation number wasn’t any surprise. It was muted, as some might say. The truth of the matter is what we’ve been saying all along. The only factor driving consumer price inflation, according the calculations of these various indices, has been oil prices.

Live by WTI, die by WTI even though there is no WTI in the consumer basket. Working backward, we begin with the overall inflation for December 2018: +1.91% year-over-year, down from 2.18% in November and 2.52% in October (when Atlanta Fed President Bostic was flipping out of his mind).

The energy component contracted by a small 0.2% but it was the first minus sign for this important contributor since September 2016.

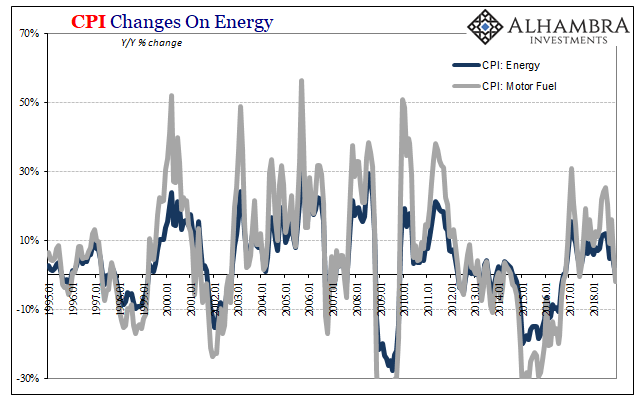

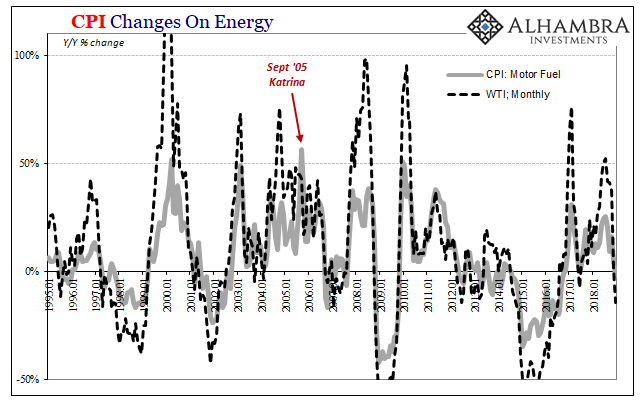

The piece that most moves CPI Energy is gasoline prices, or the subcomponent for motor fuel. This part of the index declined 1.9% year-over-year, the largest decline also since September 2016.

And gasoline prices follow WTI. As a monthly average, the domestic crude oil benchmark in December was down 14% year-over-year, setting the inflationary tone for everything that follows from it.

The end result overall is stunned and confused policymakers who were certain Verizon was the problem.

It’s important to remember the scale of absurdity that is so often deployed as an attempt to explain constantly getting it wrong. The way in which it is supposed to go sounds entirely reasonable and intuitive. One more time: labor shortage >>> competition for workers >>> sharply higher wages >>> increased costs businesses will pass along to consumers because they can >>> CPI up with or without WTI.

Yellen and Powell see the unemployment rate as confirmation of the first factor and then skip all the steps to end up with the last conclusion. When the CPI fails to confirm the unemployment rate, rather than rethink what might be going on in those steps, or even the unemployment rate itself, Yellen in 2017 made a specific point to, of all things, blame Verizon’s offering of unlimited data plans.

Normally such business ins and outs [wireless telephony] wouldn’t be of much macro concern. Earlier this week, though, the Chairman of the Federal Reserve was forced to mention the ongoing price war for no other reason than that agency’s continued inability to generate inflation. Consumer prices are no small matter for a central bank, and they take on a much larger context for all of them who have been “printing money” over the last ten years. Having created trillions of what they classify as money in the form of bank reserves, there should have been long before today some evidence in the economy in the form of consumer prices.

That’s all the stuff that comes before the labor shortage; as a central banker you print money (or, in the modern convention of moneyless monetary policy, get everyone to believe you did) which encourages businesses to invest and hire for consumers who spend it. The economic pace quickens and eventually we all get to that labor shortage point in the process.

Falsification never applies to these people. In other words, if there isn’t inflation (or growth for that matter) like spoiled children central bankers and Economists will always blame something else. This is as emotionally unscientific as it can get.

So, if Verizon’s temporary bulge begun in April 2017 delayed the CPI’s confirmation for the labor shortage outcome then after a year this “transitory” statistical blip would dissipate and all the inflation indices would finally be freed to show the real picture of a healthy, labor shortage economy.

April 2018’s inflation data arrived and:

The yearlong wireless data plan nightmare is officially over. For the second month in a row, the CPI for Wireless Telephone Services, which includes any unlimited data at fixed prices, was more stable in its annual comparison. In April 2018, the index was nearly flat to April 2017; down by less than 1%.

It was, for once, transitory. What that was supposed to have meant, however, has yet to materialize. Central bank officials like Janet Yellen and to a lesser extent Jerome Powell (who seems to be almost in hiding of late) said that once these temporary drags (specifically mentioning wireless telephone services numerous times) fell off the indices for inflation would accelerate as one final indication of full employment and economic recovery.

Only WTI; no labor shortage. Verizon was never really much of an issue, Federal Reserve officials made it one because they had to come up with something to buy more time. They did, the media bought it, as it always does, and for several months in 2018 oil prices popped giving the indices a non-labor boost. It was doomed from the start because there is no boom.

Now that the CPI is below 2% again, even the FOMC admits inflation pressures have been “muted” which they are. The only reason, though, officials are doing so rather than seeking the next Verizon is because markets have forced their hand. I wrote all through last year at some point the boom had to boom.

It didn’t. People are starting to see that.

Now the minus signs are coming including those for inflation. Aiming for its next round of the absurd, perhaps the Fed’s Chairman Powell can advocate shutting down the BLS as “stimulus.” Why not? Though it wouldn’t do any good, that would simply mean it would be just as effective as QE and everything else the Fed has come up with.

Stay In Touch