The reason I spend so much time on Japan is that it is the purest “laboratory” conditions available in which to determine, hopefully for all time, the (un)viability of monetarism. The orthodox monetary practitioners that unleashed the yen torrent were not last year equivocating in their predictions and forecasts. Abenomics and QQE would work without fail, they said; the only question was “how well.” From last October:

Mr Abe confirmed the plan following a business-confidence survey that showed optimism among Japanese companies had risen to a six-year high.

It was the latest in a series of positive reports on the world’s third-largest economy, which has struggled for years with stop-start growth and deflation.

The media, for its part, has blindingly accepted every single premise offered by the orthodox economics community as gospel. I have already distilled just how silly that is in terms of the various PMI’s, but there is far more at stake in the Japanese situation. Every single idea that was allowed to print as unquestionable “fact” has turned out to be almost exactly the opposite as intended.

Nowhere is that more apparent than this traditional talking point about how currency devaluations supposedly work. You would think, judging from the level and intensity of the recitations, that Japanese exporters would be by now so busy with export orders as to be forced to appeal to foreign work (rather than just offshoring to get away from yen instability) to fill it all. From January:

A lot is happening in the land of the rising sun. After living with nearly twenty years of economic stagnation, the Japanese people were convinced by Shinzo Abe to give him a second go as Prime Minister and let him put in place one of the most ambitious economic plans in modern history to finally get Japan out of its dormant, deflationary state. And you know what? So far, it is working quite well…

For the moment, the plan seems to be stimulating the real economy. Real GDP has grown significantly in the year since then, fostered by the decrease in the Yen, which makes the Japanese economy more competitive on the export market. Inflation has picked up and is now sitting at 1.5 per cent (a feat in itself), inflationary expectations are starting to sink in and business confidence has picked up dramatically as the Tankan survey (which surveys more than 10,000 Japanese businesses of all sizes and sectors) shows an optimism not seen since before the global recession.

This January commentary from the Globe and Mail in Toronto was pretty typical, though it should not have been given how by then export growth was already vastly underperforming all expectations. Instead, it has been import growth that far exceeded anything, and directly contradicted orthodox theory about all of this.

So too does that apply to the orthodox treatment of “inflation” which was, as the Globe and Mail described without the necessary sarcasm, “a feat in itself.” QQE has accomplished both monetary aims, yen devaluation and subsequent inflation, but only to accomplish a temporary and highly misleading transition. Extrapolations were made based on that period as if it were anything more than a monetary illusion, covering the decay under nominal reconfiguring. Household spending and income more than suggests, offering instead damning evidence, that increasing prices lead not to some promised land but rather to perhaps an even worse fate than under “deflation.”

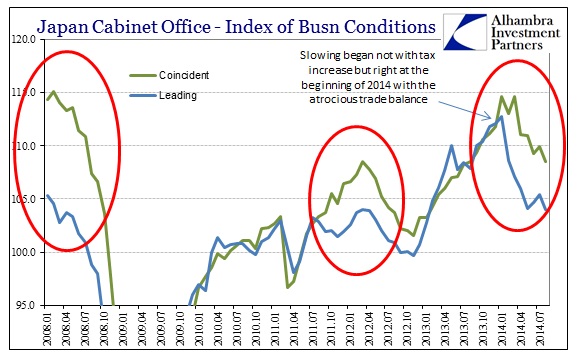

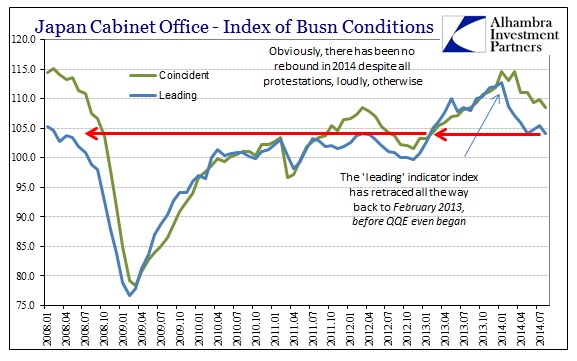

The tendency will, of course, be for the narrative to shift and blame the tax increase for Japan’s current predicament. Once again, despite all assurances otherwise, there has been no rebound in Q3 from Q2’s utter disaster (remember, taking away inventory and export/import second derivative accounting, GDP was -15%!). Increasingly, the world looks on in shock and belated misbelief as the combined effects of QQE and Abenomics have sunk the Japanese yet again.

The index of coincident economic indicators, which consists of 11 indicators such as industrial output, employment and retail sales data, fell a preliminary 1.4 points in August from the previous month, the Cabinet Office said on Tuesday. The new assessment of the coincident indicator index shows that the economy is at a “downward turning point”, it said. Previously, the office said the economy was at a standstill. According to the government’s criteria, the assessment suggests the economy may have hit a peak several months earlier and signals there is a possibility it now is in recession.

The downturn occurred before the tax change, and is a direct result of declining trade fortunes and the insistence that “inflation” held any positive potential. The Bank of Japan has unleashed exactly what monetary theorists have been protesting all along, since the Great Recession, that every central bank needed to simply “go big” and be unrelenting. The full impacts have not yet been sustained, and that is an unfortunate appearance given the now-recognized trajectory in the “wrong” direction.

The downturn occurred before the tax change, and is a direct result of declining trade fortunes and the insistence that “inflation” held any positive potential. The Bank of Japan has unleashed exactly what monetary theorists have been protesting all along, since the Great Recession, that every central bank needed to simply “go big” and be unrelenting. The full impacts have not yet been sustained, and that is an unfortunate appearance given the now-recognized trajectory in the “wrong” direction.

As I quoted yesterday, William Martin, the long-time chair of the Federal Reserve decades ago, said in 1958:

If inflation should begin to develop again, it might be that the number of unemployed would be temporarily reduced…but there would be a larger amount of unemployment for a long time to come.

Modern monetarists disagree but are now faced with exactly that in Japan (once more). Expect the tax hike to gain most scrutiny when it should not, as devaluation and “inflation” are far, far more corruptive and poisonous.

Stay In Touch