Sometimes, the government will tell you a lot when it really doesn’t want to tell you anything. It’s not what they say, but what they don’t. In the case of the Treasury Department, there was a small, seemingly nondescript morsel buried down underneath the rest of its more immediately consequential next-quarter projections. While focused, quite rightly, on the scaling back of bill auctions, and holding the line with bonds and notes, the refunding statement curiously punted on SOFR of all things.

No decision has been made by Treasury regarding potential issuance of an FRN linked to the Secured Overnight Financing Rate. Treasury continues to actively explore the possibility of issuing such a product and will provide ample notice to market participants if it chooses to move forward.

Right now, since 2014, the federal government also sells floating-rate notes (FRN) that are priced and indexed to the discount rate applied to 13-week (3-month) Treasury bills. SOFR, the Secured Overnight Financing Rate referenced above, is an amalgamated rate pieced together from various parts of the domestic monetary system by other regulators who have quite well established only their dislike of LIBOR. Clearly, pressure is being applied to pump up SOFR to make it seem more desirable than it really is, pressure that’s understandably (as you’ll see) being resisted.

In the past, certain bank regulatory agencies have declared LIBOR a fraud; even when not specifically citing the scandal surrounding it. It is a made-up interest rate on its good days, a survey of foreign banks asking them what they might get charged (own-rate) if they were to borrow unsecured US dollars offshore.

That last part is what this is really about; can’t have the world asking the uncomfortable questions about why the world’s key interest rate setting the basis for the entire global financial system is derived from conditions in the dollar system which happens to exist outside and apart from the Federal Reserve’s mandates.

However, given just how vital LIBOR is they can’t just kill the thing outright in one regulatory stroke (though I’m sure the thought has been tempting). Instead, US central bank officials convened a group of highly distinguished experts, the Alternative Rates Reference Committee, and in 2014 came up with SOFR for the explicit purpose to put LIBOR out of business.

What Treasury has said – not just in the last quarterly refunding, but prior ones, too – is that they aren’t ready to help bank regulators – the Fed, OCC, and FDIC – further legitimize SOFR. Unlike these others, Treasury seems to understand the downright idiocy behind the whole affair.

You can’t just willy nilly replace parts of the global currency system on a badly-conceived whim. Real central bankers might know that. We’ve only got domestic bank regulators who play central bankers on TV.

That’s what this is really all about. And that, not some ancient, cheesed-up LIBOR scandal, really is the true Crime of the last Half Century.

In other words, this SOFR fiasco is a crystal-clear expression of how these regulators and officials don’t get their jobs. Only incompetent yet arrogant people who have no idea how the system works would ever have come up with SOFR and then publicly stated how it was going to replace LIBOR. Now reread that sentence.

Deadlines were established anyway to show just how serious the banking system should have taken official demands. They really mean it! LIBOR’s dead, get with the program!

Instead, with the deadline pushed back yet again, it appears in addition to Treasury’s backburner SOFR admission the rest of the government crew has finally been made to understand, at least, they aren’t getting anywhere (big thanks to T. Tateo). They still don’t want LIBOR, but:

The FFIEC statement further explained that new financial contracts should either utilize a reference rate other than LIBOR or have robust fallback language that includes a clearly defined alternative reference rate after LIBOR’s discontinuation. Separately, the agencies recently issued a statement that says a bank may use any reference rate for its loans that the bank determines to be appropriate for its funding model and customer needs. [emphasis added]

Clearly defined alternative? Wasn’t that the entire purpose of SOFR? This was taken from a joint statement made by the Federal Reserve, OCC, and FDIC at the end of last November. This is a pretty stark change.

Just two days ago, on February 10, OCC published an updated bulletin so far as the LIBOR “transition” is concerned (once again, Tateo!):

Libor is referenced globally, and its expected cessation could affect banks of all sizes through direct or indirect exposure. There is risk of market disruptions, litigation, and destabilized balance sheets if acceptable replacement rate(s) do not attract sufficient market-wide acceptance or if contracts cannot seamlessly transition to new rate(s). [emphasis added]

The OCC wouldn’t be referring to the SOFR reference rate in the highlighted portion, now would it? A veiled threat, yes, but a very different one than before.

LIBOR bad/SOFR good has become LIBOR still bad/OK maybe you tell us what’s good.

Not for nothing, SOFR isn’t even the first. The Fed had instigated a LIBOR replacement, though much more quietly, beginning back in June 2008. Why June 2008? What was LIBOR doing at that time when Ben Bernanke was telling the public the worst of that crisis was behind them?

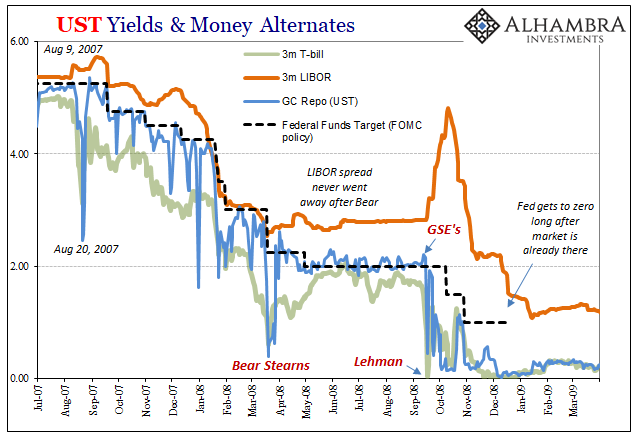

LIBOR, right then, remained at an elevated spread thoroughly signifying how that was all a lie. It may have seemed calm, and at times a low federal funds rate may have seemed consistent, but elevated LIBOR told you that the crisis, and where the crisis was really coming from, was more likely to revisit than it was likely to have ended with Bear Stearns. In fact, Bear was a key reason why this would end up being the case.

Though this New York Funding Rate (NYFR) had debuted during the early summer to “better” clarify (than LIBOR, presumably) interbank liquidity conditions also in the eurodollar market – yes, NYFR queried banks about eurodollars not domestic money – during the worst of the crisis that followed just months later the NYFR spread was even greater than LIBOR’s!

In truth, it never really mattered. LIBOR was more than sufficient enough to tell policymakers: 1. They were failing; 2. Why they were failing; and 3. Where. Eurodollar, not dollar. Would it have mattered if NYFR had been suggesting unsecured eurodollar at another +20 to 40 bps over LIBOR? No. Not one bit.

NYFR would linger onward until August 2012 when ICAP scrapped the ill-fated replacement for, of course, lack of bank participation. Coincidentally (or not?), Bernanke had testified before Congress in July 2012 about how LIBOR fixing had been the “crime of the century” (Bernanke never actually said this; he was always too careful not to say too much, preferring instead the media to say this for him).

And while, during 2018, policymakers redoubled their efforts and renewed their threats to the banking system about LIBOR’s unwanted (from the official perspective) place in it, what was LIBOR doing just then? In the eurodollar futures market, that curve (eurodollar futures contracts are priced based on predicted future 3-month LIBOR) had inverted, the first to do so, openly declaring Jay Powell’s inflationary growth, awesome-to-the-moon rate hike plans and rising interest rate forecasts complete and utter bunk.

As they really were (see: 2019).

These people hate LIBOR because it exposes the plain truth of the matter. Central bankers are not central bankers; they are, at best, pop psychologists. They don’t do money because they wouldn’t even know where to begin. And that’s the only way anyone would ever have imagined SOFR taking over from LIBOR.

SOFR will likely go the way of NYFR while regulators still seek victory by ending LIBOR though downplaying how it won’t be SOFR which replaces it; betting that the public, what little of it pays attention, would see LIBOR disappear on the Fed’s orders unaware that it actually lost the bigger battle (after having been routed during the full war; GFC’s 1 and 2).

Assuming they can even do that much. LIBOR itself is nowhere near dead yet. Not even ill-heath. Even after going on nine years of explicitly trying.

Remember SOFR and LIBOR the next time you hear these people, and the media which uncritically parrots them, tell you about the guaranteed inflationary consequences of their “monetary” policy.

Stay In Touch