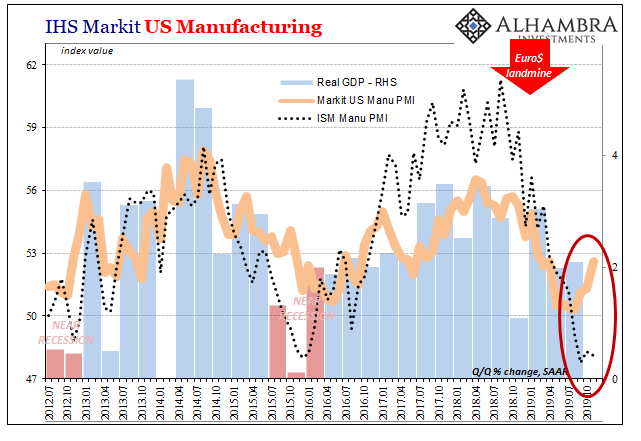

They absolutely loved the China PMI numbers, after having taken no note of Japan’s IP, dismissed Markit’s slightly higher revisions, and then totally hated the ISM’s Manufacturing PMI. That last one was supposed to join the others in moving substantially upward, contributing to widespread hopes all recession fears have been extinguished even this late into 2019.

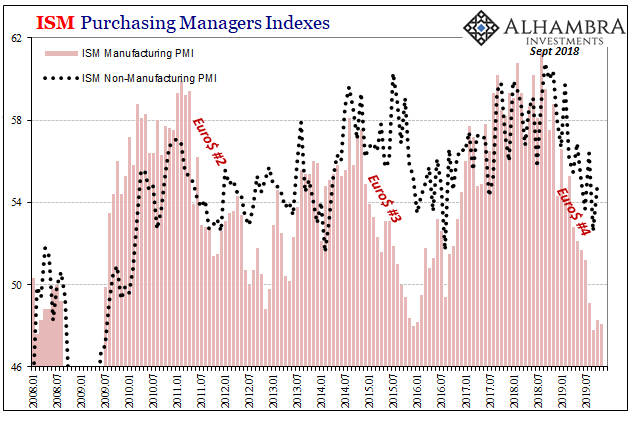

Instead, the Institute of Supply Management index continues to suffer. This one hurts, too, because it was this outfit who really started it all. The rest are imitators, the ISM basically the original. While markets move for Markit at times, with its very long history and enviable track record everyone looks to this other one first and foremost.

The number for November 2019 was an ugly 48.1. While still slightly higher than the decade-low of 47.8 in September, it was down from 48.3 in October; going the wrong way. Unlike Markit’s version which suggests a rebound, the granddaddy points instead to languishing in an unwelcome place.

Even the Economists are considering the R-word, for at least the manufacturing side of the economy.

The report shows that manufacturing “is stuck in a mild recession with little prospect of a real near-term revival. This will weigh on job growth and capex over the next few months, to the point where we are not ready to rule out a further [Federal Reserve] easing in January,” Ian Shepherdson, chief economist at Pantheon Macroeconomics, said in a note.

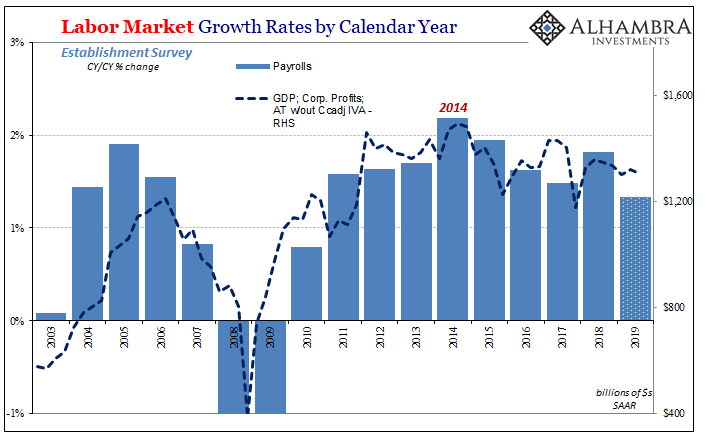

If any of that comes to fruition, if it hasn’t already, then it will add to an already dicey situation – particularly the part about “weigh on job growth.” As you well know, Jay Powell is betting everything on the allegedly strong labor market which is supposed to validate his “mid-cycle adjustment” view. The economy is expected to materially accelerate as a result, sooner rather than later.

Downturns like this produce heightening impatience.

But that’s not quite the feeling you get from the ISM, and it has a lot of recent labor and labor-related data coming down like it on the wrong side of the ledger.

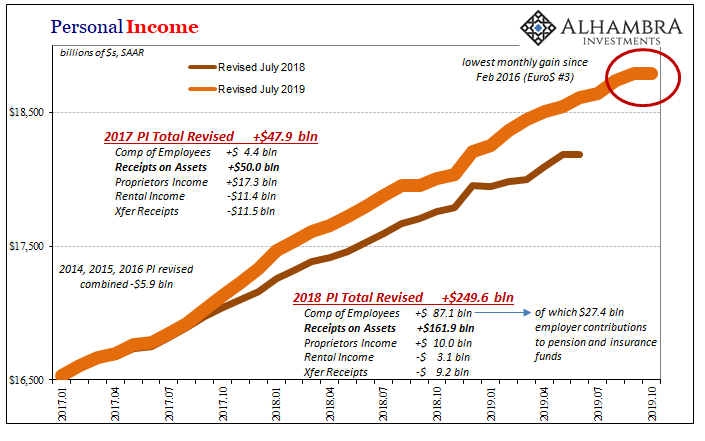

To begin with: Personal Income. If Japanese IP spoiled China’s PMI’s, the BEA’s estimates for income in the US strengthened the case for why the ISM might have refused to signal better days ahead. Reporting last week, the American government released pretty dour figures for where it counts the absolute most.

You rarely see flat nominal Personal Income growth even on a short run monthly basis (the seasonally-adjusted series is heavily “smoothed”). It doesn’t really happen outside of significant economy-wide downturns and recessions. This is the topline of all the subsets which follow, so outside of the worst of economic periods it is not meant to stumble. The last time it did was last year’s landmine.

But at essentially no growth in October 2019 from September, the last time the BEA reported this low was September 2018 at the outset of the landmine and then February 2016 near the end of Euro$ #3’s near recession.

Income growth continues to slow because it has been very uneven this year. Weak growth plus volatility leads to growing uncertainty, in terms of consumers and especially businesses plagued with already high inventory levels. In light of shaky spending patterns, the latter will cut back on new orders leading to reduced production volumes – as suggested in the ISM.

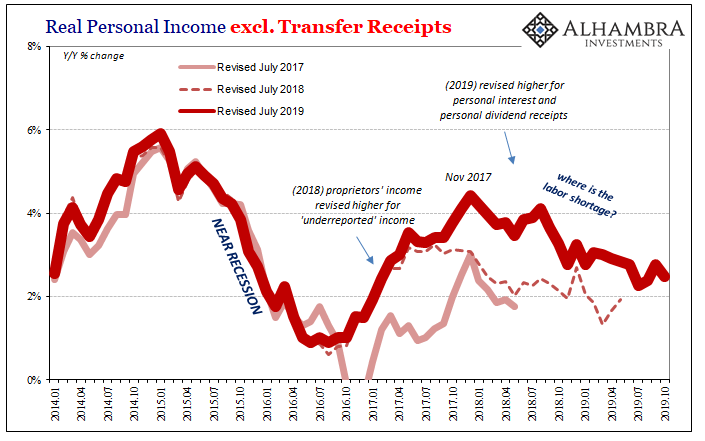

At closing in on 2% year-over-year for Real Personal Income excluding Transfer Receipts, an important BEA measure of private sector earned income, that suggests serious weakness along the lines of a clear downturn. It is also, again, consistent with a broad range of other labor market data as well as the BEA’s GDP series on corporate profits.

Uncertain consumers, low or no topline revenue growth, falling bottom lines, increased pressures to manage even cut costs – starting with labor.

Therefore, small wonder the ISM spoiled the weekend PMI party. It wasn’t just the manufacturing index by itself, it was how its low level fits too closely with a lot of other data which continues to point toward more, not less, weakness ahead.

Stay In Touch