Ever since the widespread adoption of the rules, so to speak, of Positive Economics the discipline has been trading intuitive sense for mathematics. The equations of econometrics are, for Economists, more “real” than reality.

To get to those statistical regressions it requires a whole lot of subjectivity. It doesn’t seem that way at first, or that it could be this way; in fact, it’s meant to convey especially to the layperson quite the opposite. Complex math looks objective and it seems all very scientific. The Economist wishes nothing more than to be admired like the physicist.

The physicists, on the contrary, trade nothing for their equations. They don’t have to give anything up simply because the math works. Physics is a real science: observation, prediction, replicability.

In Economics, the shorthand predominates. Take currency movements, for example. If one is falling it first must be treated as an intentional act. Econometrics assigns great even absolute authority to the central bank. So, if a particular currency is dropping the math says it is being “devalued” without considering other factors. Science has spoken!

If that’s not the case, then no matter how complex the equations they are worthless. The old computer programming adage applies: GIGO; or, garbage in, garbage out.

In August 2015, the Chinese “devalued” CNY. Not only did it go down, it did so all at once. Stimulus, they said. It had to be the PBOC looking to goose the export numbers in order to better balance more uncertain growth prospects (but why were growth prospects increasingly uncertain?) The mathematics of modern Positive Economics left no other option for analyzing what turned out to be a very different situation.

Under the conventional assignments, a “currency war” like what was being described back then produces winners and losers. The Chinese were going to gain at everyone else’s expense. Again, the shorthand. In truth, what was unfolding left no one to win. Everyone loses at this game.

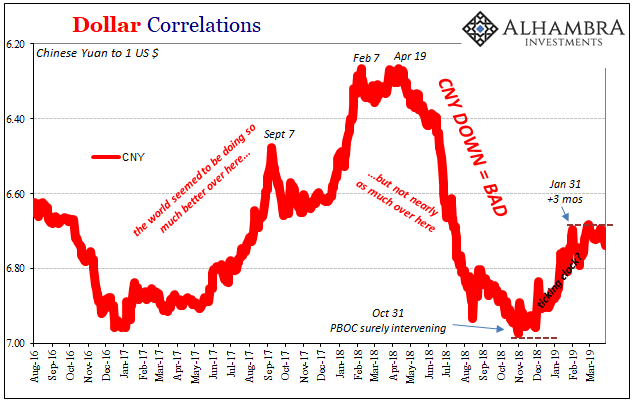

It was from this other view, one equally simple as well as intuitively complex (Euro$ #3) which led me to derive my own stab at econometrics: CNY DOWN = BAD. It is nowhere near as elegant as the mathematics contained in ferbus or the various ARCH/GARCH models hanging around throughout the world of Economics. It has been, however, far more effective.

One reason why is because the inverse isn’t “proven”; CNY UP =/= GOOD. Not necessarily or in all cases, anyway.

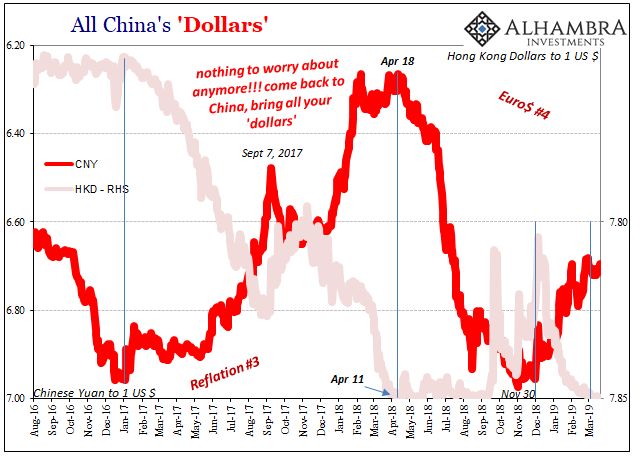

In 2017, CNY had miraculously resurrected. Like the mythical phoenix, China’s currency was rising fast and hard against the dollar. Given the way everything unfolded under Euro$ #3’s grip, that had to be good. But since we aren’t given to rigid mathematics, we were free to investigate other possibilities and look for ways systems might change.

Not everyone was completely enamored with globally synchronized growth.

During the first rumblings of inflation hysteria in November 2017, I wrote:

It’s this [yield curve flattening] that has central banks, and the media, nearly apoplectic. Central banker after central banker says things are working and getting better, and that because of this they will raise the short end of each curve. The bond market reply isn’t that central bankers are wrong about what they will do, it’s more so that markets don’t care one bit because they are wrong about why they will do it.

Why. As in, why was CNY rising? Why had it been falling? Why were curves flattening with CNY as it was?

The mainstream correlation held, the world did seem to be doing better in 2017. Appearances can be deceiving, however, and especially so once they are glossed through the complex mathematics of econometrics. Central bankers fooled themselves into believing their own fantastic, math-based creation.

Of course, last to know this group, they didn’t realize their error until only recently. After spending the balance of last year playing the (mathematical) fool, this shift it’s still today being downplayed as per usual.

While policymakers worldwide were still imagining strong growth and recovery, the other “equation” popped back into our lives. CNY DOWN = BAD. April 18 last year. Jay Powell would continue to emphasize overwhelming US labor market strength, Mario Draghi talked a lot about looming European rate hikes, and Haruhiko Kuroda an end to Japan’s QQE. And at the very same moment, CNY DOWN = BAD.

A few economists tried to go back and think about it like 2015, that this was China enacting export stimulus in the face of “trade war” dangers. But that’s the real elegance of my equation, if you could call it that. The CNY stuff isn’t really about China, not that one country alone. When the currency falls sharply what it really means is that the dollar is rising, or what we call a eurodollar squeeze.

The eurodollar is the real global reserve currency. And it’s not really a currency, it is a system. There are any number of ways it doesn’t fit into the econometrics of our time.

A squeeze or shortage in the global reserve currency system is never good – for anyone. So, while we have expected and have seen China’s economy fall under renewed economic pressure, severe pressure in some cases, it has not by any means been limited to inside the Chinese border.

Europe may already be in recession, or at least key parts of that economy (manufacturing and the goods economy). The United States? It was supposed to have decoupled. It never did.

Yesterday, we wrote about American inflation, consumer incomes and spending, the return of residual seasonality, and most pressing of all US retail sales. More and more the data is spot on, and spot on consistent. CNY DOWN = BAD.

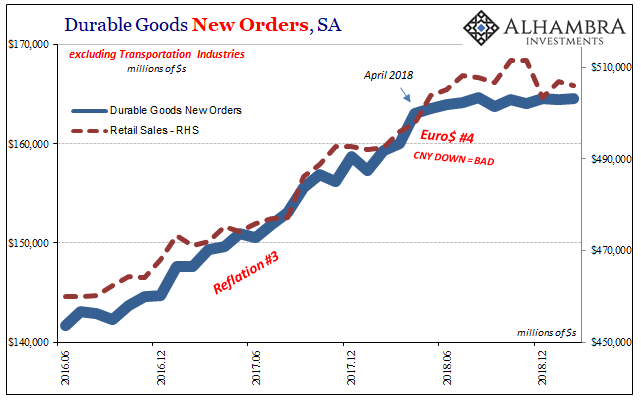

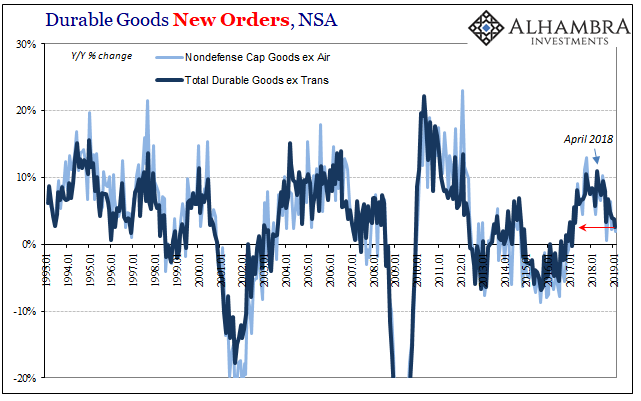

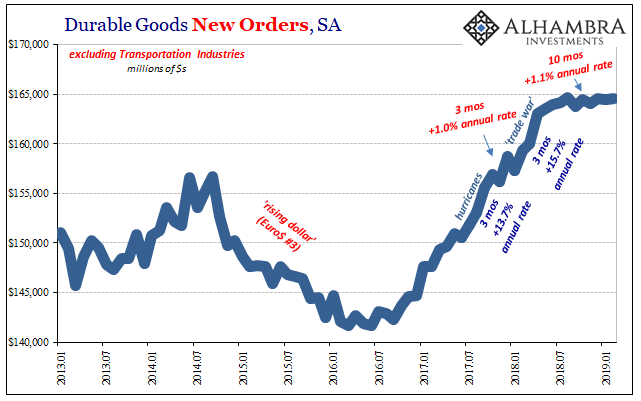

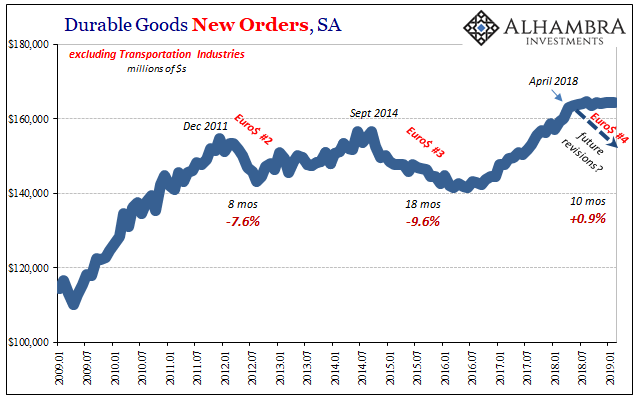

Today, the Census Bureau reports data on durable goods. New orders of them (excluding those recorded in the transportation industries) rose just 2.6% year-over-year in February 2019. This was the lowest growth rate in two years, dating back to the beginning portion of Reflation #3.

The trouble began like for retail sales around April 2018. Sideways, as it is shown currently in the seasonally-adjusted series (above), is already bad but we don’t really know by how much. I suspect that, perhaps years from now, when all is said and done revisions to the data will show that these US economic accounts in the back half of 2018 were probably contracting rather than highly unusual sideways.

Either way, boom solved. There simply couldn’t have been one. The mainstream projections were projecting a lot of faulty assumptions. As I wrote back in November 2017, “In short, bonds are calling the inflation/growth bluff. And why wouldn’t they?” The math wasn’t right.

Stay In Touch