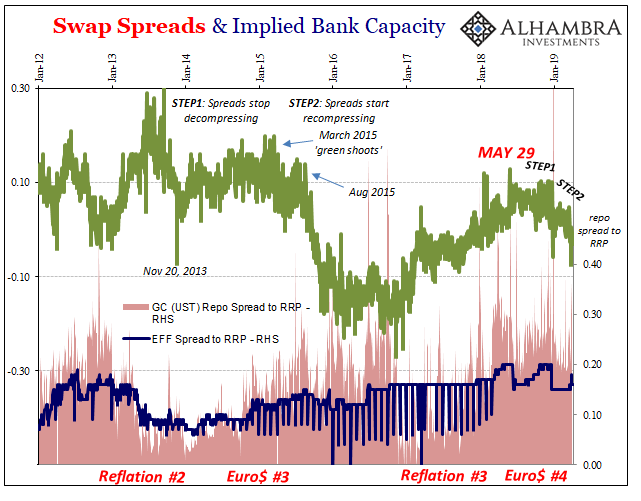

You don’t always have to understand the minute details behind these things to gain a sense of what they mean. I’m talking about things like negative swap spreads and related. From the textbook view, a negative spread makes no sense at all. On the surface, it seems to suggest the market thinks financial counterparties are less risky than the US government.

Nonsense. If that’s what the spread adds up to, you don’t really need to know what is exactly going on to recognize and appreciate how something isn’t quite right. The output or result of a huge market is nonsense; and that really can’t be anything good. Forget about when it persists.

When we are talking money and money markets (interest rate swaps very much qualify), it should leave you asking just one question. Where are the dealers? They’re the ones responsible for order, hierarchy, and, yes, making sense of prices and spreads. A negative swap spread is a dealer’s most fervent wish, an opportunity for “free” “money.”

Where are they?

And so it goes with other things. Repo. The repo rate so far above and ahead of unsecured? Nonsense. Where are the dealers?

Now let’s take this same discussion to federal funds (since I’ve been asked quite a few times since my last IOER diatribe from a few days ago). Here’s the meat of the issue from that earlier article, the gist of what monetary authorities seem to believe is supposed to happen:

It sort of goes like this: if money market rates rise near or even above IOER, this would incentivize money dealers or anyone with spare liquidity parked as excess reserves to pull them out of the Fed’s pocket and place them in these money markets. That would then, in theory, cause the money market rate in question to fall back to where it “should” be.

When EFF was a bp or two below IOER, this doesn’t seem to make sense. Why would anyone take excess reserves from the Fed’s book (giving up IOER) and then lend in federal funds for one or two bps less? No one would.

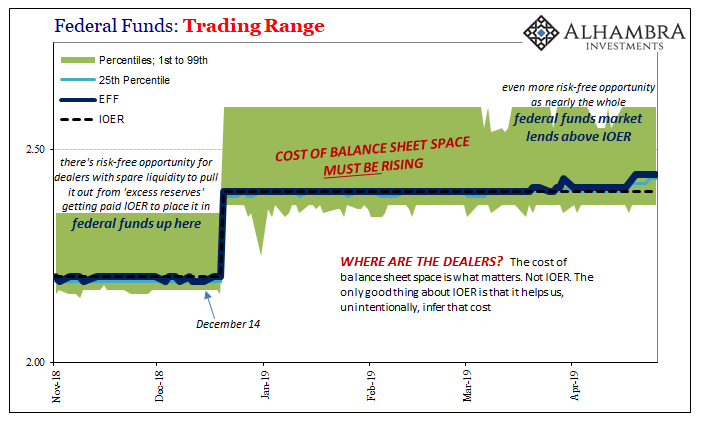

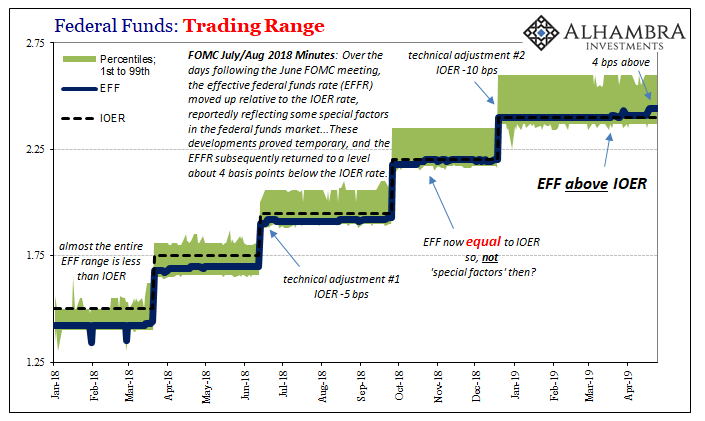

This is where we need to be careful and specific. EFF is not a single rate. It is the weighted average of many, many actual transactions which happen within this technical space. The charts I present for federal funds include the widest range for this reason; to illustrate that the actual marketplace isn’t just what is calculated out at EFF.

Go back to December 14, the last time EFF came out 1 bps below IOER. At the time, the Fed’s “ceiling” was set for 2.20%. That is a hard rate, meaning that’s just what the Fed will pay you if you leave “excess reserves” on account at FRBNY (primarily).

On the same day in the federal funds market, 50% of all the money offered was offered, and booked, at either 2.19% or 2.20%. About 24% came in between 2.17% and 2.19%, and another 24% above 2.20% to as much as 2.35%. The conventional IOER theory applied on that particular day to that upper quarter.

Banks parking excess reserves getting paid 2.20% for IOER could have instead lent out some of those reserves paying upwards of 2.35% in the federal funds market. If they had lent more than they actually did, and we don’t know how much that was, it would’ve pushed the top end down and therefore the weighted average for the day.

Instead of EFF at 2.19%, right up against IOER, those additional funds applied to transactions above might’ve caused EFF to drop down a bps or two more. That’s what the FOMC appears to have expected was going to happen (for months on end). And if you drop IOER down 5 additional bps, as the FOMC did starting December 20 (the second technical adjustment), it gives participants even more incentive to go into the top end of the federal funds market rather than hold steady in excess reserves.

Now let’s look at it with yesterday’s figures. FRBNY says that the 25th percentile was 2.43%, meaning that 75% of all federal funds transactions took place at least 3 bps above IOER (currently 2.40%). The 1st percentile was 2.37%, so we can assume that the vast majority of all lending came with a rate above IOER. It worked out to a weighted average of 2.44%, the published EFF rate.

The 99th percentile was 2.60%, or 20 bps above IOER.

It’s an easy profit. There really is no risk involved here. Though unsecured, the lack of unfamiliar players makes it pretty open. Why keep reserves parked at IOER when you can pocket 5, 10, 20 additional bps? It doesn’t seem to make sense. Players should be falling all over themselves to jump in, which would, again, push the weighted average lower.

Instead, the average keeps on rising over time, and officials are predictably befuddled.

In other words, what this market is saying is that the cost of creating or mobilizing additional liquidity must be greater than that spread! As discussed a little while back, this isn’t quite the theory behind the mainstream view of the printing press. Bernanke says for the US government to print money there is no additional cost. But in this system, it isn’t the US government which creates and mobilizes liquidity (effective money supply).

What we are witnessing is how there are, actually, costs to money. We know this simply because we are left asking, once more, where are the dealers? They are the entities who evaluate and choose to, or choose not to, absorb those costs.

Understanding what that cost is, that’s the tricky part. It is this balance sheet space, or capacity. It is not a neutral proposition between “excess reserves” and lending in federal funds. The latter requires the use of some additional balance sheet space whereas the former does not.

At some point, at some higher EFF spread (meaning distribution), the opportunity cost of using some scarce balance sheet space will be great enough such that dealers will enter as in the FOMC’s ad hoc theory. But that threshold seems to be much higher than anyone anticipated, and, more importantly, the trigger point is certainly dynamic.

What I mean, quite simply, is that if balance sheet space becomes even more scarce, it will require still higher rates across the whole range of federal funds to incentivize dealers to jump in. Exactly what we have seen. Thus, the higher rates across the EFF track, from that we can infer a negative change in balance sheet scarcity – they are intentionally passing up greater and greater nearly risk-free profit opportunities.

Just like repo; just like swap spreads.

In the old days, meaning before August 9, 2007, balance sheet space was cheap, almost cost free. Any small spread was jumped on immediately. That’s why hierarchy reigned. Dealers policed these spreads ruthlessly, vacuuming up every penny and from that chaos markets worked in very orderly fashion. Predictable.

Economists simply assumed, and have continued to assume, there was/is no cost to that order; and that order religiously took direct orders from Alan Greenspan’s famous dot-com era briefcase.

What happened to drive up the cost of balance sheet space, the overriding limiting factor, was risk. While pre-crisis capacity was cheap it was not risk-free. Everyone merely assumed that it was (the myth of the “maestro” was one reason for the assumption as well as how widespread it was). The lesson of Bear Stearns changed the balance sheet equation irreparably, and drove balance sheet space to a higher and higher premium (more and more scarce).

To the point that almost twelve years later, it shows up in more and more obvious fashion in the most out-of-the-way, irrelevant money market left. Which just so happens to be the one the geniuses at the FOMC still use to “communicate” money-less monetary policy. Oh, it’s communicating, alright.

The cost of balance sheet space is what matters. Not IOER. The only good thing about IOER is that it helps us, unintentionally, infer that cost (actually those costs; I wish it was so simple as a single factor).

Having written all that, we can just go back to my original premise. You don’t really have to read through all the fine print. It helps, but it’s not required. You can simply appreciate that when EFF is closing in on, and now above, IOER something must be wrong.

Where are the dealers?

Stay In Touch