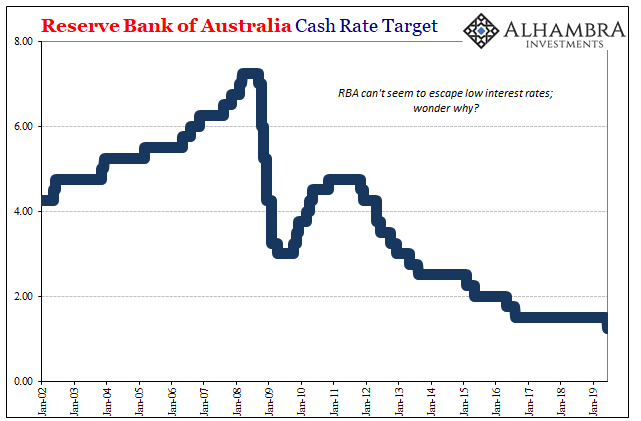

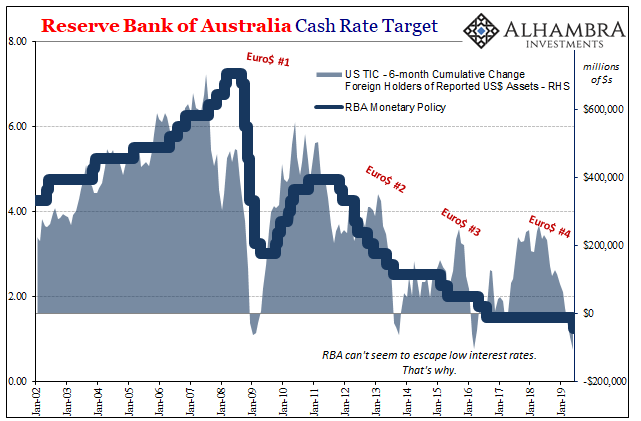

In case you missed it, the rate cuts have already started. They actually began last year among the major economies in India. If we are counting only DM countries, then Australia and New Zealand are first out of the gate; the latter smaller country beating the larger former by around a month. In a way, it is fitting how even in rate cuts there is escalation.

And in doing so, it has become perfectly clear what’s got them so bothered. Well, perfectly clear about “what” if not so much about “why.” Global trade is collapsing. They’ll keep blaming trade wars and they are very happy to have the opportunity given the alternative.

That would be to admit how warning signs were consistently missed all throughout 2018 in favor of a narrative with no actual backing. Very early on last year, in January no less, things started to get serious. By May 29, even if authorities around the world had been honest it was still probably too late.

Needing something convenient to keep it to just recently, trade wars sound so much better as a scapegoat. Otherwise the press release would have to begin, we really have no idea how the economy is performing.

Here’s the Reserve Bank of Australia’s opening in its monetary policy statement from November 2018 (note: given the way Australia’s economy runs, and therefore economic priorities, they always begin with a discussion of the “international environment”):

Global economic conditions remain robust. Major trading partner growth has continued at a bit above the average of recent years. While growth has eased in some economies, in the United States the recent fiscal stimulus has contributed to a further strengthening in growth.

The next one in February 2019, the opening for that statement:

Global growth remained above trend in 2018, despite moderating in the second half of the year. The outlook for the global economy has become more uncertain, partly because it is hard to predict how trade policies might evolve and how much support stimulatory policies will provide to domestic demand, especially in China.

And now the latest summary just announced accompanying the central bank’s first rate cut since Euro$ #3 in 2016:

Growth in a number of our trading partners eased in the second half of 2018, and growth looks to have broadly continued at this more moderate rate into 2019. The slowing has been partly the result of a sharp slowing in global trade. This has been particularly evident in trade-exposed sectors such as manufacturing and trade-oriented economies in Asia and the euro area.

It’s hard not to laugh sometimes. Global growth “eased in the second half of 2018” but they only figured this out in May 2019? Back in November 2018, which fell within that second half, “global economic conditions remain robust.” How does the language surrounding the same past period in time change with the economy’s progression?

When you want to “explain” this year’s “unexpected” problems in a way that doesn’t make you look so very bad at your job. “The economy is awesome and it’s going to stay that way” quickly becomes “it really wasn’t so great so this isn’t a huge surprise to us.”

I’ve been writing how the global economy seems to have struck a landmine in that October-December window. More and more, even in the official obfuscations of central bank lunatics, the progression is there if at a lag. If only there was some way of figuring all this out.

Rate cuts, they aren’t stimulus but they do tell us when the most optimistic group of optimists is no longer optimistic. That very clique in Australia and New Zealand have just done their part along these lines. Who’s next?

Stay In Touch