While still a professor of Economics at Princeton, future Federal Reserve Chairman Ben Bernanke was also a Research Associate for the NBER. In 1999, in his capacities with the latter organization, Bernanke advocated for widespread adoption of inflation targeting. At that time, only a few central banks had experimented with it and there wasn’t much evidence for its effectiveness.

Publishing a paper on that topic, he would return to this theme (transparency increases effectiveness) that would have, if 2008 hadn’t intruded, probably defined his official tenure. Inflation targeting worked and worked well, he claimed, when it was incorporated into communications.

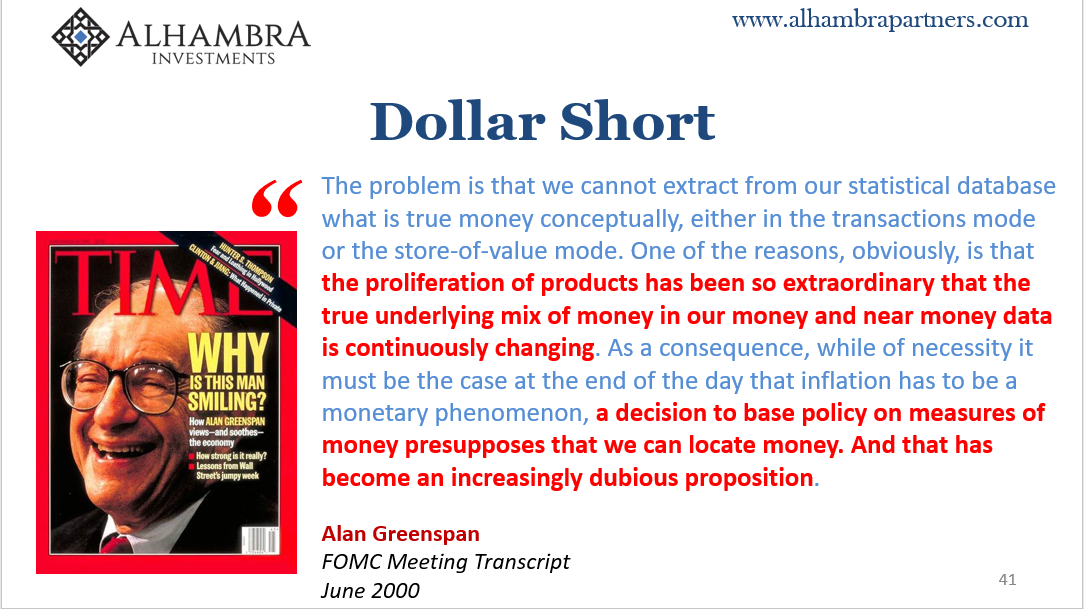

Central bank habit was at that time changing. An older generation, those like Alan Greenspan, preferred the monetary policy doctrine of Montagu Norman. The long-ago Bank of England chief had said, “never explain, never apologize.” When there was money in monetary policy, you could act this way.

Though Greenspan would worry about monetary evolution, it was Bernanke who would push the policy direction. It’s one of the few areas with which I find myself in agreement with him; if you don’t have money then you better explain yourself. Only, the “maestro’s” successor never really contemplated the full range of implications.

What if you end up in a situation that calls for an actual monetary solution?

The whole idea behind inflation targeting was to make sure this would never happen. So long as everyone believes in monetary policy no one should care about monetary evolution. In the parlance of the doctrine, expectations remain firmly anchored no matter what.

What changes, or what becomes policy, is communication and signaling about whichever central bank’s intent. Even QE was written out this way, as St. Louis Fed President James Bullard recently acknowledged. The Fed never printed money as many had come to think, rather it signaled its intent to “accommodate” (via psychology) playing on inflation expectations in that manner. This is their magic trick, or puppet show if you will.

Therefore, what Bernanke wrote in 1999 really stands out twenty years on:

In practice, other important features of inflation targeting include greater “transparency” of policy – that is, increased communication and clarity about the plans and objectives of monetary policymakers – and, in some cases, increased accountability of the central bank for attaining its announced objectives.

Notice what is missing from his brief description – money. Again, Norman – he didn’t have to explain himself, the BoE just added or subtracted from the money stock and everyone therefore knew what was what. Despite this, I have little doubt Bernanke believed what he wrote about central bank “accountability” at least in theory.

We have to remember that like inflation itself inflation targeting doesn’t mean quite what it may sound. The Fed does not promise that it will never allow consumer price growth, in the aggregate, to deviate. This is messy stuff, real economies, which is why Bernanke was writing about transparency, meaning that an inflation target comes with a time component.

As such, over time central bankers promise to maintain their specific definition of price stability. Before Bernanke, there was no explicit inflation target. In 2012, flustered as the recovery featured instead already several false dawns by that point, the 2% target was affixed. By then, Fed officials hoped bringing the target out into the open would actually aid in the efficacy of the various monetary policies in the way 1999 Bernanke had surmised.

What has happened instead is that Bernanke’s Fed has given us perhaps the simplest, most straightforward proof for how central banks are not central.

Up until December 2007, the Greenspan Fed (and Bernanke in his first few years) did very little. Suspiciously little. The FOMC would vote to move the federal funds target up and down by a quarter point here or there, maybe as much as 50 bps on only a few occasions.

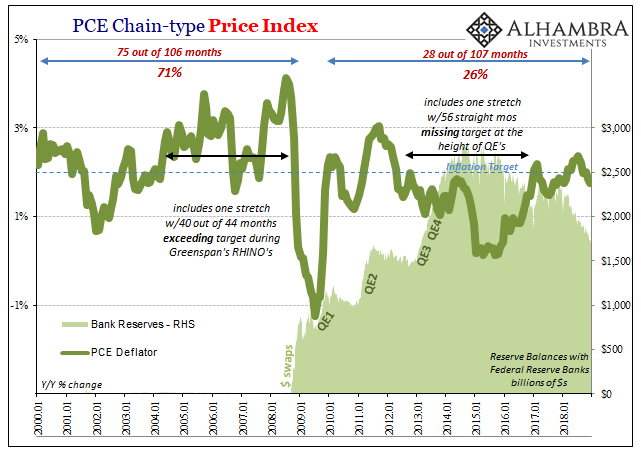

In the 21st century, while the Fed did very little (there was only ever a negligible amount of bank reserves at the time) inflation was as likely to be overshot (though the 2% target wasn’t publicly admitted until 2012, several officials have stated that it was implicit going back to the nineties). Beginning with January 2000, over 106 months the PCE Deflator was growing by at least 2% in 75 of them. This period included the entirety of the dot-com recession and the lethargic recovery which immediately followed.

It also features one stretch when consumer price inflation was less than 2% just four months out of 44. It was during these almost four years that the middle 2000’s “rate hikes” occurred. The Fed attempted to slow everything down, incorporating that message into its communications, but in terms of the PCE Deflator it wasn’t having very much success.

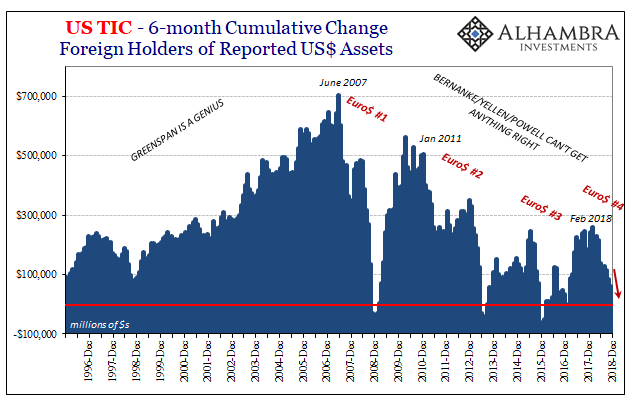

On the contrary, since the end of 2009, a period now spanning an equivalent 107 months, the Fed has done quite a lot. Suspiciously a lot. There have been four completed QE’s along with sustained ZIRP, money rates never above 2.5%. Bernanke then Yellen and now Powell have been very explicit about their intentions for monetary policy; highly “accommodative.”

And yet, in those 107 months the PCE Deflator was 2% or more in only 28 of them. This included a stretch of very nearly six straight years of undershooting, importantly the very same time period in which QE was at its zenith.

To sum up: the Fed does very little, inflation more likely to overshoot; the Fed does things that before December 2007 we thought we’d never see, and then keeps doing them, inflation is almost certain to undershoot. It is by every mainstream convention upside down. Something else is very clearly going on in terms of inflation.

The central bank doesn’t appear to be very central. More than one hundred modern months on either side of the 2008 divide are more than sufficient evidence for the claim. As Greenspan noted in June 2000, inflation is a monetary phenomenon. And then he admitted the central bank has no idea how to define money.

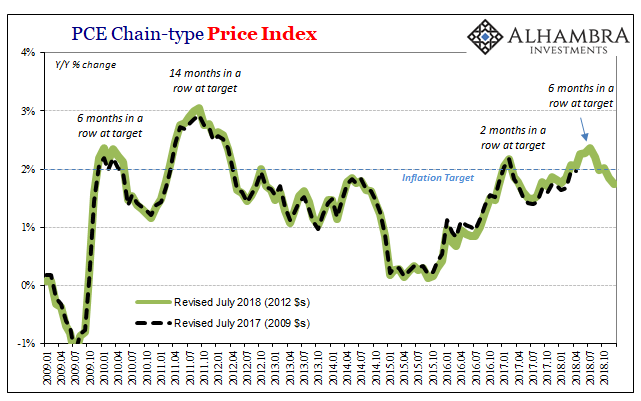

In 2018, with a tailwind in oil prices the PCE Deflator peaked above 2% for only a single six-month stretch; at most seven out of eight months. With WTI now retreating, we find the Fed missing its inflation target all over again. For the month of December, the BEA last week calculates consumer prices increased by 1.75%.

Monetary policy entering 2019 remains more likely than not to result in undershooting its mandate. Policymakers can’t figure out why, even though this is a phenomenon very well established especially in the 21st century. Whatever this something may be, it appeared to work before late 2007, again when the Fed did almost nothing, but now nothing seems to work over the last eleven years. The number of false dawns has increased to four.

Bernanke wrote two decades ago about central bank accountability under inflation targeting. Unfortunately for his reputation and record, here it is. At some point, history is going to look back on all this, setting aside the mainstream media’s current journalistic infatuation with pedigrees to finally absorb what really is the biggest story of the century.

You don’t need to know anything about the global eurodollar system to begin the journey away from Economics. The simple PCE Deflator, ironically the Fed’s preferred inflation measure, is now more than enough.

Stay In Touch