The way I look at the global economy, there are basically five different zones. The first is the US and the second is Europe. China might be third on this list but often second if not first in terms of what’s driving marginal changes. In behind those is Japan, not what it once was but still often a bellwether for those changes. Lastly, there is the developing world (as well as any small DM economies not otherwise assigned).

Standing in for the final group, I often turn to Brazil as a proxy. It is one of the most highly developed and in sheer size already one of the largest in the world.

In those other zones, economic data has been weak but not yet minuses in the big overall accounts like GDP. Though German manufacturing conditions, for example, are already equivalent to recessionary levels, Europe’s economy as a whole hasn’t posted any negative signs. GDP was close to end last year, but remains at least for now on the good side of zero.

The same, actually better in the US. GDP in Q1 was greater than 3% and the manufacturing/industry contraction is only just starting to show.

Perhaps this indicates resilience; though weakness is unwelcoming it isn’t so bad that one might even think it an optimistic sign for how the rest of this year will unfold. With markets ending last year on a terrible note, perhaps there is some basis for a second half rebound after all.

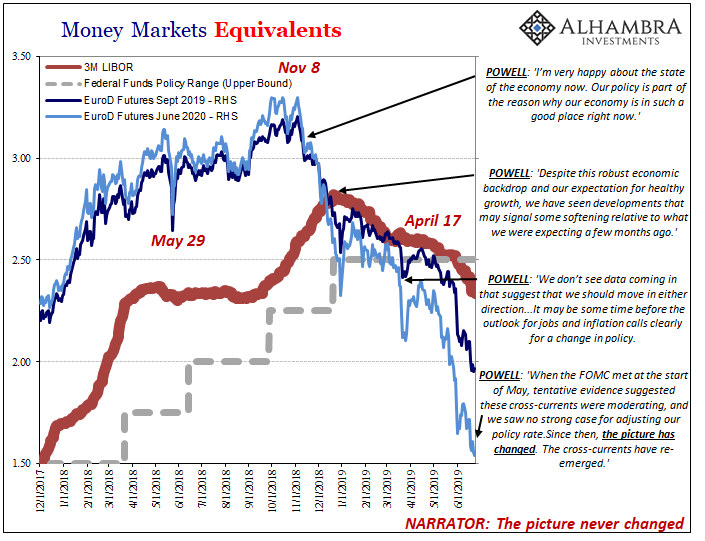

If markets are betting on rate cuts (maybe a fifty) starting at the end of next month, and with the FOMC expecting no more than a few insurance cuts in early 2020, how do we get from that much more optimistic (though certainly more downbeat) official view to Jay Powell making a month from now?

One way is for whatever it is spooking the markets to finally turn up out of the shadows, the liquidity fears being realized in a big way. Another is for the global economy to start posting minus signs in those major accounts.

In fact, the two may go hand in hand; a serious dollar shortage becoming more serious would be one potential explanation for negatives in major data points.

And that brings us to Brazil.

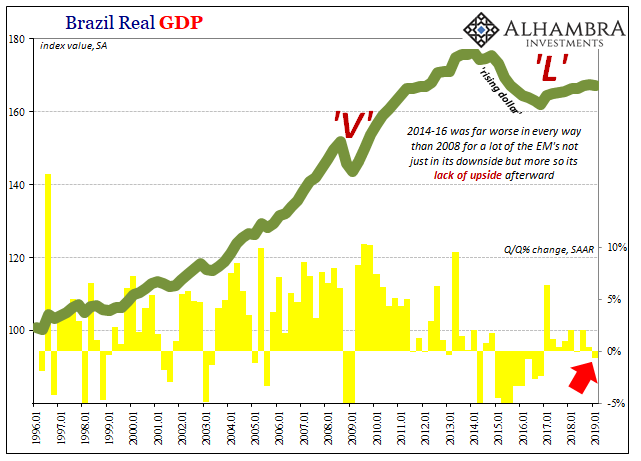

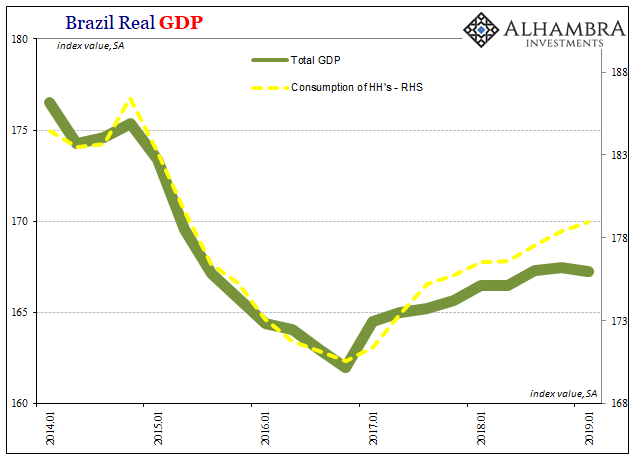

GDP for Q1, released recently, was more than a little negative quarter-over-quarter for the first time since 2016. Q2 2018 worked out to be just slightly below zero, but that was the same quarter as the massive trucker strike which paralyzed the country for several days.

Leading Brazil into contraction are all the categories which are most sensitive to financial and monetary changes. As I noted in my paper, the BIS’s Hyun Song Shin recently studied the links between the dollar and where trouble within that system ultimately shows up first. Here’s what he wrote last month:

Building and sustaining GVCs are highly finance-intensive activities that make heavy demands on the working capital resources of firms. When the financial requirements go beyond the firm’s own resources, the necessary working capital is dependent on short-term bank credit. The financing requirement for GVCs arises because firms need to carry inventories of intermediate goods or carry accounts receivable on their balance sheet when selling to other firms along the supply chain.

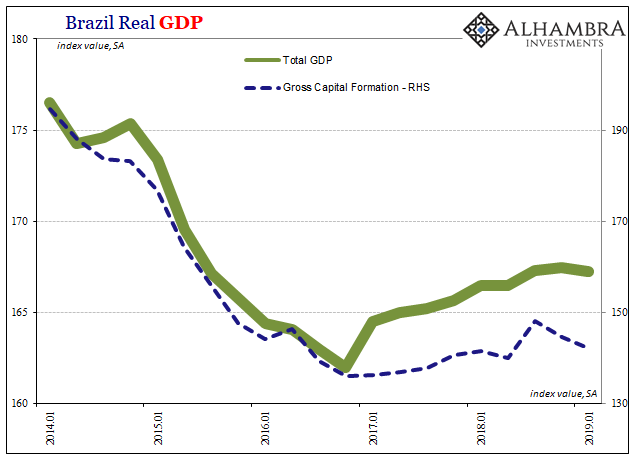

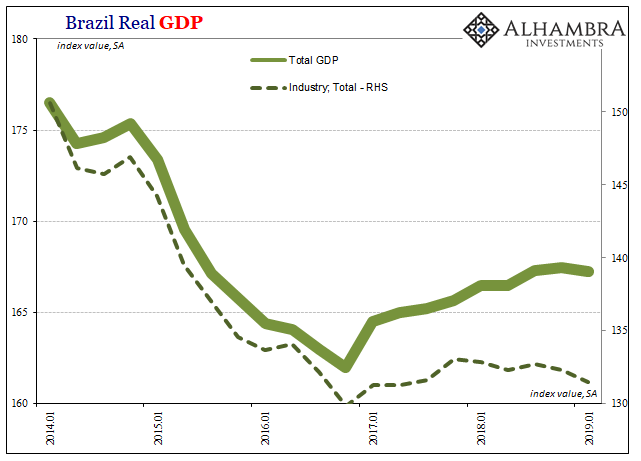

Since so much of that finance is denominated in dollars, a dollar shortage works first through industry and capital investment. Therefore, Brazil:

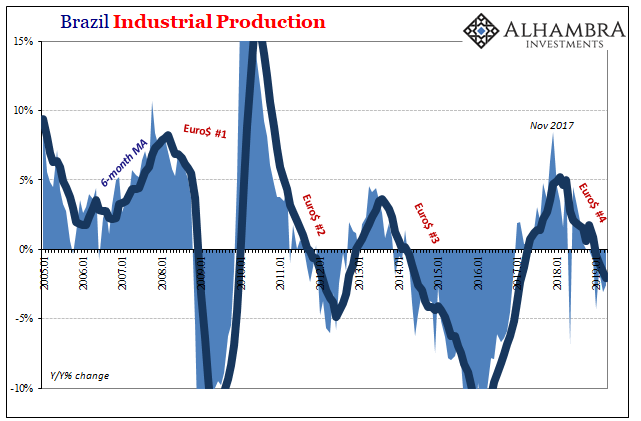

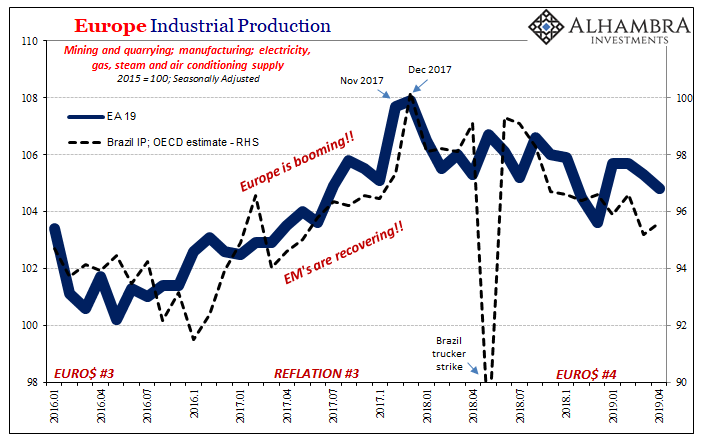

Separate estimates for Industrial Production suggest the problem may already much worse. According to the OECD, Brazilian IP has contracted year-over-year in each of the last six months (through the latest data for April 2019) dating back to last October (the landmine). As a result, the average change is now -2%, which like Germany’s similar numbers, indicates serious and still-growing problems at least in the finance-heavy industrial sector.

And that’s ultimately what grabs our attention for more than just Brazil. There really is no other way for such close correlation between what should otherwise be entirely separate economic conditions. Yet, when we look at industrial growth from one zone to the next, in this case Europe and Brazil, it is astonishingly uniform (leaving very little doubt about what’s really behind all this economic trouble).

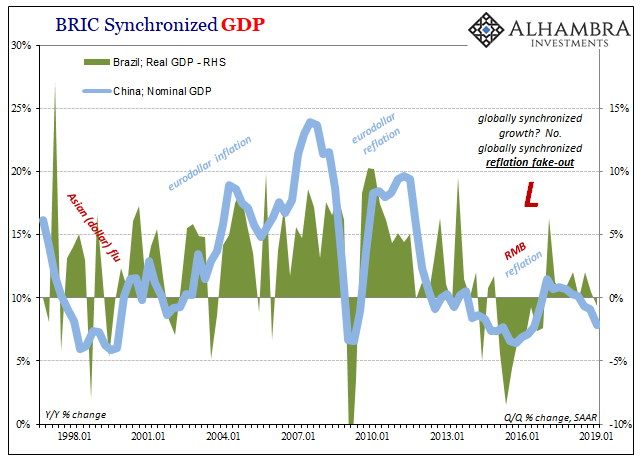

This holds in the overall economic trajectory, too. Brazil’s GDP estimates rather closely track China’s (in nominal terms). The ups and downs are, in general, following the same outline, including the latest downturn which still points down.

But is that cause for concern, or the basis for hope? The global manufacturing sector is highly exposed and therefore at greater risk. Is there resilience beyond industry?

If Brazil is anything to go by (which, obviously, that’s why I am bringing this up) then no. Much of what has supported Brazil’s “recovery” following the devastation during Euro$ #3 has been the household sector. I haven’t seen any flood of mainstream articles written about this country’s economy being “rebalanced” the way it is written up about China, though that’s probably because anything about the last five years in the former just cannot be spun like that.

Consumer spending has been consistently up whereas industry and capital formation have not. This includes the most recent quarters where there has been at least positive expansion.

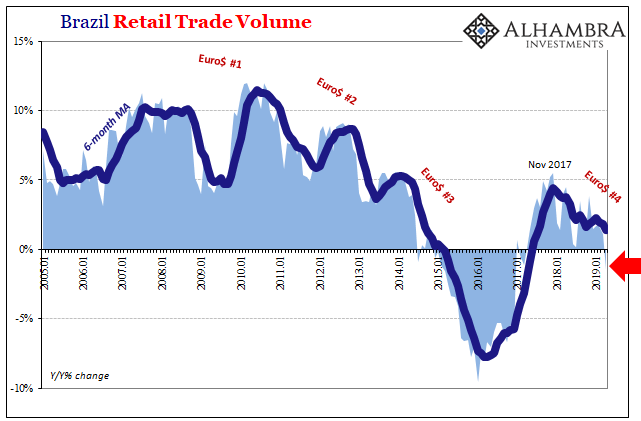

So it is with concern that we find in the retail trade account (again using OECD figures) the first minus sign appear here, too. For the month of April 2019, the latest data, retail trade fell 1.5% year-over-year.

We start with a globally synchronized downturn throughout the world’s industrial sectors. But as far as indications of any sort of firewall of solid consumer spending, Brazil’s zone sends an ominous warning. The decay process of Euro$ #4 post-landmine may not yet be done and there is at least the serious potential for contagion beyond manufacturing and trade.

And for Jay Powell’s purposes, it is a two-fer. A potential degradation in the global economy in headline accounts as well as a liquidity indication dollar-wise behind it. You get a rate cut in July if or when global minus signs proliferate on illiquid conditions already, especially when any increasing prospects for broad economic contraction only confirm fears about liquidity. The self-reinforcing vicious cycle.

Stay In Touch