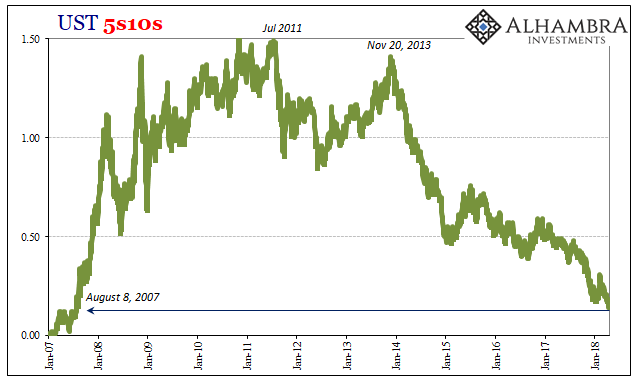

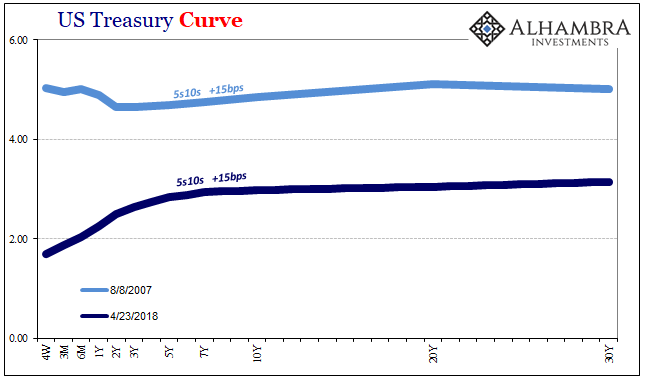

The current US Treasury yield curve in between the 5-year and 10-year maturities is today just 15 bps. It had dropped down to this level of flat about ten days ago. When it did, it had been the first time in almost eleven years. The last time the 5s10s was 15 bps? August 8, 2007.

It’s hard not to notice these things, depicting as they might a completed cycle or round trip. August 8 was the day before the system broke for good, and so the Treasury curve was then steepening after having been inverted for a good length of time beforehand. That kind of curve action, as my colleague Joe Calhoun rightly points out, is accepted as the worst kind.

You never want to see short-term rates fall faster than those of the long end. It indicates things are about to get serious, or at least that is what the market expects (and it has been the market, not Economists and policymakers, that have been correct about all this).

While true in the sense of the future short-term direction, I think there is a level worse below such bear steepening. A much more desperate condition is what we find now, this long end flattening. What’s missing from analysis is the other dimension.

Nominally, rates are rising across the Treasury curve. They are increasing much faster and farther at the short end than the long. That seems to be consistent with what’s normal, of course, and we have expected as much at whatever point the Fed had finally gotten around to its “exit.” But not all flattening is the same, either.

Many people like to use the 2s10s or as policymakers do (to increase the term distance, to therefore minimize the prospects for inversion) the 3m to 10-year, but to me all the big stuff is in the 5s10s. The 5-year range and in encompasses all the things we talk about with money and even monetary policy (mostly of delusion). The 10-year space is where all the meat of finance and credit meets with economic expectations.

Therefore, the 5s10s tell us a lot that the broader shapes can’t quite isolate. There’s purity in the 5s10s that might be missing in other, broader segments. It’s the same reason why 5-year/5-year forward inflation expectations play a similarly significant role in suggesting market views on the anchoring of much more than consumer prices. It’s about (perceived) potential.

This forward calculation is interesting for what it proclaims to be – it is, essentially, a measurement of the change in rates expected by the “market” over future five-year intervals. Thus, the first five-year interval measures the state of current affairs and whatever immediate aftermath; the second how successful anything done in that first will be in restoring long-term expected health.

The UST 5s10s is the same way. The first five-year curve interval is more about ST rate expectations and even inflation (the effect of ST rate behavior) whereas the second is what the market believes will in all likelihood be the lasting result of all those factors.

Because of that, anyone downplaying the curve flattening here is either ignorant or disingenuous. There is a whole lot wrong with the world at 15 bps on April 23, 2018, than the seemingly same 15 bps on August 8, 2007. The latter spread was the market suggesting imminent problems, while the former how those problems have never been resolved – and still aren’t likely to be over the long run.

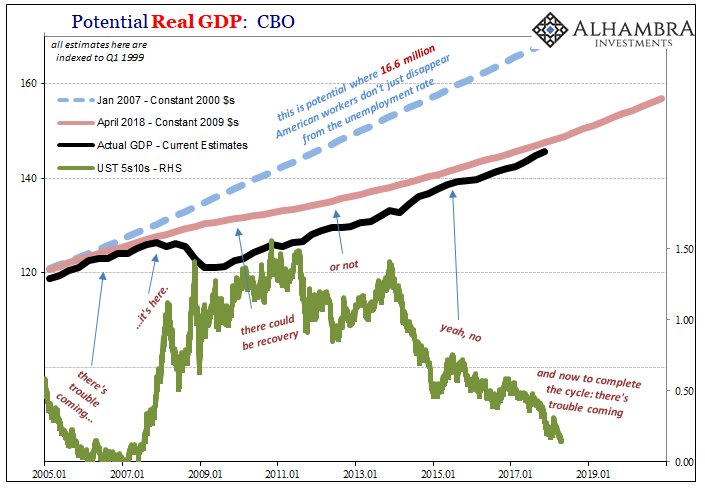

We can look at these massive differences in clearer economic terms, too. Again, if the 5s10s suggest longer run potential, it’s amazing how the CBO’s estimates for the same have over time largely confirmed these treasury spreads (and the dour interpretations of them). As the curve has flattened at much lower nominal levels than ever imagined (certainly by the designers of QE and monetary policy), the lack of economic acceleration indicated in the curve increasingly registers in the DSGE models of mainstream academic outlets as hugely diminished potential.

That’s the part nobody wants to talk about, and it’s the only thing that matters. The stuff about inversion and recession, while potentially important, misses the big picture. What’s dangerous about the economy today is not a recession tomorrow, but how the last one couldn’t have been one.

Maybe Economists don’t understand bonds because they don’t want to. From the FOMC’s December 2017 minutes:

Among the factors contributing to the flattening, participants pointed to recent increases in the target range for the federal funds rate, reductions in investors’ estimates of the longer-run neutral real interest rate, lower longer-term inflation expectations, and lower term premiums. They generally agreed that the current degree of flatness of the yield curve was not unusual by historical standards. [emphasis added]

There is everything unusual about the current treasury curve. The media still portrays policymakers as able technocrats, and their opinions therefore translate into editorial standards for all economic commentary. It has been a tremendous disservice.

In truth, they are the Keystone cops. Always have been, in 2007/08 and before, but now it really matters.

Stay In Touch