Inflation always brings out an emotional response. Far be it for me to defend Economists, but their concept is at least valid – if not always executed convincingly insofar as being measurable. An inflation index can be as meaningful as averaging the telephone numbers in a phone book (for anyone who remembers what those things were).

If you spend $1,000 a month on food for your family, and food prices rise 6% generally that’s an additional $60 that has to come from somewhere. It is substantial. By the very nature of food and food shopping, and how you pay for groceries more directly, that price increase sticks in your mind for the amount you’re pinched.

However, during the same month Verizon suddenly lets you switch to an unlimited wireless data plan which takes your monthly bill from, say, $195 down to $160. You may not, and most do not, factor that into your “feel” of general consumer prices (nor do you factor how everything once contained within a phone book is now available with your Verizon plan already on your “mobile device”; that’s another story, though).

You sense 6% inflation even though overall (in just this two item “basket”) your actual price increase is just a smidge less than 2.1%.

In macro terms, we want to know why for each of them. If food prices are rising because they are rising, but Verizon isn’t feeling very good about its data plan pricing because it can’t sell near enough to consumers at the prior price (or higher), then the inflation rate reflects what is a macro difficulty. It is a legitimate economic drag captured imperfectly by a flawed concept.

And then there’s the price of oil.

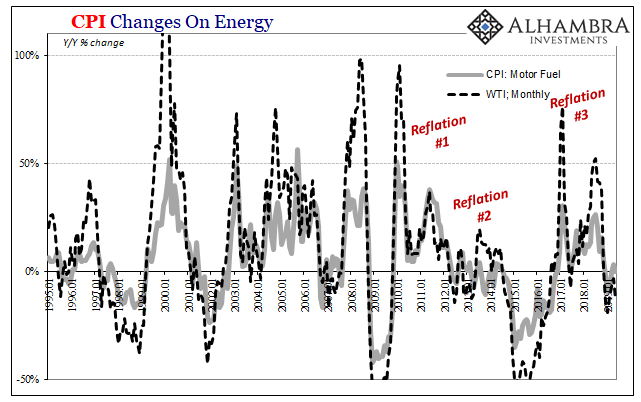

For Chairman Powell and his gang of awful forecasters, he’s always had to fight WTI like his predecessor Janet Yellen (Euro$ #3). The only one who received a substantial lift from it apart from a few months occasionally strung together was Bernanke – not that it did him any good.

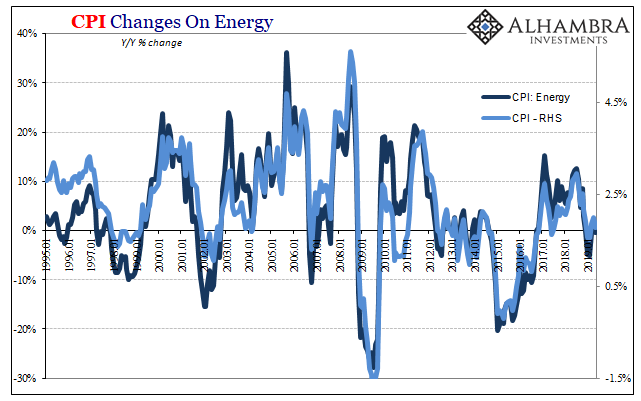

For the month of May 2019, the Bureau of Labor Statistics reports its consumer price index (CPI) gained just 1.79% year-over-year. Since our monetary authority links its inflation mandate to the PCE Deflator, a 2% target for this alternate consumer price measure, that means the economy is back to significantly undershooting the central bank mandate. Roughly, a 2% target for the deflator translates to a 2.7% to 2.9% rate for the CPI (since the way each comes up with a price index is different).

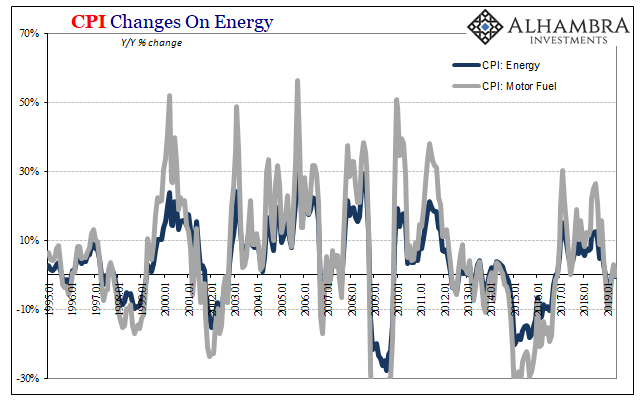

Even though WTI averaged better than $60 during the month of May 2019, that was still 13% less than its average during the previous May. Motor fuel prices and therefore overall energy prices, as far as the CPI is concerned, were slightly lower this year than last.

That means Powell has another headwind on his target. This will only grow worse as WTI renews its plunge from late last year (as oil once more builds up in Oklahoma).

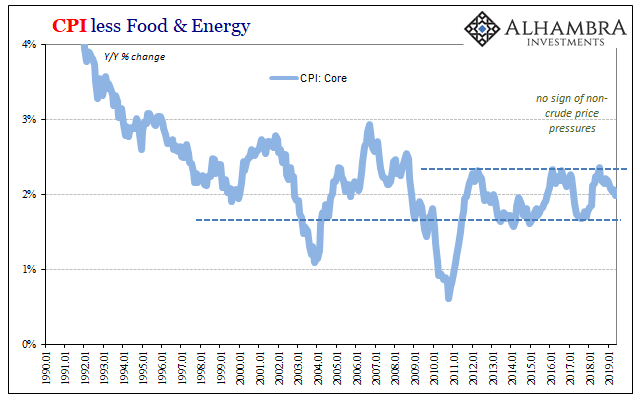

But that’s not really going to be his biggest worry. It is the lack of inflation evident anywhere else. One more time for the record book: unemployment rate now at a 50-year low suggests an epically, biblically tight labor market forcing companies to compete, nay fight over exceedingly scarce spare workers, pushing up wage rates at a rapid pace which businesses then pass along to consumers in the form of consumer price inflation. AWH Phillips’ narrow study of wages in the UK during the latter 19th and early 20th centuries still lives on in 21st century econometric models.

While Federal Reserve officials want to stop this from getting out of hand, it would actually be a good thing (before they get involved) and a very positive sign. It just isn’t happening.

The lack of inflation confirmation for the unemployment rate has itself turned more sinister recently. Stripping oil and food prices from the index, there seems to be a growing number of Verizons in the figures again. In other words, especially in the services sector, fewer and fewer companies appear to be raising prices – not only does that erase wage pressures you begin to wonder why since it isn’t attributable to general kindness and altruism.

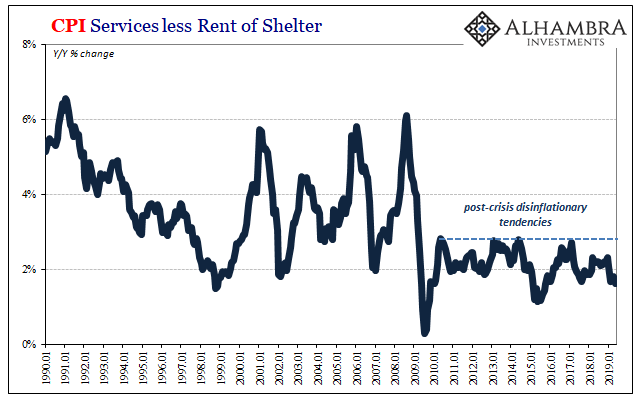

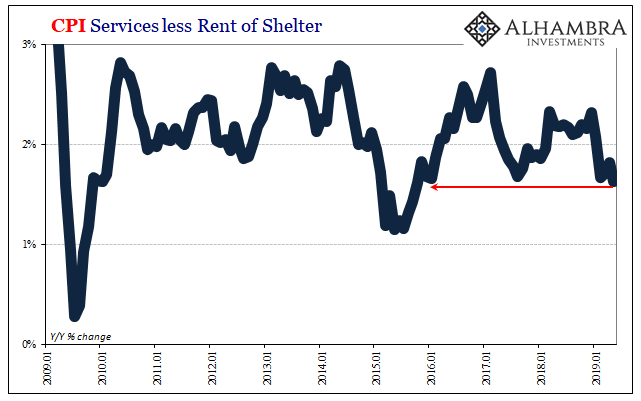

The services index, which excludes rent, increased by just 1.62% year-over-year in May. This is exactly the place where a tight labor market (and, incidentally, the end of the last decade’s malaise) would show up most forcefully. Service businesses don’t have the ability or margin to play around with their cost structure – a tight labor market goes right to their bottom lines, which would mean they would put them right back on the top line.

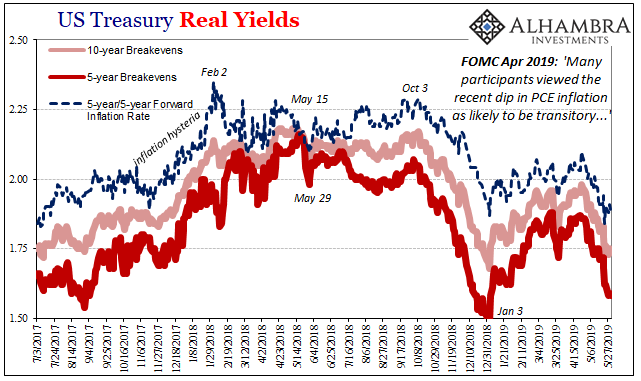

Instead, that 1.62% is the lowest since October 2015! Not exactly a good month to be compared to, nor is it a positive sign that this rate is among the lowest of the last decade. The inflation index is flawed and therefore these results tell us little on their own. However, it is still evidence and it is more which fits with corroborating indications (bond yields, most definitely).

Inflation pressures are receding right where they should be gaining. Why are these Verizons being so shy about pricing all of a sudden when the unemployment rate is 3.6%?

The answer is why Jay Powell converted from December 2018’s press conference reiterating his inflation/unemployment rate/rate hikes view to January 2019’s Fed “pause” and “muted” pressures to now last week’s rate-cuts-are-insurance surrender. As is usual in these monetary cycles, effective global eurodollar money not Fed policy, the Fed Chairman is once again having his mind changed for him. It doesn’t matter who occupies the position.

We’ve seen this all before. Janet Yellen talked a lot about full employment back in 2015 – only to embarrass herself by starting “rate hikes” and then pausing for a full year as “global turmoil” slowed the US labor market and rocked many individual economies around the world. Ben Bernanke did the same thing in 2011, talking up economic growth and oil-driven inflation prospects certainly the success of QE2 – before being forced into QE’s 3 and 4 by the end of 2012 with the global economy in uniform retreat.

The big picture is actually pretty simple. Where there should only be signs of actual strength and acceleration, there are now instead more and more going the other way. Again. The problem isn’t inflation one way or the other, it is repeating monetary cycles. Euro$ #4 is showing up in the headline and guts of the CPI, too.

For a second half economic rebound to be possible, there just can’t be this many Verizons.

Stay In Touch