The most important segments of the GDP report are, to me, final sales and gross private domestic investment (outside of inventory). Those are the proxies for end user demand in the economy (final sales to domestic purchasers), level of production (final sales of domestic product) and business tendency toward investment (or disinvestment). Overall GDP can grow at 3+% in the latest quarter, but the “quality” of any registered economic improvement is further counseled by those measures (assuming GDP holds enough validity at all).

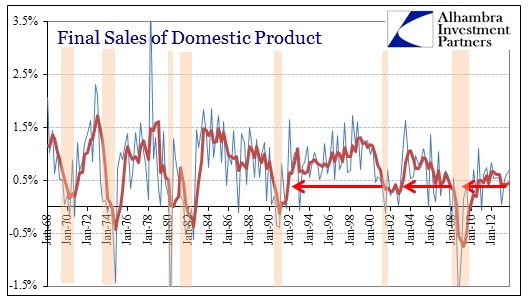

On the production end, despite a pickup in export activity in the past two quarters, relatively minor as it was, overall final sales of domestic product has continued to languish at levels associated with the Great Recession and previous recessions.

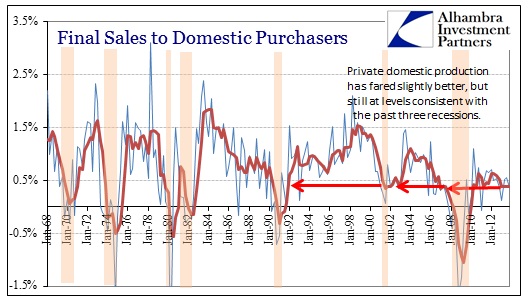

That is actually robust compared to final sales to domestic purchasers. There continues to be relatively little demand in the economy for goods and services, and that is a mighty pinch on not just the US but global trade (feeding back into growth issues for emerging markets).

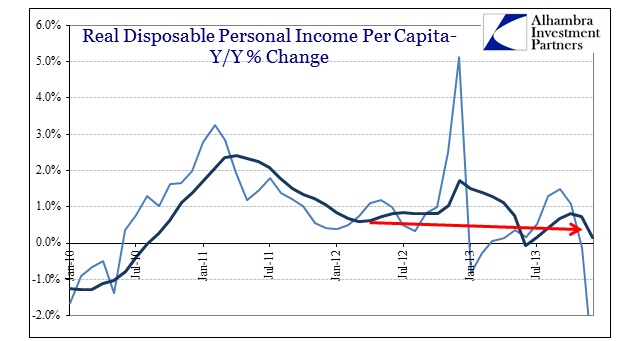

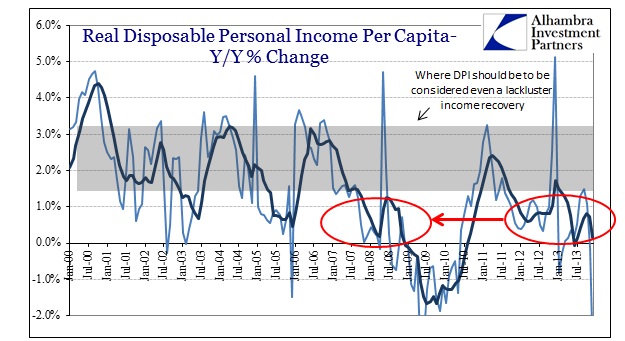

As is usually the case, the culprit for weak demand is almost always found in weak income growth. Again, it takes a reduction in standards to spin the current state of income as indicative of strong and growing employment. That counts both for the numerical level of jobs estimated in the economy and the quality of them, as personal income measures have been largely atrocious since the middle of 2012.

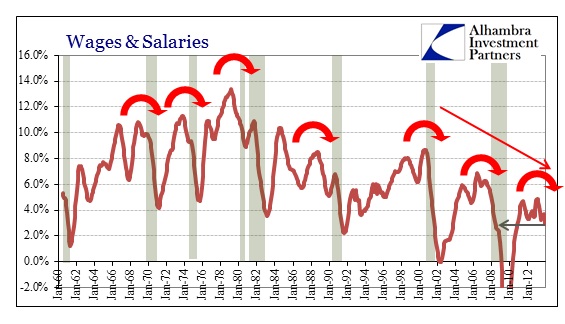

We do have the base effect from late 2012 (due to the pull-forward of income in anticipation of tax changes) that complicates comparisons, but using the average smooths out that “volatility.” We are again back at a low point for this “recovery” period, which is at odds with the narrative that employment is gaining (Establishment Survey), but very much consistent with other measures (Household Survey). That analysis is supported by the changes in growth of wages and salaries alone.

Even incorporating official estimates of inflation we see that income growth in 2013 was below even the substandard reframing that has taken place in measures elsewhere. There is no ambiguity here; even there does exist a positive trend in the numerical count of the number of employees it is not enough to pace population expansion. Further, it is not enough to countenance any semblance of a general expansion. That is why monetary policy first appeals to asset inflation, in the vain hope that the “wealth effect” will lead to a “trickle down” of both wealthy spenders and credit usage to supplement the sorry state of wages and income.

These results directly contradict the picture given by the overall GDP report. Since there are other factors included in the full GDP calculation, that may not be overly surprising. However, this contradiction is very much aligned with the questions of legitimacy I raised earlier – there is a break between employment (including income, as we see here) and GDP as a whole. That may not be true of individual pieces of the GDP calculation, but it certainly appears that way in conglomeration.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch