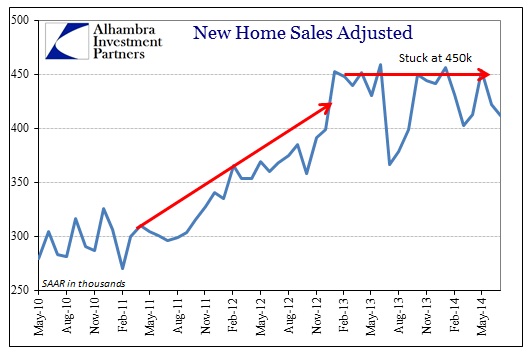

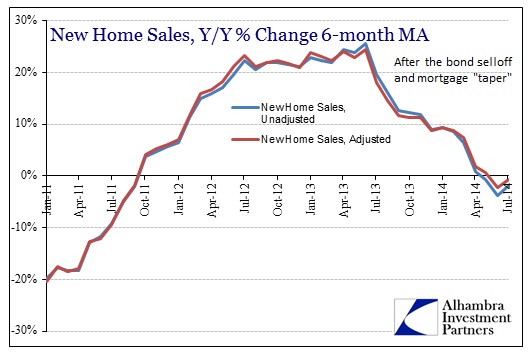

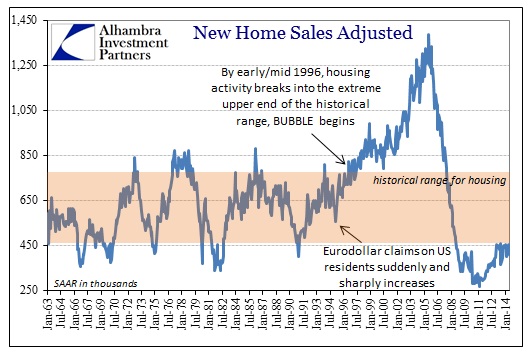

New home sales rose on a year-over-year basis, but the adjusted figures suggest that says more about softness in July 2013 than strength in July 2014. Whatever the case may actually be, the seasonally-adjusted rate of home sales has been quite disappointing after the “surge” post-winter. In fact, that bounce has been all but revised away, leaving what looks like a strangely durable ceiling on the rate of home sales going all the way back to January 2013.

Stripping out the volatility in the month-to-month, the trend is pretty clear as growth has all but disappeared aside from gyrations around the trendline.

That contrasts pretty highly with the NAR’s version of existing home sales. Of course, that is not an apples to apples comparison since they are two separate segments of the same market, but I think that the difference between these two estimates of real estate says a lot about the interference of monetarism. Some of that gets back to the as-yet uncleared imbalance left over from the main housing bubble, where it seems almost all of the MBS “stimulus” ended up as REO-to-rent. Other than that, asset inflation has been pretty much limited to the upper stretches of the pricing tiers.

In new home sales, by contrast, any skew of the bifurcation is limited since the vast majority of new home construction is, and used to be, of the McMansion variety – that vast middle tier that is behaving more and more like there are difficulties beyond the simplicities of mortgages, interest rates and home price appreciation. Without real and actual demand for homes in that middle segment, due to actual wages and income growth, home construction will struggle. The bond selloff and MBS rout from last year assured as much as so many financial firms packed up and moved out of the remnants of what was left of this latest artificial imbalance.

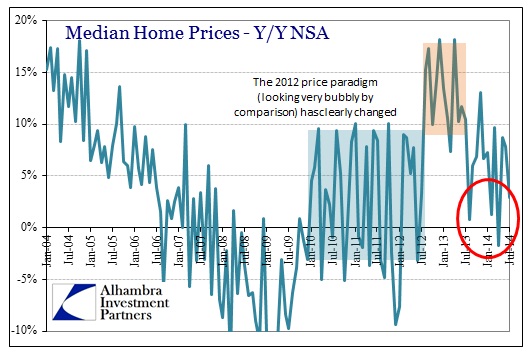

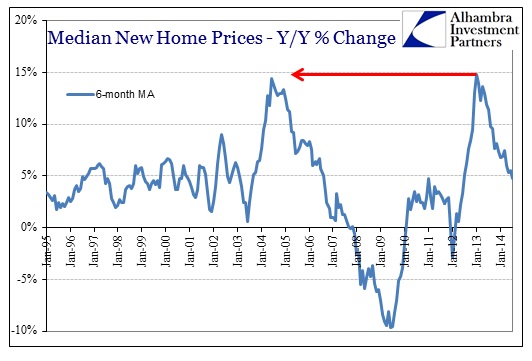

When viewing prices, I think that mini-bubble is as clear as it gets with anything in this current age of drastic revisions. Despite the heavy alterations of the past few months, prices are settling into the bubble pattern which contradicts the idea that a reduced rate of price ascent will be a primary factor in bringing new buyers to market (as the NAR narrative proclaims). That reverses cause and effect, as home price appreciation is not a cause but an effect of slowing economic advance and now a further drawdown in mortgage finance.

One final note: as of August 21, 2014, the Federal Reserve holds $1.683 trillion in MBS. That does not, of course, account for the amount of MBS par value matured or prepaid in the more than five years since QE1 first stirred the pot. Where did all that go?

You can make the argument it “helped” home owners that were in serious jeopardy being so far underwater as home prices rose and purportedly knocked down the default rate (as this theory goes, the primary factor in default is often when the owner no longer has equity to protect, they will far easier just walk away). Even if that is the case, look at the volume in the chart above. It took almost $2 trillion to squeeze price appreciation out of a historically low number of homes constructed (even factoring existing homes into that equation)?

These are some very minor and only arguable benefits that speak about the incredible inefficiency of monetarism at its core. What the Fed’s H.4.1 does not tell us directly is the embedded premiums by which the Fed paid to the primary dealers in the TBA market, to “raise” the production coupon spreads and make MBS more profitable (thus, in theory, making banks more likely to engage in mortgage lending). All we know is that the Fed’s holdings of both UST and MBS are currently showing $209 billion in “unamortized premiums”, or the amount of “ money” the Fed paid over par value for them (which they will claim was based on “market” conditions when, in fact, the Open Market Desk set the market as the largest marginal buyer). That does not include the premiums already paid and amortized, so that was a huge boost to the primary dealers’ collective profitability.

That is the most of what took place during the QE’s, as the vast majority of the policy effort hit squarely in the banks. And those very same banks are now almost totally out of that business because the non-QE paradigm in the world of taper no longer “guarantees” the same level of profitability in such flow, or in price movements. This is not some convoluted secular stagnation so much as the utter waste of vast resources and redirecting financial flow to such an enormous degree as to be counterproductive. And that has to yet factor the collateral effects of everything from collateral (repo) to bastardized corporate investment to price redistribution in the real economy. There are no mysterious headwinds in the economy, only the unqualified inefficiency by which monetarism actively encourages the decay of productive wealth.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch