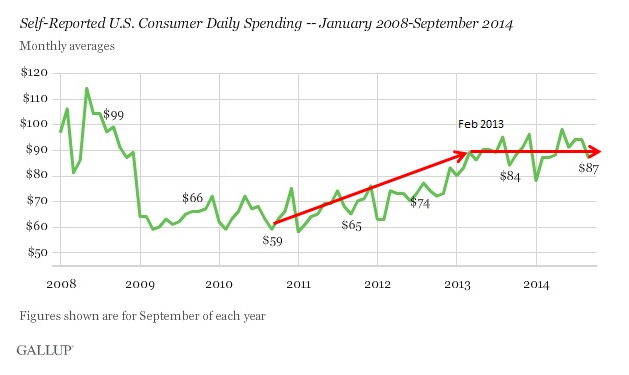

To add another point to my earlier post on price changes and spending/revenue patterns, Gallup’s various economic polls show what I think are exactly the same problems. In the daily spending poll, the amount of self-reported spending has not really grown going all the way back to February 2013.

Twenty months of largely stagnation is worse than it sounds given the likely behavior of prices over that time. And while the average reported spending in September 2014 ($87) was more than September 2013 ($84) we don’t know how much of that is prices rather than volume growth. We can reasonably assume that there is too much of the latter and not enough of the former.

Furthermore, whatever the cyclical trend in the past few years, September 2014 spending remains significantly below September 2008 – a fact that should end any appeal of “robust” economy now or anytime soon. That is why, undoubtedly, the economy remains a significant concern despite all this “recovery.”

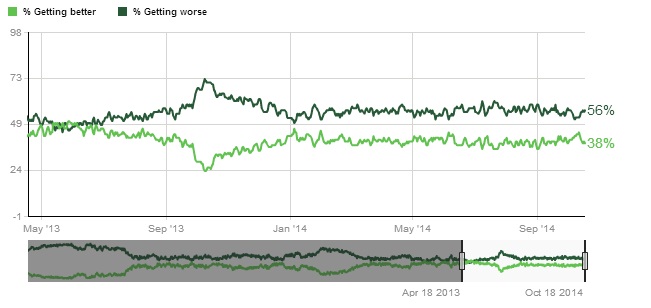

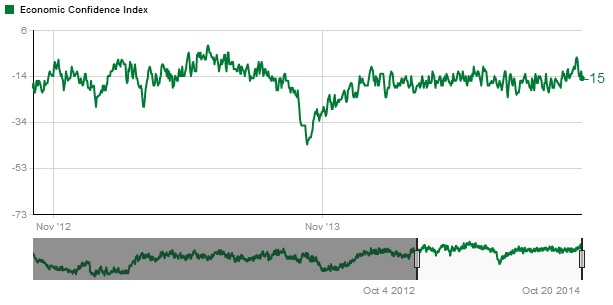

Economic confidence, along with spending, has not changed much in the past two years despite all the rational expectations attempts to turn such “pessimism” (unwarranted to the orthodox mind) into economic progress.

These are by no means definitive indications on their own, particularly any survey on “sentiment”, but they match only too well with other indications – especially the behavior of the labor force. I find it increasingly difficult to see flat spending patterns (lower taking into account prices) and no even temporary bump in sentiment during what has been proclaimed as the best jobs market this century. You would think that would make an imprint here, and in other survey results.

That leaves only a few possible explanations, but the likeliest are that the jobs are nothing more than statistical fancy, or, if they have actually been presented, they pay so very little as to be economically close to useless.

Stay In Touch