In contrast to the franc, the Danish krone continues to ignore ongoing speculation. The latest has seen rumors of not just direct buying by Danmarks Nationalbank but now even full-blown capital controls. Before yesterday, the krone had traded at or near 7.444 to the euro for 20 consecutive trading days; now surging today. In other words, the Danes don’t have a “dollar” problem to create a dangerous imbalance against its soft euro peg (really a trading band).

That doesn’t mean that Denmark is free of seemingly perpetual European strife, as Danish assets and the yield curve there continue to display financial oddities that have become more common in this age of ultra-repression. Given this behavior, there is likely much more to come from the Danes in terms of counterbalance (as much as possible), but that there is no financial impediment to their resolve.

You have the familiar sinking curve in the outer years also beset by simple insanity closer to the shortest tenors. Why -1.75% for the 1-month maturity and only -1.05% for the 2-month? I don’t think anybody really knows, as again these are simply stresses trying to find an outlet.

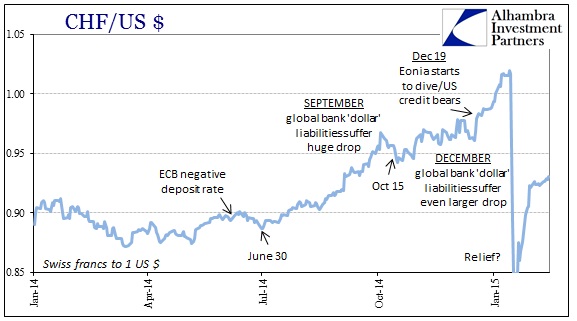

In that respect, the difference with Switzerland is not just striking it is vitally important to understanding the mechanism of wholesale finance all over the world. I’m speaking, of course, about the “dollar” and especially the global “dollar” short. If you look at the franc, for example, in euro terms what has happened in trading since January 15 looks entirely out of place.

Even on a longer-term chart, the massive move is striking and seemingly well overwrought, even unprecedented. By itself, in this narrow view, which is all everyone seems to gather, the SNB’s relenting does not make much sense.

But if you look at the franc against the “dollar”, the sharp move since January 15 essentially brings the franc back in line (almost) with more recent and certainly more placid trading and financial conditions.

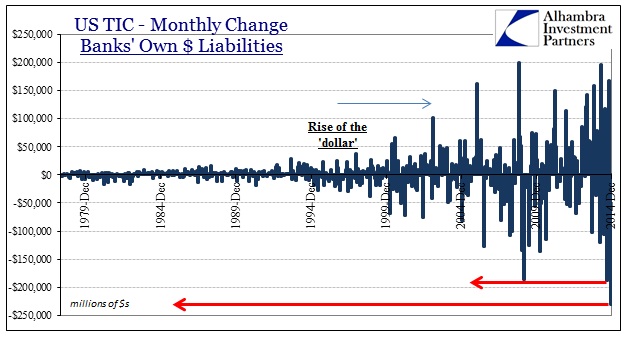

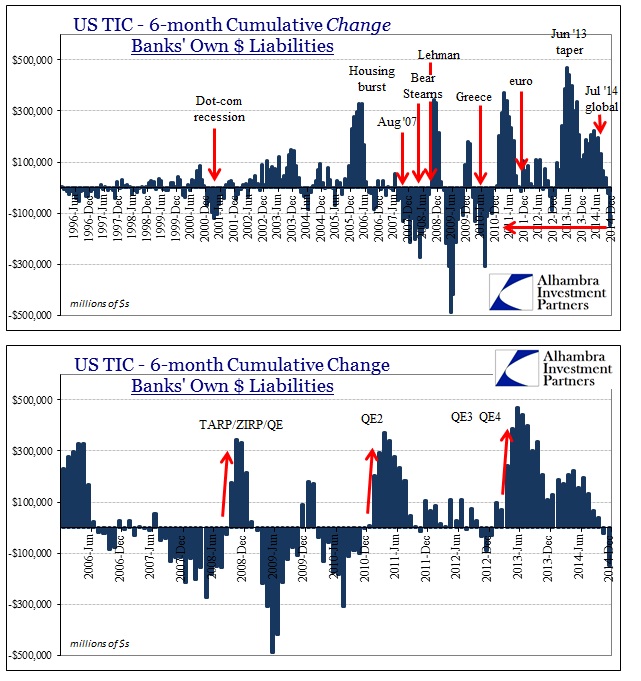

Furthermore, the trend in the franc to the dollar in the past eight months, dating back again to June 2014, is entirely reflective of other episodes of great funding stress. It cannot be overstated but currencies in the wholesale system, at least those most directly connected to or by it, are not suggestions of comparative economic strength nor interest rate differentials, the direction of the currency in large and sustained moves is a “dollar” problem.

In the most recent episode, the removal of the franc’s peg to the euro “allowed” the Swiss financial system to remove the disastrous “dollar” imbalance caused by the euro’s intended descent. Accordingly, the franc has come back down to near where it was trading before all this began – corresponding to a period where credit markets all over the world have seen a reprieve against mighty bearishness unleashed especially in December.

The point of this exercise, beyond simply belaboring the role of Switzerland yet again, is not just to demonstrate internal mechanics of the “dollar” but more importantly that all this behavior relates to the instability of the global economy. The inability of these currency and funding “markets” to generate much of their own stability relates back to the idea of Janet Yellen’s assertions about how central banks operate that I reiterated yesterday:

…it is important for the central bank to make clear how it will adjust its policy stance in response to unforeseen economic developments in a manner that reduces or blunts potentially harmful consequences. If the public understands and expects policymakers to behave in this systematically stabilizing manner, it will tend to respond less to such developments.

To which I responded:

The great weakness in all of this, as it relates to monetary neutrality and beyond, is monetary policy as a “systemically stabilizing” force. Redistribution is axiomatically the opposite of that, so it is difficult to take such an unquestioned maxim of orthodox behavior simply at face value. Monetary policy is stabilizing because of the massive imbalances that it creates?

What we see here of the franc, the euro and especially the “dollar” is empirical refutation to Yellen’s assertion of central banks as agents of stability. You cannot create financial stability by actively seeking both greater imbalance and the further disabling of the mechanisms by which former imbalance is resolved. From there, there is no way to turn financial instability into economic stability beyond short bursts of artificial activity for the sake of activity. Instead, the constant pressure of funding markets is a stop-go pattern of exactly that process intended to foster, somehow, recovery.

These imbalances simply get shifted, as best as possible, from one perception to the next. Ultimately, as we saw in the 2000’s, the ability to contain or shift imbalance becomes far too much for any single systemic input to manage, unifying dysfunction across all perceptions. We have been seeing some of that most recently with the constant currency devaluations so far “elsewhere”, leaving the US mostly unscathed (and mostly unaware, particularly those that take cues from nothing but stock prices).

The answer to such imbalance is to “grow your way out of it.” But we seem to have reached the point where financialism has gone so far beyond imagination that it takes so much resources just to maintain it – the Minsky of Minsky’s. If trillions and trillions of currency units all over the world have been asserted and inserted to gain such little economic progress, that is very good indication of exactly this problem. Too much is devoted just to standing still, but even that is not a neutral proposition as the Swiss found out fortunately before it went too far.

Will we be so lucky next time? The SNB is actually one of the few central banks that is willing to take hard measures, so in that respect luck may have yielded this on the franc. Would the Bank of England, Bank of Japan or FOMC be able to counteract under similar stress and pressure? Recent history is not reassuring. Maybe it would just be simpler to follow Yellen’s advice and embrace the role of a sheep while she fumbles about muttering over retail bond funds and reverse repo and term deposit programs that don’t even live up to the very basic of intended tasks. She and her colleagues may counter that nothing bad has yet happened, so that is at least some measure of her job performance, but such a view is not widely shared and certainly does not incorporate obvious stresses building in “dollars.”

Stay In Touch