The “dollar” has ended the month much the way it started. Despite headlines suggesting the dollar is “down” today, it is very much proving to be disruptive across every proxy. Gold was down to $1,080 at the AM fix before rebounding. Commodities were sold broadly, with copper back near $2.359, down almost $0.02 at some parts of the futures curve; oil is down too, with WTI in the front back close to $47.

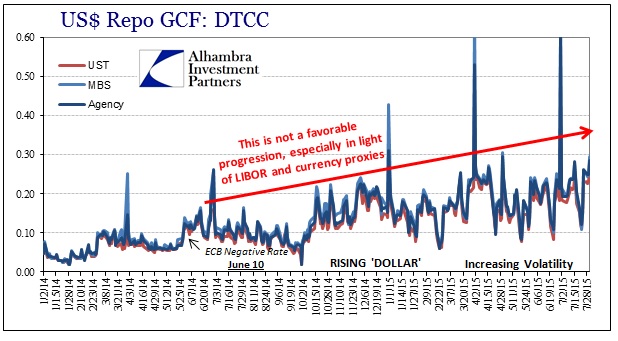

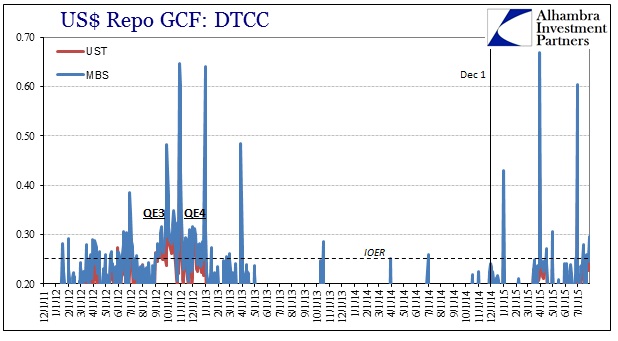

Unsurprisingly, repo rates (GC) have surged this week into what is now a regular monthly occurrence. MBS repo jumped to 26 bps last Friday and has stayed right at IOER, fixing at nearly 30 bps yesterday. All that remains is to see how high GC rates jumped into today’s close, the month-end for July.

The eurodollar curve was heavily bid, particularly inside the policy “window” out to 2018; but no less further down the curve. The nearer months are flattening out with the whole shape, meaning, again, that eurodollars are suggesting similar conditions to what we saw before the March FOMC – and no change this week perhaps because of another FOMC statement (with “some”) and more disappearing recovery. It seems interbank rates are not humored by recent developments in either the economy or FOMC academia.

The June 2016 contract is at its highest price since early July, well above the rest of its history (far more than you would expect of simple calendar rolling). As before, that seems to suggest either a reduced probability of the Fed raising rates or an increased likelihood of them doing so but not for long.

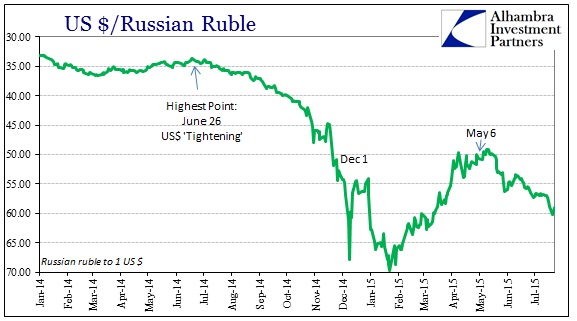

The clear “dollar” disruption has punctured currency markets, as this week the franc and ruble joined the parade of devaluations on par with a more “expensive” global “dollar” short. The ruble was back over 60 to the dollar, a four-month low, while the franc dropped to 0.97 (a three-month low) yesterday and was extremely volatile today (trading up to 0.955 before sinking again to almost 0.97).

Hardest hit has been gold’s “dollar” twin, the Brazilian real. Having had a bad July so far, and putting Brazilians on course for a much worse economic fate than they already were bracing for, the “dollar” pushed the real past 3.40 all the way to 3.42 just today. The range was a ridiculous .08, as the real was first bid in the morning before being sold with everything else. Ever since Banco do Brasil declared itself successful with its swaps (that aren’t/weren’t really swaps) back in September (which they almost assuredly were forced to do as continuing the inefficient program would have created more problems), the real has sunk fast and with only minor reprieves along the way.

In 2013, during the taper ignition to all this, the real fell quickly from 2.00 to 2.40 and was considered incredibly dangerous then. Now having dropped past 3.40, those fears have been realized and more.

Despite a week replete with heavy data and policy connotations, the “dollar” is still on a rampage. That isn’t necessarily unexpected given the past few weeks, nor the continued and public withdrawal of money dealing banks no longer so greatly “supplying” eurodollars and its necessary “dark leverage.”

Stay In Touch