Since December 2015, China’s powerful politburo has met nine times to discuss the economy. The Political Bureau of the Chinese Communist Party Central Committee is a group of 25 top officials who control pretty much everything. The politburo’s smaller Standing Committee is the very top echelon of the Communist Party. Members of the politburo are given top jobs in the official government to carry out political policies.

In the prior eight gatherings devoted to China’s growing economic uncertainty, statements released after each signaled the party’s commitment to what Xi Jinping would later clarify as “high-quality” growth. At the 19th Party convention last fall, Xi would first etch his name in the Communist constitution before speaking forthrightly about “rejuvenation”; a term that recognized this shift in priorities.

China of the second decade of the 21st century would be unlike China in the first decade. Then, growth at all costs was the ultimate goal, though for reasons that Chinese Communists most likely will never admit publicly (having to do with their quiet assessment as to why the Soviet Union ultimately failed).

This new stage was to be “quality” growth, which represented something very different. In each of those prior eight Politburo statements there’s was an economy “stable with good momentum.” If China had been seeking growth at any cost, that came with it an often terrible social cost.

These were, as described in December 2015, financial risks (bubbles), poverty alleviation (the old balance), and pollution. This new China had to find a way to address the first and third without giving up totally on the second.

The timing wasn’t an accident. China’s slowdown which began the year before was judged (quite correctly) a permanent condition. Despite Janet Yellen’s insistence on “transitory” factors, the Chinese leadership was no longer buying it. They foresaw a global economic “L” not a “V.”

The emphasis on quality growth over quantity is pure political spin. Xi was attempting to say that reduced growth was a choice, one made on behalf of the Chinese people. To do anything else would be to admit Communist central planners aren’t really in control, a fact that became awfully apparent right around December 2015.

Thus, in the official politburo statements following that particular month the economy was always emphasized as being “stable with good momentum.”

Not anymore. This ninth Party conclave held last week to debate the clear downshift in economic momentum decided to change the wording. China’s economy is now officially declared to be “stable but with certain progress.” Or, more accurately, unstable again.

The politburo also would say, “We need to attach great importance to this situation and be more forward-looking to respond in a timely manner,” admitting the existence of “growing downward pressure” due to “profound changes.” Outwardly these appear to be trade wars, with China coming out on the losing end.

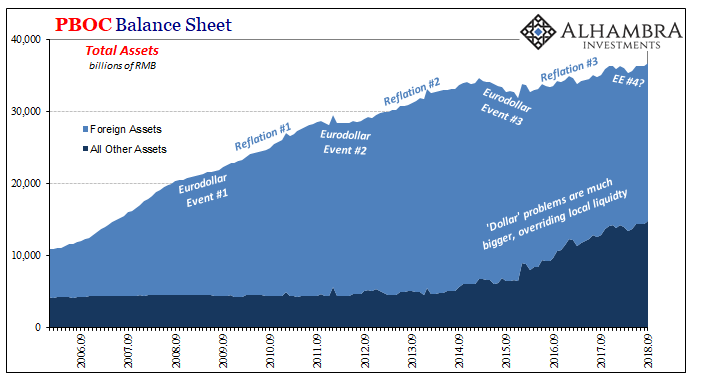

The Western mainstream believes this will mean forthcoming “stimulus.” The fiscal purse will be loosened as it was to begin 2016 and the PBOC will relax monetary conditions. As usual, the mainstream hasn’t been paying much attention, preferring to parrot whatever official line uncritically.

What the government will do on the fiscal side is anyone’s guess, but bubbles and waste are still priorities. The 2016 experience wasn’t a positive one, easily judged by what has happened in 2018 in just the altered phrasing in the politburo’s statement.

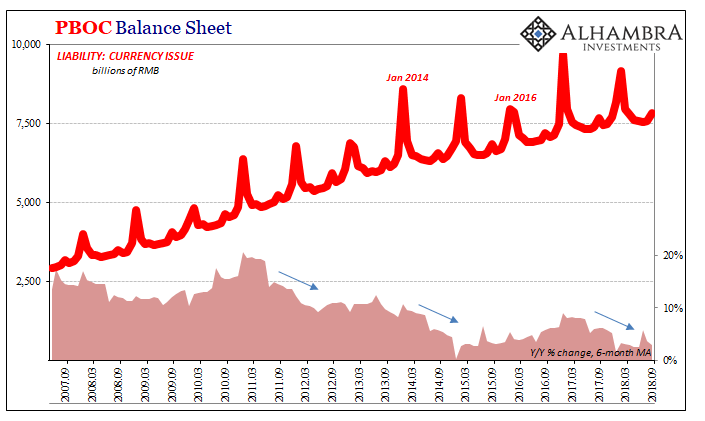

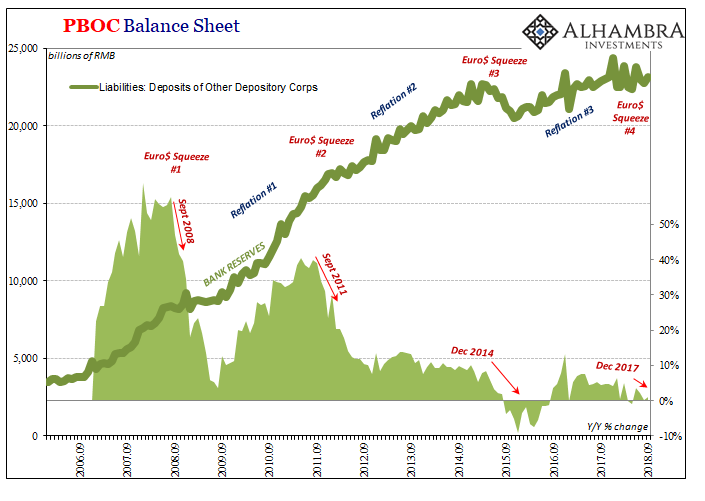

On the monetary side, the PBOC has been accommodative for more than a year. How quickly everyone will forget, and then fail to consider why, monetary policy was characterized as being tightened all through 2017 since Western Economists had declared 2016 stimulus a grand success. The Chinese economy was going to lead the rest of the world into globally synchronized nirvana.

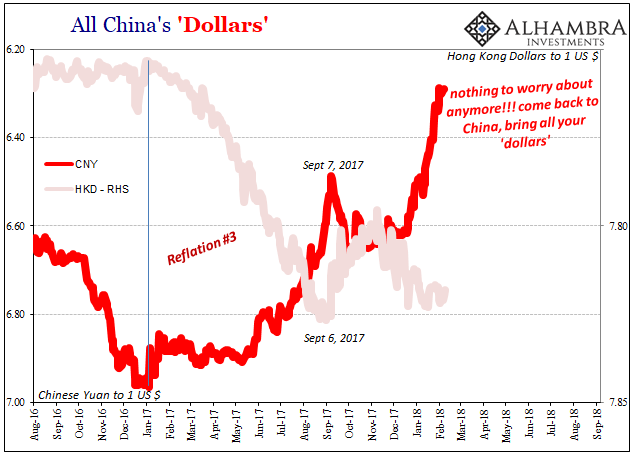

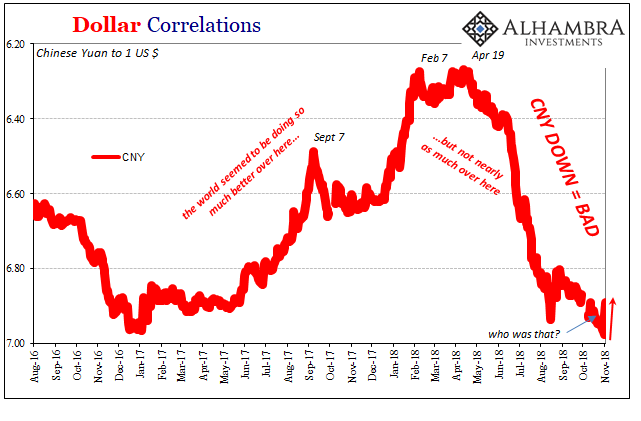

It just was never the case. The dramatic rebound in CNY played everyone for fools, which, I believe, was the whole point (Hong Kong).

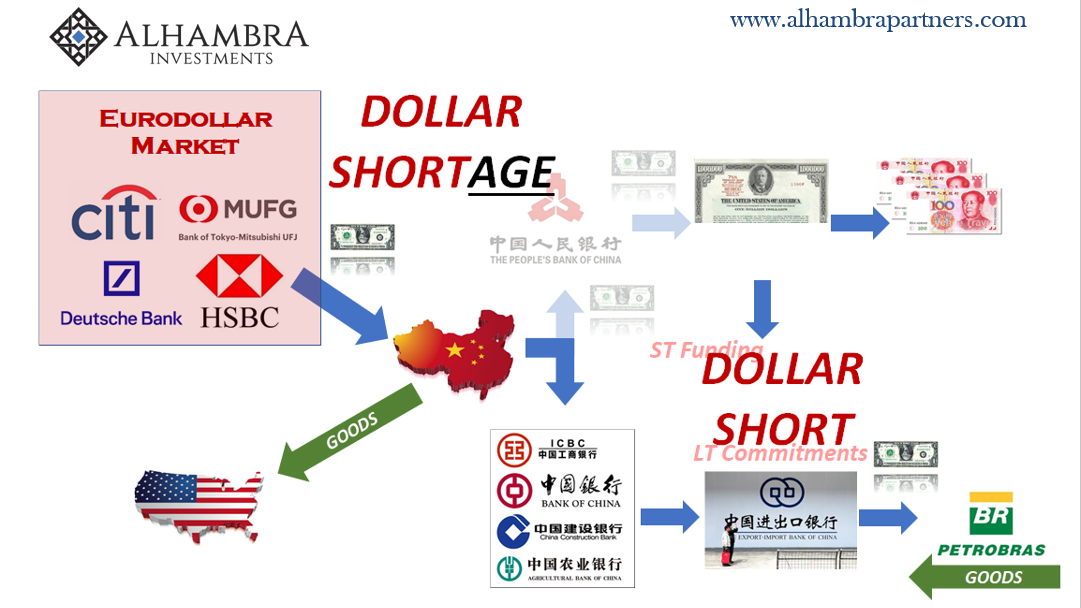

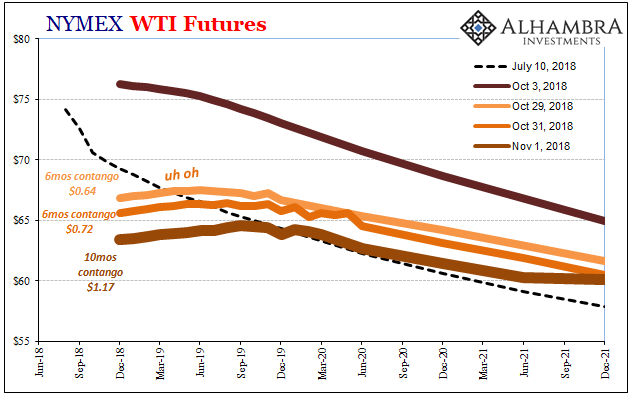

This year has turned out to be entirely different from what it was supposed to be, starting with monetary policy in RMB (onshore). The eurodollar squeeze is back in a big way, meaning that as fast as CNY rose in 2017 it sank in 2018. The currency not only offends the meaning of Xi’s post-2015 consideration (stable), it is an outright danger to the Chinese economy. Even if you don’t know why, prolonged declines in the currency exchange do not associate with anything good (CNY DOWN = BAD).

The PBOC was busy last week in the wake of the politburo’s panic. China’s central bank announced that it would, starting this week, begin selling bills in Hong Kong. It will place RMB10 billion each in three-month and one-year liquidity management bills. These are certain to be just the first in a perhaps perpetual series.

The central bank doesn’t need to borrow funds, that’s not the purpose of these securities. It is a formal asset swap designed, like US Federal Reserve Open Market Operations in theory, to drain excess funds but from the offshore CNH market in Hong Kong. It’s quite a reversal from 2010 when authorities still thinking rapid growth was China’s future set up and nurtured this offshore renminbi market (CNH) in order to make yuan a globally attractive reserve currency.

Now, it seems, they are set to blame (partially) CNH for their increasingly perilous predicament. By constraining CNH liquidity with regular bill opportunities China’s central bankers have taken to blaming those evil, end-of-the-road “speculators.” Convention sees these dastardly rogues as borrowing cheaply in CNH in order to short CNY (long US$ assets).

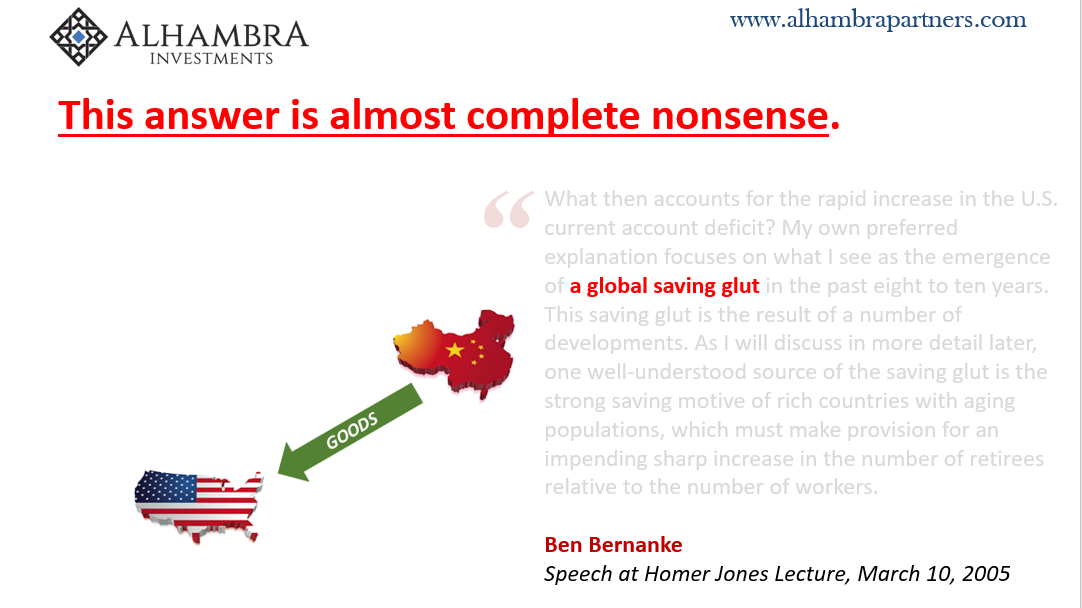

It is a page from the orthodox Economics playbook, the one that to Ben Bernanke made massive, dangerous eurodollar expansion in the middle 2000’s (the one that funded China’s economic “miracle”) seem like a benign global savings glut. It’s the same central bank manual that central banks have used time and again – with the same disastrous results.

Thailand in 1997 tried something similar, only it was in swap markets. Fighting against speculators rather understanding it was a eurodollar run, Thai authorities ended up triggering the Asian flu. Banco do Brasil in 2013 followed their example to Brazil’s ruin.

It is the nightmare scenario; the more you do to stop it, the worse you make things for yourself.

The reason why is simple, even though the mechanics and specific policies change over time. Central bank intervention is a double-edged sword. Sometimes, you have to follow Bagehot and rescue the market. At other times, especially if you don’t know what you are doing, rather than rescue the market you signal just how serious things have become overall. In this situation, you can make a bad situation worse just by confirming that it is already bad.

The Western media will describe China’s genius in draining CNH liquidity with its powerful operations. And blame Trump for trade. The eurodollar market will take from this a very different meaning; the PBOC doesn’t know what else to do. It’s a panic move, very much like pegging CNY March to August 2015.

This is a warning, not just to the Chinese people seeing the politburo admit the economy is evolving the wrong way just with respect to 2015; to say nothing about how many people still cling to the pre-crisis growth dream. US policymakers may be gloating about the US winning the trade war, but they don’t realize this is a eurodollar problem for everyone including the United States.

Nobody wins the eurodollar, largely because nobody knows that’s the game actually being played. China may be first, most exposed to risk, but it won’t be the only one damaged by it. The Chinese already have a lot of company, and, as disruptive as it has been to this point, it appears to be just getting started.

Stay In Touch