Is the dollar rising, or falling? Does it matter? In one sense, obviously it does. The way in which the dollar behaves dictates how everything else goes. The potential mix-up and confusion start when we have to define exactly what we mean by “dollar.” Or rising.

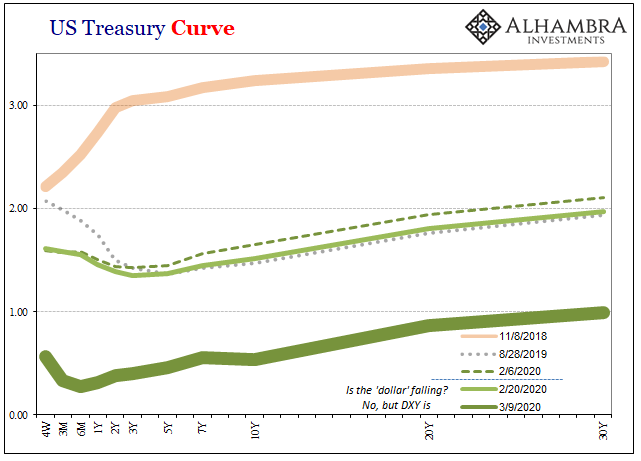

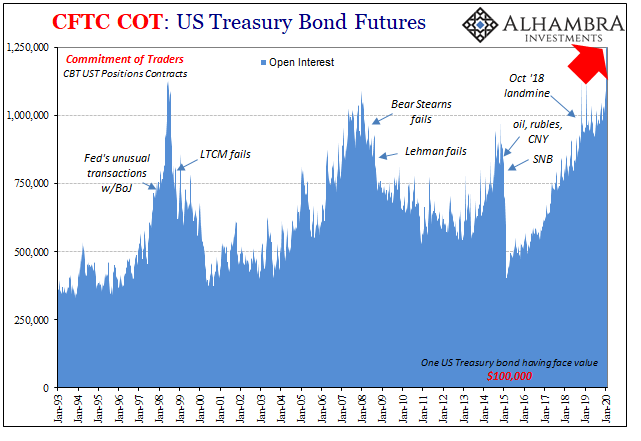

The rising dollar doesn’t always rise. If we are talking about the US currency’s exchange value, that is. It can get to be more complicated when the system behind the currency, the eurodollar, is driven into overdrive by the most basic stuff – balance sheet capacity.

Here’s an example of what I mean; you may remember early 2016 for all the same reasons you’ll remember early 2020. An oil crash and the like, the disinflationary pressures of Euro$ #3 knocking the global economy for a serious loop.

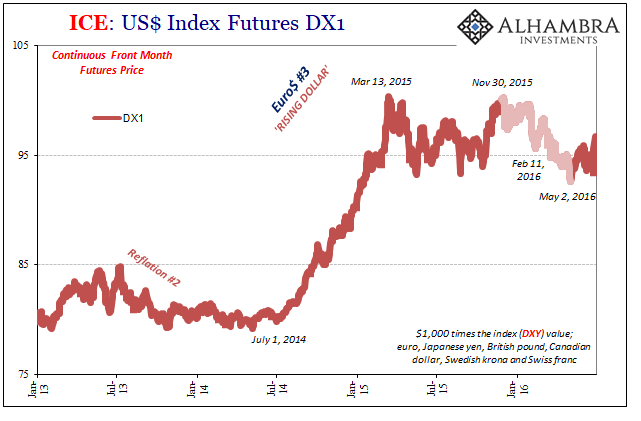

During the worst moments of it, December 2015 to February 2016, the dollar’s exchange value did what? Using specifically DXY as the proxy, it was falling!

As global eurodollar liquidity was reaching its worst, most destructive points, it appeared, at least so far as DXY was concerned, as if the dollar was getting weaker.

In fact, that had seemed the case throughout 2015 when we know for certain there was only “rising dollar stuff” going on around the world. The dollar’s exchange value is an imperfect proxy, especially at times like then – and now.

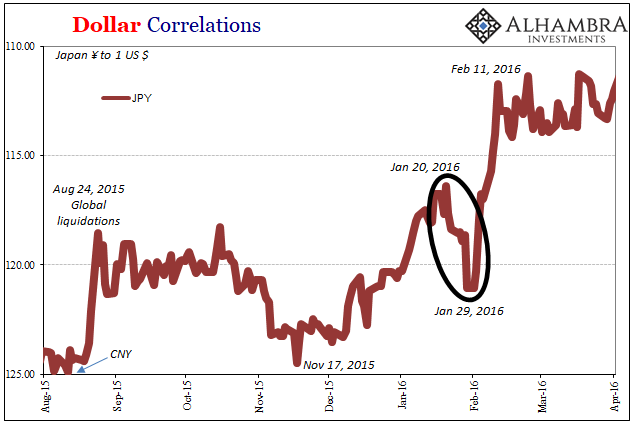

Taking it one step further, the Japanese involvement potentially skews the whole thing. A rising yen is consistent with the “rising dollar stuff” even though, by definition, a higher exchange value for Japan’s currency means the dollar is falling against it. Since yen is a big proportion (along with the euro) of DXY, the eurodollar system’s flashing warning appears to be upside down.

And it can do weird things in the short run. As markets spiraled further into liquidation in the middle of January 2016, JPY seemingly out of nowhere completely reversed course – having moved substantially higher, suddenly it dropped like a stone.

Rumors had been swirling about imminent action from the Bank of Japan. Some were betting that it would be massive and potentially effective. BoJ officials, however, don’t quite understand the word “effective” so what they unleashed was laughable NIRP; only, as soon as it was announced the market wasn’t laughing.

JPY surged and global markets tanked all over again.

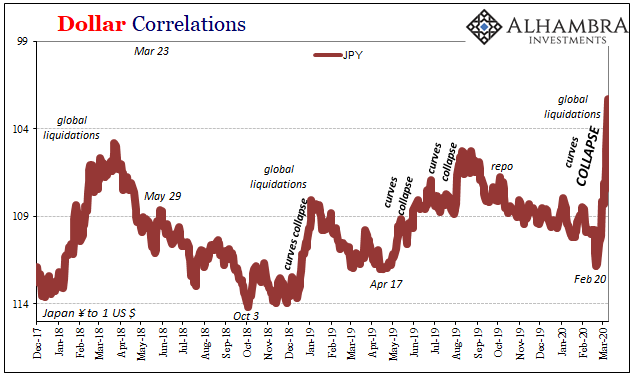

Sometimes these things repeat in almost exactly the same way; if you’ve followed JPY over the last month you probably took note of a similar seemingly out of nowhere drop in the yen (to February 20). Which was entirely reversed (coinciding with DXY’s peak) and once again the yen skyrockets at the same time all the “rising dollar stuff” is unleashed globally – even as the dollar falls against JPY.

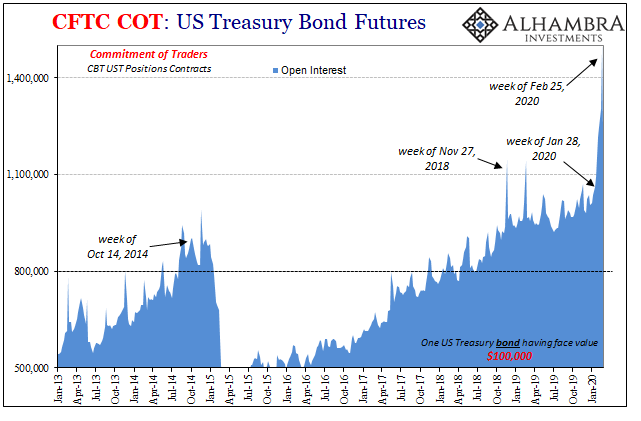

Liquidations practically everywhere (except pristine repo collateral).

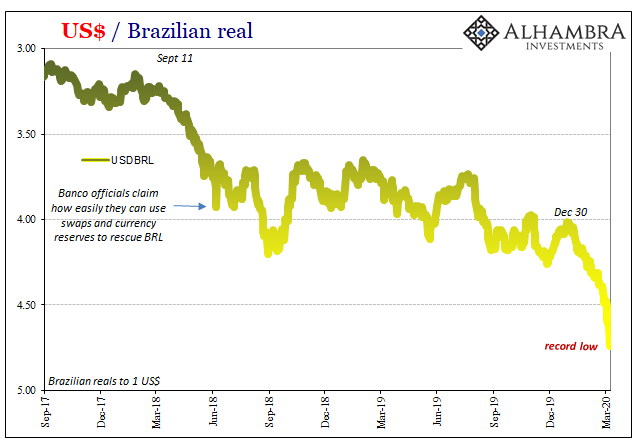

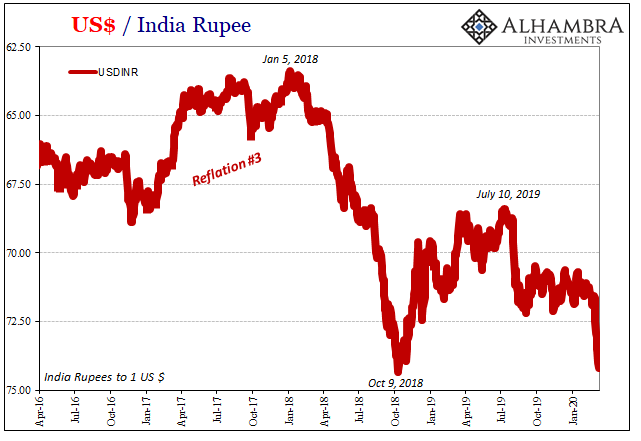

In some cases, those more directly involved, the dollar is still actually rising and quite sharply. The exchange value in other places remains consistent. While the euro and yen take up most of DXY, against other currencies around the world there has been no such distinction. The dollar is still going up, pushing local currencies down toward, and often past, record lows.

In these places, what “weak” dollar?

Even those otherwise relatively stable currency situations, such as India, for example, they’ve been drawn into the directly rising dollar position. India has been anything but stable, but the rupee has managed to avoid any big moves (apart from the last curve collapse into July and August 2019) to that end. As curves drop sharply again, so does the rupee.

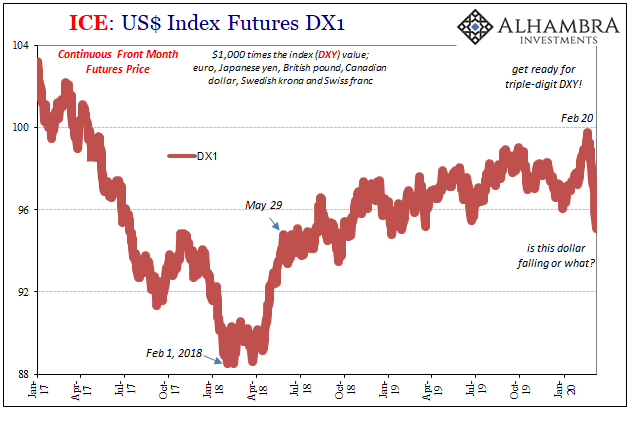

So, it’s not always a one-to-one; the rising dollar “stuff” shows up even if the dollar’s exchange value doesn’t move upward as uniformly as it had. It’s the “stuff” rather than the exchange value which ultimately matters.

This isn’t anything like the “weak dollar” situation though DXY has tanked (of course it did so just after I wrote about it moving into triple-digits). The “weak dollar stuff” is the stuff of reflation: rising nominal bond yields and interest rates, accelerating growth, even the appearance of some inflation noises. Global disinflationary pressures that do manage to abate somewhat (though they never completely disappear).

In some places like the UST market, the collapse in rates has been accompanied both by falling DXY and absolutely collapsing curves (crude and eurodollar futures as well as the yield curve). It may seem like an enormous contradiction – until you sort out JPY from the rest.

The dollar’s exchange value isn’t rising against the yen or euro, yet the more meaningful disaster associated with it rising continues to unfold before Jay Powell’s stunned and completely unprepared eyes. In fact, falling against the yen is one of the more signature moves of the “rising dollar stuff.” Call it flight to safety, it’s really just the unwinding of the real yen carry trade (global eurodollar redistribution).

While it may keep DXY out of triple digits for the time being, that’s only because the system behind everything has been plunged into exactly the kinds of self-reinforcing trends that lead to the chaos we see right now. Instability begets illiquidity which begets more instability.

The real “weak” dollar is when things at least look like they are heading in the right direction. Which they are not. DXY is down, but that’s anything but “weak.”

Once again today, junk bond yields are rising a significantly greater amount than Treasury yields are falling. And the DXY is weak, weak, weak.

— Jeffrey Gundlach (@TruthGundlach) March 9, 2020

Stay In Touch