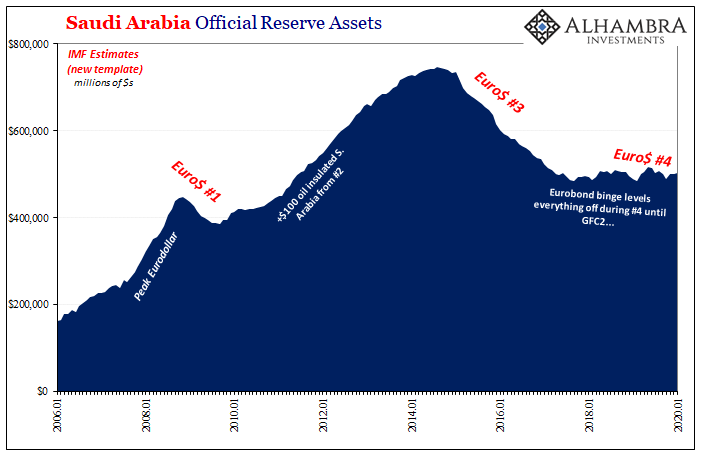

Saudi Arabia once burned through the bond market on par with demand for Argentina’s paper. During the 2016-17 globally synchronized growth-inspire Eurobond binge, the country made up for its lost oil revenues (oil crash and all) with dollar-denominated, offshore debt flotations. These merely stabilized the country’s forex reserves after they had collapsed (by a third) alongside benchmark Brent crude prices 2014-16 (the most direct deflationary consequence of Euro$ #3).

Having done nothing to change its situation in between (Reflation #3 being only a reflation rather than the globally synchronized growth recovery as was promised), the Saudis now face GFC2 after having been spent (financing deficits) to a significant degree by the first parts of Euro$ #4. Indebted itself just to stand still, all the while waiting for 2017’s bumper sticker slogan to show up somewhere in reality. Never bet on Fed Chairmen and their forecasts (or their [in]ability to decipher bonds).

Faced with these difficulties, domestic activity is going to be drastically curtailed. Unable to source dollars, bond nor banks, survival mode kicks in. As it is, Goldman Sachs estimates the country’s reserve drain in March alone was perhaps $27 billion (net).

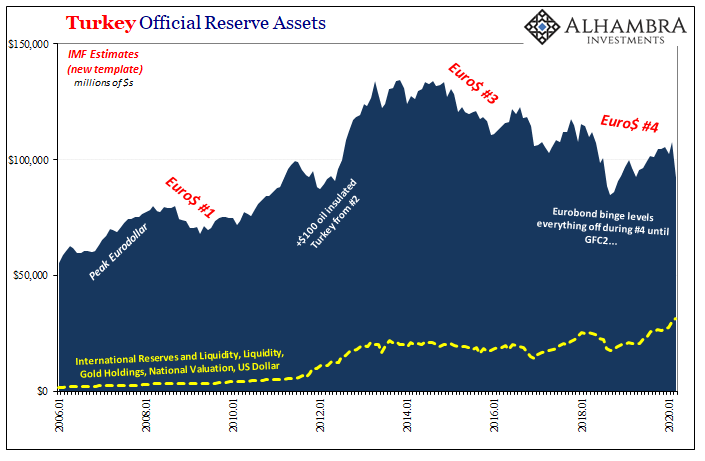

Not far from Riyadh, in Ankara, Turkish officials may have gone a step further. Using off-balance sheet arrangements, the usual swaps and whatnot, some analysts estimate Turkey’s forex stash has been looted entirely; the net level in the red after borrowing from local banks in recent months in order (to try) to prop up an unrelentingly weak lira (other side being an unrelentingly strong dollar, or dollar squeeze).

Desperate to forestall the death spiral (see: Lebanon), central bank officials have declared how even though liquid reserves might be exhausted the country still holds gold and SDR’s. Valued at national calculations, the gross is substantial and approximately one-third of Turkey’s reported total backing.

The IMF has recently admitted there’s more demand for emergency funding than it has ever handled. Or ever imagined, I imagine. In response, IMF Managing Director Kristalina Georgieva has continuously claimed that the organization has more than enough fire power while simultaneously demanding it be doubled.

This contradiction is very easy to reconcile.

Disregarding such false bravado, how is the doubling to be done? As discussed here, the IMF in the wake of the first global dollar shortage (GFC1) had set up programs where, essentially, it begs dollars (or euros) from its members. Maybe not too much to ask for normal times, but these times are nothing like those.

According to the published figures from 2016 when the NAB was last updated and expanded (to SDR 182.4 billion), the IMF expects that in a global dollar crisis of this sort Chile will provide SDR 691 million, India SDR 4.44 billion, Mexico SDR 2.53 billion, Russia SDR 4.44 billion, Saudi Arabia SDR 5.65 billion, and Brazil, whose currency is currently plummeting again, SDR 4.44 billion. You get the point.

The BBA is even sketchier where, right off the top, the organization is counting on Algeria, freaking Algeria (no offense), to commit $5 billion in US$’s in a global emergency like this; Brazil another $10 billion; $43 billion from China; $10 billion from Mexico, whose external Eurobond debt was just downgraded; and another $10 billion from Russia.

How many of those countries listed in the two paragraphs above might have asked the IMF for help, rather than the other way around? Maybe none to this point, but how long before it isn’t that way?

In other words, as you can probably guess where I’m going here, two-thirds of that existing crisis “firepower” is derived from the increasingly questionable prior commitments of IMF members who are more and more uncertain if not totally unable to hand over dollar liquidity to an international rescue which might have their own name on it. And I thought the internal eurodollar system was incestuous.

So it goes; the IMF and officials in touch with the organization are but left to go in the other direction. If you can’t find the spare dollars, and it does look like Ms. Georgieva can’t, then the last resort is SDR issue.

As the true magnitude of the Covid-19 crisis becomes apparent, the focus is shifting to finding ways to better support low-income economies in the months and years ahead. One option gaining traction is the issuance of special drawing rights (SDRs) through the International Monetary Fund.

This did happen in 2009, twice, the first raise in quotas taking place in April – after GFC1 had already destroyed what it would and settled the global system into its much lower and depressed state. The second quota issued in September 2009 was the usual useless and belated overkill. All the while, the world tried to make sense of what was yet to be recognized as a “new normal” (a fancy way of trying to admit there’d been an “L” where a “V” should have been).

Patting itself on the back, the IMF would later write, “the 2009 SDR allocations totaling SDR 182.6 billion played a critical role in providing liquidity to the global economic system and supplementing member countries’ official reserves amid the global financial crisis.”

Sure.

Even if you think that’s true, without breaking out in laughter, it still resulted in an L for the entire world – particularly after being wrestled into full and comprehensive submission by Euro$ #3. Just ask Turkey and Saudi Arabia about this. China, too.

And 2009 for the IMF was child’s play compared to what’s shaping up for 2020. A possibility we’ve not even begun to digest yet. No stats or even realistic estimates in hand.

Jay Powell’s going to get us all into a rapid “V” recovery from the combination of GFC2 and COVID-19? He’s not off to a good start. Abundant liquidity, says the US Treasury Secretary. OK, but what would he know?

I really wish either of them understood a thing about the actual dollar system. Kristalina Georgieva, too (though she’s being judged based off her predecessors, especially Christine Lagarde and something about Argentina). Unfortunately for all our sakes, 2009 was the time for officials to undertake the crash course in eurodollar crashes.

Instead, they quota’d out some more SDR’s long after it was over and waited for a recovery that never came. This time’s going to be different?

Stay In Touch