iTunes: https://apple.co/3czMcWN

Google-cast: https://shorturl.at/fpsEJ

Spotify: https://spoti.fi/3arP8mY

Alhambra-tube: below

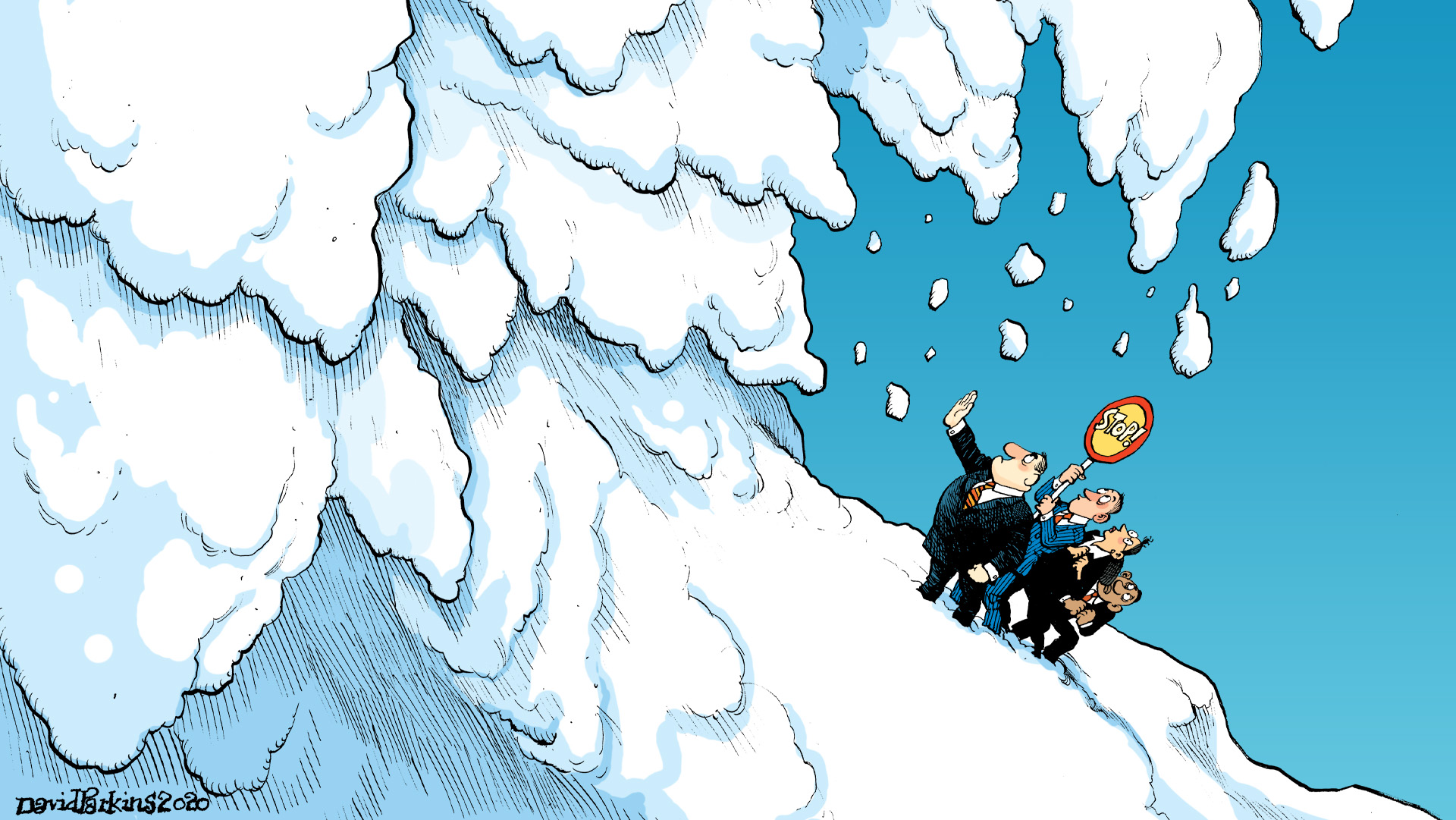

SUMMARY Hubris. It will get us to the stars but seduce us into believing we belong there. Today, monetary authorities suffer it, believing they can manage the nonlinearity, emergence, spontaneous order, adaptation and feedback loops of the unraveling. DESCRIPTION In 1929 a plague struck Florida resulting in an overwhelming government response. The consequences were not only agricultural but financial as banks, heavily exposed to the Sunshine State’s horticulture sector, approached insolvency. Bank stability, Federal Reserve responses and a suitcase stuffed with six million dollars are all part of the thrilling story.

But so is the notion of bureaucratic delay, wild swings from hope to despair (and back), contemporary titans of industry offering reassuring words, and the impotence of human effort against the monstrous chaos of a complex system reverting back towards simplicity. In today’s day, the US Treasury bond market was warning for the better part of two years that the monetary, financial and economic – to say nothing of the political and social – facets of our system were fragile. Weak.

Already enervated by six years of political upheaval and a dozen years of monetary disorder. The virus was the banana peel upon the wall that Humpty Dumpty was dancing on. The United States and European Union GDP estimates for the first quarter corroborate the bond market’s opinion. Though the virus, and the government response to it, only took hold in the final month of the quarter (with exceptions of course, Italy for example) the result was catastrophic nonetheless. In other words, the US and EU economies were already stumbling about the street, late at night after a 12-year bender when Corona stepped out from the shadowy alleyway with a billy club and an appetite for mayhem.

Articles Discussed:

Stay In Touch