I find it very uncomfortable to be in such agreement with monetary policy officials like Jay Powell. He and I both look at the inflation data, for example, and have come to the same conclusion that these consumer, producer, and commodity price deviations won’t last; though we arrive at our same view coming from very different use of analysis.

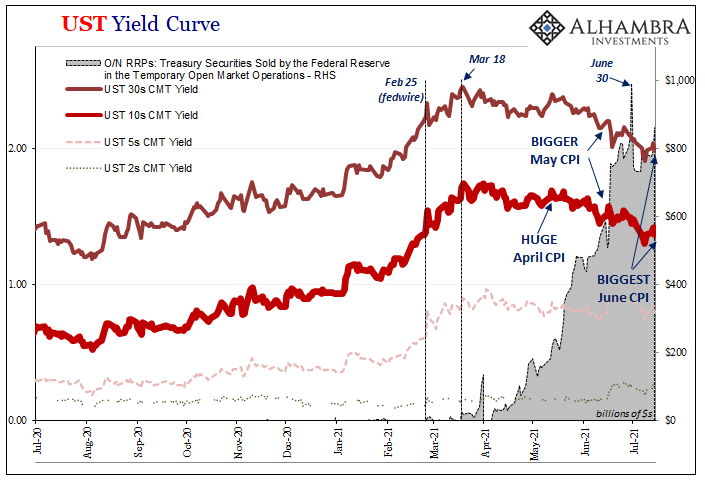

Today, the Federal Reserve’s Chairman was asked in testimony before the House of Representatives about that darn reverse repo everyone is talking about. The specific question before Chairman Powell was queried by Congressman French Hill of Arkansas, taking the usual approach (the Investopedia answer) of how there seems to be “too much money” (because everyone says so) and that’s why the RRP transactions have so ballooned.

Surprisingly, no, said Powell (~2:51:00 mark):

CHAIRMAN POWELL. You could say there is a shortage of safe short assets…So, yeah, that’s why that’s happening, there’s a shortage of T-bills, not a lot of T-bills…

Again, he and I agree right on the nose. It makes me shudder to say the same thing as this guy who gets pretty much everything wrong, especially when it comes to money and related, but then again blind squirrels and all that. Our views of the RRP align, if, once more, for very different reasons and, most important of all, we hold vastly diverging views as to what this actually means.

To Chairman Powell, and this is very clear in his response today, RRPs and a shortage of T-bills, on the contrary, this is just some technicality easily cleared up by FRBNY’s Open Market Desk maneuvering. Unfortunately for the entire world, global monetary system and all, the true reserve currency regime which gets backed by repo and derivatives requiring fluid collateral, history has conclusively shown that you don’t let problems in collateral fester.

The Fed, of course, always, always does because no one there knows any better. The absolute deflationary effects of a collateral shortage past beyond some threshold for deeper global money dysfunction is the unnecessary but repeated endpoint. There is an established pattern.

Fortunately for him, and us, we aren’t quite there yet. As noted earlier, especially following China’s RRR cut last Friday, we do appear to be on that deflationary collateral path – and that’s where Jay and I part company. This is no trivial technicality; it is absolutely crucial as the last fourteen years have proven.

For one thing, when collateral scarcity becomes a more problematic collateral shortage there’s usually an event, a single day of UST trading where it shows up to shock at least the inflation, recovery consensus. Following that, inevitably the landmine which leaves no doubt that it’s too late for either of those.

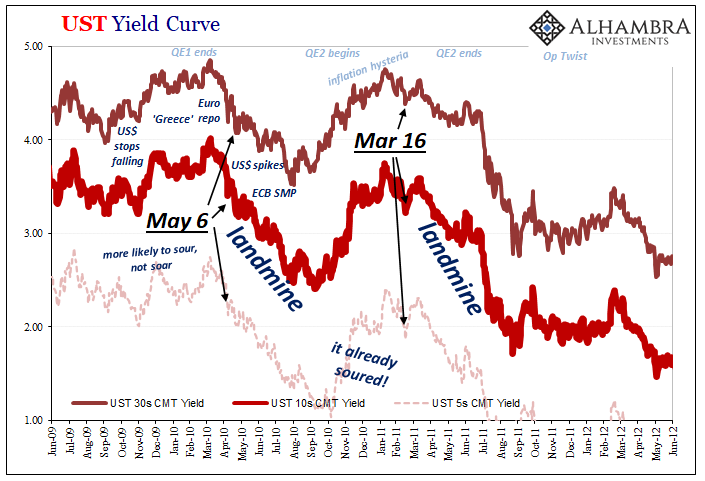

I write most often about the landmine which presented itself in October and November 2018. In truth, in each eurodollar cycle to date, there’s been one for all of them preceded in the same way by a, lack of a better term, collateral warning day.

Such was the case on May 6, 2010, a direct repo conduit into collateral problems that I wrote about in detail here. It was same day the stock market “flash crashed” which wrongly took up all the attention leaving the vastly more relevant illiquidity due to repo collateral getting seriously worse unnoticed for the public (but not for markets).

The next one, preceding Euro$ #2, followed on March 16, 2011, not even a year later. Once again, the mainstream media cited the wrong motive. Japan had just experienced its devastating earthquake and tsunami days before, and then was struggling with the nuclear nightmare at Fukushima Daiichi. It was the latter which, according to accepted convention, supposedly explained why Treasury yields suddenly plummeted by double-digit basis points when inflation, allegedly, was just ready to fall out of control.

Within a few months, though, hardly anyone was talking about Japan, not with an “impossible” second global financial crisis developing despite more than a trillion and a half in bank reserves.

It was, mostly, collateral and repo that had gone all wrong including one factor making it a whole lot worse which might sound eerily familiar to our 2021 ears:

During the week [2011] of Bernanke’s assessment of tradition FRBNY reported just $44 billion in repo fails using UST collateral. That total includes both sides, failures “to deliver” and “to receive”, even though by then the US Treasury had been withdrawing its SFA balances due to increasing uncertainty about the “debt ceiling.” Though the SFA had nothing to do with the federal budget, it was US debt and was counted as it should have been with all (mostly all) other borrowings. In other words, the count of bills and bill-like securities available for UST repo was $195 billion less (and would be withdrawn to $0 before much longer).

If you want the details, you can read about them at the link above. Short version: because of the debt ceiling, Treasury had to cut back and refund bills, including all of them attached to something called the Supplementary Finance Account, or SFA. Fewer bills, rising problems globally, the result a devastating collateral shortage made worse by policymaker decisions paying no mind to already existing collateral scarcity.

The result was the devastating Euro$ #2. Bank reserves didn’t matter.

And they never learn; the pattern established and merely repeats time and again.

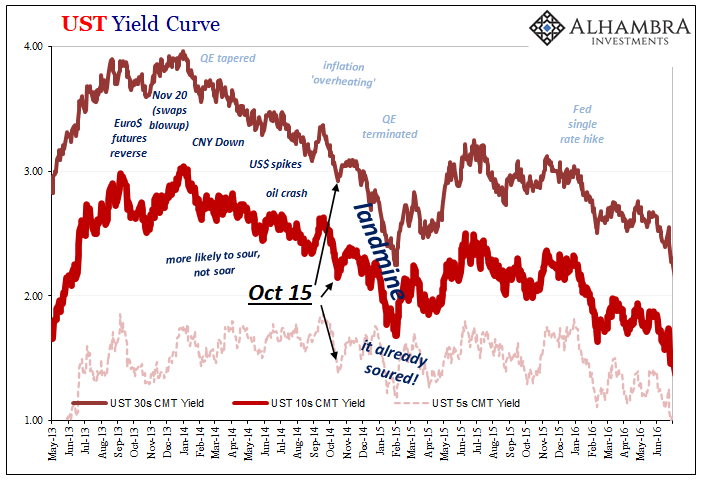

A few years later, again escalating warning signs especially later in 2013 and early 2014 (big one, CNY DOWN) and then the collateral event on October 15, 2014. Once more, it was missed and dismissed for all the wrong reasons (the day’s “buying panic” in UST’s was thought to be a computer trading problem in the market; Treasury even wrote up a ridiculous report coming to that absurd conclusion).

Within weeks, Euro$ #3’s landmine would develop in December 2014 just as the Fed was concluding its QE’s 3 and 4. The end of both QE’s should’ve led to higher rates by mainstream theory, this landmine instead pushed yields downward at a brisk pace (even faster than they had been falling all year) indicating the unmistakable (once you let go of mainstream theory and QE’s) deflationary endpoint all the previous escalating warnings had been warning about.

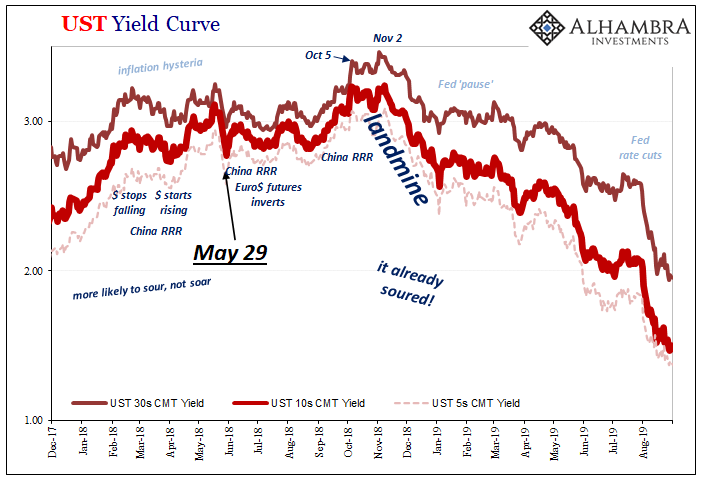

Obviously, same thing again for Euro$ #4; the collateral event on May 29, 2018, chalked up, laughingly, to Italian politics, again the sustained buying panic in UST’s (and other parts of the global bond market) that, to the trained monetary tactician (not Jay Powell, then), was an unmistakable sign of already big problems gotten much bigger.

Euro$ #4’s landmine was predictably only months behind it (after another RRR cut in China, of course).

So, in 2021, we’ve got the escalating warnings, more than a few, and quite the official acknowledgement, if for all the wrong reasons, of dangerous pre-existing collateral scarcity.

If we are, indeed, following along that same pathway toward Euro$ #next (is it 5, or 4b?) then what we’re looking for next is the same pattern: first a “collateral day” like May 6, 2010, March 16, 2011, October 15, 2014, and May 29, 2018. If we get one of those, then, in all likelihood, not long thereafter the next landmine.

And that would be the definitive signal for more eurodollar deflation, a much higher probability than the conventional interpretation of each CPI, PPI, and PCE Deflator of late.

All this is why bond yields and the global bond market has behaved in the way it has of late, a key reason, if not the key reason, why none of those has made the tiniest difference. The deflationary potential of a serious collateral scarcity, so scarce even Jay Powell said it out loud, simply overwhelms the current levels of “inflation.”

Collateral is, quite simply, a huge part of that and largely because the public still believes Euro$ #1, the first Global Financial Crisis, was all about subprime mortgages rather than collateral. In that regard, too, nothing has changed. Jay Powell knows it’s currently scarce, but he frets nothing because even after all these years and the near exact repeating of the same pattern, neither he nor anyone in the mainstream has been willing to truly see it and understand it.

Stay In Touch