There’s another foreign angle to the grave misconceptions about what overseas financial entities are doing, and are made to do, with specifically US Treasury assets (and overall US$ assets more broadly). The American public, anyway, has wrongly been led to believe that those outside the US must hate the US and its dollar; at least its recklessly spendthrift government.

None of those are true (except the spendthrift ways of the feds; they are that), yet another instance where Economics gets this important monetary/financial/economic signal entirely backward – as usual. Furthermore, the way it really works is the way it has worked for more than six decades. Yes, for sixty years foreign central banks have been employing their US Treasury assets to plug eurodollar holes that occasionally arise.

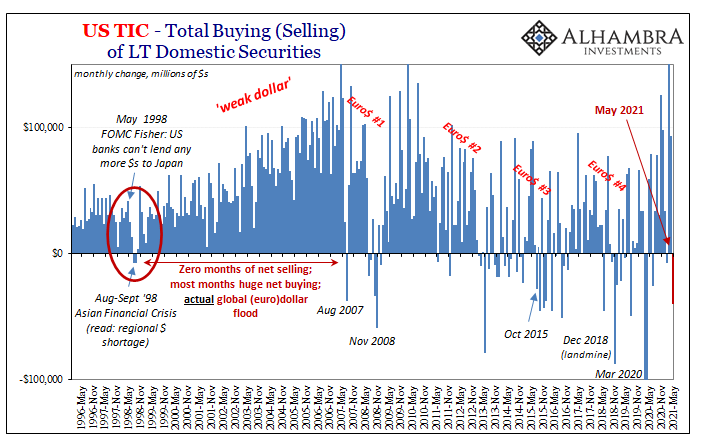

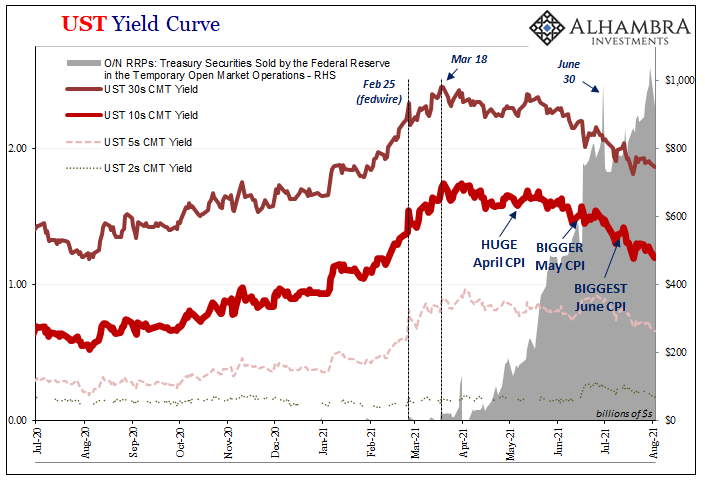

It’s the more serious eurodollar holes that leave their mark for the world to easily observe and witness – if anyone in it had been shown. Believing this is all something it is not, the evidence has instead been right there:

It has been high misunderstood for far too long in this Fed-centric era (cult) which identifies foreign selling of Treasuries with everything it is not. In other words, there has been a long and consistent history which conclusively shows foreign selling of not just Treasuries but also T-bills and other US$ assets, both by private foreign institutions as well as overseas central banks and governments, is brought up and forced upon for entirely some form of dollar problem or shortage.

Not because they hate the US, or fear its government’s reckless profligate ways. Moreover, it has nothing to do with inflation except for the correlation between Treasury or US$ asset selling (at least diminished buying) and the deflationary reserve currency (eurodollar) condition driving it.

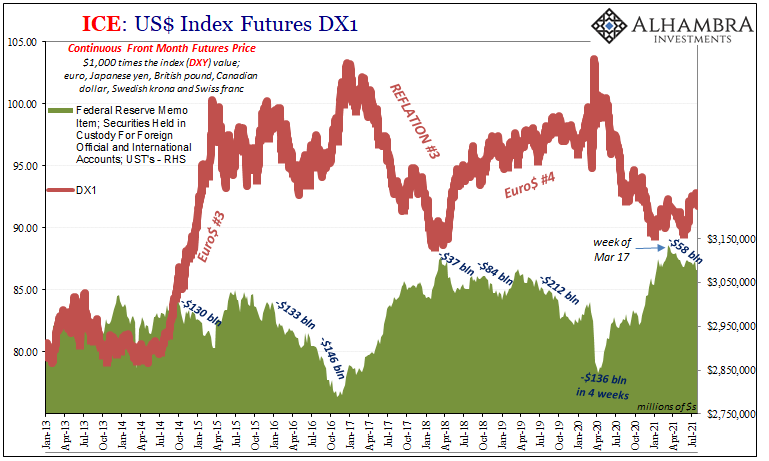

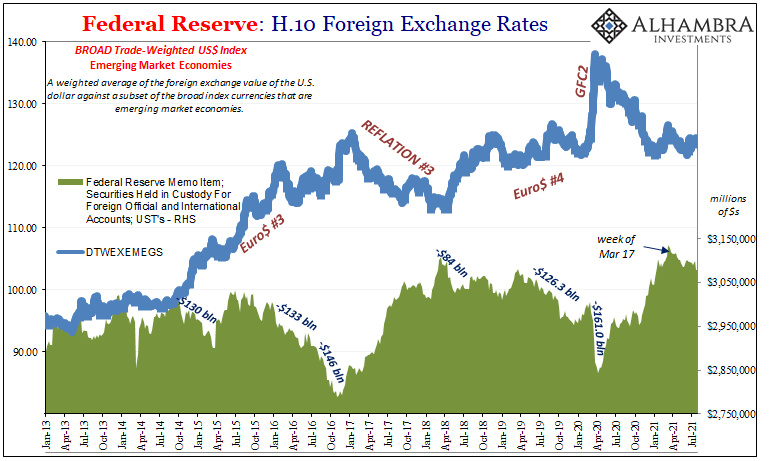

As richly vibrant as the TIC data is to illuminate this monetary truth, there are other ways to witness and appreciate the same relationship from differing perspectives. One of those is from the Federal Reserve Bank of New York’s data on what service or accommodation the branch provides in this same space.

As foreign official governments accumulate UST’s and their like – if only when eurodollars are relatively more plentiful – a very good portion of those is held in NYC at FRBNY on behalf of these FOI’s. A custody courtesy for our big foreign friends, and one step further along from the TIC figures.

What you find in aggregate custody at FRBNY is entirely expected as well as consistent with the relationship laid out via ownership: when eurodollars are relatively more plentiful, foreigners get more UST’s (TIC) and thus more of them end up and show up in the Fed’s data (a memo item). Inversely, when eurodollars become relatively scarcer (dollar shortage), these tend to disappear as FOI’s oftentimes desperately seek to plug eurodollar holes.

Like TIC, the larger the holes the more disappear.

In this way, custody amounts are the same backward to the conventional assumptions: when UST’s are falling in price, yields rising, you’ve been told to expect foreigners selling, but that’s when we find FOI’s parking more UST’s in New York, not fewer.

The flipside is true, too; UST’s rising in price, yields falling, UST’s disappear from FRBNY custody even though from the tradition of Economics this seems counterintuitive.

The strong if imperfect correlation further ties in with the US$ exchange value to add even more support to our interpretation of what’s going on; all of it driven by eurodollar conditions rather than some conspiracy-like politics.

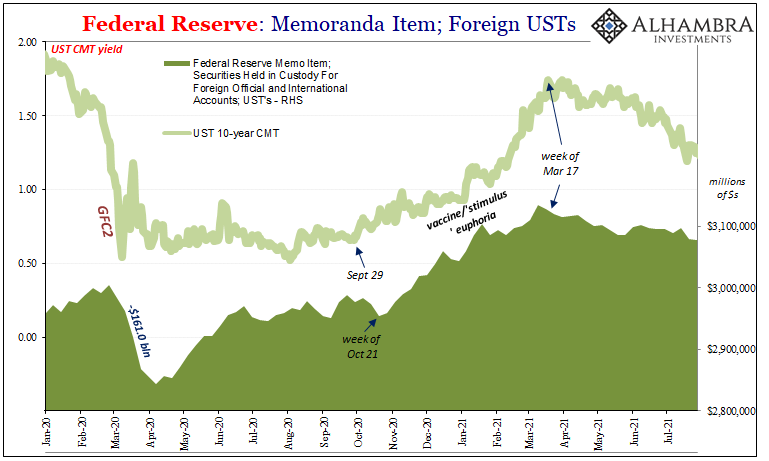

Big thanks to my podcast co-host Emil Kalinowski for bringing this up recently given just how close the correlation has been over the past four and a half months therefore another big clue about what’s really going on here.

Another ‘Ide’ from March, and another BIG ONE:

Over the past year or so, just when foreigners should have been getting rid of UST’s – because of all the huge inflation which, we’ve constantly heard, absolutely will destroy their value as the dollar simultaneously sinks into oblivion – they instead accumulated them and quite a lot of them; or what we call around here reflation. A bit more plentiful on the eurodollar front, voila, more UST’s end up in foreign hands left in FRBNY custody.

Clear as day.

Since that same week in mid-March we’ve been highlighting since just after the Ides of that March, UST’s have been gaining in price (and the US$ exchange value steady to higher) yet they are once more leaving FRBNY for reasons not stated.

We don’t need this data to state those reasons because it is perfectly consistent with a whole bunch of other data, market prices, as well as that very long history. Eurodollar holes.

That’s not all, Emil showed on our latest podcast episode (Episode 93) this relationship also steadies very well into the gold market, too.

In other words, it might not be well known to the vast majority of the public – for reasons of pitiful Economics and those unscrupulous enough seeking to take advantage of the illiteracy to sell their narrative – but what it all comes back to is an incredibly solid deflationary signal which is, unlike those others, internally consistent and thoroughly corroborated in addition to being historically accurate.

Too much money? Inflation on the rise?

No. No chance; or at best a tiny chance getting smaller by the day. Maybe no one else is listening, if only because they don’t know they should, but a whole lot of these eurodollar parts are speaking in unison. Whether the central bankers, Economists, or members of the financial media hear the speech or not, it’s happening anyway. The mainstream has it all wrong right down to the basics and the basics of real history.

Again.

Stay In Touch