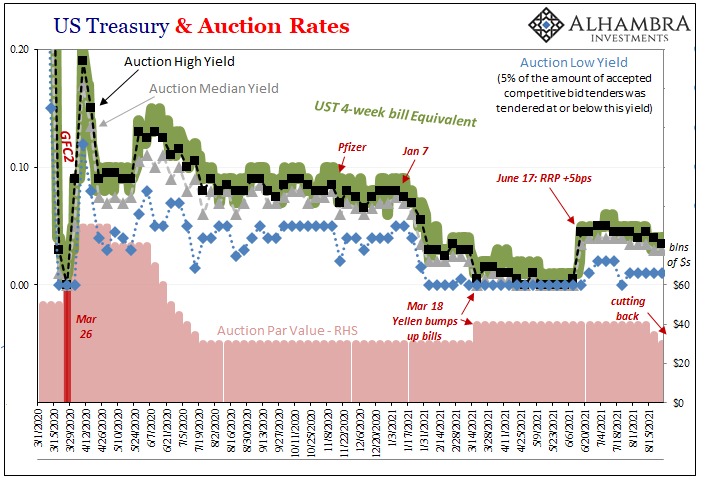

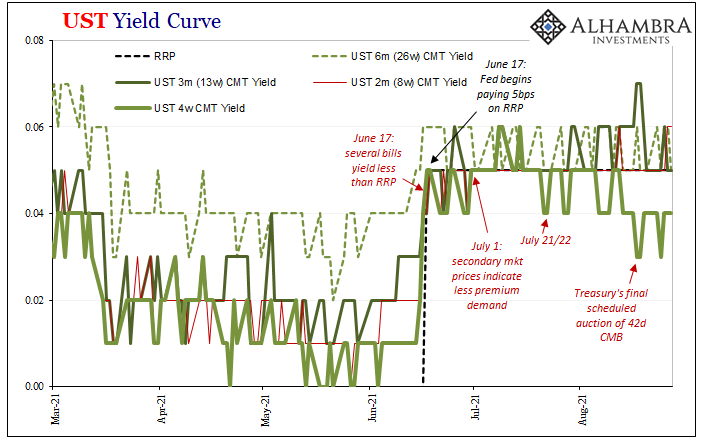

In the absence of the 42-day Cash Management Bill, all that demand for it has to go somewhere. Treasury stopped offering this issue ten days ago on August 17, which is when 4-week bill yields dropped more persistently into the 3s (bps).

Yellen’s Department will try to supplement next Tuesday by reopening the August 10 issue of the 42-day, selling $45 billion of what will be essentially a 21-day CMB.

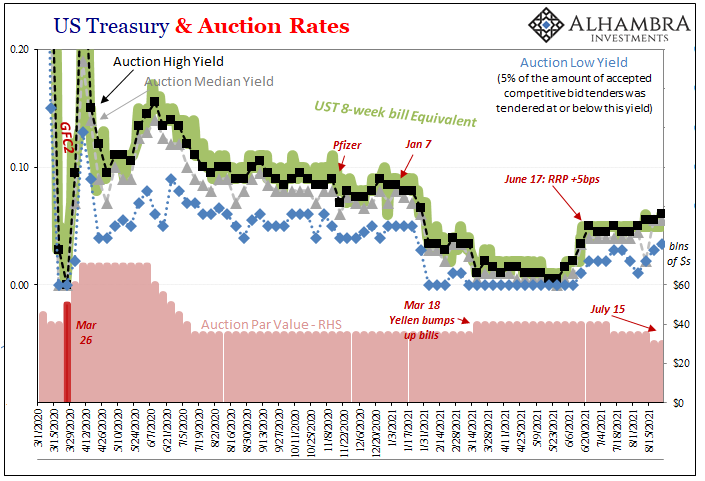

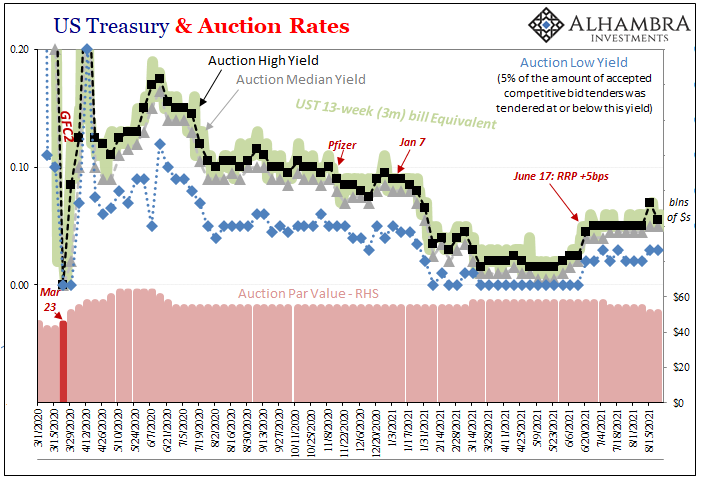

In addition to these eliminations and adjustments, there are ongoing subtractions is what’s offered in the regular bills; the 4-week, 8-week, or 13-week maturities. The first of those, the shortest one, has been scaled down from $40 billion two weeks ago to $35 billion last week and now just $30 billion this week.

There’ve been smaller cutbacks in those other two dating back to July. In other words, major supply factors reaching their crescendo.

At the same time, the debt ceiling deadline looms. Thus, it may be why the 8-week bill auctions are now being bid at slightly lower prices despite fewer of them and all others. Especially when compared to the 4-week price heading toward zero, it might be that this $45 billion reopening will satiate demand in that maturity space.

Or it could be the usual debt ceiling effect, where investors avoid bills just in case the government skips paying off one or another. That has never happened, of course, but every time we do this rumors swirl and money market funds sweat it.

But the world needs bills and lots of them, so what we are seeing here is that it is about to get a whole lot more interesting at the front of the yield curve. Messy interesting. Good and messy hardly ever coexist particularly when it comes to collateral.

It isn’t coincidence that the last several of these interesting periods for bills leading up to debt ceiling deadlines each coincided with transitionary phases out of reflation and into more serious dollar shortages. The last one was late in 2017. Before that, October 2013.

And maybe the biggest one, 2011. What the Fed said – but didn’t understand fully – back then applies today, including the part where they don’t fully understand the deflationary implications and potential.

MR. SACK. Some market observers are concerned that the looming debt ceiling is going to impose a substantial squeeze in the supply of Treasury bills, as the Treasury attempts to maintain its coupon issuance while its ability to borrow is limited. They believe that Treasury bill yields and GC repo rates could be driven negative in response, potentially inducing a number of unusual market issues.

As I said, it’s about to get interesting. Unless something’s different. It hasn’t been different yet.

Stay In Touch