The American people were first introduced to the Treasury helicopter in 2008, not 2021. The Bush Administration’s “radical” approach to keeping the Great “Recession” from becoming a contraction, obviously, failed spectacularly even though the initial returns had been positive – literally positive in how Q2 ’08 GDP suddenly turned higher as if this was by skilled design.

Economists, including those at the Fed (meaning everyone at the Fed), practically called it a day thereafter. By mid-2008, they weren’t yet popping champagne corks but the bubbly had already been put on ice.

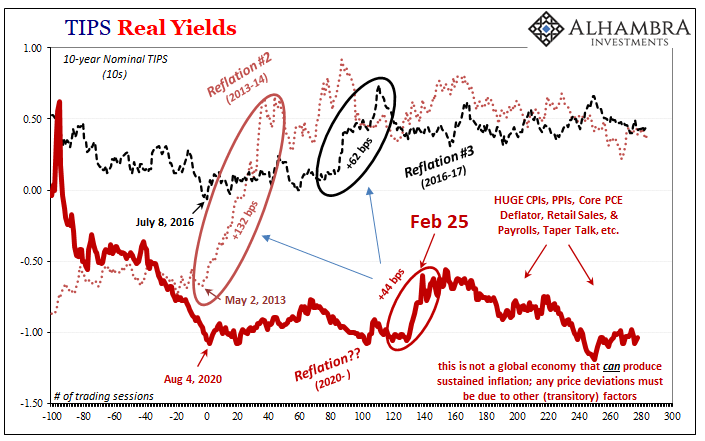

What a gigantic mistake; fooled by the transitory into ignoring all the increasingly desperate warning signs.

The effects of that very first monetary drop faded so fast they’ve all but faded completely from memory; that’s how little they mattered given just a little bit of additional time along with an unhealthy dose of global dollar shortage. We’ve been warned about the fiscal side’s effectiveness, or ineffectiveness, since then.

None of it stimulates, at least nothing outside the very short run which is to mean it is not stimulus!

So, the dual drop of Trump’s final package along with Biden’s first in the early part of this year predictably scrambled the short run. Because of it, and to get ahead of it, the US goods economy went into an enormous frenzy. It pushed up prices as well as pulled forward goods deliveries particularly the farther they might have to travel.

Imports, therefore.

In that mania to take advantage of the supply squeeze (not inflation), everyone just ditched the pretense of prudent management and ordered whatever they could for whenever they could get their hands on it. As John Dizard of the Financial Times wrote not long ago:

Do you have any idea how many containers of stuff are bobbing offshore from Shanghai to Rotterdam, baking in marshalling yards or collecting diesel smoke film in traffic jams?

Of course not. Nobody does. The inventory en route around the world defies the imagination, not to mention the antique information systems in the shipping business.

After having interviewed many, one logistics manager told Mr. Dizard, “For me, the more chaos, the better.” For the economy, though, when everyone doubles or triples up their order book and flow just to be assured something gets delivered someday, what happens if by the time the goods do show up, or even before while on the way, demand goes soft?

History shows the answer, and it isn’t the inflationary one just like it would never have been in 2008.

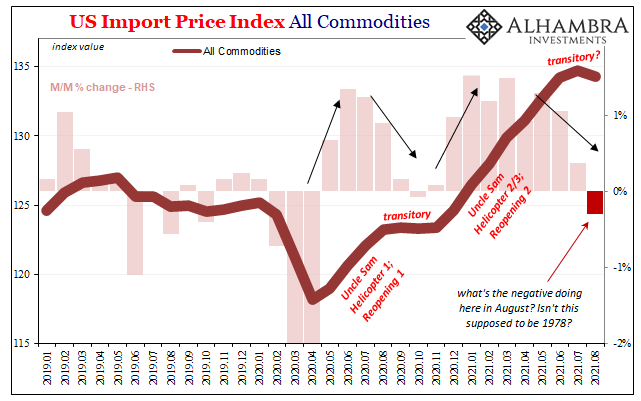

The BLS actually produces three levels of inflation measure, the third in the series being import prices. The first comes out from producers and recently showed more than a modest amount of “transitory.” The second, the key one for consumers, quite a bit more than producers (especially as you get farther from gasoline).

Thus, by the time we get to the third of them now two-thirds through 2021, how shocking is it, really, that a minus sign – yes, a monthly negative – has materialized for these? It doesn’t matter if or that analysts weren’t expecting it, the economy in these transitionary periods rarely conforms to their extrapolations.

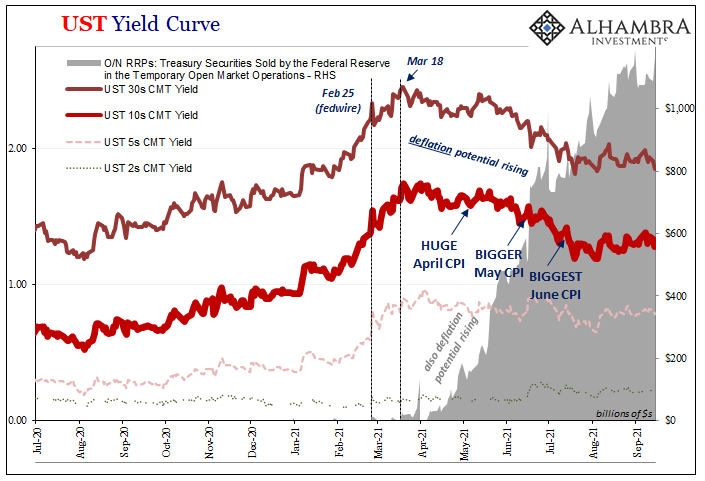

What the Fed will do is go ahead with tapering its QE6. As I’ve said repeatedly, and the bond market continuously prices, tapering doesn’t matter one bit in the real economy. It is merely the projection of confidence in models that never seem able to match these real-world characteristics and conditions.

As the global economy falls off, quite predictably, monetary policymakers, like their Bernanke-led predecessors, will begin to think and act quite contrary to reality.

The chaos of the current supply chain problems is very real; it’s just not as definitive nor primary as those cheering the Fed and its newfound confidence would like. Economic weakness comes in many forms, but in the end it is all weakness no matter what it’s called in the media. Merely labeling it something else, or blaming other factors beside this what’s obvious, that’s rationalizing and it has become big business ever since that same middle of 2008.

Substitute delta in 2021 for what had been somewhat ridiculously attributed to “trade wars” in 2018.

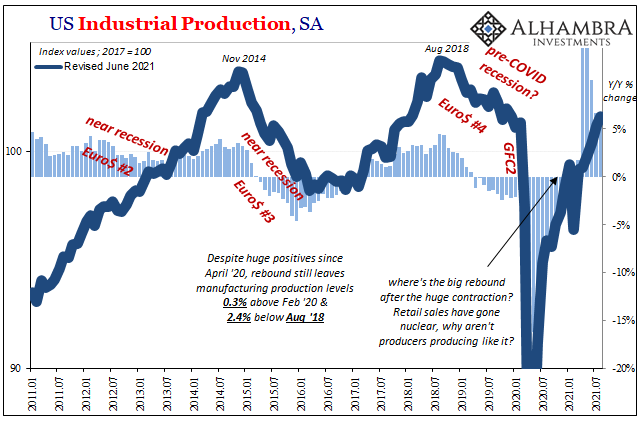

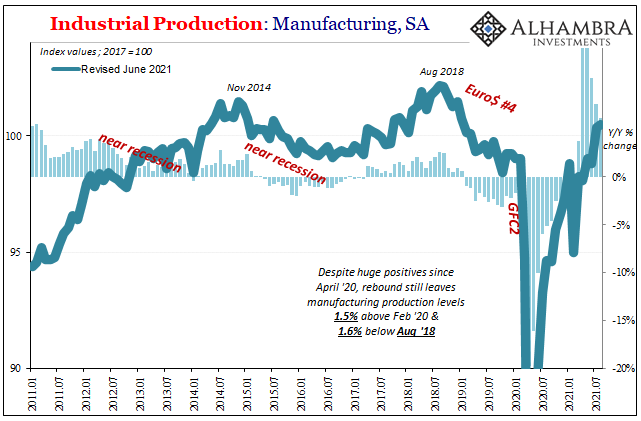

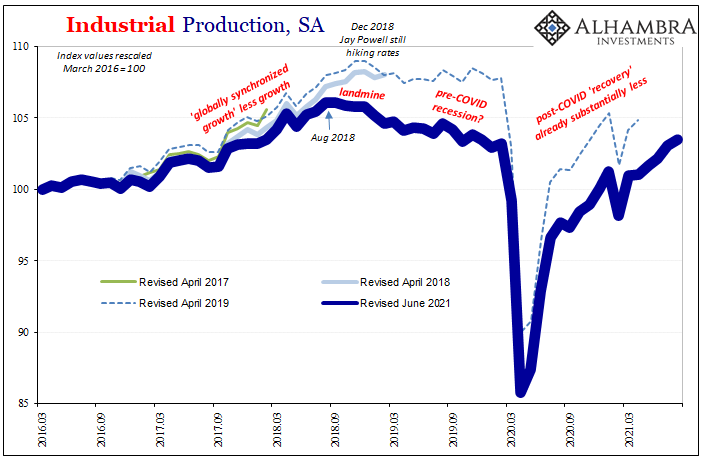

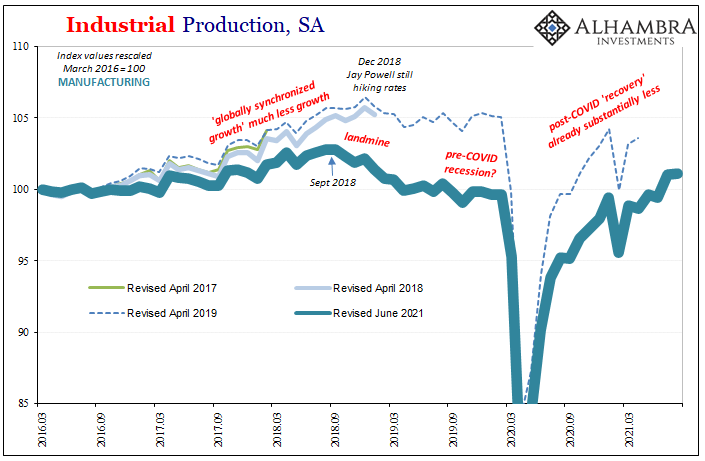

Take, for example, domestic US industry. Prices went way up for goods at the consumer level, farther at the producer level, and yet production overall has only remained muted throughout. According to the Federal Reserve’s very own estimates for Industrial Production, total output in August 2021 finally caught up with February 2020 – seemingly without anyone considering just how in the world it could have taken eighteen months, a year and a half, with all that constant “stimulus”, just to get back to that point.

And that’s just even with February 2020; total output is still about 2.5% behind August 2018. How can that possibly be? Were trade wars really that devastating? Of course not. This is no boom, meaning this isn’t even close to recovery and therefore prices have been unquestionably behaving according to something else.

Logistical chaos caused and amplified by the blunt hammer stroke of the inefficient helicopter, not economic fundamentals.

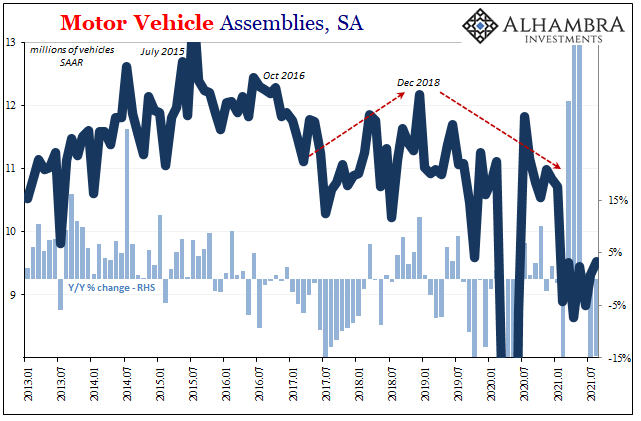

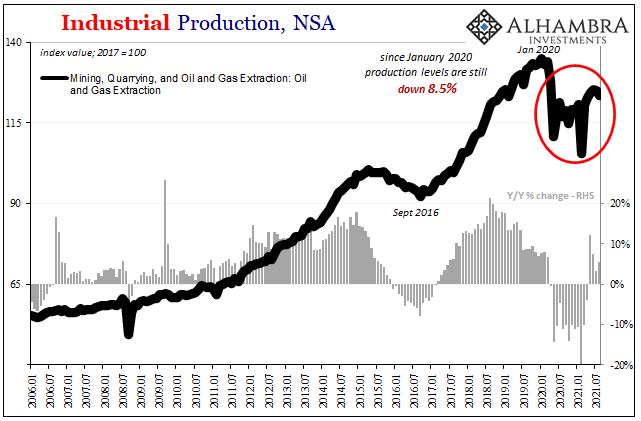

For every repeated mention of the auto industry’s inability to source microchips, there should be some for the energy industry’s perfectly clear reluctance to embrace oil and natural gas prices during the very same months. Production levels are being restrained for a number of reasons, maybe not all but many of which must trace back to far more pessimism about the post-helicopter world and what in it legitimate demand might really look like.

And that might explain the part of incredibly low auto assemblies despite rising prices supply factors alone cannot.

With August import prices now down for the month on average (even though imported auto prices were again way up), and domestic production levels still leveled off, and overseas industry not even that well, isn’t French shipper CAM CGM’s decision to adjust its pricing regime starting to make a hell of a lot more small “e” economic sense?

Far more sense than the letting the flawed unemployment rate set the Fed’s taper.

Helicopters plus supply factors led to a clear bulge in consumer, producer, and import prices. But unless the “stimulus” actually stimulates, once the short run effects recede (they always do) what’s left is the real state of the real economy plus an added negative “bonus” of having to clean up the additional helicopter-fueled mess.

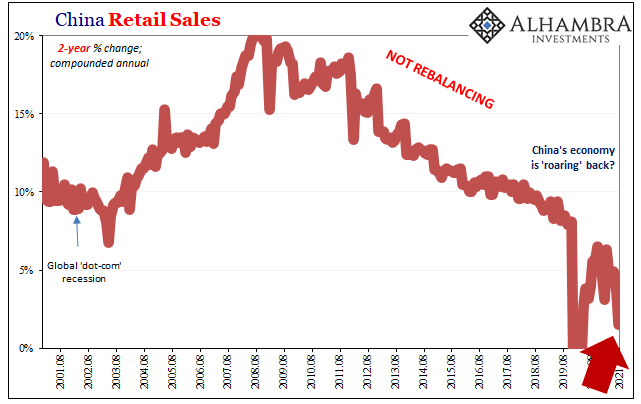

And if the real state looks like, say, what it looks like right now in China, then all that untracked, uncontrolled inventory floating around just might accelerate the transitory just as it finally shows up.

Stay In Touch