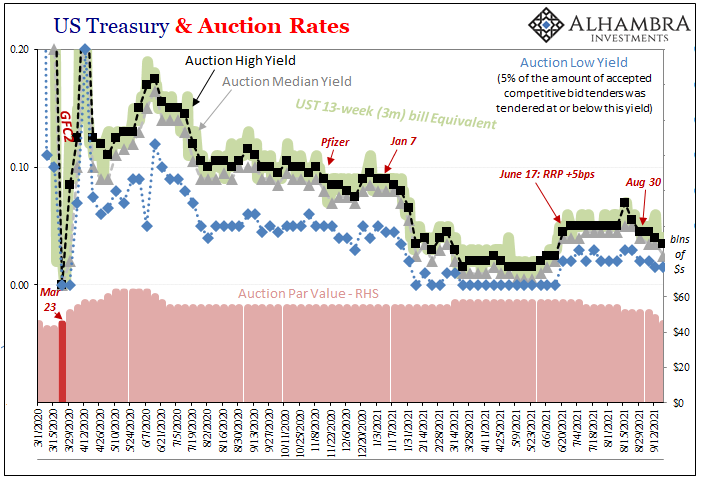

The US Treasury auctioned off $45 billion in 3-month (13w) bills this morning. Despite the Federal Reserve paying 5 bps for SOMA UST collateralized, for “some” reason the primary market’s players wanted this issue far more. The auction’s high was just 3.5 bps, its median 2.5. These are down from 4 bps and 3.5 bps, respectively, last Monday.

With the world on edge over China’s Evergrande, it has more than a few people talking about prospects for dreaded contagion. The generic honorific “Lehman” has been liberally tossed about, too, since we live in a clickbait world.

While Evergrande’s real trouble is almost certain to make things uncomfortable and disorderly in RMB markets and for the PBOC (and other regulatory headaches), as I wrote earlier, I don’t believe this is something new nor emergent. In a way, it’s part of the same overriding plan for managed decline.

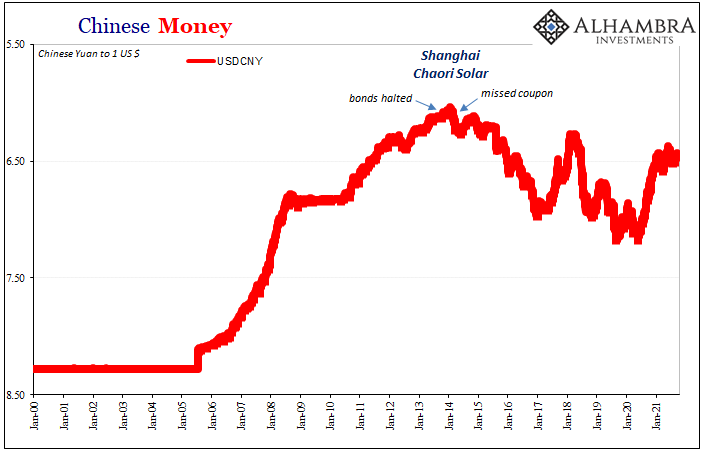

It won’t help, obviously, and there is a bit more downside uncertainty which comes with such a big institution whose reach is quite extensive. I still believe, however, the fallout from it is more generalized to a very long ongoing trend than specifically a repeat of a short run “surprise” disruption like Lehman Brothers. This, like its predecessor Chaori, just another bellwether on the same stupid road toward baseline deflationary lack of growth.

The Communists confirming how the last seven years and more have been globally synchronized but without growth potential.

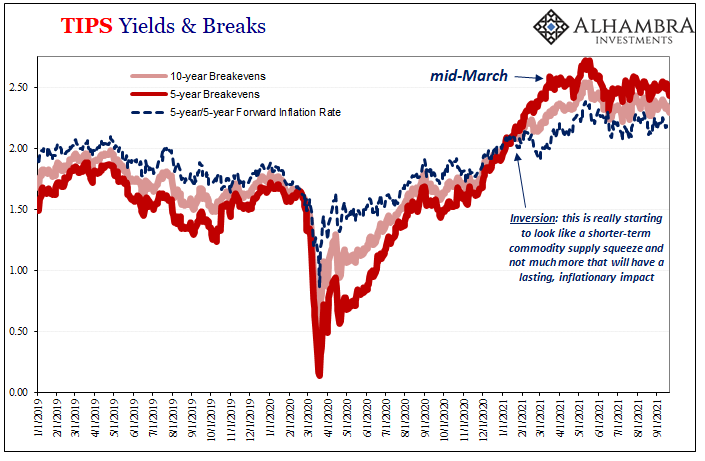

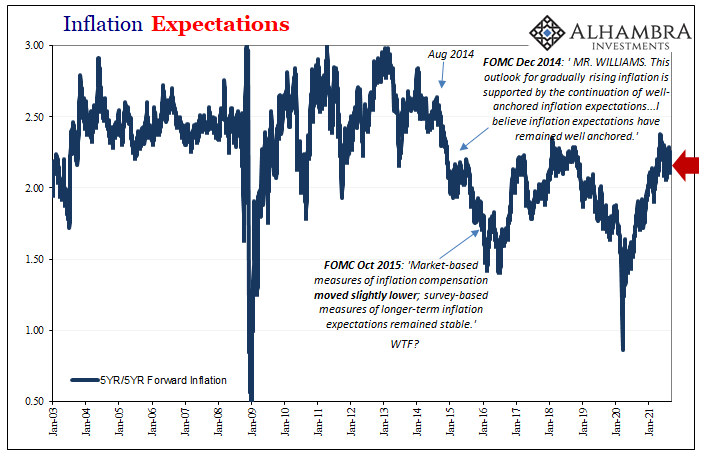

If it helps clarify anything, more so how (real) inflation is such a small, distant probability globally. Any pockets of consumer price deviations never more than transitory.

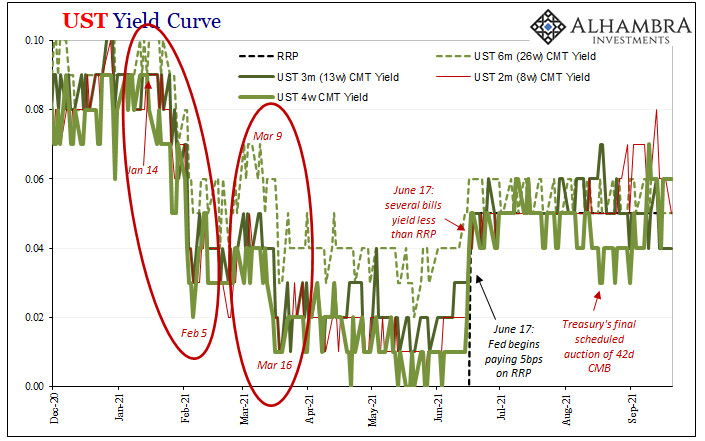

Any actual contagion, meaning something more acute than just quickening the pace of reversion, you better believe something like that would immediately show up in the US bill market (see: March 2020). Collateral supply is already extremely tight and getting tighter, plus it is just after the mid-September bottleneck. If not now…

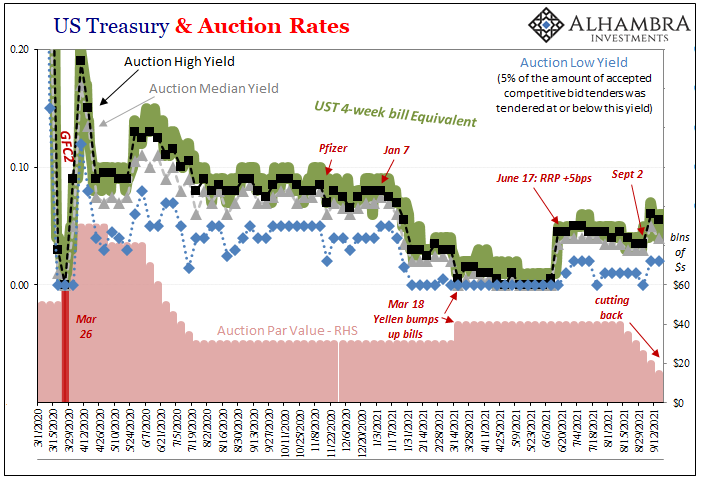

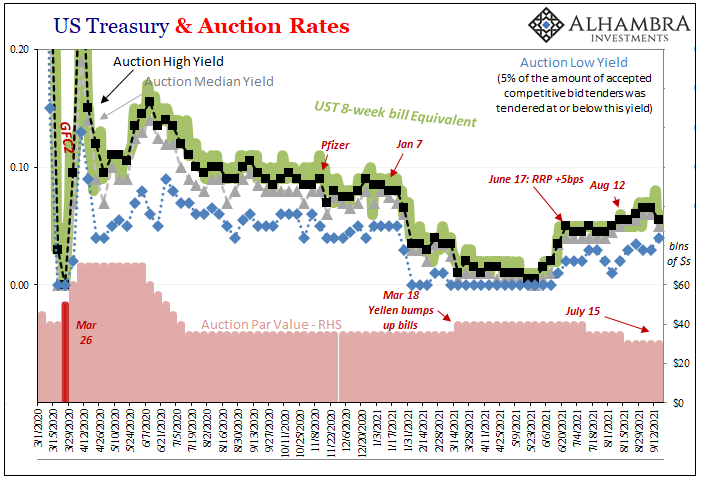

Despite the auction results cited above, those are hardly out of line with recent trends. In fact, they’re right on. The 13-week bill is gaining higher bids out of necessity due to those supply constraints as well as money market funds’ slight distaste for the shorter 4- and 8-week instruments, acting out of overabundance of debt ceiling caution.

While longer UST notes and bonds were bid right from the Asian open last night, it was an orderly bid rather than something closer to a “collateral day”, which given the combination of factors cited above if Evergrande was becoming a something it would do so across bills, notes, and bonds.

Instead, for now, anyway, that buying in notes and bonds – as well as the same trend in bills – is basically the same rising deflationary potential as it has been over the past six and seven months (see: TIPS). There wasn’t anything today additionally special about trading, and rather than representing imminent contagion Evergrande to this point just another datapoint in a majority of them for the same deflationary potential (thus, notes and bonds).

It only seems that something might be different given the stock market which, for its own purposes, a 2% down day has become an exceedingly rare event. This says more about stocks than China and any possible relation to everything else.

Stay In Touch