Because it’s what you don’t see that ultimately matters, the public is left entirely in the dark unable to join what really should be easy dots to connect. Something is wrong, and pretty much everyone acknowledges this if in their own way. We can see the social and political disintegration before our very eyes, the anger, the “revolution”, even the increasing fragmentation as a world once buoyed by globalization turns diametrically against it.

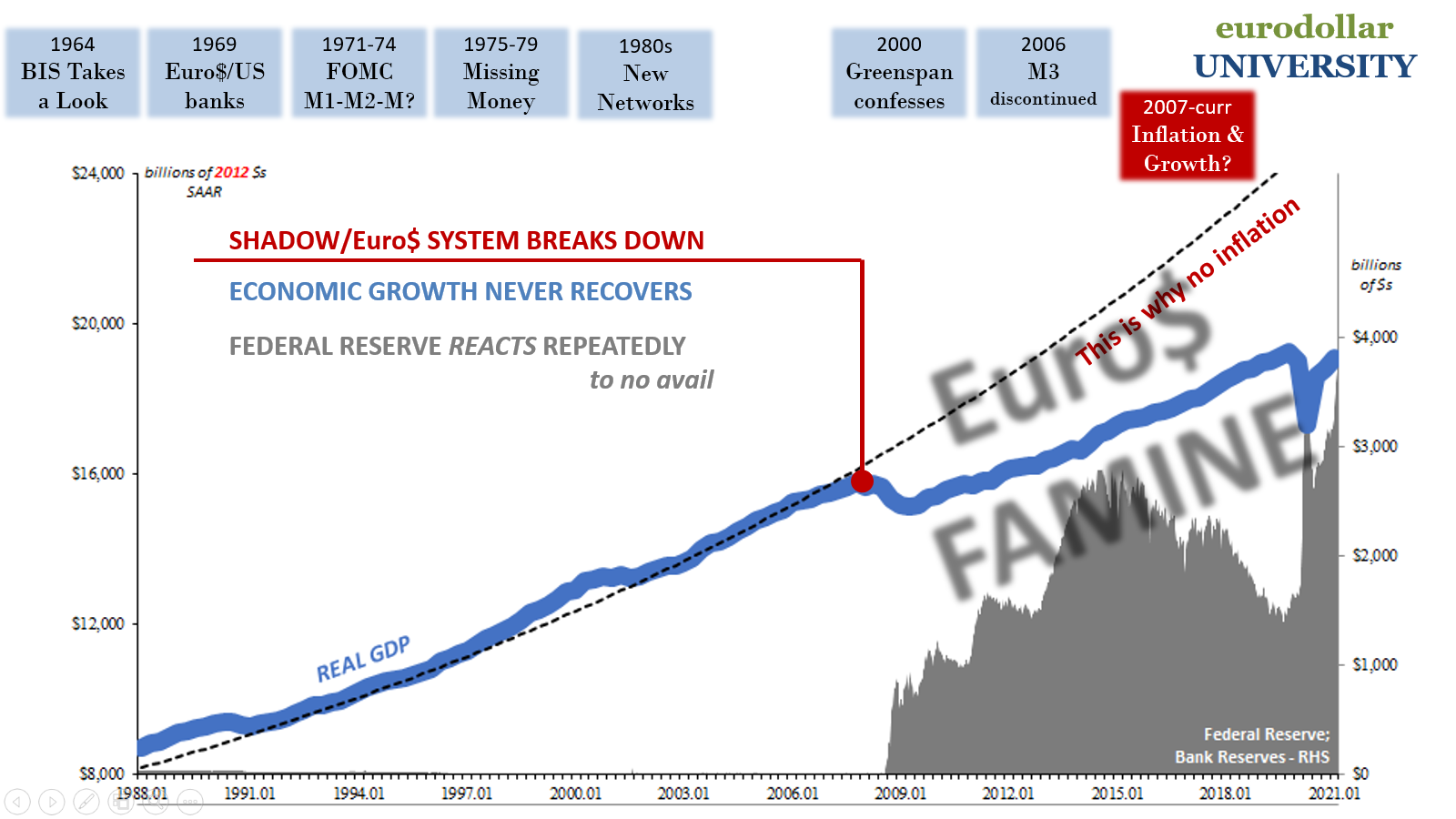

We are constantly told to expect growth and therefore inflation; not purely because anyone truly wants consumer prices to rise more than what little they have, rather if that ever would happen then it would finally confirm the vastly more important growth part. This means real inflation, the money kind, and not some supply-driven bulge from other (and unsustainable) artificial factors.

Every few years, central bankers and Economists assuredly decree how a golden age is imminent, right around the corner. They steady themselves for the celebration, the parade which they anticipate will follow when all “emergency” programs are finally removed. Taper then terminate QE’s, hike rates, finally normalization across all global finance.

And every few years it eventually becomes clear this isn’t going to happen. But why? No one ever says. They promise and guarantee, the media gets hysterical about it…and then dead silence.

People have been led astray and not just for the one thing, inflation. First of all, the intense focus on inflation and fearing inflation has distorted our ability to read and interpret even basic data.

It starts with the stuff you do see which gets hyped sky-high by both proponents and critics alike; both, actually, not that they know it, falling on the same side as one another. Each declares an age of “easy money” from the Federal Reserve or ECB, whomever else. Proponents merely say there’s enough “accommodation” while critics charge it’s only ever way too much “money printing.”

There’s never any room for the truth derived from most times purposefully obscured if not fully hidden facts; the Fed like the ECB, neither is a central bank. There’s no money in their accounting leftovers, these trillions of otherwise near-useless bank reserves.

No “easy money”, certainly not “accommodative”, and the only thing printed is the financial media’s uncritical acceptance when publishing these words.

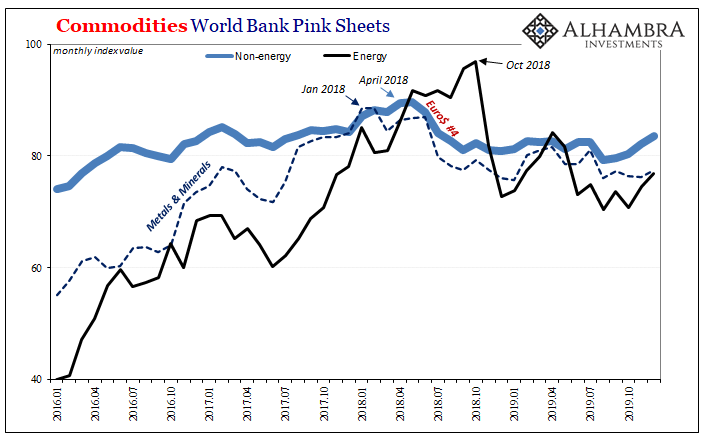

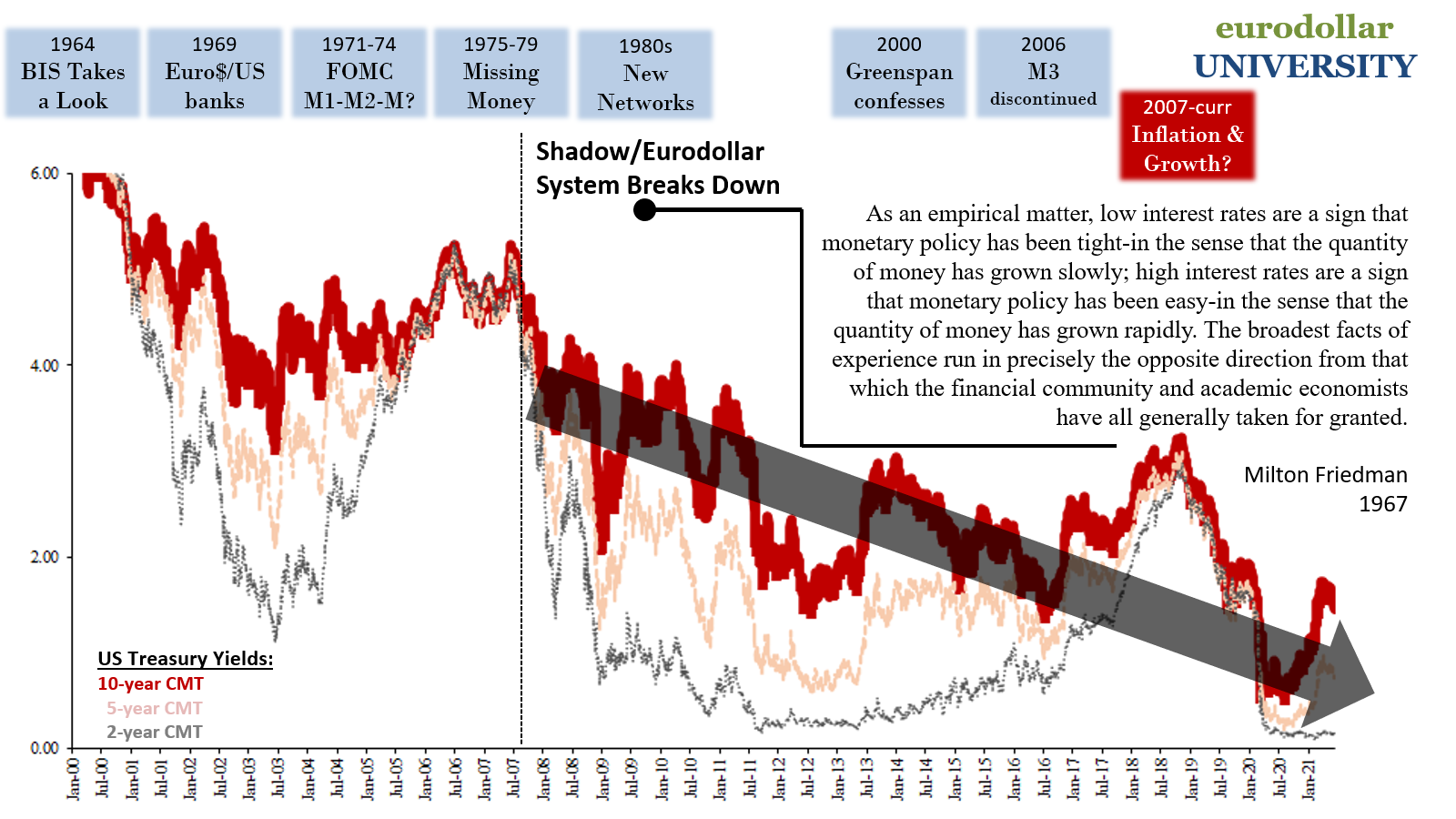

Instead, it’s what you don’t see or don’t know what you should that’s actually easy to see which matters. We’re taught about interest rates in the opposite way as they really are. We’re meant to focus exclusively on oil, when other commodities more often are more instructive.

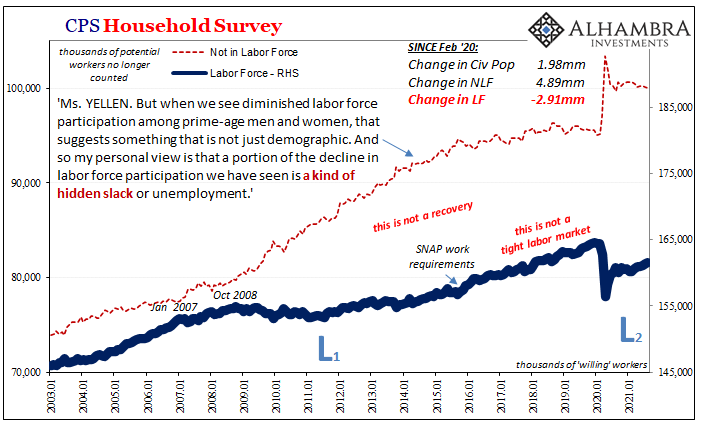

The labor market, in particular, we’re told full of nothing but lazy Americans because, Economists declare, it just cannot be – not with all that money printing – a more than decade-old monetary problem has left the world dealing with deflationary pressures, real textbook stuff like Keynes had written, and that is why the labor force has been left to rot for as long as it has.

So, we are instead forced to repeat history that isn’t even that old. Just like the last time, all these things go largely unnoticed, misinterpreted, left undisturbed back in the shadow. I wrote four years ago, nearing the apex of globally synchronized growth just as it was about to turn toward the always-unexpected globally synchronized downturn:

There is very little sympathy for the plight of workers pretty much anywhere, but especially in the US and Europe. Economists have convinced the so-called elite political class that each economy is working and therefore it is the workers within them who are themselves the cause of growing, deepening disaffection.

Yet again in 2021, rather than think differently about the Fed’s bank reserves or what’s really going on with interest rates resisting the constant mainstream invitation to skyrocket (what would actually signal inflation and growth), no, we blame overly generous government handouts. Then, right on cue, central bankers predict very soon even these won’t matter.

Worse, failing to have accounted for only failure year after year, this time the inflation/growth/rainbows/unicorns is somehow even more guaranteed!

Tapering in the coming months is their assurance that, like 2017 or 2014, their work is done. How dare you question otherwise! Governments absolutely will not, so don’t bother thinking too hard about it.

From a political or “elite” standpoint, this disconnect is somewhat understandable if entirely unsympathetic. It’s not just that Economists claim there is little or nothing wrong with the economy, even those who otherwise relate to the struggle of workers fail to identify and explain the reason for that struggle.

Four years after, what’s changed? Nothing. What I wrote then applies just as much in 2021 as it did in 2017, or would have in 2014 or 2011.

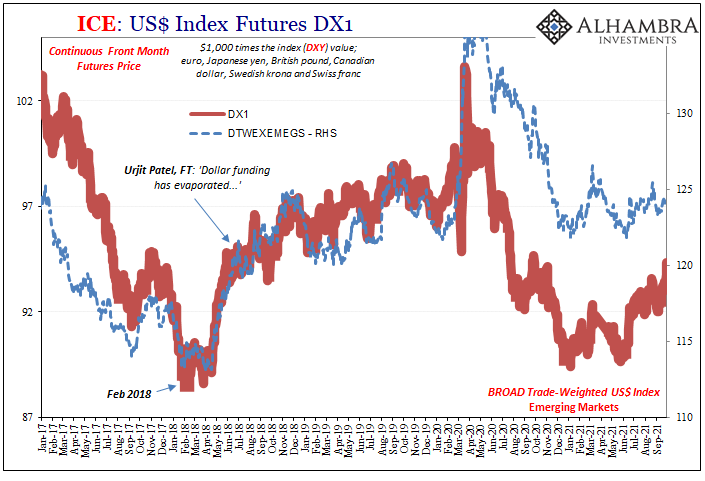

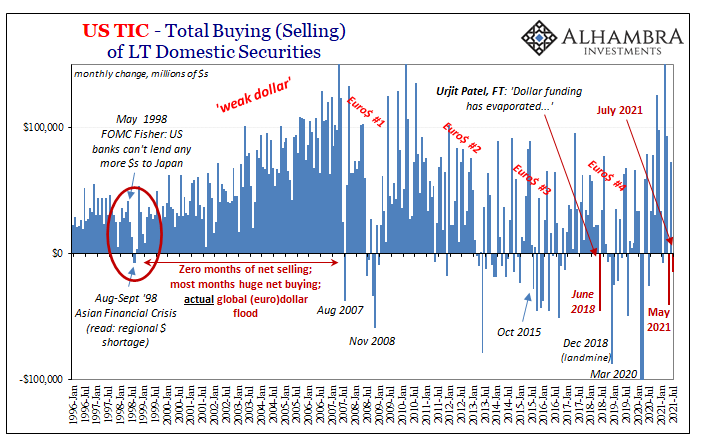

What actually followed 2017 in 2018 wasn’t even close to recovery, growth, or inflation. The media filled throughout that year with ever more confident predictions about how everything was right on track – even as the evidence continued to pile up into the stratosphere depicting only the opposite, if done so in the blackout of mainstream contempt for anything which doesn’t argue in favor of the technocrats.

It was all right there; rising dollar, Tokyo banks headed for the exits, depressive metals and minerals prices, eurodollar futures, flat not steep curves, panic foreign selling of US$ assets, Urjit Patel, and on and on and on. All of this public information.

The public heard little of it, understanding none. Jay Powell, now, he was our hawk therefore, as the band wrote, nothing else matters.

This is Economics. Science used to be about evidence to validate theories, but today it is only about the scientist; their pedigree and which impressive office they might hold for reasons we’ll never get to know. The correct visual appearance, the Orwell.

This more than anything has prevented enough people from connecting all these dots which uniformly point at a shadow money deficiency therefore persisting deflationary economic conditions – no inflation puzzle here – when inevitably the growth narrative gets bludgeoned to death by true monetary reality, and like clockwork central bankers fall silent.

In that silence, the vast majority of the global populace is left only to turn on each other.

We live in a non-linear world. What that means is rate of change governs everything. Contraction, therefore, like deflation isn’t necessarily a nominal absolute; GDP can be rising and still the world in depression. Silent depression.

But when the rate of change in economy goes down, even if still positive just substantially less, the rate of change in politics will go up. This, too, very easy to observe. It is as inevitable as the sun rising in the east, a fact behind much if not most of the worst parts of human history. Ancient as well as modern.

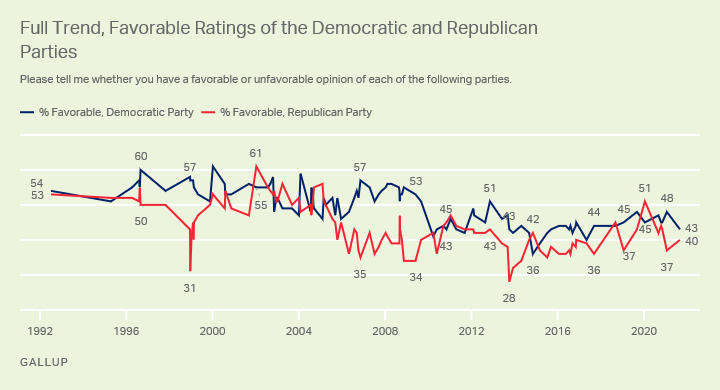

Sure enough, a little bit more data, “somewhere” around 2008 the American voting public (according to Gallup) stopped liking even their own political parties as much as they once did before. This is merely the last of the dots connected effortlessly to all the others once you get past the “money printing” and bank reserves, set aside what you can see and are told to only see, to instead appreciate what’s actually been right there the whole time.

We blame each other. We blame our politicians. We even blame the Fed, but for the exact wrong reasons. Everything else but the truth that’s right here:

Stay In Touch