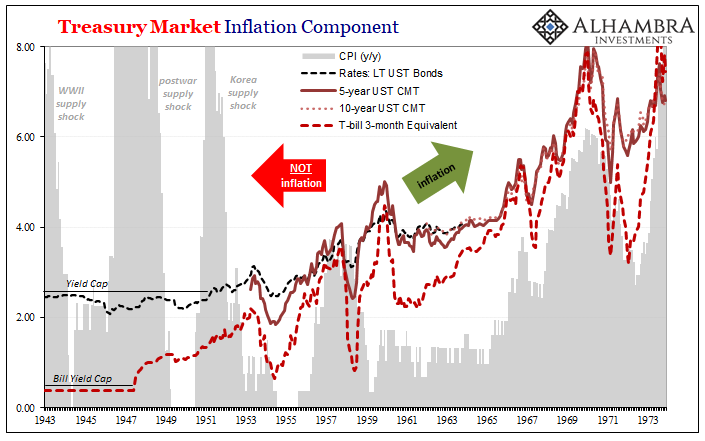

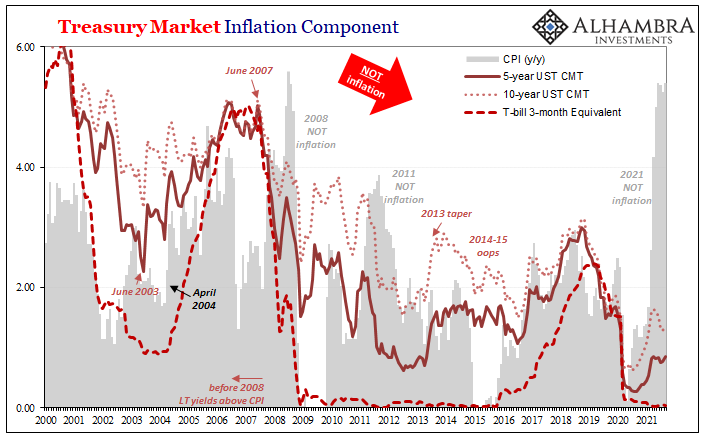

Supply shock versus inflation. There’s a huge difference, both in terms of what causes each and how they play out. As discussed in great detail here, it is the bond market not central bankers which repeatedly has proved it can sort out this enormously consequential distinction. Bonds know if there is an overflow of money, they need to pay attention and work out to price how it would last.

If no money, it won’t bother longer-term yields because however severe the consumer price bulge in the short run it can’t and won’t last for very long.

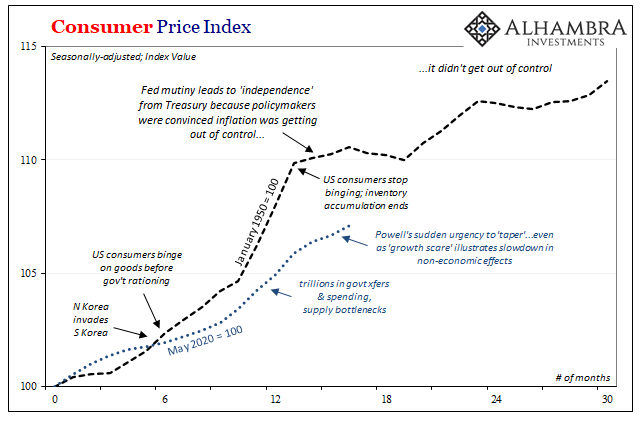

This is a consistent pattern that has played out time and time again through history. At least before there was an unnamed inflection; “something” momentous must have changed right after the last bout of supply-shock-not-inflation-consumer-prices in 1950-51.

Here’s what the BLS noted with profoundly unsatisfied curiosity about that on the occasion of its CPI reaching a full century back in 2014:

In retrospect, the early 1950s mark a turning point in the American inflation experience. The decades leading up to the Korean war era featured alternating periods of sharp inflation and genuine deflation, with the former generating active efforts to control prices and the latter generating fears of recession and, sometimes, active efforts to raise prices. Although severe inflation and even price controls would return, the post–Korean war era would look different from the 1941–1951 period, with less volatility and a near absence of deflation.

This “less volatility and a near absence of deflation” also sounds suspiciously like what James Stock and Mark Watson would write in 2003:

But because most of the reduction [in volatility] seems to be due to good luck in the form of smaller economic disturbances, we are left with the unsettling conclusion that the quiescence of the past fifteen years could well be a hiatus before a return to more turbulent economic times.

Neither the BLS nor Stock and Watson could come up with a reasonable guess to fully explain what changed, and happened. Still, even nothing was better than Economics which just made up “expectations” and the Volcker Myth.

Let’s just review the facts: before the middle 1950s, “inflation” tended to be the short run variety caused by other factors than money, a currency regime which was more preoccupied by its own tendency to be in short supply, thus deflation and depression.

From the mid-fifties onward, globalization, prosperity, low-volatility economic growth with this inexplicable “near absence of deflation.”

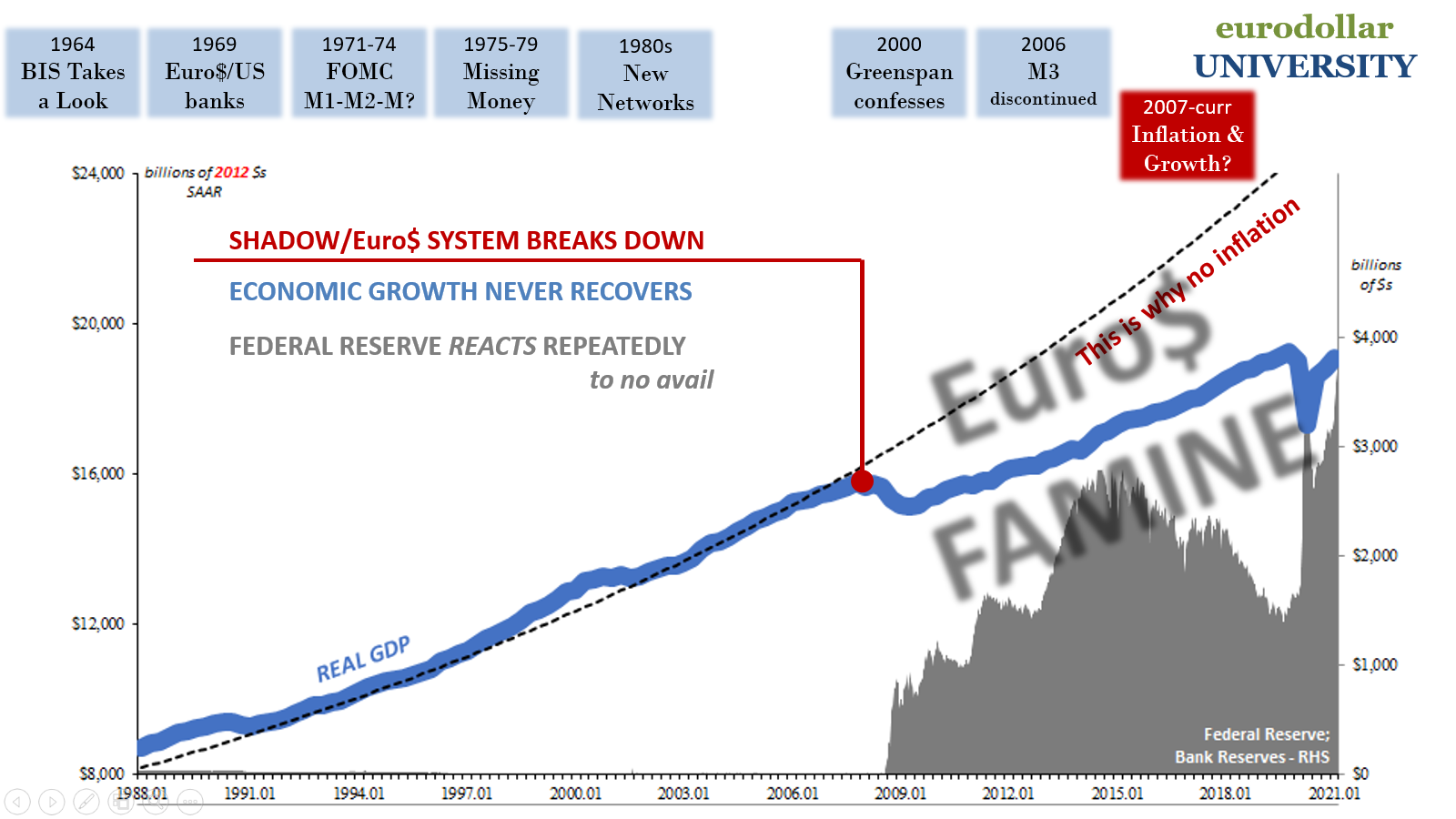

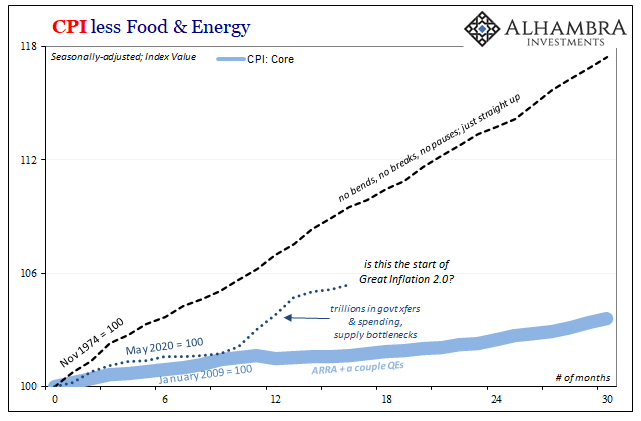

This paradigm seems to have lasted, while including the serious and actual outbreak of inflationary money during the Great Inflation sixties and seventies, until just a few years after Stock and Watson wrote their paper.

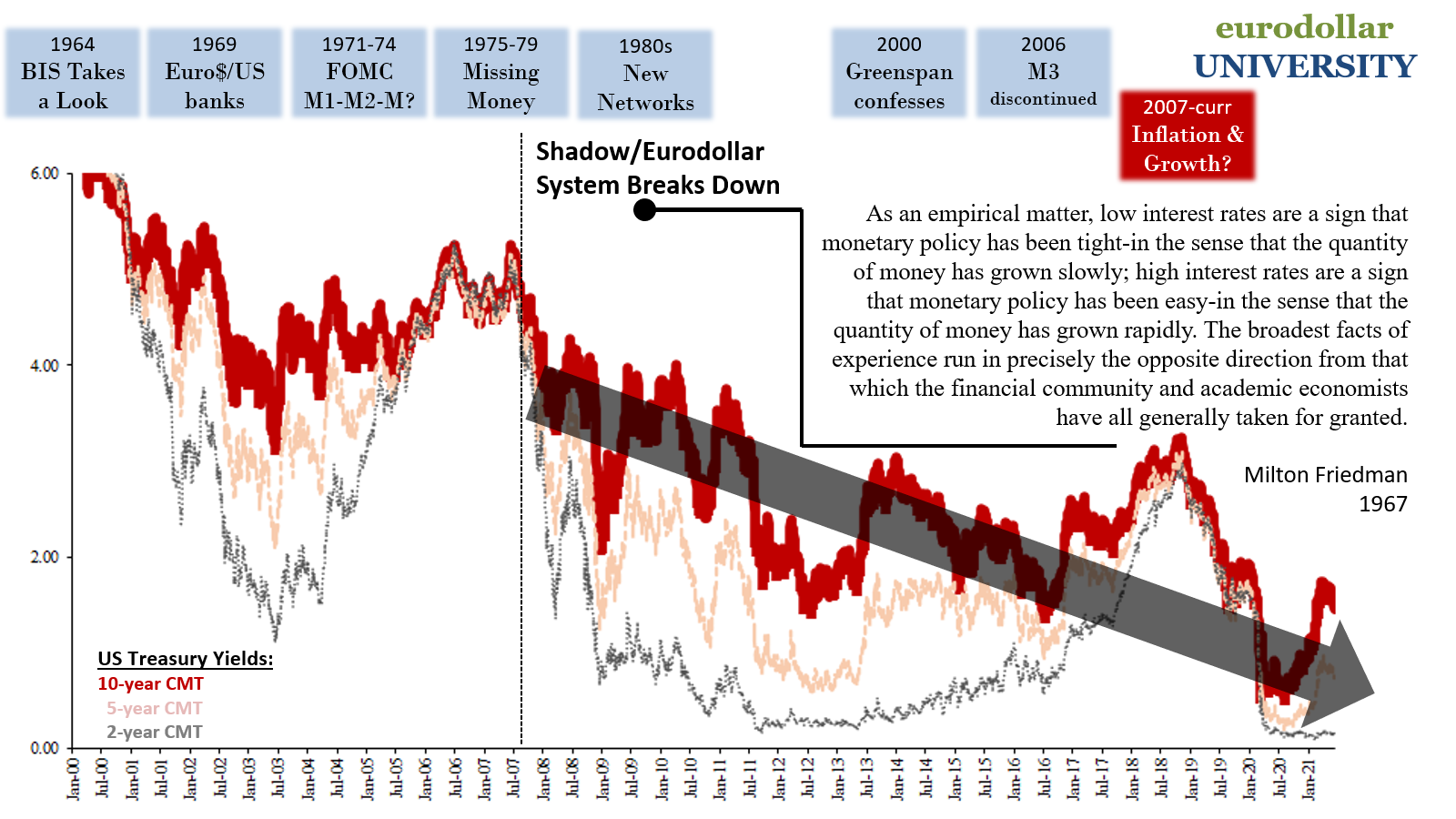

In exactly August of 2007, our “good luck” seems to have run out with the unwelcome return of consumer price and economic conditions more akin to the pre-1955 setup. That is, non-money “inflation” punctuated again by inelasticity producing at the very least damaging disinflation if not, at times and in places, outright deflation (there needn’t be 1930-levels of it for deflation to cause enormous havoc and harm).

What could possibly account for this stunning difference in overall character of the global economy? A multi-decade isolated case, an island of global prosperity almost exclusively found to be inflationary than not, a highly distinct period which began around 1955 and lasted until August 2007?

I apologize for the over-the-top sarcasm, but if you’ve never heard the term “eurodollar” or realized the full extent behind it, such as Watson, Stock, Bernanke, Greenspan, Volcker, the BLS, etc., this is a question seemingly without any answer. Might as well have been random good luck; might as well base “monetary” policy on magic and puppet shows.

If, however, you get the eurodollar, this same question answers itself.

This also tells us why bond yields in 2021 seem to have gone so far back in time; they have returned to their pre-1955 tendency to view “inflation” as needing the quotation marks, therefore nothing to bother longer run yields when only faced with non-money factors. The greater danger outside either end of the eurodollar island is as the BLS described, downside if anything.

What’s going on today in terms of the CPI and those non-money factors, usefully, helpfully similar in so many respects to 1950’s supply shock variety. Right now, government helicopters boosting consumer spending creating bottlenecks. Seventy years ago, government supply bottlenecks through which war-wary consumers tried to squeeze everything possibly for sale.

Consumer spending (PCE, or personal consumption expenditures) only accounted for a fraction more than 4 percentage points of each of those quarterly gains. Over half of the Q1 increase was inventory restocked after the ’49 recession lows.

Then came the war.

Americans responded to the news by absolutely binging on goods. Consumers shopped for all they could find, and then went out and bought some more.

The BEA says Q3 1950 GDP again surged this time by another enormous 16.4%, of which 13.4 percentage points was due to people buying mostly durable goods.

Hardly gluttonous, the US public knew full well what war in Korea would mean for their own households. Having suffered through the prior conflict ended only five years earlier, memories had remained fresh and sharp as to the forced privations which quite naturally surround any truly national struggle.

It kept up until the first half of 1951. Guess what? The Federal Reserve saw this supply shock “inflation” as inflation, too! Just like in 1936, 1947, and once again in 2021. The people who we are always told know the most about the monetary system can’t ever distinguish the effects of money on consumer prices from non-economic causes; as if they have no idea about the monetary system.

The Fed back then even went so far as to force its “independence” from Treasury, creating a serious political scandal during the early months of the war, all because its policymakers were absolutely convinced inflation was going to get out of hand unless they were finally allowed to do something to head it off. That’s what independence was all about, these people committing the same error.

Even before the Federal Reserve achieved its independence in March 1951, consumer hoarding died down and so did the CPI. Bonds had already traded on this monetary distinction.

This, too, sounds entirely too familiar.

The US consumer buying binge following North Korea’s invasion would simply offer another test of this highly crucial difference: bond yields neither predict nor depict the CPI, rather they quite accurately forecast and realistically reflect inflation.

There’s a huge difference between those two very divergent outcomes.

What, specifically, makes all the difference? For the post-1955 world, everything comes down to the one thing central banks don’t know: eurodollar money. It is why bonds got the Great Inflation right – and the Fed once again became a laughingstock. It’s why bonds accurately priced the Great “Recession” and its aftermath – while the stunned Fed channels its modern combination of astrology and mentalism in lieu of technical proficiency in this area.

Neither astrology nor mentalism is going to get to inflation in 2022. Nor full employment. Following the eurodollar, and recognizing the wealth of information about it supplied by bond curves and the like, you already knew that.

Stay In Touch