Have hedge funds acted rashly, perhaps stupidly? There is a segment of the population media that very much wants people to think so. According to recent data, fund speculators have gone long short-term US Treasuries, particularly the 2-year (as well as eurodollar futures), since early October. And not just long the short end, the most in almost seven years!

What idiots, right?

As Bloomberg rushes to tell you in the wake of last week’s flop, this month-long building up of long positions has already created widescale, widespread losses on them. After all, 2-year Treasury yields “surged” from around 27 bps to a high (intraday) of about 56.

See, whatever you do, Don’t you dare Fight The Fed!

Truly underwhelming, isn’t it, especially when you consider the whole rest of the global bond market. You can therefore see why this piece was written; having been trying to make “tantrum” happen so as to preserve the myth of the Fed’s central place in the system, this is really all that’s left available; this utter pittance.

The real world is the opposite of the way we're taught. It's bonds that don't give a crap about what the Fed is saying (or doing).

— Jeffrey P. Snider (@JeffSnider_AIP) November 4, 2021

As usual, @Hedgeye nails it.

'Tantrum' https://t.co/z8so6xlI1p

If the “rout” in the 2s doesn’t sound like any rout at all, a(nother) media mountain out of a minuscule molehill, that’s because it absolutely is nothing. And the article doesn’t do much by way of recalling what happened that last time, either.

So, in the interest of kicking off our week of landmine reviews, we’ll do it for everyone.

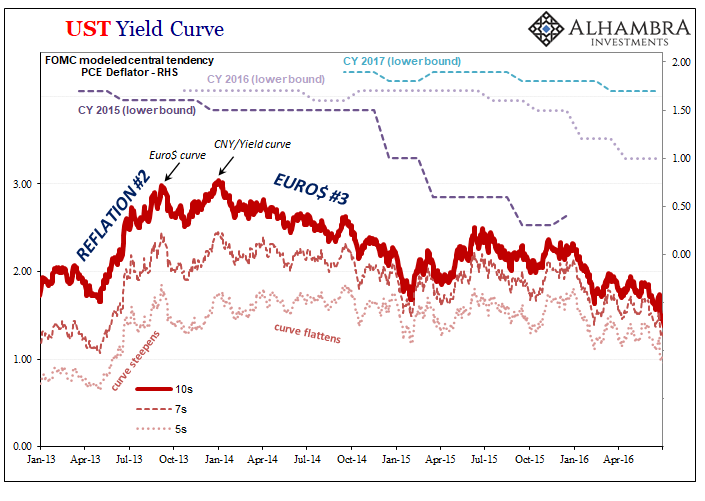

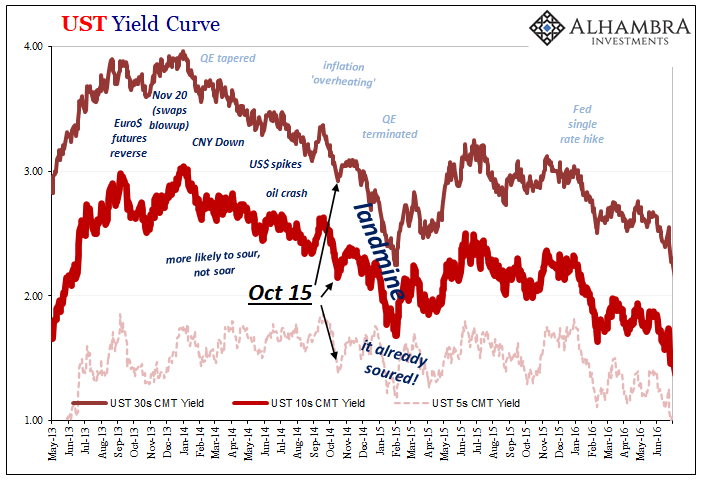

While there may have been a “tantrum” all over the yield curve in 2013, as Emil Kalinowski has pointed out this would’ve been better and more accurately termed a curve celebration since it wasn’t a tantrum in any way; as in, the bond market for a brief few months had begun to more seriously consider the economic assessment behind Ben Bernanke’s belief the economy was moving steadily forward (therefore, his reason for tapering).

By the start of 2014, and much earlier in eurodollar futures (September 2013), that celebratory agreement faded as the curve flattened back into depressionary disappointment. The state of the real economy globally, unlike how it had been characterized by everyone from central bankers to Economists to their puppets in the media, continued to worsen on every front – including underneath the US’s “best jobs market in decades.”

Late in 2014, landmine.

This being a widely agreed upon (by everyone who matters, meaning those in the monetary system who also trade in size in global bonds) point of no return, by early 2015 there was every reason to believe the Fed was all wrong as was the mainstream economic narrative.

It was supposed to have been increasingly inflationary pressures (this process really does repeat every few years).

Even as Janet Yellen’s FOMC continued to posture for more “hawkish” policies in words, promising what was would have been the start of a regular rate hike regime (meaning like Greenspan’s, a quarter point higher at every meeting thereafter beginning everyone said by the middle of 2015). In deeds, she barely squeaked out a singe rate hike before falling silent an entire year.

Deflationary rather than inflationary pressures broke out all over the worldwide landscape, in such fashion even the FOMC couldn’t deny the “overseas turmoil” and its material effects on what would nearly develop into a domestic recession (thus, why there was only the one embarrassing rate hike at the end of 2015).

In this post-landmine world, there was every reason to be tactically bullish on bonds – including those at the short-end. There would be opportunity even in the 2s for or after any short-run selloffs being driven largely by the uninformed betting over their heads on the mainstream, Yellen-ish viewpoint.

Outside of a few weeks around the one rate hike in December, short end Treasuries barely moved much at all and for most of that time yields were lower (including almost an entire year after it.) At the same time, the long end buying was sustained throughout (curve flattening even more dramatically) until Reflation #3 began to show up later in 2016.

Despite every single reassurance that inflation was the case, and the Fed was going to turn seriously hawkish, neither of those turned out to be true – those betting eurodollar futures and even upfront Treasuries were paid off having steadfastly shut out all that mainstream noise.

It was after December 2014’s landmine everything had changed; BOND ROUT!!!! risks had essentially disappeared outside of a few minor and temporary market fluctuations. None of this was ever reported in the “news”, of course, instead one article after another trying desperately to salvage QE’s reputation as inflationary and successful.

That’s really what this is all about, trying to salvage the conventional, central bank-centered worldview from what otherwise seems to be total confusion and chaos when in reality the real global economy is looking out instead for landmines the whole time (and then reacting to them once they happen).

The perpetually confused.

— Jeffrey P. Snider (@JeffSnider_AIP) November 6, 2021

Realize instead that bonds don't give a crap about taper, QE, Federal Reserve…

Irving Fisher. Early 20th century. Growth & inflation. Lacking in those, lower yields are really easy to understand. https://t.co/x64xtah5Mf pic.twitter.com/qanClrYK4f

Are these funds acting stupidly in 2021 by going long ST UST’s and eurodollar futures? Bloomberg would like everyone to think so, and believe they’ve already been badly burned by betting against almighty Jay Powell. But if all you can point to and overhype is a minor fluctuation up front after this major build up for “taper”, the Federal Reserve really must be that powerless and irrelevant.

That’s another point about landmines; trillions in bank reserves don’t do much to prevent the financial and economic damage they create once triggered.

In light of previous ones, what might these speculative positions also be telling us about the perceived possibilities – probability – of another landmine? Bloomberg and central bankers have to claim you’d be crazy to bet on it, because to consider anything else, no matter how many times it keeps happening, is to face uncomfortable reality about the whole thing. Why, in fact, the bond market and more just did and has been since not long after February’s Fedwire fiasco.

We aren’t quite there yet, but you can smell all the ingredients lying around the macro and money kitchen. Thus, it’s worth taking some time this week to review these mysterious landmines which only remain a mystery because of this desperation, the increasingly confused plea to hold on to the technocratic impossibility.

Stay In Touch