It hurts, so people want to know what to blame. Who should they punish for inflicting their pain? Enter human bias and the emotional processing of preconceived conclusions, “inflation” is no longer a topic which can be discussed rationally. A statistical weapon instead to be wielded attempting to settle other debates.

Joe Biden did it. No, this is a Biden Boom, must still be Trump’s fault somehow. Damn that Fed and its money printing!

How about none of those? If there is one thing we can all count on, whether we want to acknowledge this or not, when it comes to economics (small “e”) politics is rarely ever correct. And that is largely because of Economics (capital “E”). Both “sides” of the partisan divide rely on the latter and its high priests at the QE-spewing Fed.

But QE is not money printing, a fact of life left up to the commercial banking system which long ago (August 2007) largely abandoned the property. The global system’s actual money printers have told us all along, in increasingly urgent terms, whatever is going on with consumer prices in 2021 it has nothing whatsoever to do with excessive currency.

So, what is the deal with consumer prices? Given a single word to describe it: gasoline.

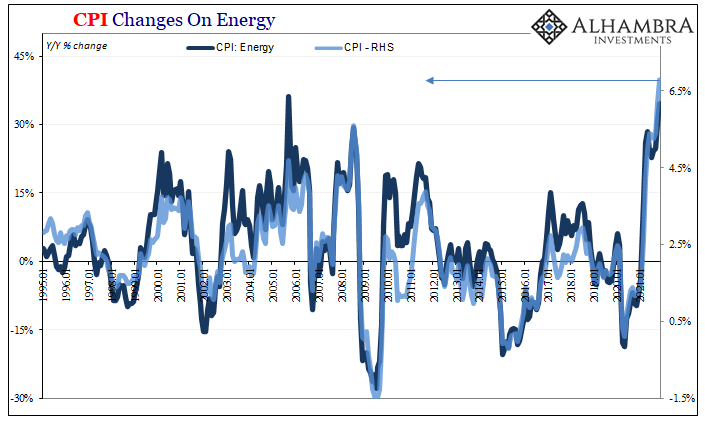

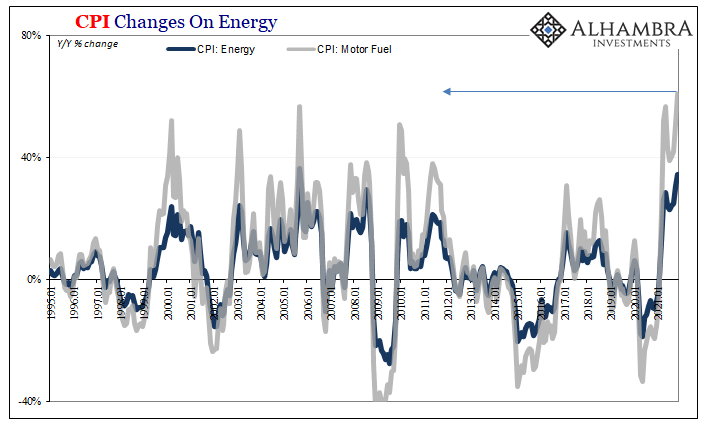

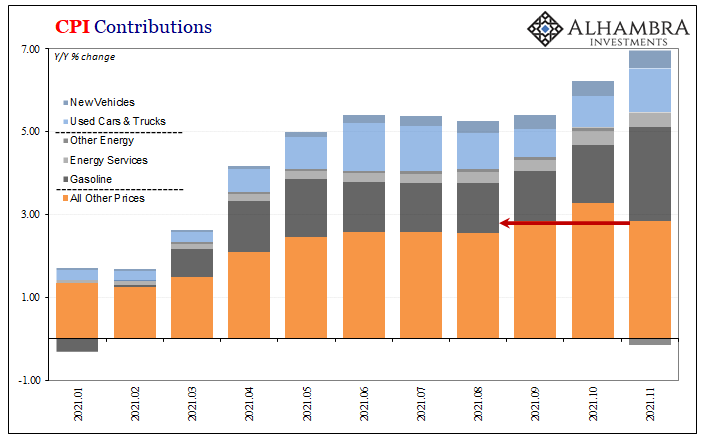

Oil prices bleeding into those for what the BLS generically terms motor fuel have been creating an outsized impact on the same agency’s Consumer Price Index dating back to March. In the latest monthly figure for November 2021, motor fuel prices alone would almost have met the Fed’s 2% (PCE Deflator) mandate.

That’s how much gasoline has contributed, and therefore exactly why emotions have, like the index, run so hot. It’s hard to escape the gasoline pump in today’s world. Using the BLS datasets, just gasoline prices accounted for a whopping 2.28% “inflation.”

In other words, if the price of every other item apart from motor fuel in the consumer bucket hadn’t moved one cent, the US CPI still would’ve been an uncomfortably, unusually (for the post-2008 world) high 2.28%!

We don’t live in such a world of ceteris paribus, however, so other prices have been rising precipitously, too, if not quite to this absurd extent and involvement. But it isn’t all those others which are responsible for the overall CPI just barely missing 7% year-over-year in November.

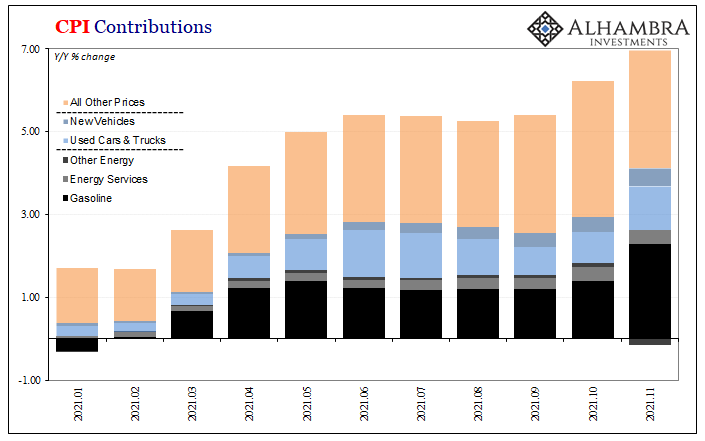

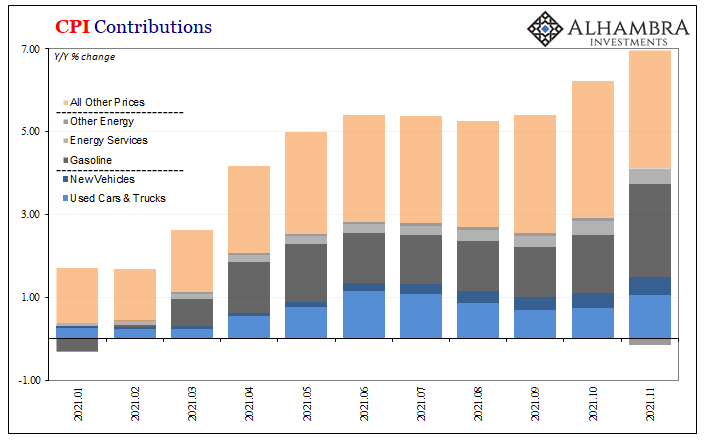

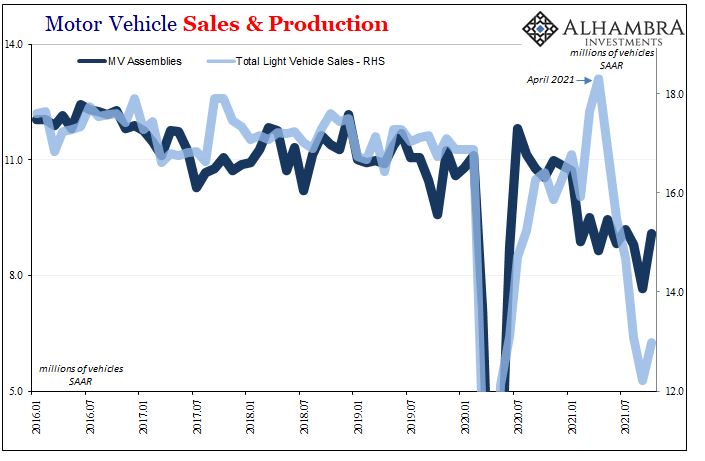

If we break apart the bucket, as I did last month, in addition to gasoline and other forms of energy prices (energy services like what utilities charge) the consumer price numbers are being influenced the most by automobiles; used cars, in particular.

For just those two categories, energy and autos, the contribution to the November CPI was up to an astounding 58%. The index apart from those two would’ve gained just 2.8% year-over-year last month. And that rate was actually the lowest since August; down significantly from October.

That’s still higher than has become normal, and you can’t just ignore gasoline like you can vehicle prices by not buying a vehicle, yet we are narrowing down the bucket to its basic cases for the purposes stated at the outset.

Why so much pain from mostly these narrower slices?

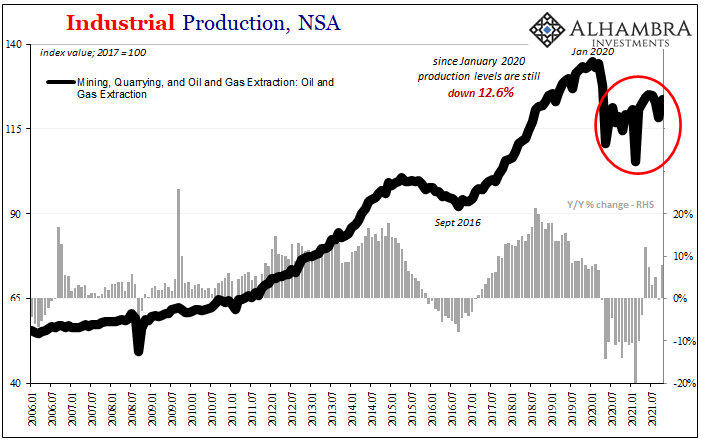

Supply. Supply. Supply.

They aren’t making cars because, they claim, mostly a chip shortage. They aren’t pumping oil because, they claim, something about geopolitics and other factors. Demand has gone up while supply has to a far lesser degree; small “e” economics demands prices adjust upward.

No need for a single printed Federal Reserve Note in either.

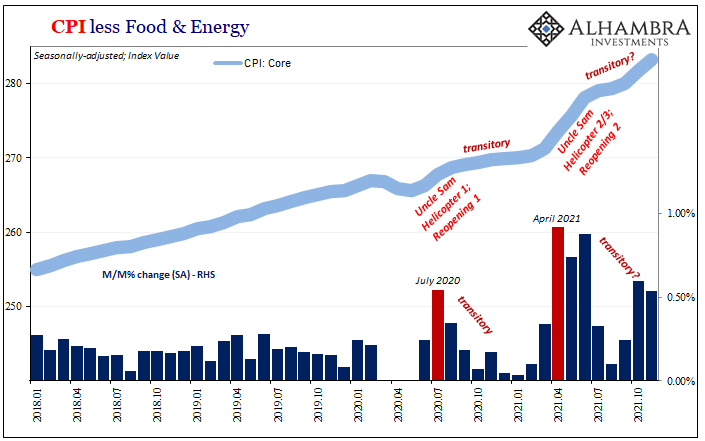

But wait! Maybe the Fed’s QE didn’t do any money printing, but Uncle Sam sure did with his epic helicopters. Trillions were electronically delivered directly into consumers’ hands who then flipped them into Amazon accounts filled with orders for goods coming from overseas.

While that had the effect of temporarily boosting the demand for goods from around the world, and this is largely responsible for the earlier kink in consumer prices apart from energy and autos, there really hasn’t been much or any lasting effect in anything, really, including the CPI and related.

The BLS’s core inflation measure, while the annual rate is the highest in seemingly forever, it has come in bunches and those bunches are due pretty much entirely to the non-money “inflation” fever induced by the motor vehicle trade. The core rate excludes motor fuel and food, but it leaves in it this other which accounted for a third of the nearly 5% annual increase.

The other two-thirds came almost entirely from April, May, and June.

More to our point, however, the further you get away from goods the less of even “inflation” there has been. This would then suggest, like overall spending figures provided separately by the BEA, even the Uncle Sam helicopters were only influencing a very narrow slice of the typical economic life.

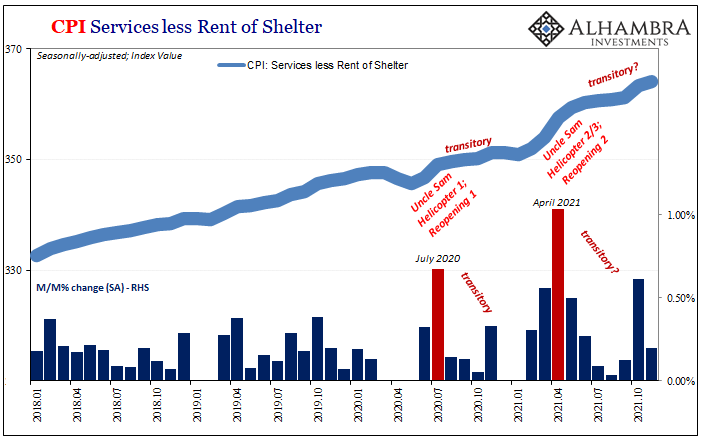

Furthermore, that influence is absolutely and clearly waning. October had produced a single upward lurch in the core services CPI (below), yet already in November back down to very little.

This leaves us, and the CPI, with pretty much supply factors and even then primarily motor fuel in November. There had been an earlier influence in the first few months of this year during the helicopter drops when supply and demand more broadly were the most imbalanced, over time that situation has become more rebalanced (see: inventory) apart from, once again, cars and gasoline.

By other data and market accounts, it seems to be weakening demand overall which has accomplished much of that rebalancing; which certainly seems to be the case in services.

Not only does all this argue against “money printing” in any sense, it also indicates a lot more. LABOR SHORTAGE!!!! and all that, but apart from those narrow goods prices there’s nothing here to suggest especially service providers being able to pass along the alleged labor shortage to consumers in what everyone says is a booming economy.

Because services businesses don’t want to? Or because they can’t? If more the latter, then “inflation” doesn’t just take the quotation marks it also brings with it the bond market’s skepticism about more than just the future state of consumer prices.

Who does this leave us with to target with out torches and pitchforks?

Oil producers who don’t seem very confident despite WTI’s levels it will hold up; auto producers who left themselves to the mercies of semiconductor producers, assuming that they, like in the oil patch, aren’t in reality all that optimistic, either; and the disappointingly brief imbalance earlier in 2021 the federal government (under both parties) dropped on the system which was promised to give the economy a recovery-like push when instead it just created a bigger mess already being ironed out if possibly negatively.

In short, no wonder “growth scare”:

What was it that could have spoiled the trend?

To start with, Uncle Sam; helicopter payments and other transfers were heavily front-loaded into the first few months of 2021. Ever since, they’ve been fading and falling out, leaving the underlying real state of the private economy more exposed…

Another possible factor, that very “inflation”; oil and gasoline prices, in particular. As history has shown, you want to interrupt pretty much every positive economic trend possible, merely “introduce” an oil price shock and then sit back and wait for the inevitable downturn if not full-on recession.

Many people won’t want to believe it, but, yes, even this “epic” CPI high and all its related data actually fit the profile. Thus, yield curve, Euro$ futures, rising dollar, etc.

Stay In Touch