For the FOMC, there was no alternative. The CPI’s keep going higher while the unemployment rate continues lower. Those who are Economists and practice Economics’ brand of econometrics, these would be scary times ahead. Inflationary times unless someone puts a stop to them first.

Not because of consumer prices today, but because officials are worried consumers are becoming normalized to these high rates of price acceleration. If the public and businesses all begin to expect these to continue, according to the unsubstantiated official theory, for central bankers (who don’t work at an actual central bank) that combined with a tight labor market is nearly their worst case.

Thus, today double taper.

Rather than go through this convoluted, misdirected pathway to inflation and expectations, Jay Powell and his committee might instead take the direct route. We don’t actually need this astrology to somehow divine consumer emotions, nor should anyone take the unemployment rate at anything close to face value (some lessons really should stay learned), we have at our disposal all the information we’d ever actually need.

The problem, of course, is that understanding this information necessitates understanding the Federal Reserve is not a central bank and its QE is not a monetary response. On the contrary, this entire taper fiasco is but more direct proof, real-time evidence as to what I’ve already written here.

Long-term bond yields were supposed to be rigged by the Fed, completely under the whims of the deep-pocketed official desk in its New York branch.

For the past nine months or so, first whispers of taper, then full-blown demands for it, followed by its official announcement and commencement and now today a double-time to taper’s pace. Yet, for those three quarters of a year the same LT yields have marched lower; not in a straight line, taking only the usual very mild seasonal detour along the way.

For all the entire media’s searching and pleading for a tantrum in exactly this yield curve space, these same “susceptible” LT instruments have refused every opportunity. Quiet as a mouse, the entire tantrum has instead been in that very media who can’t make sense of these developments for being unwilling to see the undressed guy running around calling himself the monetary emperor.

That guy is Jay Powell. Today, more than even recent days, we have been treated to the bare-naked spectacle; stripped of any stitch of clothing, holding no sway on money nor markets, yet all we ever hear is how powerful and well-appointed the man must be.

Why? Overwhelming evidence to back up this omniscience combined with omnipotence? No. It’s just what everyone says.

Double the taper, zero tantrums.

— Jeffrey P. Snider (@JeffSnider_AIP) December 15, 2021

I've been told – vehemently – that without Jay Powell esp. LT USTs would be toast. Not to mention last CPI.

Since FOMC announced taper on Nov 3, yields on 10s down 13 bps; 14 bps for the 30s.

Irving Fisher was right; the Fed's a cult. pic.twitter.com/zlI7ZL46V7

I keep writing, and I’ll continue to remind anyone open-minded and honest enough to see through the fog of myth, we have the monetary system itself laying everything out for us. Chairman Powell may not like the crystal-clear message because it undercuts his religion – it tears his cult entirely apart – the verdict is today as steadfast.

No inflation. On the contrary, deflationary pressures not only persist they continue to mount as the dominoes keep falling.

Jay Powell and his people are going to be buying so many fewer UST’s in the months ahead, and then stop altogether, allegedly a fatal blow to those very securities. Given the way taper is revered, as a byproduct of QE worship, you’d think that with now double taper there’d have been quadruple the tantrum.

On the contrary, what the Fed won’t buy the market is increasingly confident those in it will; and not just buy, but more and more likely to bid at any price. I said back in August there’d be no tantrum, plainly stating why:

But this is where the similarities to 2013 end; no tantrum anywhere in sight. This isn’t because the market doesn’t believe Powell’s group will do what they’re now more openly hinting. Oh no, it’s because the market doesn’t believe in what Powell believes.

The US labor data might be steady and even convincing about the current state of the US labor market and maybe the domestic part of the economy, but remember what Bernanke said back then; “and we have confidence that it is going to be sustained.” The FOMC’s confidence is rising while at the same time the bond market’s is plummeting.

So long as this remains the situation, there will be no “tantrum” even if there is taper.

Four months later, the FOMC’s confidence didn’t exactly rise, rather its backwards fears about expectations mush and the unemployment rate in lieu of anything else of use across what’s left on the official inflation “dashboard” and all because Economics leaves Economists (and those who follow them) in the dark about what really matters for inflation as well as economy.

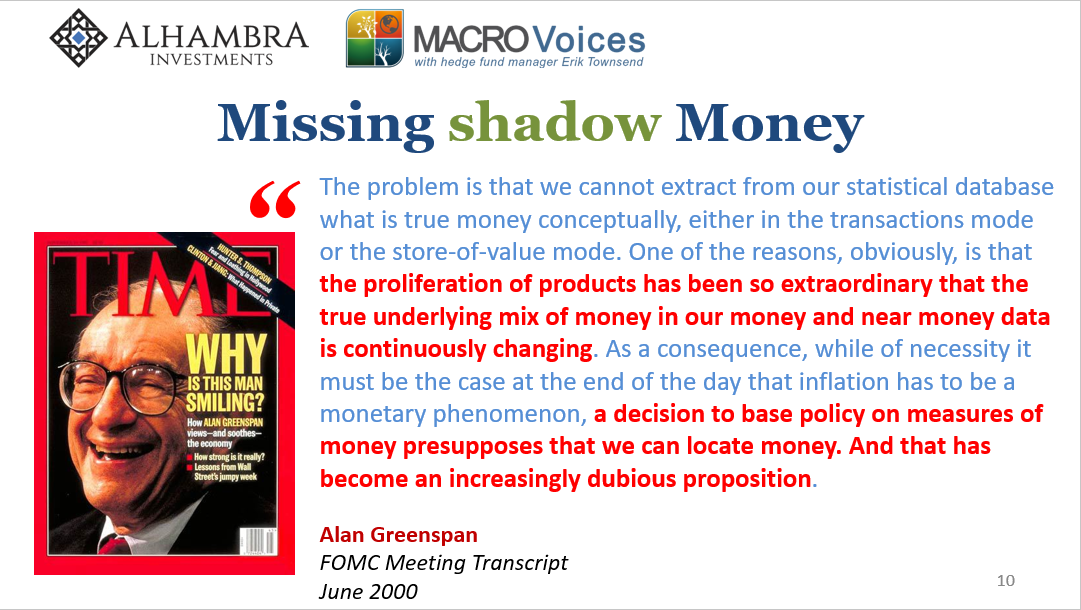

Money. Even the “maestro” knew that much.

Over these same four months, the market’s skepticism by contrast has gone up – way up – as the curves have traded flatter and down (one inverted). Confidence in all these things and then some: the FOMC’s got the (global) economic situation all wrong; being entirely too dependent on the unemployment rate which had already twice before led these same people astray in the exact same way; lastly putting the most emphasis on an inflation factor, expectations, that’s not even in the same unscientific ballpark as astrology.

We’re way past taper without tantrum. Today a good and timely reminder what this really has become: taper rejection.

FOMC: We're doubling down on the unemployment rate.

— Jeffrey P. Snider (@JeffSnider_AIP) December 15, 2021

Curves: We knew you would make the same mistake nine months ago. pic.twitter.com/s7KDXwEa16

Stay In Touch