Was this taking it a little too far, a little too obvious? Central bankers, since they aren’t real central bankers, their entire job is to project confidence. We get that. No matter what happens along the way, you can be sure policymakers aren’t going to ever let on in public they’re concerned. Think the famous scene in the Naked Gun movie where Leslie Neilson’s character stands in front of the exploding fireworks factory shouting, Nothing To See Here!

Over in Europe, energy was already pinching Europeans and then the Russian advance into Ukraine made it worse while simultaneously introducing even more risky scenarios (food, at the top of the list). To which the ECB’s top central banker pretender Christine Lagarde, donning Monty Python’s famous Black Knight costume, declared it all no big deal.

…even in the bleakest scenario, with second-round effects, with a boycott of gas and petrol and a worsening of the war that goes on for a long time – even in those scenarios we have 2.3% growth.

Is anybody (outside the media) really buying this? I’d wager she doesn’t, either, not really, and says so in private.

For one thing, the global economy may already be experiencing a downturn – one part based on oil gone too high, the other on a recovery built on the illusion of supply shock-ed prices – with Europe the unfortunate leader displaying both.

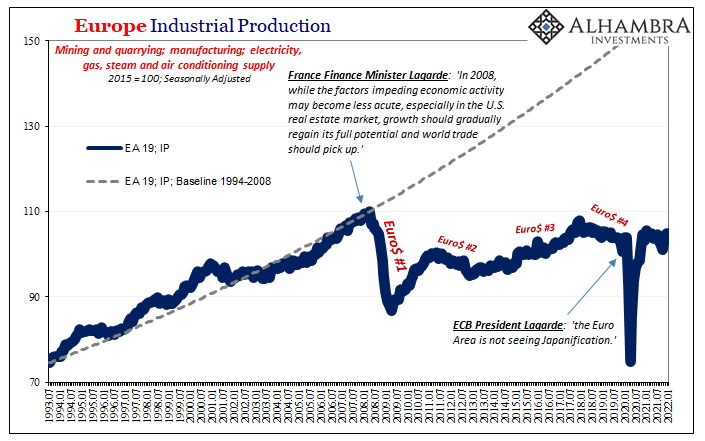

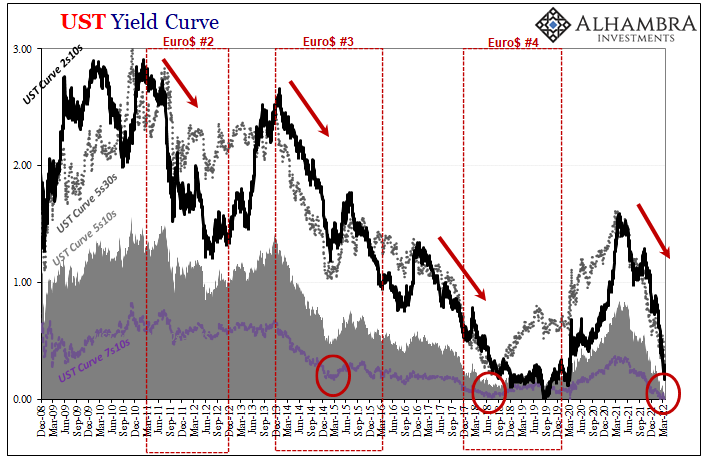

Ms. Lagarde’s task renders her incapable of making sense, admitting what’s obvious from just her own datasets or others gleaned from similar government efforts (Eurostat). While this week she said she “doesn’t see stagflation”, as recession dropped on Europe in December 2019 (pre-COVID) the newly-installed ECB Governor had similarly claimed she didn’t see Japanification back then (when you can plainly see it on the chart above).

What world do these people inhabit?

It is a rhetorical question; the answer is a planet dominated by psychology, or at least that’s their working theory (which doesn’t work very well, according to every last bit of evidence).

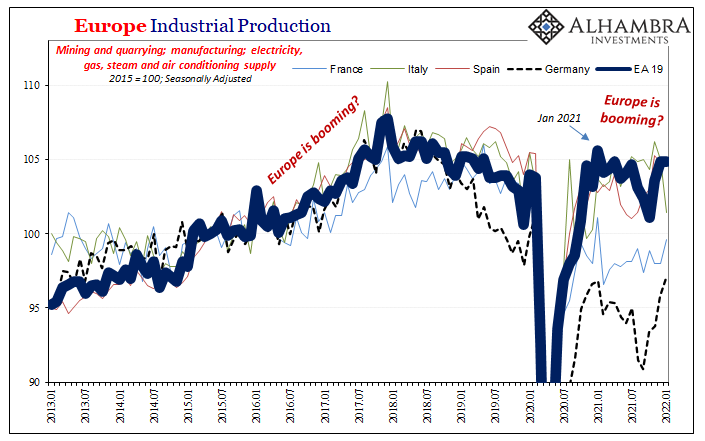

Building upon our earlier assessment of recent sentiment figures, starting in Europe we find that the “hard data” is right there backing up them up, those like levels of Industrial Production where stagnation would actually be a preferable result to what’s going on there now.

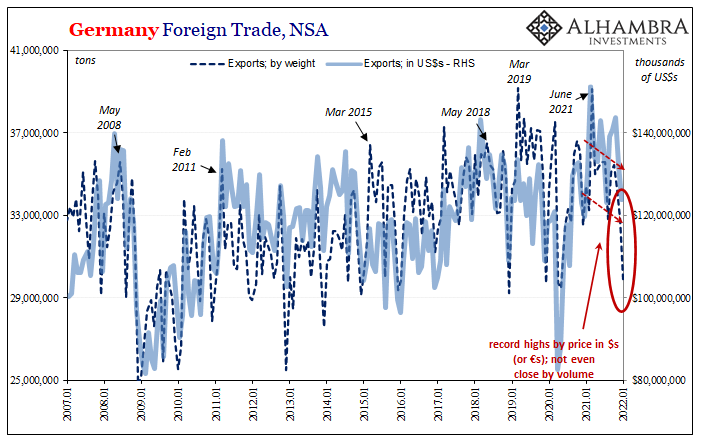

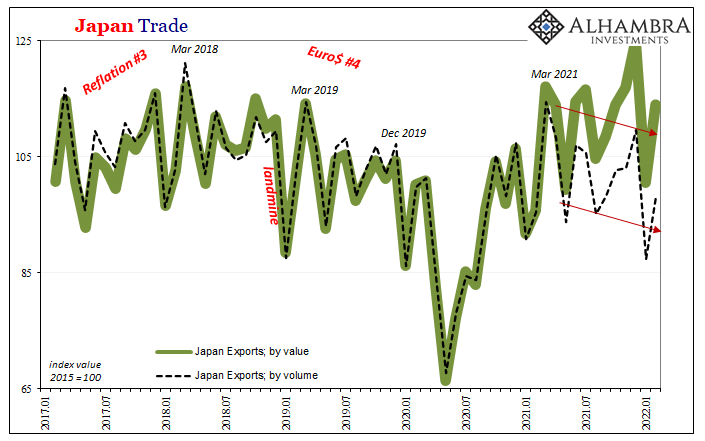

A big part of the reason isn’t the shortage of semiconductor chips or other supply problems widely blamed, rather it is the other side of last year’s massive price illusion. The economy just looks much better than it is, or was, especially when it comes to trade leading (or, in this case suppressing) production.

The mismatch between value and volume speaks enormous volumes about the prospects for pre-Russia economic distress. Jumping ahead of the hard data, the Markit sentiment numbers for March already fit these poor trends, suggesting they’re going to continue:

The figure for manufacturing sentiment fell to 57.0, which sounds pretty solid, yet was the lowest in 14 months due to a slower output reading but mostly a clear slump in new orders (nearest to 50 since July 2020) and new export orders dropping under 50.

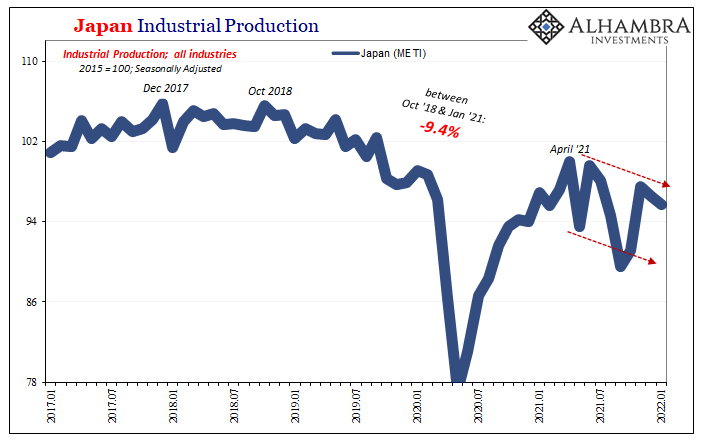

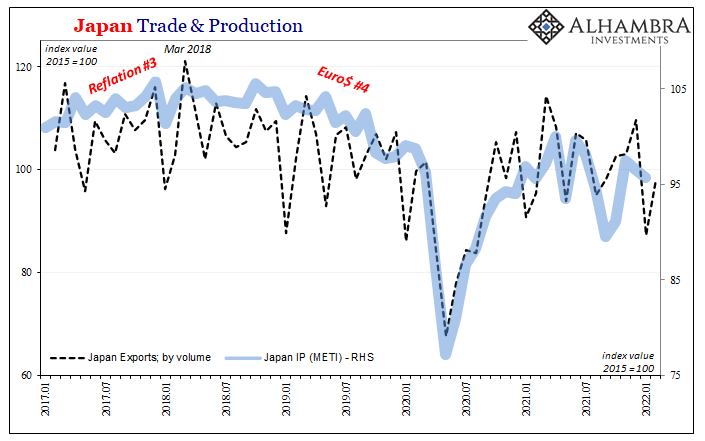

To drive this point home, here’s the twin dirty shirt to Europe’s: Japan. Global trade, the leader in determining the world’s economic direction over more than the short run. Same lackluster, same price illusion, same downward direction. Last year was a bust apart from prices paid, but prices paid alone are only going to create price pain all over the place in the future.

The global economy was already paying the price before the Russians raised it.

After all, a global economy that never really recovered from the last recession isn’t really going to be much for resisting high prices foisted onto it; the same prices which made last year seem like it was better than it actually had been.

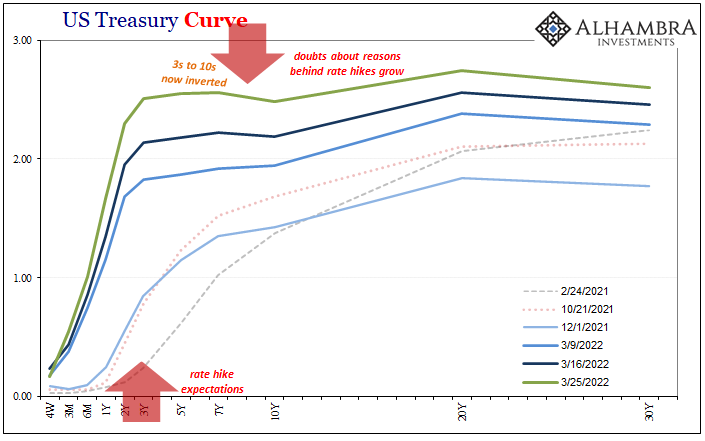

Maybe all these together account for why curves are so much more twisted and resistant to rate hikes, threats of rate hikes, and more promises of persistent inflationary threats. There are no shirts, there is no laundry, everyone and everything they’re wearing is all covered in the same dirt.

What there may have been of recovery, mostly just a dead-cat bounce from the 2020 recession, it had peaked way back in the middle of last year. Some places the downside case is already more visible than others, which has nothing to do with laundering shirts (or the quickly-forgotten COVID) and everything to do with timing.

Then again, not seeing stagflation nor Japanification, Europe’s top “authority” on the subject says you should be confident that the European economy’s floor is something like 2.3% short of nuclear annihilation. From that, the public might extrapolate as much or better across the rest of the world not so close or exposed to rewarmed Cold War geopolitics.

Just look at the US unemployment rate!

Yeah, no wonder there are so many deep pockets out there using the heck out of long run Treasuries and eurodollar futures to hedge the wild potential for demand destruction and downturn (or worse), these global rate hikes are inspired by nothing more than the price illusion combined with a heavy dollop of pedestrian Lagarde/Powell/Kuroda psychology.

Stay In Touch