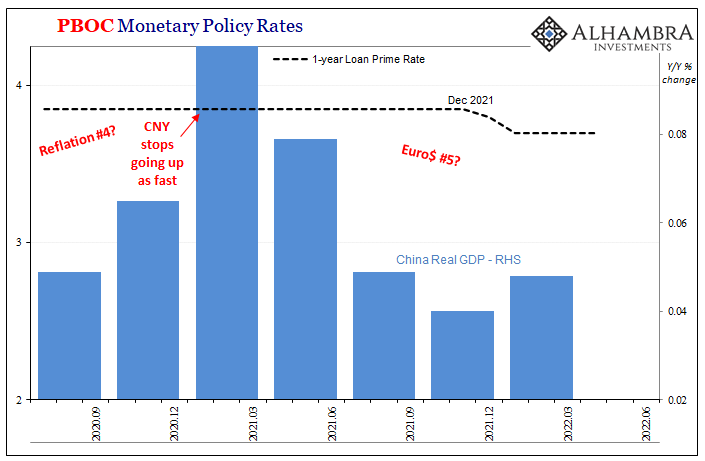

For the third month in a row, China’s PBOC refrained from guiding its quasi-credit benchmark lower. This seemed out of line with what Premier Li Keqiang, in particular, had stated last week before authorities did drop the RRR rate on Friday. Saying that China would “step up” support for its faltering economy, however the RRR cut was half of what had been expected.

Now the central bank does nothing to the LPR.

Authorities had cut the country’s 1-year Loan Prime Rate (LPR) once in December and then again in January. Oddly enough, those were unexpected by most Western analysts. Since all indications have pointed to more weakness yet to come, despite some favorable initial January-February data, since then the same analysts have been predicting (myself included, if anyone would call me one of those) persistently lower LPR.

Without that, it has left many to wonder what’s going on over there. There are those who now question if maybe China’s central bank is being cautious because of the Fed. With more aggressive rate hikes here, the PBOC cutting rates there, according to mainstream theory, going in different directions would risk a decline in the Chinese currency against a “stronger” US dollar.

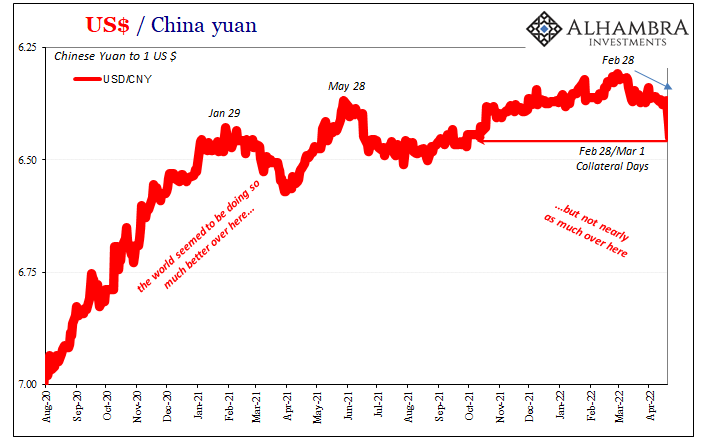

On the one hand, that’s not how the dollar works. And on the other, CNY has tanked anyway the past couple days even without the rate cuts.

Macro analyst concerns instead center around corona outbreaks, meaning the authoritarian pandemic policy pursued by Xi Jinping’s government.

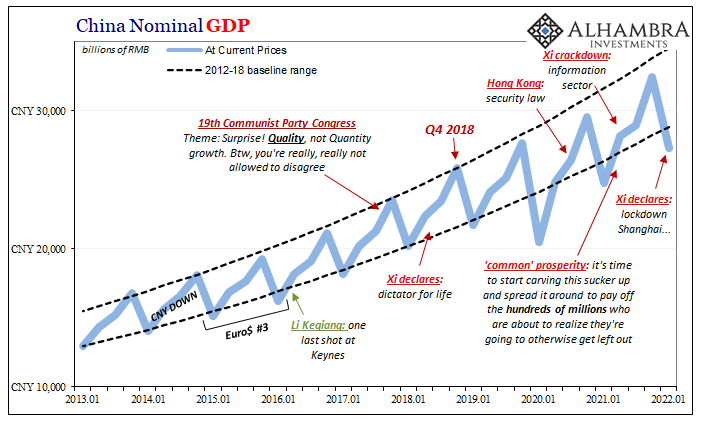

I maintain this is backward; China’s zero-COVID isn’t really about having zero COVID. Rather, the Chinese response to both current and likely future economic weakness is unlikely to be found in the PBOC, thus the “disappointing” lack of any real action in April.

Instead, Xi’s answer to the economy’s plight is what you see in Shanghai – especially since this rather than huge “stimulus” keeps more in line of past political and economic trajectories. The economy is going to do what it is going to do, and the Communists are intent going along managing its decline.

Sometimes that would be more benign, at others, well, what better (in the most perverse sense) demonstration of raw government will than to put in near-total lockdown (over a tiny fraction of the population becoming infected) one of the world’s leading and largest cities.

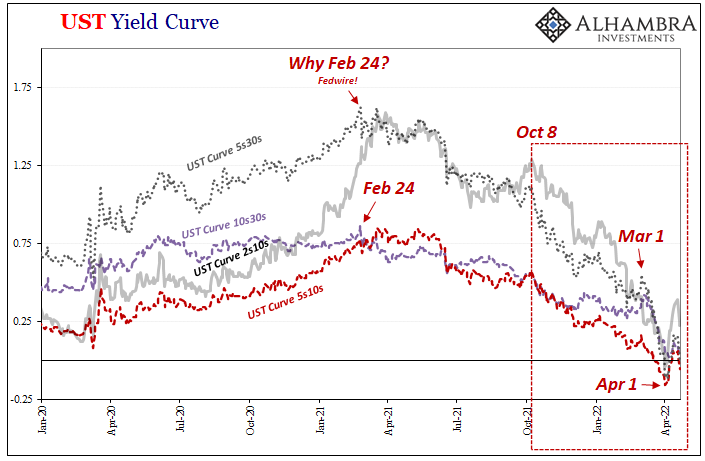

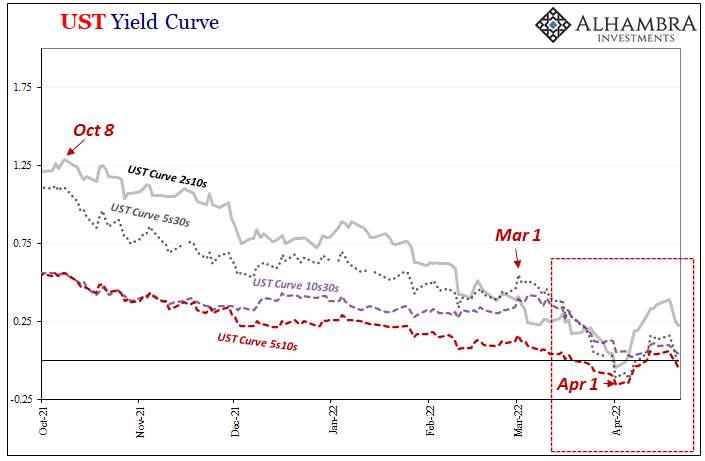

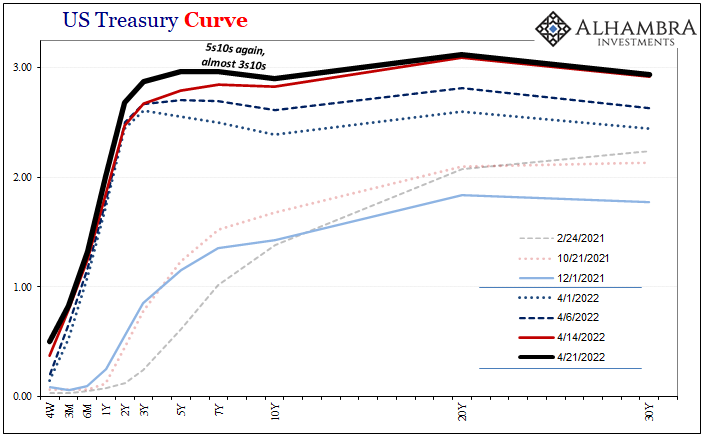

This only contributes more to global macro uncertainty, to put it kindly, depressing the current US Treasury yield curve instincts, among other growing financial negatives (like CNY). When this latter un-inverted earlier this month (though never fully, the 7s10s stuck upside down this whole time), how many were quick to declare the whole thing a farce and over with?

Pretty much everyone.

Unaware of history, fluctuations such as these are incredibly common; even expected. As it happens, now that it has, the curve will un-invert, re-invert, and go back and forth perhaps many times over the weeks/months ahead. This simply means whatever is nagging market participants, widespread concerns across the majority of participants, “it” is increasingly expected to happen.

Not surprisingly, UST yield curve re-inverted up to 5s again. This isn't unusual, short run fluctuations always happened. Like Euro$ inversion back in Dec, it will pop in and out until whatever's going to happen really starts to happen.

— Jeffrey P. Snider (@JeffSnider_AIP) April 21, 2022

Probability "it" will is high.

And we had just witnessed that very same behavior in eurodollar futures barely a few months ago; after first inverting to start last December, this other curve straddled inversion/un-inversion for nearly two months before going underneath more completely.

This is just the nature of markets.

As of yesterday, the 5s10s curve re-inverted before today the 5s30s joined with the 3s10s not far behind. Even the mainstream 2s10s, which steepened substantially after only two days upside down, if the “bad” form of steepening, that one is heading back in the wrong direction yet again.

Why?

One is a healthy dose of unhealthy money meaning collateral; which we showed very clear evidence of here. The other is risk aversion growing out of these very same macro concerns proliferating across the world rather than red-hot economic inflation.

It is “inflation”, mostly, to go along with inventory (the latter itself a contributor to the former) creating so much nastiness. Nothing has changed as it pertains to those, nor anything about what remains bad and wrong about the monetary system, collateral and otherwise (these only get worse as more risk aversion sets in).

Putting all these things back into Chinese terms, the fact that Xi reacting to the economy his way rather than letting the PBOC, along with dollar difficulties and renewed curve twists, those rather than Fed rate hikes are CNY.

And if it keeps going, as we all might remember, CNY DOWN = BAD.

Will CNY DOWN = “it?”

Stay In Touch