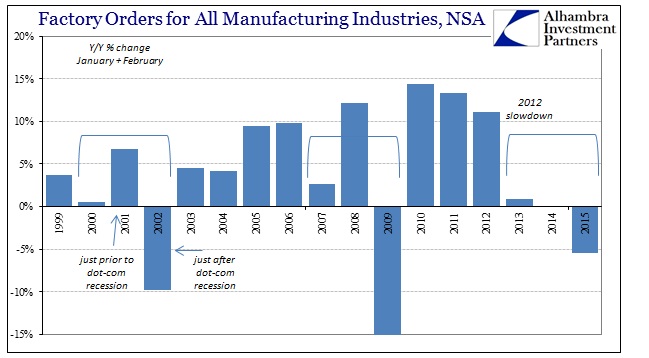

In viewing incoming data for January, it looked as if the “dollar” being exactly right about the US economy’s place within the falling global economy was increasingly correct. At that time, the declines in many accounts were way beyond even what we saw of 2014’s “snowy” disruption. That itself suggested that any repeat in 2015 was more than simple repetition, portending a potential end to even the elongated cycle peak process that began all the way back in 2012.

Factory orders, in particular, were highly suspicious toward that interpretation, as I said last month:

There are innumerable data points that strongly demand recognition of the 2012 slowdown for what it was, but they now increasingly have attained a rate of deceleration that shows at the very least growing instability in the US economy, if not a full-blown end to the cycle itself. Credit and commodities may have pegged this one exactly right in timing and degree.

To be more confident in that assessment would mean a repeat of the same in January into February – and even March (which has already occurred in some estimates and accounts). True to credit expectations, factory orders were just as bad in February as January, which means that “something” is certainly wrong and is not easily relenting. That raises, again, the possibility still further of serious economic dislocation perhaps forming into a full-blown cycle peak.

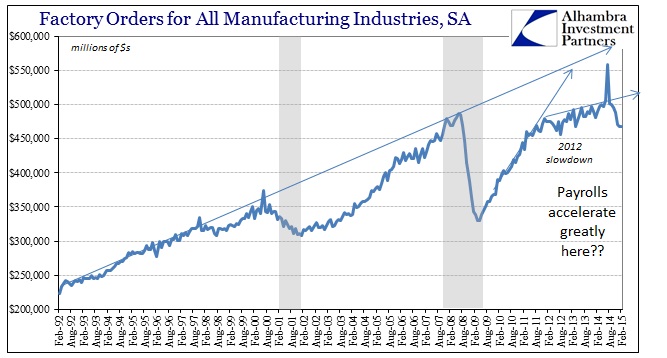

In seasonally-adjusted terms, factory orders increased by the slightest amount which is to say only that it didn’t get any worse. At an adjusted rate of just $468 billion, factory activity was the slowest pace (including January) since March 2013. That is a serious disruption in not just the already-weakened trend going back to 2012 but overall.

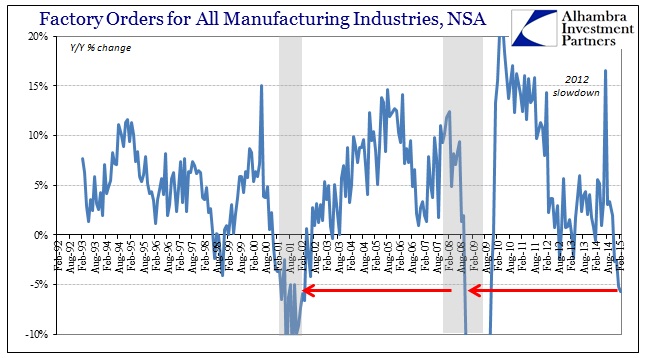

That point is emphasized when using the unadjusted figures – February’s level was 6.1% below February 2012! In terms of year-over-year growth, no commentary is needed:

This is the worst start to any year since 2009, by far, and only equivalent to recessions. That comparison includes not just a negative sign in front of the “growth” rate, but more importantly the degree to which contraction has developed. Another such month without any deviation in trend would not only suggest full economic contraction but also raise the possibility of finally encountering the more traditional V-shaped part of the cycle.

As with this morning’s global trade assessment, this is perfectly compatible with the rising “dollar” as the opposite condition of the true strong dollar. It is increasingly confirmed that currency instability, in that direction, was foremost a function of bank balance sheet contraction under the perceptions of a weakening economic foundation. Any such feedbacks derived from that, including oil prices, only reinforces both that view and the financial/economic relationships.

We are, it seems, speedily moving beyond the point of “might it get bad” and moving right on into “how bad will it get.” Again, wholesale funding and the “dollar” short are not optimistic, but we don’t yet know how the intertwined nature of leverage and actual economic function might still unravel. That is, at this point, a source of both hope and despair.

Stay In Touch