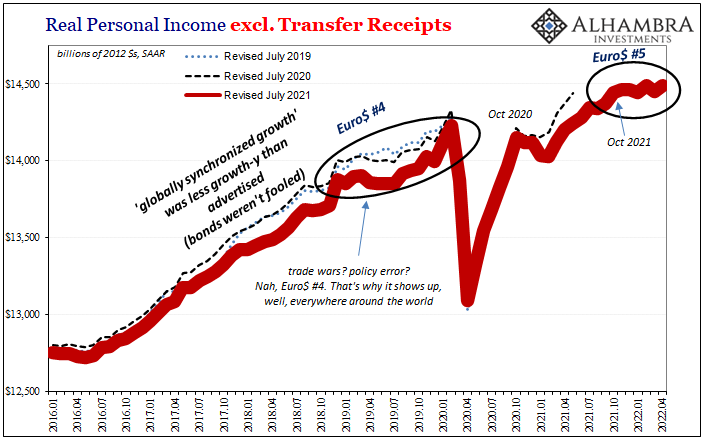

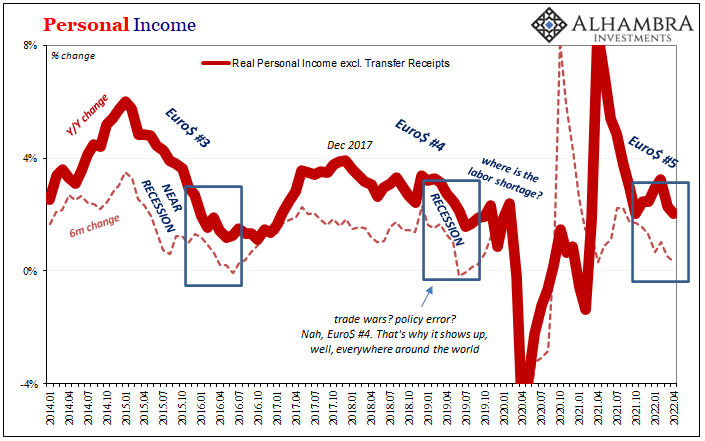

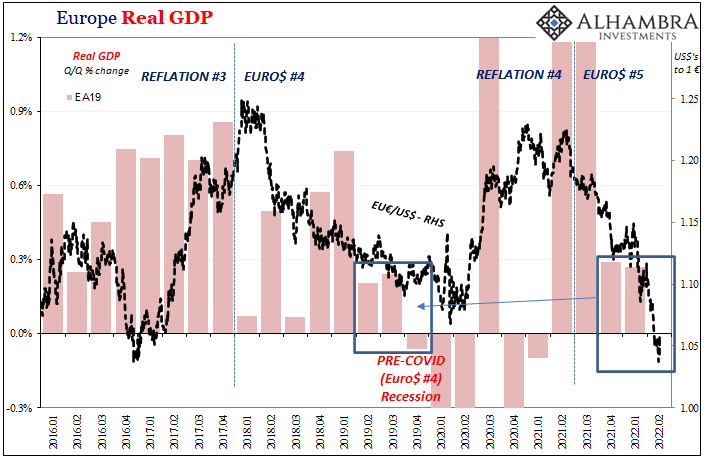

Another economic discussion lost to the eventual coronavirus pandemic mania was the 2019 globally synchronized downturn. Not just downturn, outright recession in key parts from around the world, maybe including the US. We’ll simply never know for sure because just when it was happening COVID struck and then governments overrode everything including unfolding history.

What anyone can say for sure is that 2019 hit a rough patch where there was only supposed to have been smooth sailing. The Federal Reserve rather embarrassingly had pitched a sequence of rate hikes needed to further smooth out the sailing only to instead begin battening the hatches with rate cuts (and then, following some “unknown” flash in repo markets, not-QE5).

However much it went wrong, we all can at least agree it didn’t go right. The question never really answered was, why?

At the time, most were content to blame a certain blend of geopolitics, the so-called trade wars. Yet, even the most academic of econometricians was hard-pressed to connect a relatively minor bilateral tariff exchange to the unleashed global havoc causing very real and widespread real economy damage.

The best they could do was “sentiment”; to assert how negative feelings beyond the countries involved must have spread around the globe.

Others fell back on their conventional training. As I wrote a few months ago, anticipating what’s about to happen, when in doubt just shout Fed, Fed, Fed:

And Economics demands total fealty to the central bank (whichever one). So, if an economy is rip-roaring one day but careening toward recession seemingly the next, the first (and last) place you’re supposed to look for answers is in the direction of monetary policy (even though there’s no money in it).

The crass disappointment of 2019, this group tried to say, was simply the dreaded “policy error.” The Fed had raised rates a notch or two too far (and QT-ed too much), stalling the economy and requiring rate cuts (and not-QE) to rescue it.

You’re not supposed to think much about any specifics; like how rate cuts actually slow anything, or assuming they do how a pitifully small 2.50% fed funds upper limit allegedly was enough to wreck what these same Economists had said in 2018 was an outright booming condition. Neither did they see the downturn coming, nor had they warned about the Fed crossing 2.25% as some line-too-far, just post hoc spit-balling to put forward some plausible-sounding explanation for why something went very wrong.

Global recession. Global reserve currency. Global dollar shortage. Euro$ #4, not any of that nonsense.

I don’t believe the public was buying the policy error, as shiny a silver lining as there could be, but like the ultimate destiny for 2019’s economy we’ll simply never know.

To revisit this again from February, what we are about to witness unfold is increasingly likely (if not already), “an economy is rip-roaring one day but careening toward recession seemingly the next.”

As Emil Kalinowski has repeatedly warned, “they” are going to try to take credit for it again. Yes, credit.

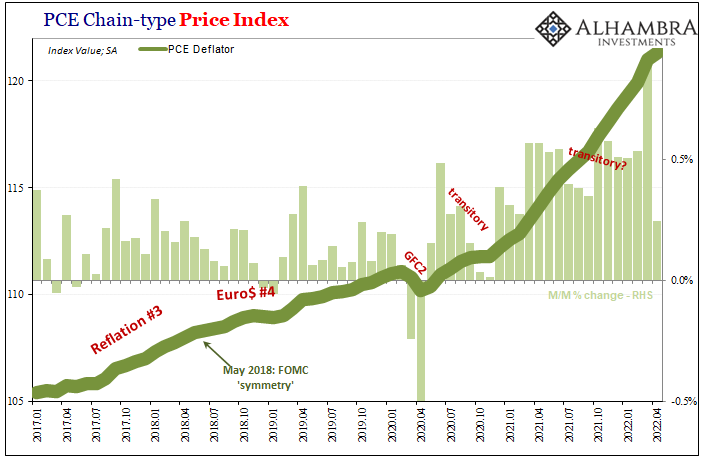

This time, unlike last time, the CPI and PCE Deflator actually did go way up. From what the FOMC has claimed, the only hope anyone has for relief is a sustained and aggressive series of rate hikes (and QT), otherwise Welcome To 1977.

That’s not what markets are pricing, however. And when I write “markets”, I mean all of them. Equities included. Even crypto.

In fact, there’s already much about 2022 repeating that 2019 zeal, only ten times the intensity. As before, eventually, the public will ask, why? One day we’re told it is seventies-style inflation, then, bam, suddenly all about recession.

Emil is right in that Jay Powell (and his legion of sycophants) will try to write himself into the Volcker legend, even to the point of saying the Fed provoked this recession (if one does turn up soon enough) just to tame inflation as the long-ago former Chairman once did.

Paul Volcker is widely credited in ending the 1970s Great Inflation starving reserves, purposefully pushing the USA into recession (twice). Balderdash! Volcker blinked when rates spiked. And it was stratospheric oil prices that brought on recession.https://t.co/rulcapeL6c

— Jeffrey P. Snider (@JeffSnider_AIP) April 26, 2022

Except, that was all a myth, too. The public largely bought it over the decades in between, the gaslighting undertaken during the Great “Moderation” to turn what wasn’t a central bank into the all-powerful money center so as to make real the theater spectacle non-money monetary policy had become (expectations policy).

At least Volcker had some numbers on his side. What has Jay Powell got?

If a recession shows up in the back half of this year, as markets increasingly price, he’ll be asking us to accept an even more preposterous assertion than 2019’s. That the biggest, most serious eruption of inflation (as he sees it) since Volcker was vanquished by, what, 1.50% fed funds? Maybe 2.00%, if they get that far (increasingly in doubt)?

It’s so damn absurd; when you stop and think about it.

That’s what truly propels these myths; you’re never supposed to ponder the details. Just accept as causation the mere correlation between the Fed doing something and whatever the result.

Insofar as 2022’s “inflation” might be concerned, there’s a building chance it’s already behind us. It was never once genuine inflation caused by a surplus of effective and circulating money, instead the simple (small “e”) economics of a supply shock. We know how those end; history provides ample examples.

Recession.

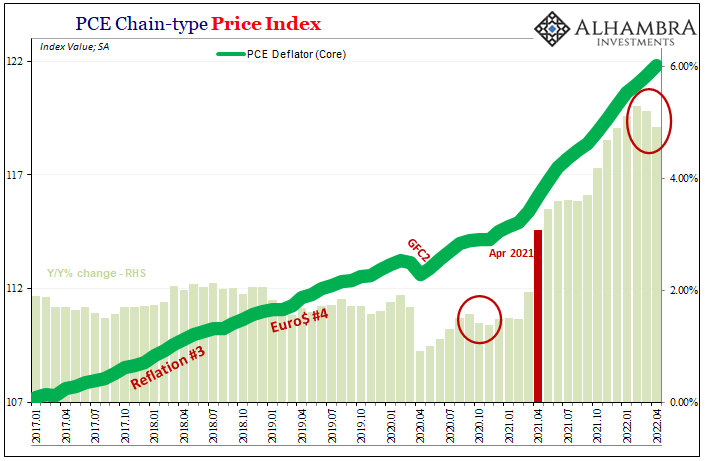

Markets have been moving toward that conclusion for over a year, ever since the PCE Deflator first erupted. There’s no mystery nor conspiracy; the only complication is to realize the money part was absent the whole time – which markets had shown from the very beginning.

Evidence from consumer prices is beginning to stack up. The Fed began hiking rates in the month of March, and now for the second month running the annual rate of change in the core PCE Deflator has decelerated. First time we’ve seen that since the transitory downslide pocket in 2020 between helicopters.

Was that because the FOMC chickened out and only managed a single 25 bps hike?

The second of its rate hikes didn’t hit until the start of May, so we couldn’t even account for the second month of price deceleration by actual policy action.

Like when the first set of confused observers had to append “sentiment” to “trade wars” back in 2018 and 2019, the desperate “policy error” group will repeat the folly. They’ll say the actual rate hikes didn’t make the difference – because obviously they didn’t.

Rather, the end of “inflation” was due to rate hike sentiment. The Fed talking up taper last year, forward guidance (that silly concept) altered to prepare the economy for upcoming aggressive hawkishness. A bunch of deliberate communications from 2021 that they’ll tell you turned the tide before the actual rate hikes.

One and a half percent fed funds is less of a ridiculous explanation than this mush.

But if you don’t know anything about money and macroeconomics, and they don’t, what else is there? If your worldview revolves around the Fed, then when something transpires it must be because the Fed meant for it to transpire. Even when policymakers didn’t mean for it to transpire.

As I stated, I don’t think the public was buying this garbage the last time. And I don’t believe people will this time, either. This isn’t to say that the Fed Cult won’t try to float the policy error and combine that with a stab at bringing back Volcker, I just don’t think they’ll be able to get away with it.

Stay In Touch