Critics of government debt, a group which really should include every taxpayer, like to point out how governments prefer to pay back that debt with hugely inflated currency. You don’t pay it off so much as inflate it away. Change the convertibility number for your local currency and, voila, a much more manageable credit profile emerges.

Only, there are often grave economic consequences for turning in this direction. Many see this as inevitable, underlying a large part of the dollar-is-dead thesis. Interest rates have nowhere to go but up, and the dollar has nowhere to go but down. The more time passes, the greater the imbalances in those directions.

Historically, though, that’s not really what happens all that often. In the old, old days, debt was given a jubilee; that is, governments just defaulted. It happened in the middle 19th century in America, when states went on a canal-building and public works program based on borrowed money and bad assumptions. The federal government (wisely) refused to bail them out and the debt was written away.

That’s not good, either, and can be more destructive than the inflationary scenario especially in the short run.

There is also a third option. You don’t so much inflate as grow out from under your obligations. This is the 1950’s set-up. Governments all over the world incurred massive, massive liabilities on account of WWII, some succumbed to inflationary currency but most including the US became fiscally responsible enough to benefit from rapid economic expansion without screwing it up (until 1965).

This is the path that governments are currently choosing, very much looking forward to it. Only they can’t seem to find where that path begins. To traverse onto the growth option, you of course need growth first.

No one argued much when fiscal deficits blew through all sorts of records around 2008 and 2009. Orthodox policy declared this the prudent course, automatic stabilizers and whatnot. Many wanted especially Western governments to get truly crazy, Paul Krugman notably leading the charge of “austerity” even in trillion-dollar US deficits.

Where does it end? It was supposed to end in recovery, but now that’s been (predictably) scrapped (again).

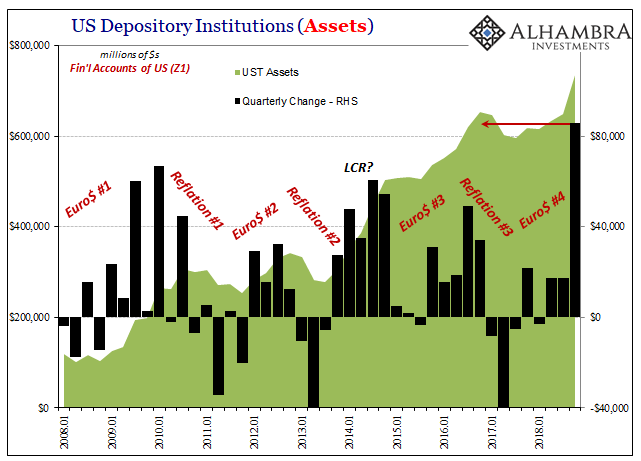

Yet, bond yields are dropping – not rising. The long-term risks grow even darker, but investors particularly the banking sector cannot get enough of government debt (despite what their own Economists keep saying in public). When faced with only bad choices, you choose to live to fight another day and let the chips fall where they may once you’ve secured your place beyond tomorrow.

This is the permanent lesson of Bear Stearns, as noted earlier this week. Ironically, it is these times when the growth option fades quickly into the background, lowering the probability that much more, when demand for questionable debt spikes highest. Liquidity concerns dominate even though by destroying growth it increasingly assures the need for more drastic steps in the future.

And, of course, this allows irresponsible governments to keep on being irresponsible, and all in the name of the economic growth which they never seem to get when rates go as low as they do.

Italy is one such mess, and a primary one. Last year, the new populist government submitted a budget which was rejected because it violated EU budgetary rules (that now all of a sudden are being strictly enforced). Negotiations took place, agreements were struck, the country back in line with those same rules.

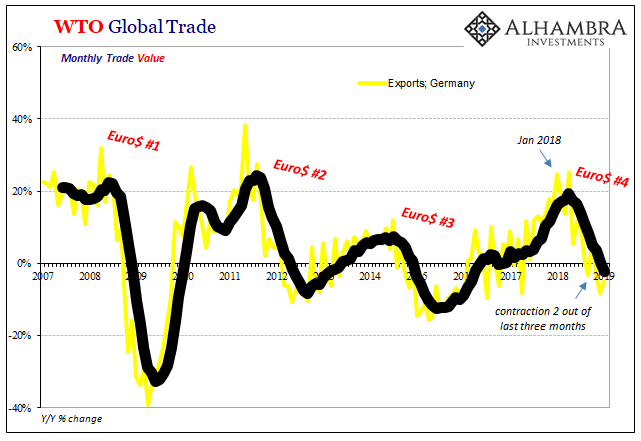

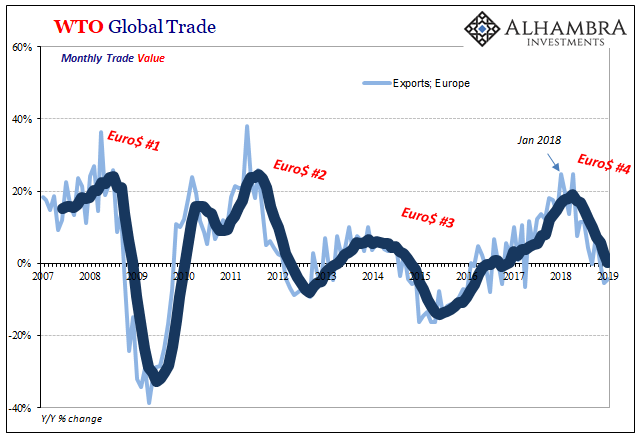

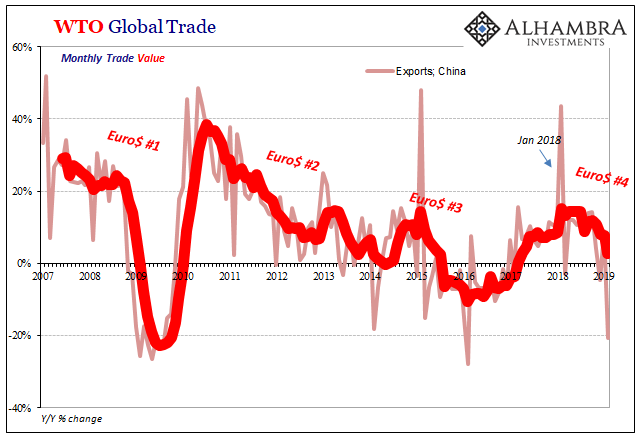

Except, now Italy’s economy is no longer growing and may be contracting already. Europe was supposed to have been booming last year. Instead, Italy, Germany, and many of their peers ran into some sort of unforeseen wall. The economy just stopped even as European authorities kept ignoring the warning signs.

Italian officials, it has been said, have recently cut their growth projections for 2019 to about zero, just 0.1% (and that’s being optimistic). So, renegotiated spending levels that were conforming just a week ago are probably going to violate deficit limits anyway. And Economists and policymakers are going to demand less “austerity” to combat what sure looks to be another recession.

It all sounds like a paradox. You need deficit spending to achieve the economic growth required to pay off the debts arising from those deficits. The longer you go without growth, the greater the accumulated deficits as well as the temptation to increase them further, therefore you need even more growth to avoid the catastrophic future scenarios.

That’s how officials see it, Economists and central bankers most of all. It isn’t a Catch 22. Italy’s problems are not Italian in nature. They are widely shared because the problem itself has been. Growth is elusive because nobody can say what’s actually wrong – even though it is, I think, pretty obvious.

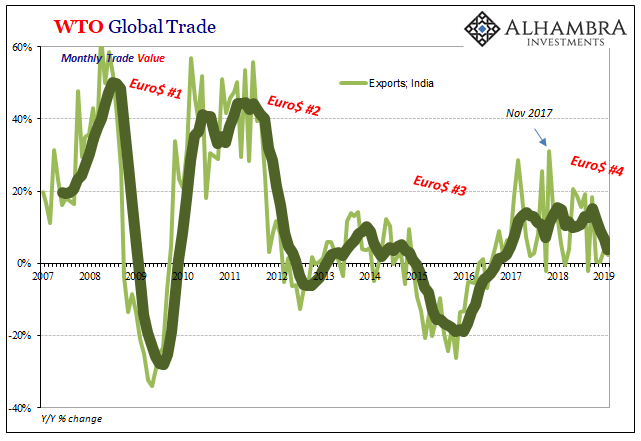

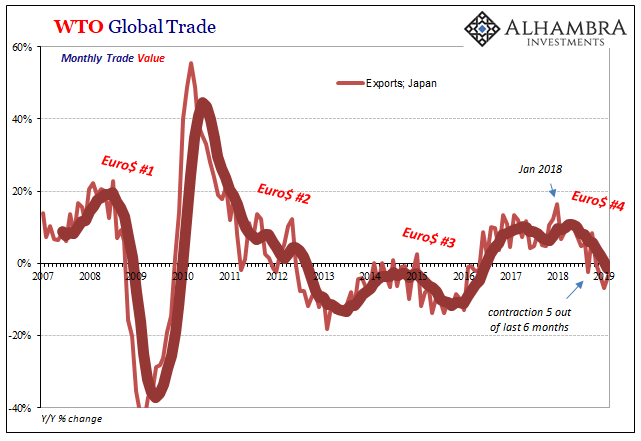

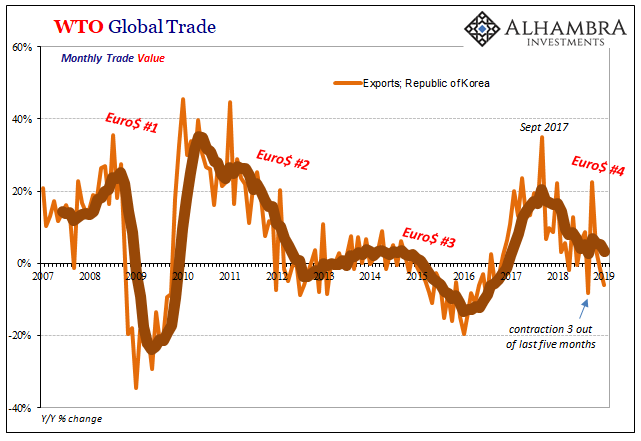

When all the charts from all over the world look exactly alike, what else is there to conclude?

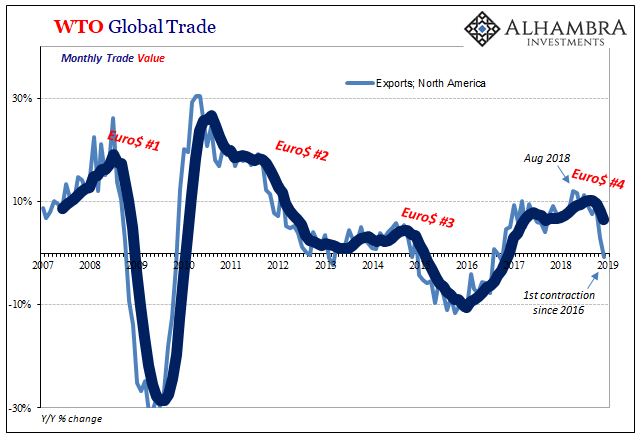

It’s not just Europe, either. This is now a global downturn striking first through the trade channel. That pathway is susceptible because for global trade to happen you need to have the global currency (easily) available to make it happen. Dollar shorts and dollar shortages.

So, exactly during these times when banks, the source of that global currency, are supposed to be paying more attention to long run risks and selling their government bonds they do the opposite merely hoping that someday, with a little luck, they might survive long enough to care. This is very hard for many people to imagine.

Bond curves flatten and fall as global trade does. The world’s problem is debt, but credit-based global money first and foremost before government obligations.

We may find out the real irony in all this if the monetary system is ever fixed. I still believe that actual, sustainable growth would explode once that happens. And when it does, even these astounding debt piles won’t seem so unmanageable and dangerous. What will destroy the bond market isn’t going to be fears of default and devaluation, it will actually be the substantial growth which minimizes the chances of each.

As perceived risks fall with GDP maybe hitting double digits, if everything really does go right, only then will bond markets be massacred.

It is counterintuitive simply because the world economy is just that upside down, thanks to Economists and central bankers. Every time it starts to go right again, even modestly, these intermittent reflation episodes, the decay in eurodollars assures that it can’t.

This latest one began as the others with monetary irregularity and now its fingerprints are all over the global economy. Again. As of December, even North American trade is back in the minuses. BOND ROUT!!!! therefore called off just as this means the Italian, US, and every other fiscal situation is surely to grow even worse.

Stay In Touch