After having gotten one bailout terribly wrong, when she takes over at the European central bank Christine Lagarde is set follow in the traditional path of her predecessors like Mario Draghi who keep moving up no matter what level of disaster they leave in their wake. Crafting the biggest national “rescue” in history while leading the IMF, Ms. Lagarde can apparently just ignore her hand in the Argentina debacle while now being tasked to bailout perhaps all of Europe. Nothing ever changes.

Ironically, former Bank of England Governor Mervyn King was in Washington this past weekend to address the very IMF Lagarde is leaving behind. At its annual meeting, sans Lagarde who has pretty much moved in already at the ECB’s headquarters in Frankfurt, the subject of his speech was how nothing has changed and how curious that has been.

No one can doubt that we are once more living through a period of political turmoil. But there has been no comparable questioning of the basic ideas underpinning economic policy. That needs to change.

In the devastating aftermath of the Great Depression, to the contrary, it was period of dramatic intellectual advances almost across-the-board. For good and bad, at least policymakers went off in new directions and earnestly investigated what might’ve brought the world to such a lowly state. They didn’t get everything right, but they went looking to figure out what had been wrong.

King’s point about the last decade after the somehow Global Financial Crisis stands in stark contrast. Contemporary policymakers had bungled their way through the 2008 panic and then simply followed the Japanese model which they had already known, and discussed, didn’t work.

Ben Bernanke says they were courageous in how they acted. Mervyn King now says they were utterly sheepish. And he would know – he was one of them having been at the helm of the BoE during the panic period and for years immediately thereafter.

In preparation for her promotion to the ECB, Lagarde, who was also a key official in 2008 as France’s Finance Minister (always failing upward), is now on her promotional tour of the world. Milton Friedman was right when he said near his death that the one thing, the only thing perhaps, central banks were good at is public relations.

Over the weekend, there was Lagarde appearing on 60 Minutes in the US (why?) turning her nose up at the very idea any politician would ever, ever dare challenge the independence of any central bank. It was framed, of course, as Donald Trump versus Jay Powell (and the former’s “boneheads” tweet) but the wider discussion involved the growing populist criticisms and backlash more broadly.

….The USA should always be paying the the lowest rate. No Inflation! It is only the naïveté of Jay Powell and the Federal Reserve that doesn’t allow us to do what other countries are already doing. A once in a lifetime opportunity that we are missing because of “Boneheads.”

— Donald J. Trump (@realDonaldTrump) September 11, 2019

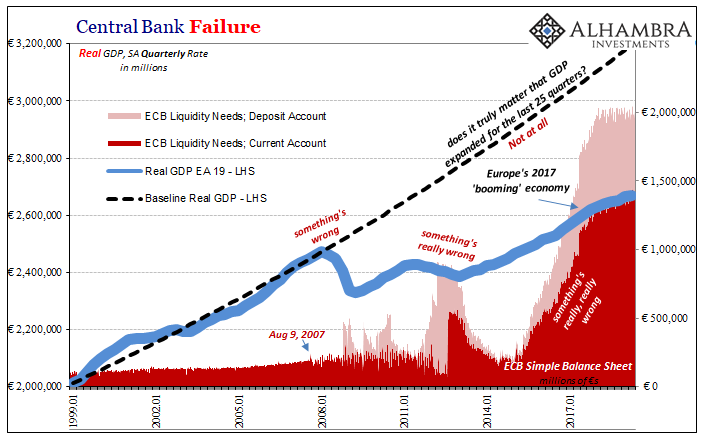

According to Lagarde and other officials like her, central bank independence means being freed from politics. And while that may be technically true, what it really has meant especially since August 9, 2007, is that central bankers are free from accountability.

They are also untethered to the destruction they sow and let happen on their watch due to the simple fact they don’t know their jobs. Argentina was a poignant recent example of just that fact for Lagarde. Mervyn King supplied the big one as it related to the rest of the world:

Conventional wisdom attributes the [post-2008] stagnation largely to supply factors as the underlying growth rate of productivity appears to have fallen. But data can be interpreted only within a theory or model. And it is surprising that there has been so much resistance to the hypothesis that, not just the United States, but the world as a whole is suffering from demand-led secular stagnation.

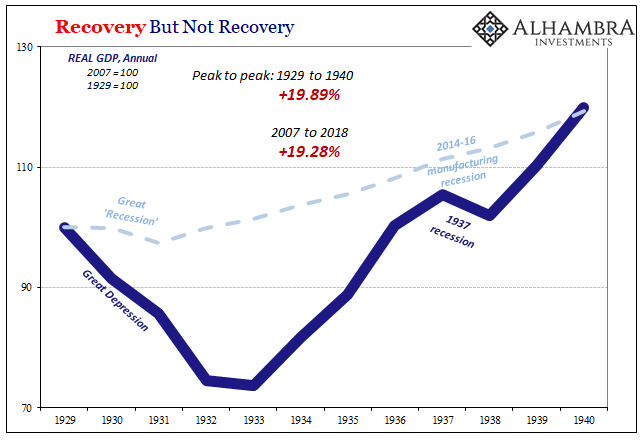

King pointed out, as I have frequently enough, how the “recovery” following the again somehow Global Financial Crisis in the US and elsewhere has been worse than the one which followed the Great Depression. How can that be?

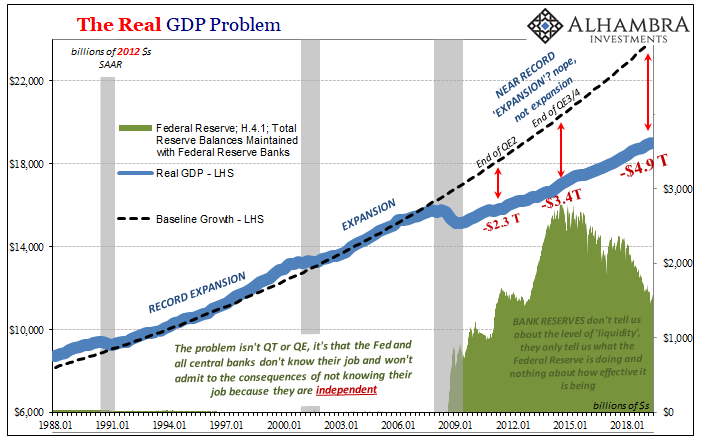

Central bank independence. The people who got 2008 all wrong were the same people who were left in place when it finally came time to get the world out of that mess. And rather than being humble about it, short of dollars the globe’s endless supply of Bernanke’s created a new narrative; they didn’t get it wrong, it wasn’t their fault at all! Subprime mortgages and greedy bankers had been to blame.

In fact, they said, we should be thanking them for stopping the crisis before it got even worse.

But here’s the thing; they all promised recovery from there on forward. However you might’ve felt about their performance up to then, pushing on was their chance to answer all challenges. Not with a “recovery” or anything questionable, a full one the very same which had come after each and every recession. If there had been supply side issues, which they all now complain about, why didn’t they complain about them back then?

In short, they neither saw the “subprime mortgage” Great “Recession” coming nor did they see the “supply side” secular stagnation forming where recovery should have. They can’t seem to get anything right, which was one of King’s strongest points (again, he should know).

This is no mere academic trivia, and it is a very good sign that a former BoE leader, the very one who was in charge in 2008, no less, is making an effort to connect most of the dots. Though he doesn’t yet connect to the first one, the genesis in the global eurodollar system, he has finally come around to seeing a more complete chain of causation.

He correctly connects the downside of central bank independence (ideological rigidity) to secular stagnation (that isn’t necessarily aging Baby Boomers and labor force demographics) and then crucially with the last one:

Another economic and financial crisis would be devastating to the legitimacy of a democratic market system. By sticking to the new orthodoxy of monetary policy and pretending that we have made the banking system safe, we are sleepwalking towards that crisis.

This new orthodoxy of monetary policy King speaks of is, as I’ve been working out for years, actually a very outdated orthodoxy. That’s the real implication of central bank independence. Like any monopoly it has no incentive to change with the times; and the “times” of the last three and four decades have seen radical changes in every corner of the world except central banks.

But he’s right in that the final dot to connect, the last outpost on the road to the Dark Age, if there is to be one, is how secular (monetary) stagnation could lead to unpredictable political and social realignments. It’s already happening and in many key places.

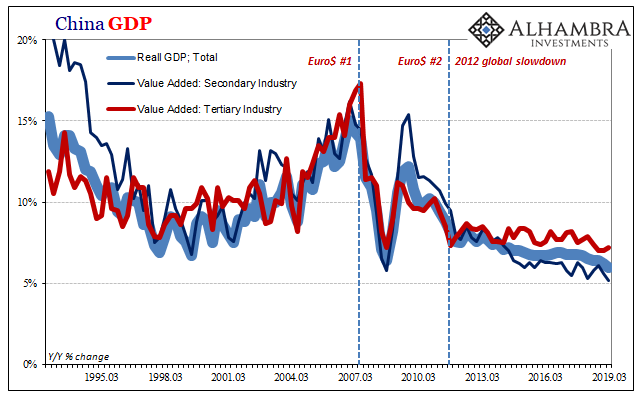

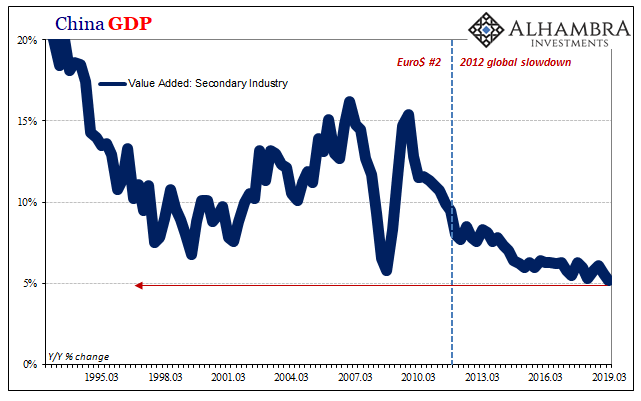

As I wrote last week, where Xi and Li are duking it out is over what to do next about what has already been done. It has become the conventional baseline on both sides that this is how things are now. The very idea of global recovery is dead. Euro$ #3 proved that much to Xi and the failure of globally synchronized growth (never more than Reflation #3) seems to have settled the matter on all fronts.

The Chinese are desperate for some help while the darker authoritarian forces now have the upper hand:

The entire regime is stuck and so officials are unsure what to do moving forward – because there is no realistic way for them to move forward. On the one hand, the reactionary who is reacting rationally to years of empirical evidence where global money and the economy is concerned in order to take China back. On the other, the Western-style academics committed to reform and liberalization by doing more of the things that haven’t, and won’t, work.

And over here in the West, Christine Lagarde is promoted to do even more of those things that haven’t, and won’t, work on an even bigger scale than she was given no matter how obviously terrible the results.

The ideal of central bank independence may be a noble one, but in practice it has been a complete and total disaster. One who’s final outcome is not yet known, but in a direction that is uniformly tilting the wrong way.

Maybe King’s speech is a sign of an official awakening, the very real possibility that they will remove their heads from their rears before passing that critical threshold, the point from which there is no easy return. A rallying cry for reformers and hope.

Then again, I look at the repo rate, see Jay Powell removing T-bills from the collateral flow, and I can’t help but think yet again they really don’t know what they are doing and despite that they will never willingly acquiesce to something else. Therefore, the only way forward is for outside political forces to create from scratch a new set of “they.”

Stay In Touch