It’s another one of those things that just blows up the whole convention, another pretty clear sign that the mainstream has it all backward. We are seeing it play out right now with China. The Chinese are being accused of unfair currency manipulation, the sort of “competitive devaluation” that fills whole chapters in the Keynesian Economics textbooks.

The idea is simple and seemingly intuitive: you reduce the value of your currency against mine making it relatively cheaper for the world to buy your goods instead of mine. If your currency is weak, that just means it takes a lot less of someone else’s to complete the transactions.

According to convention it really is that easy. A bunch of stuffy officials in smoke filled backrooms in whichever palatial government building in whichever imperial capital decide one day to boost their export sector and, voila, so it is done. The currency drops by fiat (pun intended) and while your neighbors protest you’ve created some necessary stimulus for your own economy.

What’s going on in China is a very good example of this being all wrong. Yesterday, we went through (only some of) the details behind what it is that’s really moving CNY lower. For the past year and a half, we’ve also chronicled how despite a lower CNY China’s economy (including exports) has only descended further into dangerous questions.

In short; if the Chinese are purposefully engineering a lower currency exchange value, they haven’t done their country any favors. It isn’t working.

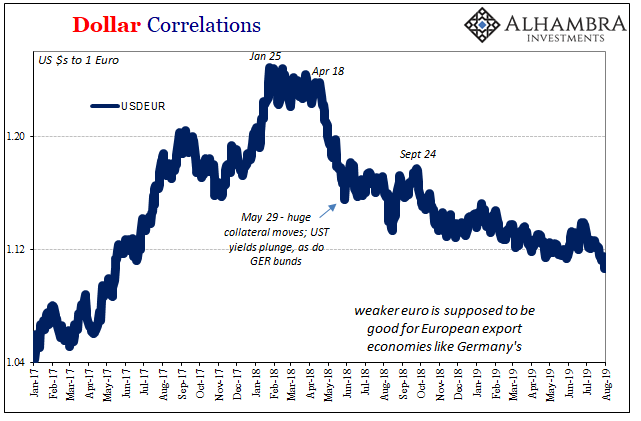

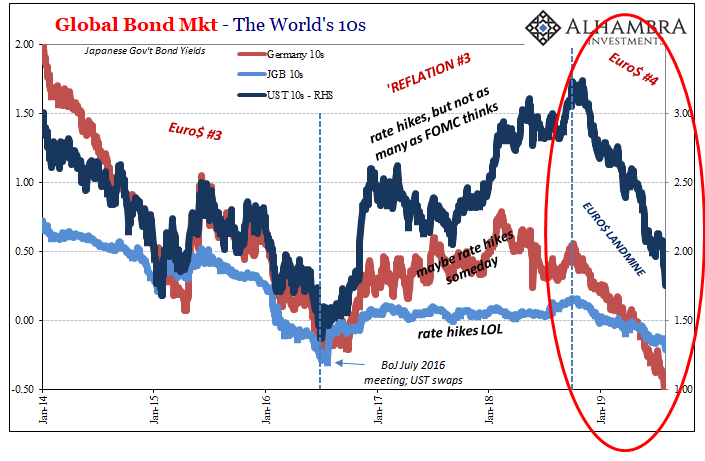

CNY isn’t the only one playing out this way. In fact, just as China’s currency stopped ascending Europe’s did, too. They both shifted right at the end of January 2018. Several months later, a hard reverse.

By the textbook, then, Germany must be absolutely booming. Not only had Mario Draghi fixed the internal European economy and put it onto the ramp for liftoff the added “benefit” of a significantly weakening euro should’ve placed especially the German manufacturing machine into an extra awesome overdrive.

It should have been close to perfect.

Obviously, we know that hasn’t been the case. The textbooks are all wrong where currencies are concerned. The weaker euro as the weaker yuan has meant torture for German as well as Chinese industry. The problem isn’t the exchange value so much as what it actually represents in the real world apart from textbook imaginings of outdated theory.

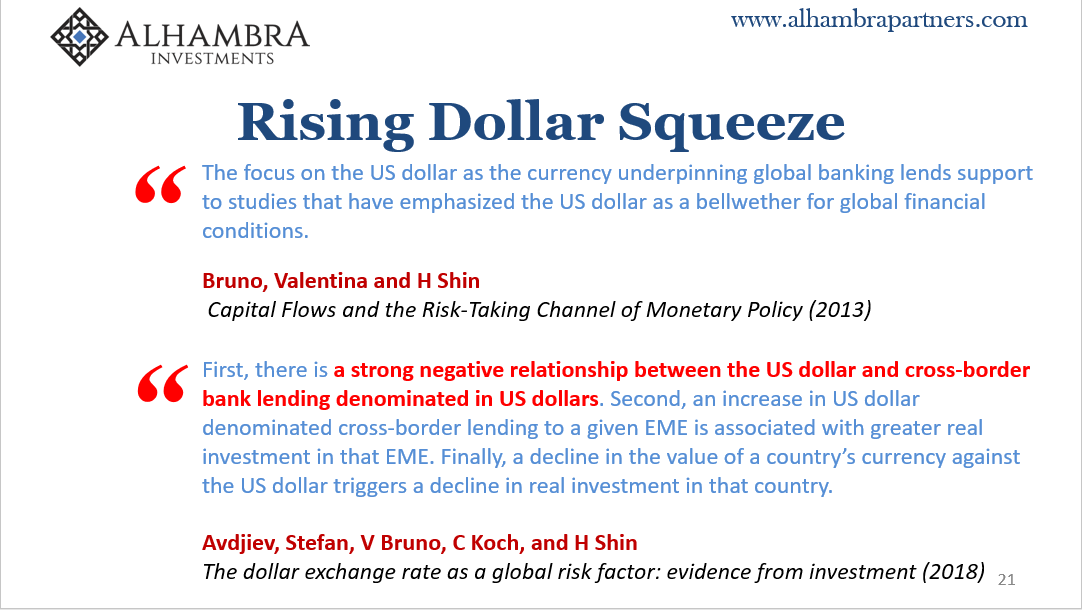

In other words, CNY DOWN = BAD doesn’t mean the Chinese are stealing more industrial activity from the rest of the world. It’s bad because it means the effective monetary grease that keeps the global system moving along efficiently is lacking. That’s bad news for China, bad news for Germany, bad news for the entire global economy.

When the dollar starts to rise, forget trade valuations. Those don’t matter. It is pure economic misery for everyone – beginning in the trade channel.

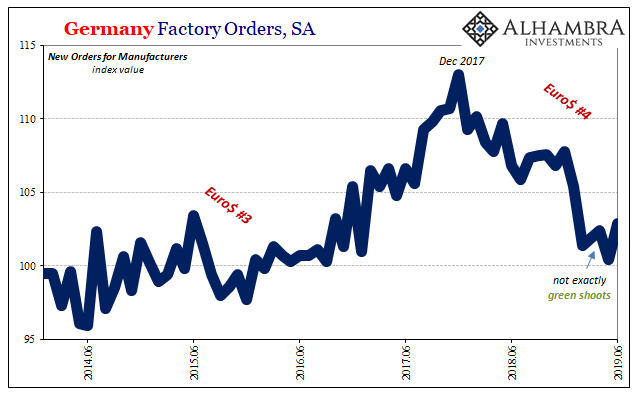

By every market indication related to dollar liquidity, and therefore easy and efficient supply of global reserve, things haven’t gotten any better in 2019. There’s quite a bit to suggest it’s gotten much worse – including bond yields in Germany of all places.

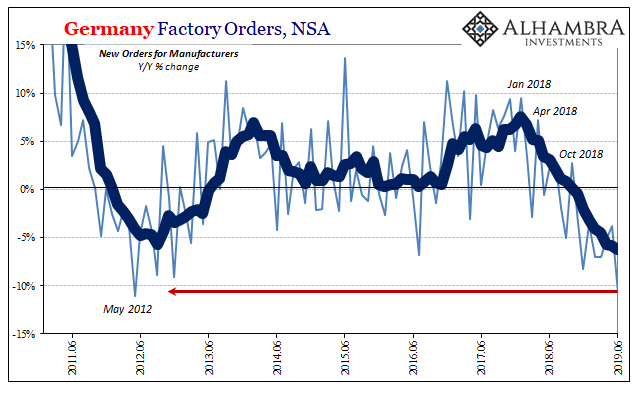

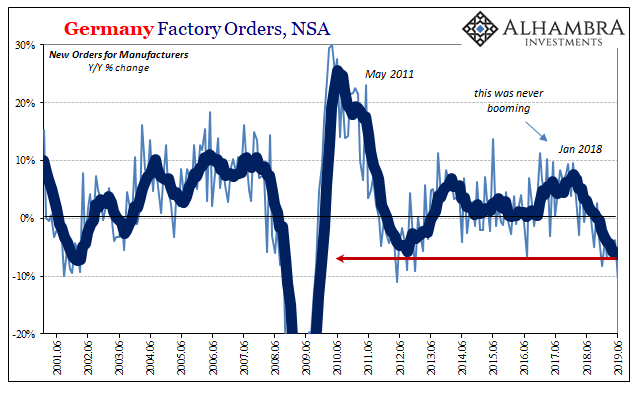

Thus, as the euro keeps falling against the dollar Germany’s industrial sector keeps finding new lows. According to that country’s DeStatis agency, the government bureau which estimates economic data, factory orders fell by 10.9% year-over-year in June 2019. And June 2018 wasn’t exactly a great month from which to compare.

As it stands, June is the second worst month since 2009. Only one other month, May 2012, was a bigger negative – and that was the low point for Germany during what was a full-scale European recession.

More importantly, the 6-month average as a result has dropped to -6.3%. That is the lowest since 2009, suggesting both that Germany’s economy is already in very rough shape and since factory orders are forward leaning it doesn’t seem likely to get any better anytime soon. Halfway through the year, no rebound in sight.

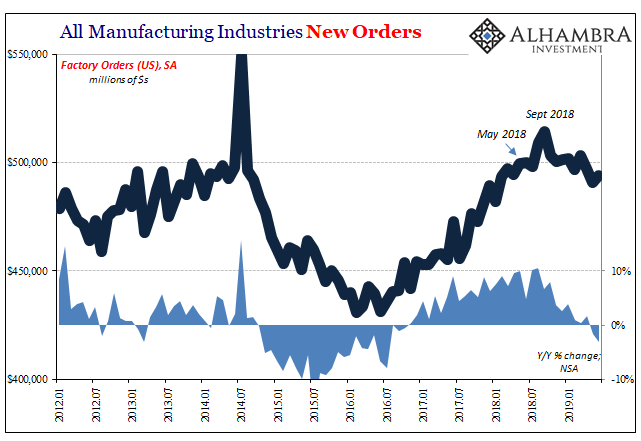

This extends both ways. If anyone might think King Dollar’s increase is to the benefit of the United States economy at the expense of China or Germany, pure upside down from the textbook, that’s wrong, too.

Though there are losers, there are no winners anywhere. The movement of the currency doesn’t tell one from the other, it only signals that everyone is going to be on the losing end. Eventually. The timing isn’t the same, nor is the intensity of the negative monetary pressure. In the end everyone comes out on the wrong side when the eurodollar takes over.

The US economy is significantly further behind in the process of reverse than either China or Germany. It is, however, firmly planted on the same downward slope. The Census Bureau reported last week that factory orders in the United States contracted by 3.1% year-over-year in June, as well. That follows a 1.7% contraction in May.

Not as bad as Germany, but also not meaningfully different, either.

The dollar is no one’s tool. There are those who claim the US will come out and signal its intentions to weaken its currency before too much longer; President Trump reportedly itching to do so. The backrooms are already filling up with faceless bureaucrats lighting up their cigars and planning for a new currency value.

They are reading up on the relevant chapters in the textbook.

But that’s the thing about the eurodollar – it’s also no one’s currency. It is called a dollar and is supposed to be a dollar; it just hasn’t been in a very, very long time. Its value isn’t a value at all. At most, it is a signal and an import indication.

What it indicates right now is trouble. Trouble for China. Trouble for Germany. Trouble for all those in between. And trouble for the US.

Nobody is devaluing their currency. It’s the tell-tale sign of the eurodollar downgrading and damaging the whole global economy. Unlike central bankers and politicians, the bond market knows what has actually taken over total economic control. It isn’t rate cuts and dovishness.

Stay In Touch