Retail flows, in my analysis, having absorbed any minor trepidation from the debt ceiling and shut down, are seemingly positioned as if taper and monetary policy are back to last year’s unlimited promises. That may very well be the case, though it does not appear as if institutional positioning agrees.

In my mind, the MBS and UST portions of the current QE program are separate and distinct, thus I indicate the former as QE3 and the latter as QE4 (owing to chronology – QE3 announced in Sept 2012; QE4 in December 2012). When analyzing rate markets and repos, the tendency is to highlight QE’s actions only in UST, thus minimizing any disruptions in MBS markets. I am guilty of that as much as anyone.

The bank earnings reports that have been released in the past week or so highlight one potential and technical factors that may suggest the institutional position is right. With the September taper decision behind us, the pace of QE3 will be uninterrupted, for now. However, the talk of taper over the summer certainly disrupted the public’s appetite for mortgage borrowing. At Wells Fargo, as I noted this week, loan applications were off 54% from Q3 2012, and the pipeline heading into Q4 was down 46% from the beginning of Q3.

These numbers, plus broader mortgage application estimates from the Mortgage Bankers Association and others, suggest that loan volume did not just decline over the summer, but it collapsed. That led a lot of these banks with heavy exposure to mortgage lending to lay off a significant number of workers, suggesting they are not sanguine about the return of mortgage business. Since that tailing of activity takes some time between application and actual funding, we have only seen the leading edge of this taper-distortion and have yet to really see the full extent in actual lending and volume flows.

According to SIFMA, MBS issuance in the first seven months of 2013 averaged $186 billion per month. In September, MBS issuance fell 30% below that average, with only $130 billion issued. The same story played out in agency issuance, with September flow also down 30% from the prior average.

We can reasonably extrapolate that gross MBS issuance from here to at least the end of the year will be significantly lower still. That would drastically increase the proportion of the MBS market QE3 is taking. Would that create a shortage, including for repo market collateral?

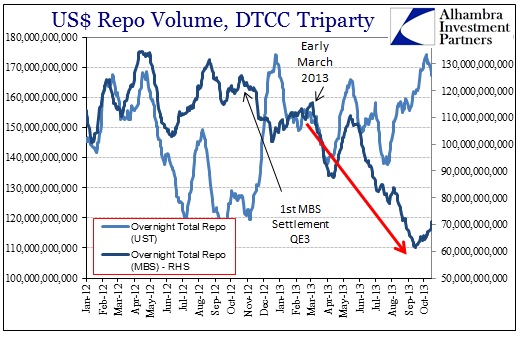

Since the first settlement in QE3 MBS back in October 2012, triparty repo volumes using MBS collateral have declined. That trend really picked up in early March, exactly the time collateral issues and illiquidity first became noticeable – though most attention was, again, directed toward UST.

A word of caution first – the numbers presented in the above chart are for Triparty repos only. We have absolutely no idea what the OTC repo market looks like or how it has reacted. Since the OTC portion is the vast majority of lending/borrowing, this only presents a small possible window into repo market funding conditions.

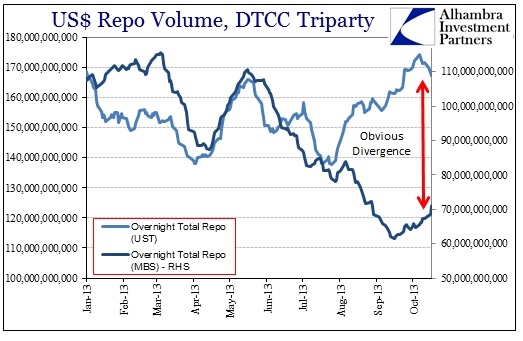

With that warning in mind, it does appear as if MBS repo volumes may be playing a role in collateral issues. If nothing else, the divergence between MBS triparty volumes and UST since July suggests that some collateral demand may be switching. Without sufficient MBS available in the marketplace, it may just be that some firms are increasing their demand for UST to make up for declines in MBS availability, and thus the rise in relative UST repo volume (including t-bills).

If that is the case, then the expectations for a further drop in new MBS issuance would only strain this market further, pushing more demand on UST’s for collateral. In other words, the Fed may run into a flow problem in MBS if they continue to buy at the same rate. This is by no means an assured outcome, but there is enough evidence (and intuition) here to make the suggestion.

Further, if it did force the Fed’s hand on QE3, how would credit and funding markets react? If the summer’s actions taught us anything, it is that credit markets do not agree (at all) with the Fed’s interpretations of its own actions. To the FOMC, tapering is not a change in policy stance, only fine tuning. To the credit markets, the threat of taper was tightening, and it became as much (particularly eurodollars, and thus the flow-through to emerging market turmoil). Since credit markets completely set aside “forward guidance” and made their own interpretations, the danger remains that they might do so again even if the Fed had a ready-made technical reason in MBS flow.

Again, all of this is speculation on my part based on trends in certain places. There is no way to make any solid determination other than to recognize it might be a mistake to continue to ignore MBS repo and flow in the future.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch