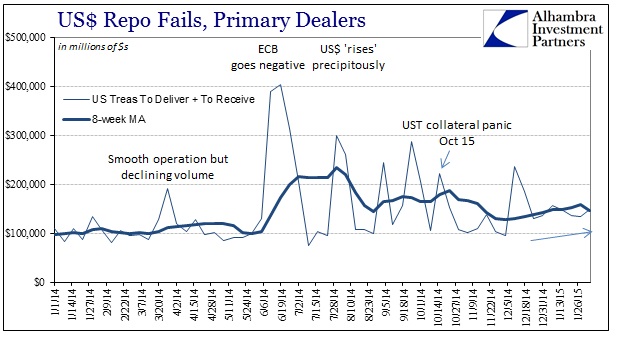

It was a bit of a shock in June 2014 when the repo market experienced sudden and sharp disorder. The surge in fails seemingly did not fit the conditions as convention held them in the middle of last year when everything was supposedly running so smoothly. In the eight months since then, repo fails have not much calmed, which has perversely given more “comfort” to the already-high degree of recency bias about such things. The perpetual, it seems, repo problems “must” be nothing to worry about since the world has moved along without having been swung off its axis because of them.

As if to illustrate this point, the FOMC is much more concerned about retail bond fund investors than the constant or sustained repo disruptions. It is not just ridiculous, as retail fund investors will be the last in the herd shifting dynamics, it is perilous. The repo and wholesale markets will be the “tip of the spear” or leading edge in any serious liquidity reversal. We already saw that close up on October 15, and bond funds were nary a sight then.

Institutional liquidity is primary at the start of any of this, and the repo market’s continued disfavor marks not comfort but concern. There is something very wrong in the system, but because it is intangible, esoteric and almost completely unobservable there is scant attention among those that have ability to act or influence. That is a huge problem, as the only way people will care is when it is erupts into open, sustained and severely detrimental disorder that “nobody saw coming.”

It is possible that the FOMC is worried about wholesale funding and just not letting on in public, but given the history of their attempts to mitigate in this area I am much less than convinced officials hold even a little awareness. I am also nearly certain, also given past treatment, that they will surrender no responsibility here even though it is almost as clearly substantiated as anything in this area can ever possibly be.

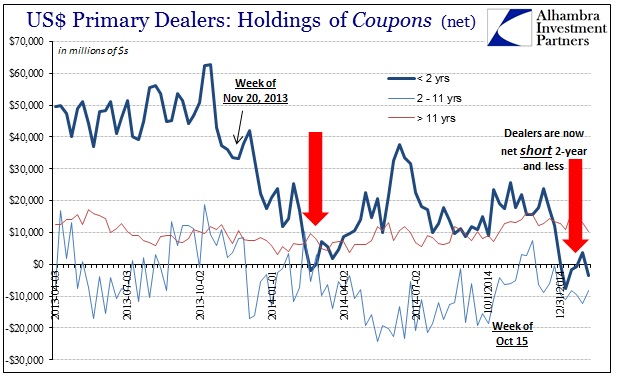

To start with, today, repo rates in the 2-year treasury area are moving highly “special”; that is, repo rates for that particular UST maturity, not even just a specific CUSIP but the entire maturity encompassing any number of securities, are deeply negative once again. The last time the 2-year repo went so far special was the middle of December, as well as the June-July “tightening” that started all of this.

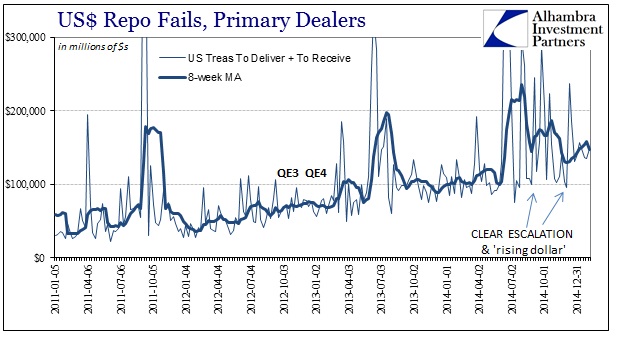

The problem in funding doesn’t stand out well in the chart above, but it is absolutely clear via a longer-term perspective.

The trend in fails has been toward elevation since the end of 2010, not coincidentally timed to the inauguration of QE2. In the most immediate weeks, the lack of alleviation of funding irregularity is concerning, and thus it is not surprising to see the “rising dollar” appear simultaneously (since funding problems and “tightness” are the essence of the modern version of the surging price of the “dollar” as it relates to the global “dollar” short).

So we know well the pathology in repo in the longer trend of QE accumulation of otherwise usable collateral; and where the Fed’s offered “solution” to that was the now-completely disproven reverse repo program (RRP). However, we can also observe the Fed’s own interference within the dealer function, which I will submit is of greater alarm. Again, it is not surprising to see the 2-year stand out in “specialness” as that is the maturity range that dealers themselves have been disposing (or shorting) the most going back to late 2013.

Why might they do that? Might it have something to do with constant and persistent threats to change ZIRP? In more traditional understanding of dealer existence and mechanics, the Fed’s monetary policy should not matter as dealers are supposedly neutral and matching books. But I believe that is one of the greatest and most underappreciated aspects (of a whole range of issues that are likewise underappreciated if not fully misunderstood and ignored) credit and funding liquidity under QE/ZIRP repression.

As I said yesterday, dealers can no longer “afford” to be neutral and thus have taken to speculating with these very central activities. If dealers are short the 2-year, then that does little to help not just the repo market but the rest of dealer activities bleeding right on into more important derivatives and risk capacity. I highlighted before how I believe that dealers were using perceptions of Fed policy to set interest rate swaps, and thus were also caught in the maelstrom of the mid-2013 MBS selloff – in fact, “caught” is probably the wrong active word, as I have little doubt that dealers taking speculative IR swaps positions according to their perceptions of Fed policy was a great contributor to illiquidity and how that selloff went so far and so violently as it did.

If dealers and “market” speculators are all on the same side, indeed indistinguishable, there is nobody left to catch that falling knife when conditions suddenly change in the opposite direction as expected. Thus the falling knife turns into a bidless condition, the collapsing mountain that is not arrested without so much asymmetric damage to systemic pricing. In one narrow sense, we were lucky in 2013 that disruption was relatively minor and seemingly “contained”, but unlucky in that everything taking place into 2015 is very much still related to ripples of disorder in funding markets because of dealer displacement.

Is anyone truly prepared for liquidity without dealers? Maybe that wouldn’t be much of a concern under less imbalanced conditions, but deleveraging never took place after 2008 despite all proclamations otherwise, and globally, to which the “dollar” connects all finance, there is now far more debt and credit than even 2007. In the modern count of financialism, liquidity and regularity in pricing is paramount to keeping it all afloat, which is why the related and also constant roil of currency crises demands more attention and appreciation. Asset bubbles need and demand consistent pricing to remain asset bubbles.

It would be nice if any regulatory agency or body even attempted to acknowledge or address this kind of liquidity problem instead of paying what little attention to retail bond funds. This is where it all starts; the bond funds are will it will all end. The herd is all lined up and now includes the dealers themselves.

Stay In Touch